Add to the growing list of forecasts about the fate of retailing in America a new report by the global consulting firm A.T. Kearney that suggests the survival of shopping centers and malls will be predicated on their “morphing” into Consumer Engagement Centers (CES) that are less about buying and selling products and more about creating experiences for consumers.

“The U.S. retail sector is moving from a ‘push’ model to a ‘pull’ model where consumers are demanding more curated experiences,” explains Michael Brown, a Partner with A.T. Kearney's retail group, and co-author of “The Future of Shopping Centers.”

The report stems from a larger study his firm conducted to examine and predict prospective consumer behaviors over the next 10-15 years, says Brown. The focus of the latest report is on Millennials, who will reach their peak spending years within the next decade.

The authors note that the U.S., at 23.5 sf of retail space per person, is already seriously overstored, compared to countries like Canada (16.8 sf/person), Australia (11.2 sf), the United Kingdom (4.6 sf), and Japan (4.4 sf). The U.S. also lags Europe when it comes to locating retail in proximity to transportation hubs, and building stores that are part of mixed-use developments.

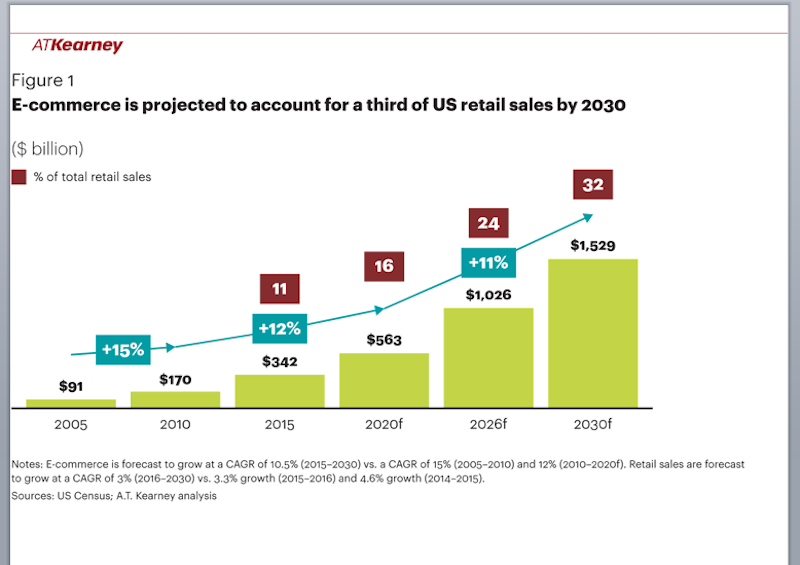

Looming in the background of A.T. Kearney's forecasts is the expanding encroachment of ecommerce. The report estimates that online purchases could account for 32% of total retail sales in the U.S. by 2030, or the equivalent of $1.53 trillion that year. That would be nearly triple the percentage in 2015, but Brown defends his firm's aggressive projections by noting that ecommerce has barely penetrated the grocery sector yet, but is likely to make a bigger splash there over the next several years, especially in light of Amazon’s $13.4 billion purchase of Whole Foods last year.

In addition, the report expects that, by 2030, at least two-fifths of all consumers will be digital natives who won’t draw distinctions between digital and physical retailing. Consequently, it is critical for retailers to master and embrace digital retailing not only to communicate with shoppers and transact business, but also to identify new customers, track purchases, and analyze patterns.

The report talks about how technology is creating “personalized digital ecologies” for consumers, which CES operators need to tap into along with autonomous, on-demand mobility technologies (from driverless cars to robots) that could play a much bigger role in future shopping experiences.

Online purchases could account for nearly one-third of all U.S. retail sales by 2030. Retailers need to embrace digital commerce to attract consumers who are less disposed to distinguish between on- and offline shopping experiences. Image: A.T. Kearney

Logistics will determine winners from losers

When it comes to product assortments, retailers now find themselves scrambling to respond to consumer fragmentation, which Brown explains is leading toward “micro segmentation” that has the potential to cut into big-brand hegemony. Consequently, retailers need to build a logistical infrastructure driven by data analytics that allows them to offer multiple brands they can switch in and out of relatively quickly as consumer buying trends change.

The report believes consumers are going to want a lot more say in the goods and services that retailers bring to market. Their veto power starts with their smartphones, which give them the alacrity to select, or block, any input they choose. Advances in smartphone technology—along with advances in 3D printing, machine-to-machine interfaces, and artificial intelligence—will not only give consumers greater expectations about the control they wield over what goods and services retailers make available to them, but also how those products are ultimately delivered.

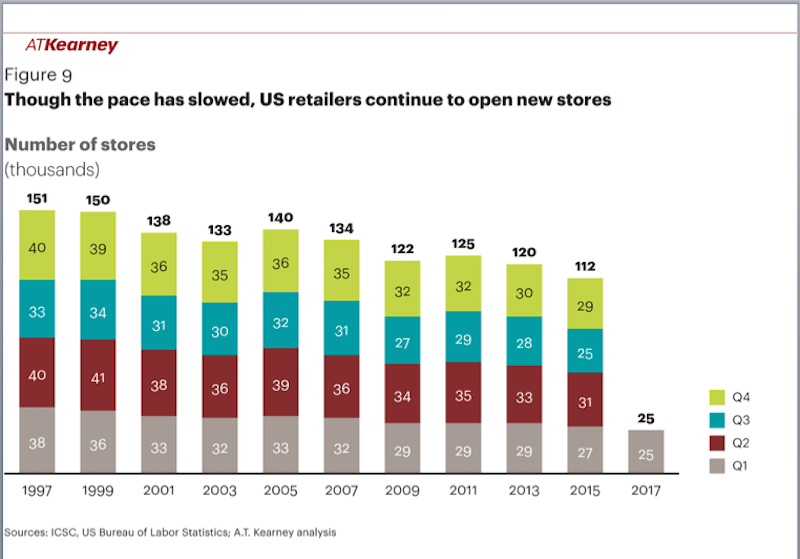

Physical stores aren’t going away; in fact, dealers are opening more stores in the U.S. And the picture about retailing’s future gets muddled when online retailers like Amazon and Boll & Branch are opening brick-and-mortar stores.

Even though the U.S. in overstored, dealers continue to open new outlets, although a growing number are using stores more as showrooms and distribution hubs for pickup by consumers who made their purchases online. Image: A.T. Kearney

But physical space, says Brown, is more likely to be used in the future to display merchandise and build experiences with consumers than to conduct actual buying and selling of products. He points specifically to the sporting goods retailer Foot Locker, which is reducing its store count but enlarging its remaining stores to enhance shoppers’ experience; and the home furnishings retailer Restoration Hardware, which has been opening “mansion” stores, 50,000- to 60,000-sf showrooms that support this dealer’s online selling strategy.

“Walmart and Amazon are successful because of their logistics,” says Brown, “and the speed and agility of a dealer’s infrastructure will be what’s important” going forward.

A.T. Kearney’s report divides successful future shopping centers into four distinct types:

•Destination centers that are regional malls with flagships, tenants that cater to specialized shopper groups, and possibly nontraditional anchors like theme parks. These destination centers could serve as digital distribution hubs, and even offer customers weekend experiences by tying into restaurants, hotels, and local entertainment;

•“Retaildential” centers, mixed-use facilities that are built to incorporate housing and are conveniently located near mass transit options;

•Value centers “that are anchored by an idea, not a retail nameplate,” the report states. Brown explains that value centers might cater to a specific ethnic group of customers, or to comsumers with like interests such as sports, fashion, or dining. These centers could include spaces for concerts, competitions, exhibits, and community events; and

•Innovation centers, that might be part-store, part research facility. They could include test stores and alternating-themed retail environments for the purpose of analyzing shoppers’ needs and behaviors over time.

Related Stories

| Aug 11, 2010

Florida mixed-use complex includes retail, residential

The $325 million Atlantic Plaza II lifestyle center will be built on 8.5 acres in Delray Beach, Fla. Designed by Vander Ploeg & Associates, Boca Raton, the complex will include six buildings ranging from three to five stories and have 182,000 sf of restaurant and retail space. An additional 106,000 sf of Class A office space and a residential component including 197 apartments, townhouses, ...

| Aug 11, 2010

Glass Wall Systems Open Up Closed Spaces

Sectioning off large open spaces without making everything feel closed off was the challenge faced by two very different projects—one an upscale food market in Napa Valley, the other a corporate office in Southern California. Movable glass wall systems proved to be the solution in both projects.

| Aug 11, 2010

CityCenter Takes Experience Design To New Heights

It's early June, in Las Vegas, which means it's very hot, and I am coming to the end of a hardhat tour of the $9.2 billion CityCenter development, a tour that began in the air-conditioned comfort of the project's immense sales center just off the famed Las Vegas Strip and ended on a rooftop overlooking the largest privately funded development in the U.

| Aug 11, 2010

The softer side of Sears

Built in 1928 as a shining Art Deco beacon for the upper Midwest, the Sears building in Minneapolis—with its 16-story central tower, department store, catalog center, and warehouse—served customers throughout the Twin Cities area for more than 65 years. But as nearby neighborhoods deteriorated and the catalog operation was shut down, by 1994 the once-grand structure was reduced to ...

| Aug 11, 2010

American Tobacco Project: Turning over a new leaf

As part of a major revitalization of downtown Durham, N.C., locally based Capitol Broadcasting Company decided to transform the American Tobacco Company's derelict 16-acre industrial plant, which symbolized the city for more than a century, into a lively and attractive mixed-use development. Although tearing down and rebuilding the property would have made more economic sense, the greater goal ...