A recent survey of AEC firms and real estate owners and developers found a strong majority that had deployed off-site construction in the previous 12 months and planned to utilize it to a greater extent going forward.

The Off-Site Construction Council of the National Institute of Building Sciences in Washington, D.C. conducted its 2018 Off-Site Construction Industry Survey as a follow-up to a 2014 survey to gauge the industry’s interest in off-site construction, which it defines as the planning, design, fabrication, and assembly of building elements at a location other than their final point of assembly onsite.

Ryan Smith of Washington State University and Kambaja Tarr of the University of Utah conducted and compiled the latest survey for NIBS.

“With the ongoing shortage of skilled craft workers (which exceeded two million in 2017), prefabrication in a controlled, off-site environment may become a necessity for many U.S. contractors attempting to remain competitive with a lower-skilled workforce,” the survey states. But as with any new process or technology innovation, and despite growing demand, ”uncertainties accompany the utilization of off-site construction.”

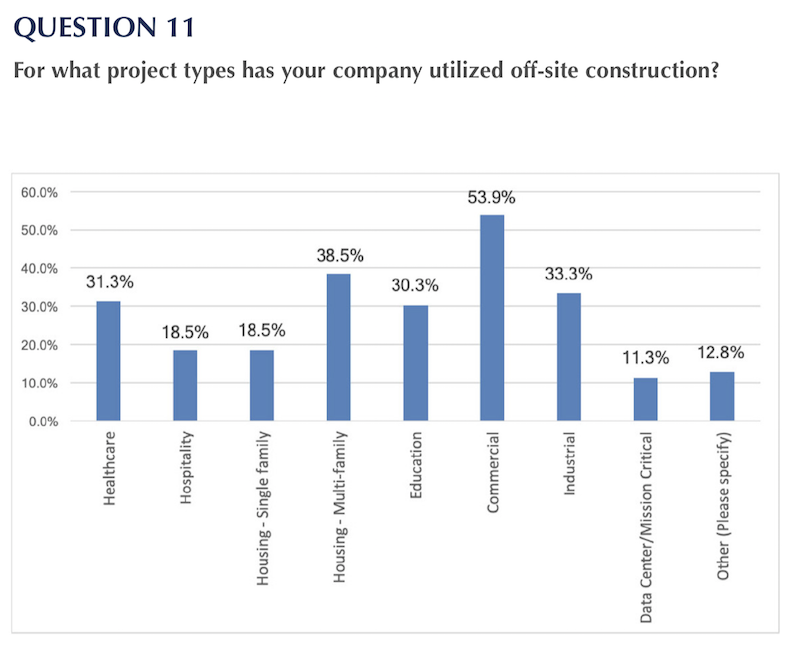

The commercial, multifamily and healthcare sectors are where off-site construction has been finding its greatest demand. Image: NIBS

A total of 205 participants responded to the 2018 Off-Site Construction Industry survey, versus 312 respondents to the 2014 poll. The participating companies provide a variety of different services, including construction management/general contracting (24.75% in 2018; 46.7% in 2014), engineering (21.72% and 38.3%), trade contracting (2.53% and 27.3%), architecture (87.88% and 15%), and owners/developers (10.1% and 8.3%).

Nearly nine of 10 respondents to the 2018 survey (87.72%) had used off-site fabricated components to some degree over the previous 12 months, and more than eight in 10 (81.63%) expected to engage off-site construction more often or the same amount in the following 12 months. (Both percentages were down slightly from the 2014 survey.)

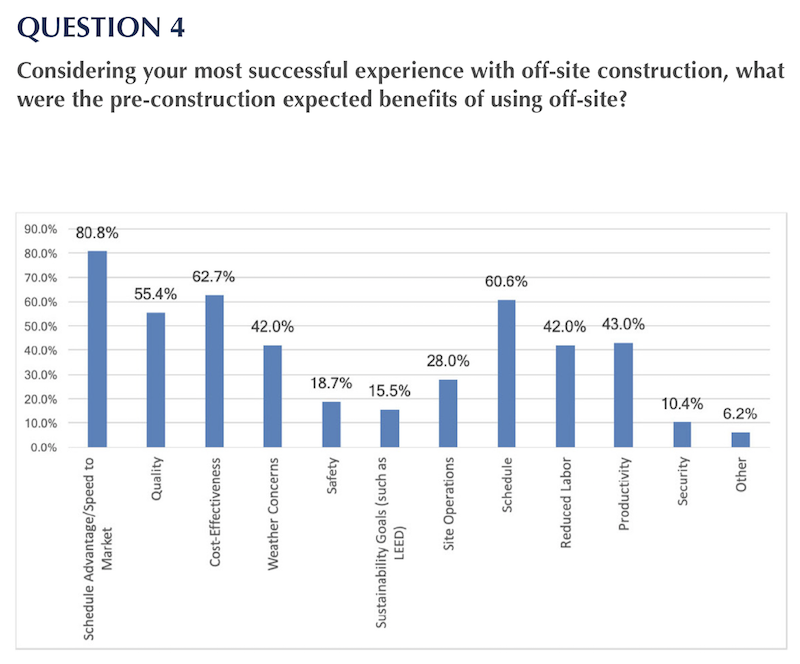

The primary benefit identified in both surveys is a reduced overall project schedule, specifically the duration of the construction phase.

For more than three fifths of respondents (63.22%) designers, architects and engineers were the primary decision makers about when off-site construction is implemented, followed by construction managers or general contractors (47.67%), clients (41.97%), and others, primarily subcontractors (21.24%).

Keeping projects on schedule is where companies that deploy off-site construction have been seeing the greatest benefit. Image: NIBS

Interestingly, however, respondents stated that the most significant barrier to off-site construction is the culture of design and construction in general. Comments indicated that late design changes, lack of collaboration and an adversarial climate for project delivery leads to difficulties in realizing the benefits of off-site construction.

The survey notes that the building component fabrication industry is still maturing and needs more time to integrate effectively with site-built work. In addition, contractors are still learning how to manage off-site products for assembly on-site.

Transportation is another significant barrier: specifically, how far away a factory is located from the construction site.

Respondents in both surveys qualitatively noted that some projects, particularly those with long spans, may not be suited for the use of pre-fabricated elements, and that each project has unique requirements that must be met through an appropriate technical solution.

Related Stories

| Aug 11, 2010

PCL Construction, HITT Contracting among nation's largest commercial building contractors, according to BD+C's Giants 300 report

A ranking of the Top 50 Commercial Contractors based on Building Design+Construction's 2009 Giants 300 survey. For more Giants 300 rankings, visit http://www.BDCnetwork.com/Giants

| Aug 11, 2010

Pella introduces BIM models for windows and doors

Pella Corporation now offers three-dimensional (3D) window and door models for use in Building Information Modeling (BIM) projects by architects, designers, and others looking for aesthetically correct, easy-to-use, data-rich 3D drawings.

| Aug 11, 2010

Sargent launches power over ethernet campus access control solution

Sargent takes campus access control to the edge of the network with the new Passport 1000 P1 Power over Ethernet (PoE) hardware. Passport P1 connects to a facility’s Ethernet network with standard cabling, and provides full online access control even when the network is unavailable.

| Aug 11, 2010

Webcor, Hunt Construction lead the way in mixed-use construction, according to BD+C's Giants 300 report

A ranking of the Top 30 Mixed-Use Contractors based on Building Design+Construction's 2009 Giants 300 survey. For more Giants 300 rankings, visit http://www.BDCnetwork.com/Giants

| Aug 11, 2010

NBBJ selected to design Russell Investments’ Seattle headquarters

NBBJ has been hired by Russell Investments as the architectural firm to design the interior space of its new global headquarters at 1301 2nd Avenue, a building also designed by NBBJ.

| Aug 11, 2010

High-profit design firms invest in in-house training

Forty-three percent of high-profit architecture, engineering, and environmental consulting firms have in-house training staff, according to a study by ZweigWhite. The 2008-2009 Successful Firm Survey reports that only 36% of firms overall have in-house training staff. In addition, 52% of high-profit firms use an online training system or service.

| Aug 11, 2010

Construction cost trend remains negative despite August increases, according to AGC

Despite increases in construction costs in August, new figures released today by the U.S. Bureau of Labor Statistics indicate that prices for the sector remain significantly down from a year ago, the chief economist for the Associated General Contractors of America said today in analyzing the data.