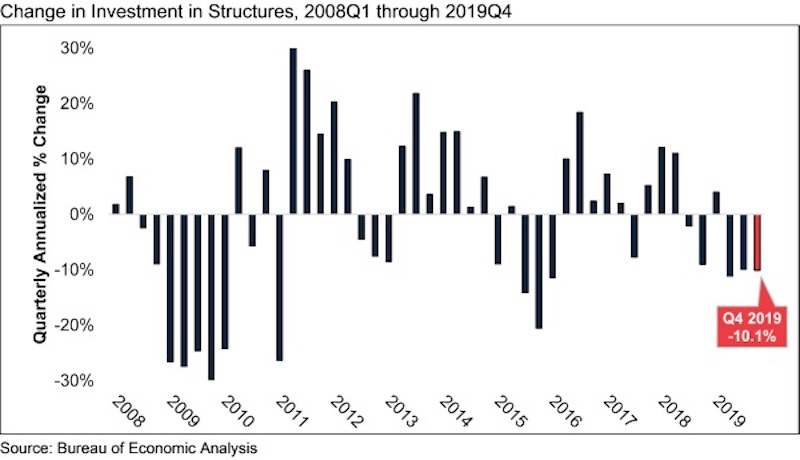

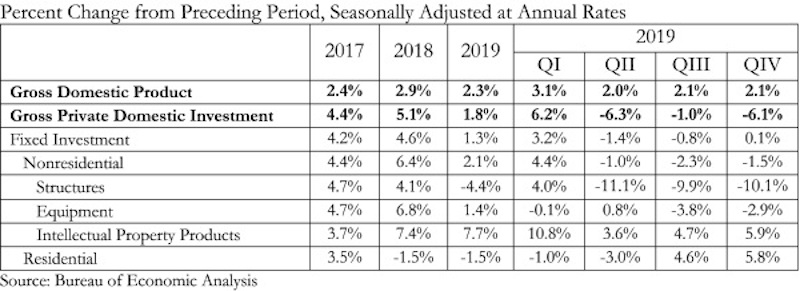

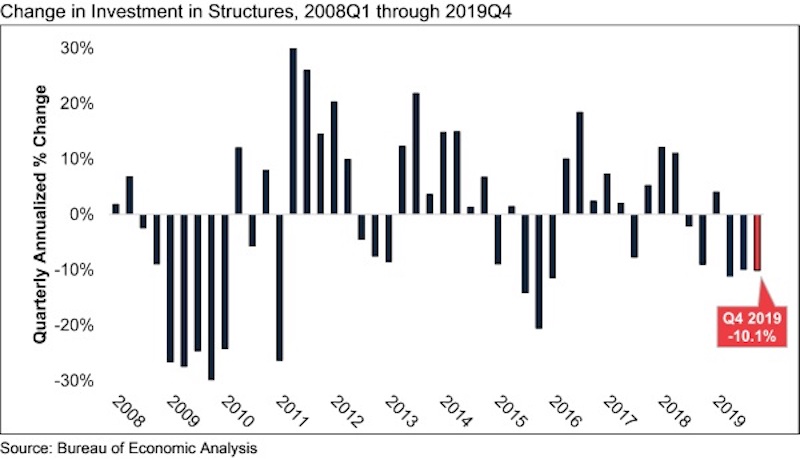

The U.S. economy expanded at an annualized rate of 2.1% in the fourth quarter of 2019, despite investment in structures declining at an annualized rate of 10.1%, according to an Associated Builders and Contractors analysis of data released today by the U.S. Bureau of Economic Analysis. Investment in structures contracted for three consecutive quarters and declined 4.4% during 2019.

In 2019, real GDP expanded by 2.3%, which was slower than the 2.9% rate of growth observed in 2018. Investment in structures contracted 4.4% in 2019 after expanding by 4.1% in 2018.

“Last year will be remembered as decent but unspectacular for the U.S. economy,” said ABC Chief Economist Anirban Basu. “Strong consumer spending, historically low unemployment, surging asset prices and healthy backlog levels, according to ABC’s Construction Backlog Indicator, were offset by soft business investment, flattening levels of nonresidential construction and soaring national debt. In addition, key segments of the economy, including manufacturing and agriculture, were particularly weak.

“But 2019 tells us little about 2020 dynamics,” said Basu. “Coming into last year, many expected interest rates and the general cost of capital to rise. Instead, interest rates dipped, creating an improved environment for purchasers of construction services. Last year was also shrouded by fears of worsening trade wars, but with the ratification of the USMCA and the attainment of a first phase trade deal with China, the level of uncertainty has abated. Through the first month of 2020, this has translated into rising stock prices, which should induce greater business investment.

“This year’s presidential election may cause some purchasers of construction services to adopt a wait-and-see attitude,” said Basu. “Contractors are currently upbeat about their prospects over the next two quarters, according to ABC’s Construction Confidence Index. However, given contracting levels of investment in structures, it is unclear if that will persist through the end of 2020.”

Related Stories

Contractors | Sep 12, 2023

The average U.S. contractor has 9.2 months worth of construction work in the pipeline, as of August 2023

Associated Builders and Contractors' Construction Backlog Indicator declined to 9.2 months in August, down 0.1 month, according to an ABC member survey conducted from Aug. 21 to Sept. 6. The reading is 0.5 months above the August 2022 level.

Contractors | Sep 11, 2023

Construction industry skills shortage is contributing to project delays

Relatively few candidates looking for work in the construction industry have the necessary skills to do the job well, according to a survey of construction industry managers by the Associated General Contractors of America (AGC) and Autodesk.

Market Data | Sep 6, 2023

Far slower construction activity forecast in JLL’s Midyear update

The good news is that market data indicate total construction costs are leveling off.

Giants 400 | Sep 5, 2023

Top 80 Construction Management Firms for 2023

Alfa Tech, CBRE Group, Skyline Construction, Hill International, and JLL top the rankings of the nation's largest construction management (as agent) and program/project management firms for nonresidential buildings and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Sep 5, 2023

Top 150 Contractors for 2023

Turner Construction, STO Building Group, DPR Construction, Whiting-Turner Contracting Co., and Clark Group head the ranking of the nation's largest general contractors, CM at risk firms, and design-builders for nonresidential buildings and multifamily buildings work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Market Data | Sep 5, 2023

Nonresidential construction spending increased 0.1% in July 2023

National nonresidential construction spending grew 0.1% in July, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.08 trillion and is up 16.5% year over year.

Giants 400 | Aug 31, 2023

Top 35 Engineering Architecture Firms for 2023

Jacobs, AECOM, Alfa Tech, Burns & McDonnell, and Ramboll top the rankings of the nation's largest engineering architecture (EA) firms for nonresidential buildings and multifamily buildings work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Aug 22, 2023

Top 115 Architecture Engineering Firms for 2023

Stantec, HDR, Page, HOK, and Arcadis North America top the rankings of the nation's largest architecture engineering (AE) firms for nonresidential building and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Aug 22, 2023

2023 Giants 400 Report: Ranking the nation's largest architecture, engineering, and construction firms

A record 552 AEC firms submitted data for BD+C's 2023 Giants 400 Report. The final report includes 137 rankings across 25 building sectors and specialty categories.

Giants 400 | Aug 22, 2023

Top 175 Architecture Firms for 2023

Gensler, HKS, Perkins&Will, Corgan, and Perkins Eastman top the rankings of the nation's largest architecture firms for nonresidential building and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.