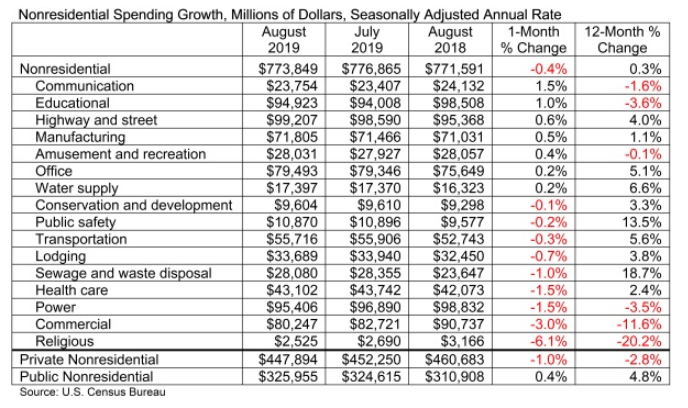

National nonresidential construction spending declined 0.4% in August, according to an Associated Builders and Contractors analysis of U.S. Census Bureau data published today. On a seasonally adjusted annualized basis, spending totaled $773.8 billion, 0.3% higher than in August 2018.

Private nonresidential spending fell 1% on a monthly basis and is down 2.8% compared to the same time last year. Public nonresidential construction expanded 0.4% for the month and 4.8% for the year.

"Nonresidential construction spending is down nearly 3% from its peak in April 2019 due to declines in private construction,” said ABC Chief Economist Anirban Basu. "Construction spending in the commercial category, which encompasses retail space among other segments, is down nearly 12% on a year-over-year basis. Spending related to lodging, including new hotel construction, was down 0.7% for the month and is up less than 4% year over year. Spending in the power segment also decreased in August and is down 3.5% compared to the same time last year."

“All of this is consistent with a slowing economy, especially as measures such as industrial production and capacity utilization remain stagnant,” said Basu. “While this could be attributed to trade wars and a slowing global economy, construction dynamics are rarely so simple. Another likely explanation is that America’s growing shortage of skilled construction workers has driven up the cost of delivering construction services, even in the context of flat materials prices, resulting in more project owners delaying projects.

“On the other hand, public construction spending continues to rise,” said Basu. “Construction spending on public safety is up 13.5% on a year-over-year basis and spending in the sewage/waste disposal category is up nearly 19%. State and local governments continue to benefit from an economy that has pushed property tax, sales tax and income tax collections higher. Low borrowing costs also serve as an inducement to leverage revenues with debt, resulting in more infrastructure spending. Given the recent path of interest rates, this dynamic should continue into 2020.”

Related Stories

Market Data | Apr 4, 2016

ABC: Nonresidential spending slip in February no cause for alarm

Spending in the nonresidential sector totaled $690.3 billion on a seasonally adjusted, annualized basis in February. The figure is a step back but still significantly higher than one year ago.

Market Data | Mar 30, 2016

10 trends for commercial real estate: JLL report

The report looks at global threats and opportunities, and how CRE firms are managing their expectations for growth.

Market Data | Mar 23, 2016

AIA: Modest expansion for Architecture Billings Index

Business conditions softening most in Midwest in recent months.

Retail Centers | Mar 16, 2016

Food and technology will help tomorrow’s malls survive, says CallisonRTKL

CallisonRTKL foresees future retail centers as hubs with live/work/play components.

Market Data | Mar 6, 2016

Real estate execs measure success by how well they manage ‘talent,’ costs, and growth

A new CBRE survey finds more companies leaning toward “smarter” workspaces.

Market Data | Mar 1, 2016

ABC: Nonresidential spending regains momentum in January

Nonresidential construction spending expanded 2.5% on a monthly basis and 12.3% on a yearly basis, totaling $701.9 billion. Spending increased in January in 10 of 16 nonresidential construction sectors.

Market Data | Mar 1, 2016

Leopardo releases 2016 Construction Economics Report

This year’s report shows that spending in 2015 reached the highest level since the Great Recession. Total spending on U.S. construction grew 10.5% to $1.1 trillion, the largest year-over-year gain since 2007.

Market Data | Feb 26, 2016

JLL upbeat about construction through 2016

Its latest report cautions about ongoing cost increases related to finding skilled laborers.

Market Data | Feb 17, 2016

AIA reports slight contraction in Architecture Billings Index

Multifamily residential sector improving after sluggish 2015.

Market Data | Feb 11, 2016

AIA: Continued growth expected in nonresidential construction

The American Institute of Architects’ semi-annual Consensus Construction Forecast indicates a growth of 8% in construction spending in 2016, and 6.7% the following year.