Despite the lingering effects of an over-built housing market, the continued difficulty to obtain financing for real estate projects, budget shortfalls at state and municipal governments and the anxiety surrounding the prolonged European debt crisis, there are signs that the U.S. design and construction industry will be improving.

Corporate profits have returned to pre-recession levels and businesses have subsequently been increasing their capital spending, borrowing costs are at record low levels and pent up demand for commercial and retail projects factors into what projects to be a 2.1% rise in spending this year for nonresidential construction projects.

The American Institute of Architects (AIA) semi-annual Consensus Construction Forecast, a survey of the nation’s leading construction forecasters, also projects a 6.4% increase of spending in 2013.

“Spending on hotels, industrial plants and commercial properties are going to set the pace for the construction industry over the next two years,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “The institutional market won’t experience the same growth, but healthcare facilities and places of worship are poised for a positive economic outlook in that sector.”

|

Market Segment Consensus Growth Forecasts |

2012 |

2013 |

|

Overall nonresidential |

2.1% |

6.4% |

|

Commercial / industrial |

5.6% |

11.4% |

|

Hotels |

10.2% |

19.7% |

|

Industrial |

6.0% |

10.2% |

|

Retail |

5.0% |

9.9% |

|

Office buildings |

4.3% |

9.6% |

|

Institutional |

-0.1% |

3.6% |

|

Religious |

5.1% |

6.3% |

|

Healthcare facilities |

4.5% |

5.3% |

|

Amusement / recreation |

0.2% |

6.5% |

|

Education |

-1.7% |

3.1% |

|

Public safety |

-3.8% |

0.3% |

Remarking on what could derail a positive turnaround, Baker added, “We are concerned that the unusually high energy costs, given the overall weakness in the economy, might trigger a jolt in inflation and hamstring economic recovery. The housing market also needs prices to stabilize and to resolve the high number of delinquencies and foreclosures before it can fully recover.” BD+C

Related Stories

Cultural Facilities | Mar 27, 2024

Kansas City’s new Sobela Ocean Aquarium home to nearly 8,000 animals in 34 habitats

Kansas City’s new Sobela Ocean Aquarium is a world-class facility home to nearly 8,000 animals in 34 habitats ranging from small tanks to a giant 400,000-gallon shark tank.

Market Data | Mar 26, 2024

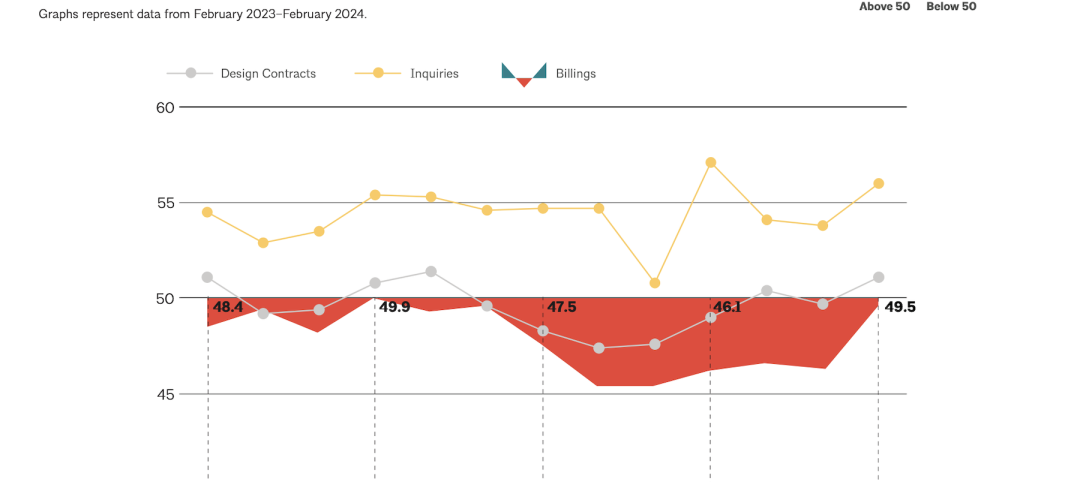

Architecture firm billings see modest easing in February

Architecture firm billings continued to decline in February, with an AIA/Deltek Architecture Billings Index (ABI) score of 49.5 for the month. However, February’s score marks the most modest easing in billings since July 2023 and suggests that the recent slowdown may be receding.

Cultural Facilities | Mar 26, 2024

Renovation restores century-old Brooklyn Paramount Theater to its original use

The renovation of the iconic Brooklyn Paramount Theater restored the building to its original purpose as a movie theater and music performance venue. Long Island University had acquired the venue in the 1960s and repurposed it as the school’s basketball court.

Adaptive Reuse | Mar 26, 2024

Adaptive Reuse Scorecard released to help developers assess project viability

Lamar Johnson Collaborative announced the debut of the firm’s Adaptive Reuse Scorecard, a proprietary methodology to quickly analyze the viability of converting buildings to other uses.

Security and Life Safety | Mar 26, 2024

Safeguarding our schools: Strategies to protect students and keep campuses safe

HMC Architects' PreK-12 Principal in Charge, Sherry Sajadpour, shares insights from school security experts and advisors on PreK-12 design strategies.

Green | Mar 25, 2024

Zero-carbon multifamily development designed for transactive energy

Living EmPower House, which is set to be the first zero-carbon, replicable, and equitable multifamily development designed for transactive energy, recently was awarded a $9 million Next EPIC Grant Construction Loan from the State of California.

Museums | Mar 25, 2024

Chrysler Museum of Art’s newly expanded Perry Glass Studio will display the art of glassmaking

In Norfolk, Va., the Chrysler Museum of Art’s Perry Glass Studio, an educational facility for glassmaking, will open a new addition in May. That will be followed by a renovation of the existing building scheduled for completion in December.

Sustainability | Mar 21, 2024

World’s first TRUE-certified building project completed in California

GENESIS Marina, an expansive laboratory and office campus in Brisbane, Calif., is the world’s first Total Resource Use and Efficiency (TRUE)-certified construction endeavor. The certification recognizes projects that achieve outstanding levels of resource efficiency through waste reduction, reuse, and recycling practices.

Office Buildings | Mar 21, 2024

Corporate carbon reduction pledges will have big impact on office market

Corporate carbon reduction commitments will have a significant impact on office leasing over the next few years. Businesses that have pledged to reduce their organization’s impact on climate change must ensure their next lease allows them to show material progress on their goals, according to a report by JLL.