Price increases—some to record-setting levels—and long delivery delays are causing hardships for construction firms that are also experiencing challenges in completing projects with crews limited by illness or new work site procedures resulting from the pandemic, according to an analysis by the Associated General Contractors of America of government data released today. Association officials urged the Biden administration to review and rescind a range of trade tariffs in place, including for Canadian lumber, that are contributing to the price increases.

“The extreme price increases, as reflected in today’s producer price index report and other sources, are harming contractors on existing projects and making it difficult to bid new work at a profitable level,” said Ken Simonson, the association’s chief economist. “While contractors have kept bids nearly flat until now, project owners and budget officials should anticipate the prospect that contractors will have to pass along their higher costs in upcoming bids.”

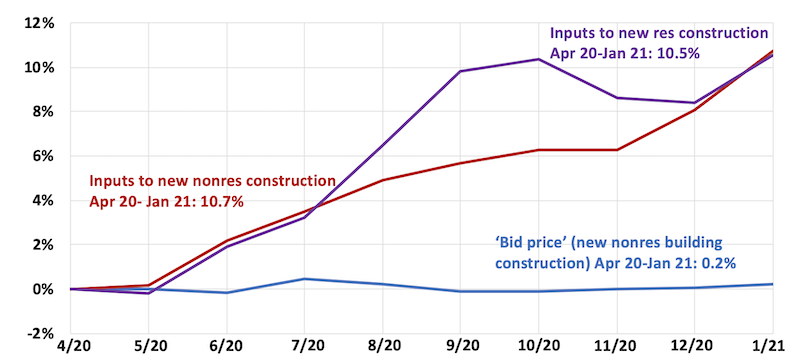

Prices for materials and services used in construction and contractors’ bid prices both declined at the beginning of the pandemic but have diverged sharply since last April, Simonson said. A government index that measures the selling price for materials and services used in new nonresidential construction increased 2.5 percent from December to January and 10.7 percent since April. Meanwhile, the producer price index for new nonresidential construction—a measure of what contractors say they would charge to erect five types of nonresidential buildings—increased only 0.2 percent over both the latest month and the nine months since April.

“The government data was collected more than a month ago, and numerous sources indicate price increases have continued or even accelerated since then,” Simonson added. “For instance, the Framing Lumber Composite Price compiled by the publication Random Lengths hit an all-time high last week. Several steel product prices are also reported at record levels, and copper futures are at an eight-year peak. Meanwhile, delivery delays are affecting both imports and domestically sourced construction inputs.”

Association officials said that while there are a range of reasons driving price spikes for key building materials, tariffs on numerous materials, including lumber and steel, are contributing to those cost increases. They urged the Biden administration to rescind these tariffs to provide immediate relief to construction employers caught between stagnant bid prices and rising materials costs. They also urged the administration and Congress to explore new ways to expand capacity for a host of key construction materials by reviewing regulatory impediments to expanding logging and steel production, for example.

“Left unchecked, these rising materials prices threaten to undermine the economic recovery by inflating the cost of infrastructure and economic development projects,” said Stephen E. Sandherr, the association’s chief executive officer. “Widespread harm is caused by maintaining tariffs on products that so many Americans need to improve their houses, modernize their infrastructure and revitalize their economy.”

View producer price index data. View chart of gap between input costs and bid prices.

Related Stories

Hotel Facilities | Jan 22, 2024

U.S. hotel construction is booming, with a record-high 5,964 projects in the pipeline

The hotel construction pipeline hit record project counts at Q4, with the addition of 260 projects and 21,287 rooms over last quarter, according to Lodging Econometrics.

Multifamily Housing | Jan 15, 2024

Multifamily rent growth rate unchanged at 0.3%

The National Multifamily Report by Yardi Matrix highlights the highs and lows of the multifamily market in 2023. Despite strong demand, rent growth remained unchanged at 0.3 percent.

Self-Storage Facilities | Jan 5, 2024

The state of self-storage in early 2024

As the housing market cools down, storage facilities suffer from lower occupancy and falling rates, according to the December 2023 Yardi Matrix National Self Storage Report.

Designers | Dec 25, 2023

Redefining the workplace is a central theme in Gensler’s latest Design Report

The firm identifies eight mega trends that mostly stress human connections.

Contractors | Dec 12, 2023

The average U.S. contractor has 8.5 months worth of construction work in the pipeline, as of November 2023

Associated Builders and Contractors reported today that its Construction Backlog Indicator inched up to 8.5 months in November from 8.4 months in October, according to an ABC member survey conducted Nov. 20 to Dec. 4. The reading is down 0.7 months from November 2022.

Market Data | Nov 27, 2023

Number of employees returning to the office varies significantly by city

While the return-to-the-office trend is felt across the country, the percentage of employees moving back to their offices varies significantly according to geography, according to Eptura’s Q3 Workplace Index.

Market Data | Nov 14, 2023

The average U.S. contractor has 8.4 months worth of construction work in the pipeline, as of September 2023

Associated Builders and Contractors reported that its Construction Backlog Indicator declined to 8.4 months in October from 9.0 months in September, according to an ABC member survey conducted from Oct. 19 to Nov. 2. The reading is down 0.4 months from October 2022. Backlog now stands at its lowest level since the first quarter of 2022.

Multifamily Housing | Nov 9, 2023

Multifamily project completions forecast to slow starting 2026

Yardi Matrix has released its Q4 2023 Multifamily Supply Forecast, emphasizing a short-term spike and plateau of new construction.

Contractors | Nov 1, 2023

Nonresidential construction spending increases for the 16th straight month, in September 2023

National nonresidential construction spending increased 0.3% in September, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.1 trillion.

Market Data | Oct 23, 2023

New data finds that the majority of renters are cost-burdened

The most recent data derived from the 2022 Census American Community Survey reveals that the proportion of American renters facing housing cost burdens has reached its highest point since 2012, undoing the progress made in the ten years leading up to the pandemic.