A recent survey of AEC firms and real estate owners and developers found a strong majority that had deployed off-site construction in the previous 12 months and planned to utilize it to a greater extent going forward.

The Off-Site Construction Council of the National Institute of Building Sciences in Washington, D.C. conducted its 2018 Off-Site Construction Industry Survey as a follow-up to a 2014 survey to gauge the industry’s interest in off-site construction, which it defines as the planning, design, fabrication, and assembly of building elements at a location other than their final point of assembly onsite.

Ryan Smith of Washington State University and Kambaja Tarr of the University of Utah conducted and compiled the latest survey for NIBS.

“With the ongoing shortage of skilled craft workers (which exceeded two million in 2017), prefabrication in a controlled, off-site environment may become a necessity for many U.S. contractors attempting to remain competitive with a lower-skilled workforce,” the survey states. But as with any new process or technology innovation, and despite growing demand, ”uncertainties accompany the utilization of off-site construction.”

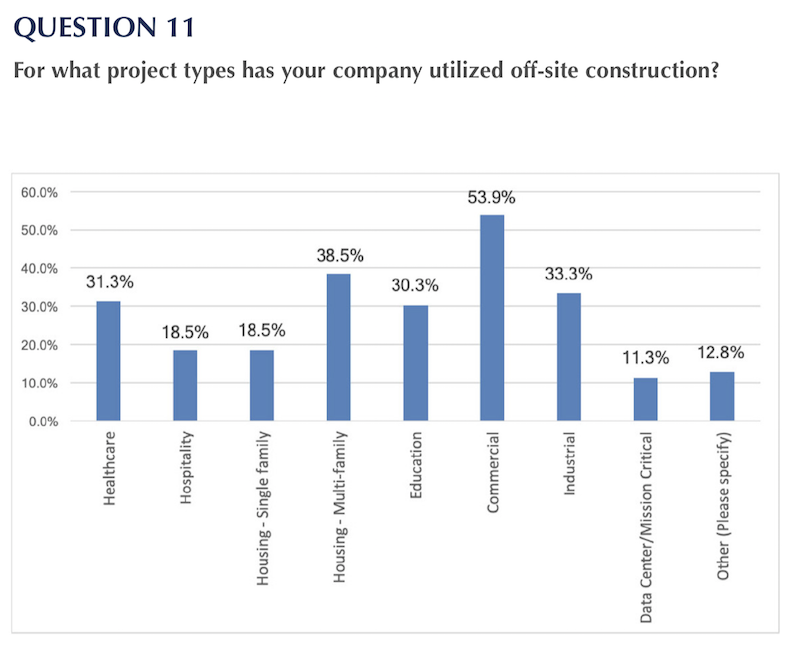

The commercial, multifamily and healthcare sectors are where off-site construction has been finding its greatest demand. Image: NIBS

A total of 205 participants responded to the 2018 Off-Site Construction Industry survey, versus 312 respondents to the 2014 poll. The participating companies provide a variety of different services, including construction management/general contracting (24.75% in 2018; 46.7% in 2014), engineering (21.72% and 38.3%), trade contracting (2.53% and 27.3%), architecture (87.88% and 15%), and owners/developers (10.1% and 8.3%).

Nearly nine of 10 respondents to the 2018 survey (87.72%) had used off-site fabricated components to some degree over the previous 12 months, and more than eight in 10 (81.63%) expected to engage off-site construction more often or the same amount in the following 12 months. (Both percentages were down slightly from the 2014 survey.)

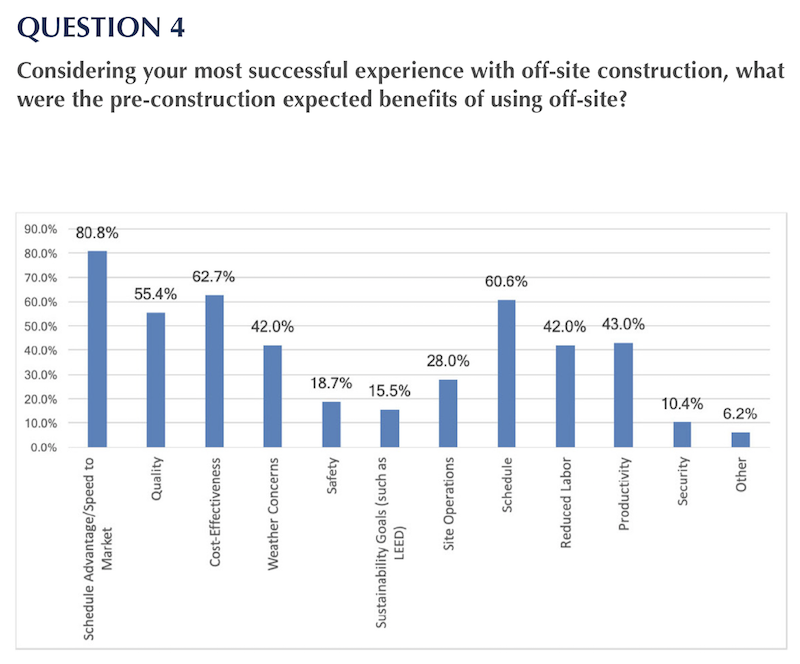

The primary benefit identified in both surveys is a reduced overall project schedule, specifically the duration of the construction phase.

For more than three fifths of respondents (63.22%) designers, architects and engineers were the primary decision makers about when off-site construction is implemented, followed by construction managers or general contractors (47.67%), clients (41.97%), and others, primarily subcontractors (21.24%).

Keeping projects on schedule is where companies that deploy off-site construction have been seeing the greatest benefit. Image: NIBS

Interestingly, however, respondents stated that the most significant barrier to off-site construction is the culture of design and construction in general. Comments indicated that late design changes, lack of collaboration and an adversarial climate for project delivery leads to difficulties in realizing the benefits of off-site construction.

The survey notes that the building component fabrication industry is still maturing and needs more time to integrate effectively with site-built work. In addition, contractors are still learning how to manage off-site products for assembly on-site.

Transportation is another significant barrier: specifically, how far away a factory is located from the construction site.

Respondents in both surveys qualitatively noted that some projects, particularly those with long spans, may not be suited for the use of pre-fabricated elements, and that each project has unique requirements that must be met through an appropriate technical solution.

Related Stories

| Aug 11, 2010

SAFTI FIRST hires Tim Nass as National Sales Manager

SAFTI FIRST, a leading USA manufacturer of fire rated glazing and framing systems, is pleased to announce the addition of Tim Nass as National Sales Manager. In his new role, Tim will be working closely with architects and contract glaziers in selecting the appropriate and most economical fire rated glazing solution for their project. He will also be coordinating SAFTI FIRST’s extensive network of architectural representatives throughout the United States.

| Aug 11, 2010

NCARB welcomes new board of directors

The National Council of Architectural Registration Boards (NCARB) introduces its Board of Directors for FY10, who were installed during the culmination of the Council’s 90th Annual Meeting and Conference in Chicago.

| Aug 11, 2010

Nonprofit healthcare providers turn to real estate for liquidity and to preserve capital, says Jones Lang LaSalle report

Long considered to be stable investments immune to recession, hospitals and other healthcare facilities are now feeling the effects of a cash-strapped economy as decreased charitable contributions are forcing nonprofit hospitals to pare back and seek new financing sources, according to Jones Lang LaSalle’s 2009 Healthcare Real Estate Financing Outlook.

| Aug 11, 2010

New CertainTeed Gypsum drywall compound reduces airborne dust by more than 70%

CertainTeed Gypsum launches two new revolutionary drywall compounds that significantly reduce the amount of dust traditionally associated with finishing gypsum walls and ceilings. The products—Dust Away Reduced Airborne Dust Drywall Compound and Renovation Mud—join CertainTeed’s Easi-Fil and ProRoc brands of finishing products currently available throughout Canada.

| Aug 11, 2010

Suffolk Construction Company acquires William A. Berry & Son

Suffolk Construction Company, New England’s largest construction company announced today that they have acquired William A. Berry & Son (Berry), the second largest construction company in the region. The two companies, both with deep New England roots and successful track-records, combined will have more than 1,200 employees and projected revenues of $2 billion.

| Aug 11, 2010

Polshek Partnership unveils design for University of North Texas business building

New York-based architect Polshek Partnership today unveiled its design scheme for the $70 million Business Leadership Building at the University of North Texas in Denton. Designed to provide UNT’s 5,400-plus business majors the highest level of academic instruction and professional training, the 180,000-sf facility will include an open atrium, an internet café, and numerous study and tutoring rooms—all designed to help develop a spirit of collaboration and team-oriented focus.

| Aug 11, 2010

University of Florida aiming for nation’s first LEED Platinum parking garage

If all goes as planned, the University of Florida’s new $20 million Southwest Parking Garage Complex in Gainesville will soon become the first parking facility in the country to earn LEED Platinum status. Designed by the Boca Raton office of PGAL to meet criteria for the highest LEED certification category, the garage complex includes a six-level, 313,000-sf parking garage (927 spaces) and an attached, 10,000-sf, two-story transportation and parking services office building.

| Aug 11, 2010

Aslaug Haraldsdottir, Ph.D. receives highest honor from the Society of Women Engineers

The Society of Women Engineers (SWE) is pleased to announce Aslaug Haraldsdottir, Ph.D. as the recipient of the 2009 SWE Achievement Award for accomplishments in Air Traffic Management, communication, navigation and surveillance system design, greatly influencing the future worldwide Air Traffic Management systems.

| Aug 11, 2010

Nonresidential construction will be down 14% in 2009; 17% in 2010, according to FMI report

FMI released its Construction Outlook: Second Quarter 2009 Report, and the outlook isn't good for the nonresidential market. FMI forecasts the market to decline 14% this year, followed by a 17% slide in 2010. FMI says that while the economy is showing some signs of improvement, it is just the beginning of the downfall for nonresidential construction.