The developer TPA Residential recently selected McShane Construction to build Woodward Crossing, a Class-A, 265-unit apartment complex on 7.8 acres in Buford, Ga. The apartments would be inside two buildings, four and five stories, designed by the architecture firm Niles Bolton Associates. Its completion is scheduled for May 2022.

The Southeast is one region of the country where multifamily construction remains steady, according to construction firms active there. “Our core footprint is currently in the Southeast, [where] apartments are performing very well right now,” says Marc Padgett, president of Summit Contracting Group. Demand for multifamily isn’t cooling off, either; Summit had signed contracts for more projects through September 2020 than it had during the same nine months last year. And Padgett expects 2021 to be better for his company than either of the two prior years.

“What many don’t realize is when the economy worsens, the demand for multifamily improves,” he explains.

Last January, the general contractor Brasfield & Gorrie completed Deca Camperdown, a $48 million, 11-story building in Greenville, S.C., with 217 apartments that average 1,007 sf and feature luxury finishes. NELSON Worldwide was the architect, and Daniel Corporation the developer.

Deca Camperdown in Greenville, S.C., which was completed last January, boasts 217 homes with luxury interior finishes such as quartz countertops, stainless steel appliances, and designer light fixutres. Images: Kevin Ruck, courtesy of Brasfield & Gorrie

Opportunities for urban infill high rise construction are scarcer, acknowledges Roddy McCrory, Brasfield & Gorrie’s Vice President and Regional Business Development Director. But Alabama-based firm is encouraged by stronger demand for “affordable options”—like garden-style apartments or podium products—that support workforce renters’ needs in cities and suburbs in the Southeast.

PROJECTS PROCEED, DESPITE SOME MARKET SOFTNESS

On a national level, the multifamily sector, which over the past several years gave housing construction its wings, has been coming back to earth. The annualized rate for housing starts in buildings with five more apartments stood at 295,000 units in September, which according to Census Bureau estimates was 17.4% below starts for the same month in 2019. Multifamily permits, a barometer of future building, were also down in September, by 22.2% to 390,000 units.

Also see: Multifamily’s long-term outlook rebounds to pre-COVID levels in Q3

Multifamilybiz.com, citing Dodge Data and Analytics as its source, reported that for the 12 months ending in September, multifamily starts were off 5%, compared to a 7% gain in single-family starts over the same period.

CBRE’s economic advisers predict the multifamily market will reach its bottom in the fourth quarter of 2020 and begin recovering in the first quarter of 2021. Vacancies will rise to 7.2% by the end of 2020, a full 3.1 percentage points higher than what’s projected for the end of 2021.

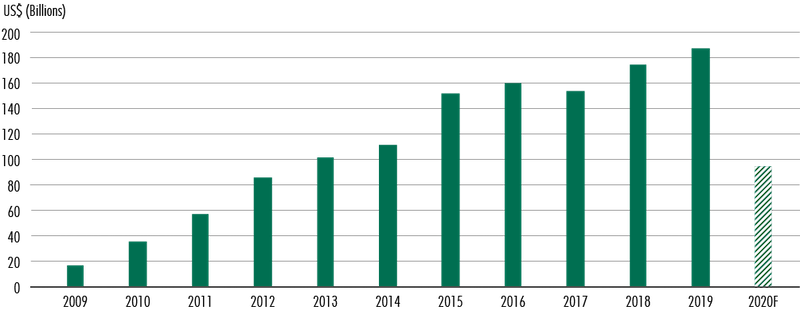

CBRE projects that investment in multifamily properties will be way off this year, but start recovering in 2021. Image: CBRE

This national pullback notwithstanding, large multifamily projects continue to get built, often as centerpieces of ambitious redevelopment plans. Last August, Brasfield & Gorrie completed The Julian, a 14-story 381,000-sf apartment complex in Orlando, Fla., designed for Ustler Development by Baker Barrios Architects, with 409 units and a 10-story 234,000-sf parking garage. The Julian is part of Creative Village, a 68-acre mixed-use transit-oriented urban infill neighborhood.

The Julian Apartments are the first housing in Orlando's Creative Village neighborhood development that are not restricted to students of the new downtown University of Central Florida campus. Image: Ben Tanner Photography, courtesy of Brasfield & Gorrie

That same month, ground broke for the $130 million AJ Railyards mixed-use building on 2.89 acres in Sacramento, Calif. (Brown Construction is the GC, LPAS Architects the design architect.) AJ Railyards will have 345 rental apartments (69 of them affordable), and 5,000 sf of ground-floor retail. This project, scheduled for completion in the winter of 2022, is a partnership between LDK Ventures and USA Properties Fund. It is part of a 244-acre urban infill redevelopment that, while still in its early stages, will eventually double the size of downtown Sacramento.

Also see: Miami’s yacht-inspired UNA Residences begins construction

On October 27, Shawmut Design and Construction broke ground on 1.16 acres in Providence, R.I., for Emblem 125, a nearly $90 million development that, when it opens in the summer of 2022, will include 248 residential units, 22,700 sf of ground-floor retail space, and an 1,800-sf rooftop space. This mixed-use building, developed by Exeter Property Group and designed by Torti Gallas + Partners and ZDS, is one of the largest to break ground within the I-195 Redevelopment District. Rhode Island’s Governor Gina Raimondo lauded Emblem 125 as “a huge step forward for the growth of the Providence Innovation and Design District.”

A rendering of Emblem 125, a $90 million multifamily project that will be part of Providence, R.I.'s Innovation and Design District. Image: Exeter Property Group.

COVID-19 RATTLES SUPPLY CHAIN

As was the case for other building types, multifamily supply and demand were hobbled by the spread of the coronavirus. In Freddie Mac’s 2020 Midyear Outlook, Steve Guggenmos, the agency’s Vice President of Research and Marketing, wrote that multifamily demand in the second quarter saw “a meaningful slowdown given the nationwide shutdown,” along with a high rate of lease renewals as tenants stayed put during the height of quarantines and lockdowns. Guggenmos also cited estimates by Reis, a leading commercial real estate data source, that multifamily completions tracked at least 30% lower than pre-pandemic levels through the first half of 2020.

Some market watchers also contend the COVID-19 pandemic drew attention to the country’s chronic housing shortage. And the virus certainly changed behaviors on multifamily jobsites.

Gilbane Building Company is using an artificial intelligence tool on some of its multifamily sites to perform checks on whether people coming to the site are wearing face coverings, and to provide temperature checks. Gilbane was also an early adopter of Proximity Trace, a wearable technology that detects social distancing.

Brasfield & Gorrie has limited the number of workers in its jobsite hoists and elevators, heightened cleaning protocols, and made changes in its break areas and food vendors, says McCrory.

The pandemic has created some supply-chain headaches, especially in the availability and pricing of lumber, says AEC sources. “The biggest impact we are seeing [on multlfamily] is the sourcing of materials for core building components,” says Sean Buck, Vice President-Operations for JE Dunn Construction. He explains that in the high-rise space, products like electrical fixtures, countertops, and casework are typically sourced from various countries. “Given the current COVID and political environment, this poses some procurement risk,” and has led JE Dunn more toward U.S.-based suppliers.

Padgett says Summit Contracting has always strove to buy American, “and right now, 100% made in the U.S.A. is most desirable” to minimize delays in availability and delivery. Padgett adds that “good planning and coordination” can overcome supply-chain blips most of the time.

Gilbane, which has been tracking the supply-chain status of critical commodities on a biweekly basis this year, saw signs of “stabilization in both price and availability” in the third quarter, according to Grant W. Gagnier, the firm’s Vice President and New York City Business Unit Leader.

LUXURY AND AFFORDABILITY IN DEMAND

590 Park in St. Paul features 92 upscale micro apartments that target local professionals. Image: UrbanWorks.

One-fifth of the homes within 19 Dutch, in Manhattan's Financial District, will be affordably priced. Image: Gilbane Building Company

Multifamily continues to address a full range of price options, and higher-end products remain attractive. In St. Paul, Minn., the GC Kraus-Anderson just completed 590 Park, a 57,982-sf building with 92 upscale micro apartments—ranging from 352 to 602 sf—designed specifically for professionals. The $20 million, six-story building—owned by Engelsma Limited Partnership and designed by UrbanWorks Architecture—is near the State Capitol, Regions Hospital, and the Green Line stop at Capitol/Rise Street Station, which provides connectivity to Minneapolis.

However, it also appears that more of what’s being developed, designed, and built targets tenants and buyers seeking affordability.

Among Gilbane’s recent multifamily projects has been 19 Dutch, a 66-story residential tower in Manhattan’s Financial District. Developed by Carmel Partners and designed jointly by Gerner Kronick + Valcarcel and SLCE Architects, the 770-ft-tall tower, which was completed last year, includes 483 furnished apartments, 97 of them affordable. The project also features two floors of retail space and three amenity levels. A rooftop terrace on the 63rd floor is accessible through an adjoining indoor lounge.

“Metrocentric markets make a lot of economic and environmental sense,” says Gagnier, “so we believe there will continue to be demand for multifamily housing—especially affordable housing—in cities and their surrounding areas.” Gilbane anticipates more developer interest in reconfiguring apartment layouts to accommodate home offices.

Summit Contracting still builds “a good bit” on the luxury end of the multifamily spectrum. “But we do see more of a push toward the mid-grade and affordable product,” says Padgett. Summit saw this trend coming a few years ago, and responded with its Summit Prototype Program, which leverages Summit’s buying power and vendor relationships, allowing buildings to be pre-priced and upgraded or downgraded depending on a developer’s budget and desired level of finishes. This program can offset rising land and labor prices and still come in 5-10% lower than a custom-designed project, says Padgett.

Related Stories

| Jan 21, 2011

Harlem facility combines social services with retail, office space

Harlem is one of the first neighborhoods in New York City to combine retail with assisted living. The six-story, 50,000-sf building provides assisted living for residents with disabilities and a nonprofit group offering services to minority groups, plus retail and office space.

| Jan 21, 2011

Nothing dinky about these residences for Golden Gophers

The Sydney Hall Student Apartments combines 125 student residences with 15,000 sf of retail space in the University of Minnesota’s historic Dinkytown neighborhood, in Minneapolis.

| Jan 21, 2011

Revamped hotel-turned-condominium building holds on to historic style

The historic 89,000-sf Hotel Stowell in Los Angeles was reincarnated as the El Dorado, a 65-unit loft condominium building with retail and restaurant space. Rockefeller Partners Architects, El Segundo, Calif., aimed to preserve the building’s Gothic-Art Nouveau combination style while updating it for modern living.

| Jan 21, 2011

Upscale apartments offer residents a twist on modern history

The Goodwynn at Town: Brookhaven, a 433,300-sf residential and retail building in DeKalb County, Ga., combines a historic look with modern amenities. Atlanta-based project architect Niles Bolton Associates used contemporary materials in historic patterns and colors on the exterior, while concealing a six-level parking structure on the interior.

| Jan 20, 2011

Worship center design offers warm and welcoming atmosphere

The Worship Place Studio of local firm Ziegler Cooper Architects designed a new 46,000-sf church complex for the Pare de Sufrir parish in Houston.

| Jan 19, 2011

Baltimore mixed-use development combines working, living, and shopping

The Shoppes at McHenry Row, a $117 million mixed-use complex developed by 28 Walker Associates for downtown Baltimore, will include 65,000 sf of office space, 250 apartments, and two parking garages. The 48,000 sf of main street retail space currently is 65% occupied, with space for small shops and a restaurant remaining.

| Jan 7, 2011

Mixed-Use on Steroids

Mixed-use development has been one of the few bright spots in real estate in the last few years. Successful mixed-use projects are almost always located in dense urban or suburban areas, usually close to public transportation. It’s a sign of the times that the residential component tends to be rental rather than for-sale.

| Jan 4, 2011

An official bargain, White House loses $79 million in property value

One of the most famous office buildings in the world—and the official the residence of the President of the United States—is now worth only $251.6 million. At the top of the housing boom, the 132-room complex was valued at $331.5 million (still sounds like a bargain), according to Zillow, the online real estate marketplace. That reflects a decline in property value of about 24%.

| Jan 4, 2011

Grubb & Ellis predicts commercial real estate recovery

Grubb & Ellis Company, a leading real estate services and investment firm, released its 2011 Real Estate Forecast, which foresees the start of a slow recovery in the leasing market for all property types in the coming year.