Reconstruction work is alive and kicking for many AEC firms. “Higher education is huge for us, and that sector just stopped spending when the recession hit,” recalls Mark DiNapoli, President and General Manager (Northeast Region), Suffolk Construction. “Now we’re seeing projects starting to take off.” Healthcare, science and technology, and commercial (office/retail/hospitality) are also coming back in the Northeast, he says, as clients “think about how to transform their existing buildings.”

“The reconstruction market has gotten much busier,” notes Karl Anoushian, Senior Vice President and Director of Preconstruction Services at Structure Tone. “The smart landlords, the financially stable ones, have timed the market and are pulling the trigger on deals.” The strategy: repositioning—reskinning exteriors to make them pop, sprucing up lobbies and core bathrooms, upgrading the lighting, air-conditioning, and elevators.

SCROLL DOWN FOR GIANTS 300 RECONSTRUCTION FIRM RANKINGS

Mary Miano-Sleeper, Vice President/Director of Corporate Development in the Dallas office of PageSoutherlandPage, says the growth in the rehabilitation of “tired spaces” in Class B and B+ buildings is “due to the availability of capital that was on the sidelines waiting for distressed assets to be vetted and put back into play.”

Wight & Co. has been getting “a good share of our work out of renovations,” notably for college and K-12 structures of the ’60s and ’70s, says Ken Osmun, PE, LEED BD+C, DBIA, Group President, Construction. The work often entails adding air-conditioning, bringing buildings up to code, and restoring their original appearance.

“Most of the activity we are seeing is in cities immediately adjacent to large cities,” says Mathew Dougherty, PE, Vice President, McShane Construction. High-density, mixed-use urban infill developments with substantial upgrading and direct access to public transportation remain “highly popular with both tenants and developers,” he says.

MAKING THE DEALS WORK

AEC firms have to help clients capture available funds, such as historic tax credits, says Suffolk’s DiNapoli. “We provide detailed cost information every month so that they can collect their funds,” he says. “We’re much more involved at an early stage on these projects, to help with financing.”

In older cities like Boston, infrastructure usually has to be upgraded when a building is renovated. “The utilities are requiring transformer vaults inside the buildings instead of pad-mounted transformers,” says DiNapoli. That’s a hidden cost the client has to absorb, but it’s necessary to help prevent brownouts.

AEC firms are making the business case for reconstruction. Wight & Co. recently completed the renovation of a 70-year-old college residence hall that came in at one-third the cost of new construction. “Our clients have limited budgets, so renovation can help them manage their resources,” says Osmun.

Structure Tone’s global procurement process provides dollar savings and accelerated product delivery for clients. The firm also uses its contractor-controlled insurance program and subcontractor qualification process to hold down costs. “We’re big in cost segregation, which can have real tax advantages for the owner,” says Anoushian, whose firm does 800-900 reconstruction projects a year. “We try to offer the client the best savings over the life of the project.”

USING TECHNOLOGY WISELY

For a 420-bed hostel in Boston, Suffolk laser-scanned the interiors of all six floors of a landmark building and created a Revit-based BIM model that informed the design. “In reconstruction, the unknown is more important than the known,” says DiNapoli. “We need to provide clients with as much information as possible, set budgets with appropriate contingencies for unknowns, and plan, plan, plan.”

“We’re doing animated flythroughs on our renovation jobs, using Revit and 3D, to articulate to clients what they’re actually going to get,” says Osmun. “There may be piping that will affect actual ceiling height, or a column that can’t be removed. This helps establish client expectations more realistically, before we start the work.”

Structure Tone routinely uses geothermal and ice-storage technology on office renovations. “Major financial institutions have huge data demands, and you have to keep their data centers at 60 degrees” [Fahrenheit], says Anoushian.

STEADY GROWTH, BOOST IN SUBCONTRACTOR COSTS

“The second half of 2012 will continue to show slow but steady growth in reconstruction,” says PageSoutherlandPage’s Miano-Sleeper.

“After dropping their fees just to retain their people, subcontractors are trying to make a recovery,” says Suffolk’s DiNapoli. “We’re definitely seeing price escalation from subs, 6-8%, and it’s been a little startling for our clients—and for us.”

Wight & Co.’s Osmun says, “Our estimators are saying it’s a 2% increase overall in the last year. We have to sharpen our pencils more than ever. We have to be smart, and we can’t make a mistake in the field.”

“Firms need to develop ways to meet client needs for remodels and expansions,” says D. Bruce Henley, AIA, LEED AP, DBIA, Principal/Office Director with Dewberry. “It will mean survival for many.” +

TOP 25 RECONSTRUCTION SECTOR ARCHITECTURE FIRMS

| Rank | Company | 2011 Reconstruction Revenue ($) |

| 1 | HOK | 133,348,629 |

| 2 | Cannon Design | 93,000,000 |

| 3 | EYP Architecture & Engineering | 48,332,935 |

| 4 | SmithGroupJJR | 44,275,000 |

| 5 | ZGF Architects | 38,566,000 |

| 6 | Gresham, Smith and Partners | 27,662,548 |

| 7 | PageSoutherlandPage | 27,585,000 |

| 8 | Perkowitz+Ruth Architects | 26,910,000 |

| 9 | RSP Architects | 26,190,000 |

| 10 | EwingCole | 25,500,000 |

| 11 | Corgan Associates | 23,850,000 |

| 12 | CTA Architects Engineers | 23,276,400 |

| 13 | Beyer Blinder Belle Architects & Planners | 22,700,000 |

| 14 | FRCH Design Worldwide | 21,690,000 |

| 15 | RBB Architects | 20,370,000 |

| 16 | S/L/A/M Collaborative, The | 17,764,184 |

| 17 | Reynolds, Smith and Hills | 16,800,000 |

| 18 | BSA LifeStructures | 15,860,773 |

| 19 | Albert Kahn Family of Companies | 14,000,000 |

| 20 | Swanke Hayden Connell Architects | 12,500,000 |

| 21 | Fletcher Thompson | 12,300,000 |

| 22 | Baskervill | 11,412,700 |

| 23 | CASCO Diversified Corp. | 11,000,000 |

| 24 | Wight & Co. | 10,027,500 |

| 25 | Ennead Architects | 9,944,000 |

TOP 25 RECONSTRUCTION SECTOR ENGINEERING FIRMS

| Rank | Company | 2011 Reconstruction Revenue ($) |

| 1 | URS Corp. | 1,945,200,000 |

| 2 | Jacobs | 1,810,600,000 |

| 3 | STV | 275,000,000 |

| 4 | Stantec | 235,000,000 |

| 5 | Wiss, Janney, Elstner Associates | 64,080,000 |

| 6 | Dewberry | 63,384,145 |

| 7 | Middough | 51,750,000 |

| 8 | Simpson Gumpertz & Heger | 41,490,000 |

| 9 | Syska Hennessy Group | 40,121,834 |

| 10 | Thornton Tomasetti | 31,708,579 |

| 11 | Henderson Engineers | 31,000,000 |

| 12 | Eaton Energy Solutions | 30,374,875 |

| 13 | Sebesta Blomberg | 30,271,508 |

| 14 | Science Applications International Corp. | 28,696,000 |

| 15 | Clark Nexsen | 20,407,051 |

| 16 | RMF Engineering | 20,403,000 |

| 17 | H&A Architects & Engineers | 18,750,730 |

| 18 | Rolf Jensen & Associates | 16,000,000 |

| 19 | Michael Baker Jr., Inc | 15,184,500 |

| 20 | Bard, Rao + Athanas Consulting Engineers | 15,100,000 |

| 21 | Dunham Associates | 13,500,000 |

| 22 | TLC Engineering for Architecture | 13,463,203 |

| 23 | Degenkolb Engineers | 11,920,636 |

| 24 | Henneman Engineering | 10,800,000 |

| 25 | Bridgers & Paxton Consulting Engineers | 9,707,771 |

TOP 25 RECONSTRUCTION SECTOR CONSTRUCTION FIRMS

| Rank | Company | 2011 Reconstruction Revenue ($) |

| 1 | Gilbane Building Co. | 2,149,930,000 |

| 2 | URS Corp. | 1,945,200,000 |

| 3 | Jacobs | 1,810,600,000 |

| 4 | Structure Tone | 1,699,180,000 |

| 5 | Turner Corporation, The | 1,476,646,000 |

| 6 | Shawmut Design and Construction | 465,000,000 |

| 7 | Holder Construction | 350,000,000 |

| 8 | Swinerton | 326,929,500 |

| 9 | Suffolk Construction | 238,619,421 |

| 10 | Walbridge | 216,975,000 |

| 11 | Ryan Companies US | 210,943,550 |

| 12 | Power Construction | 207,000,000 |

| 13 | Weitz Co., The | 179,880,756 |

| 14 | Walsh Group, The | 161,205,219 |

| 15 | W. M. Jordan Co. | 137,277,920 |

| 16 | O’Neil Industries/W.E. O’Neil | 130,140,000 |

| 17 | Bernards | 113,894,000 |

| 18 | KBE Building Corp. | 102,083,867 |

| 19 | EMJ Corp. | 100,905,397 |

| 20 | Robins & Morton | 89,106,900 |

| 21 | Clayco | 82,000,000 |

| 22 | Layton Construction | 75,200,000 |

| 23 | Hunt Construction Group | 75,000,000 |

| 24 | Kitchell | 71,070,000 |

| 25 | Doster Construction | 66,202,115 |

Related Stories

Architects | Mar 15, 2024

4 ways to streamline your architectural practice

Vessel Architecture's Lindsay Straatmann highlights four habits that have helped her discover the key to mastering efficiency as an architect.

Healthcare Facilities | Mar 15, 2024

First comprehensive cancer hospital in Dubai to host specialized multidisciplinary care

Stantec was selected to lead the design team for the Hamdan Bin Rashid Cancer Hospital, Dubai’s first integrated, comprehensive cancer hospital. Named in honor of the late Sheikh Hamdan Bin Rashid Al Maktoum, the hospital is scheduled to open to patients in 2026.

Codes and Standards | Mar 15, 2024

Technical brief addresses the impact of construction-generated moisture on commercial roofing systems

A new technical brief from SPRI, the trade association representing the manufacturers of single-ply roofing systems and related component materials, addresses construction-generated moisture and its impact on commercial roofing systems.

Sports and Recreational Facilities | Mar 14, 2024

First-of-its-kind sports and rehabilitation clinic combines training gym and healing spa

Parker Performance Institute in Frisco, Texas, is billed as a first-of-its-kind sports and rehabilitation clinic where students, specialized clinicians, and chiropractic professionals apply neuroscience to physical rehabilitation.

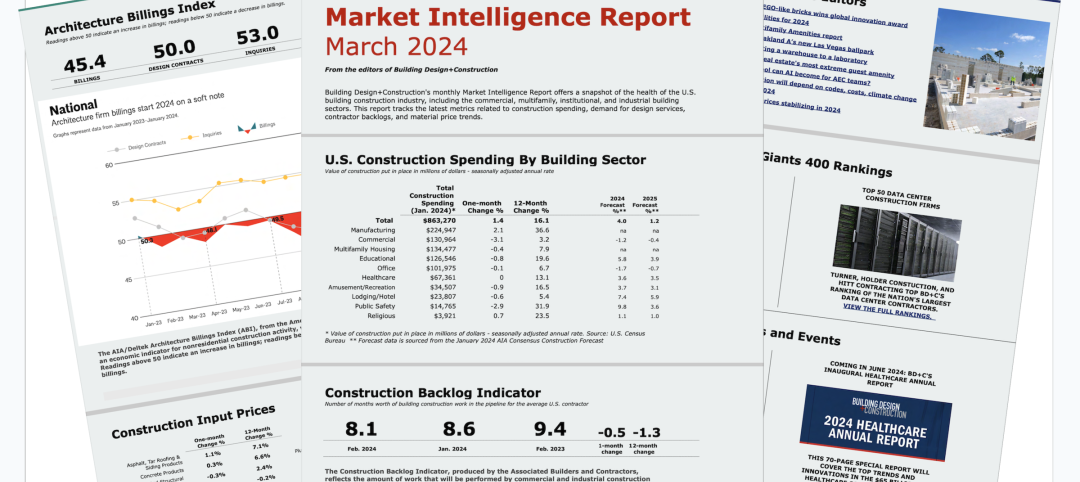

Market Data | Mar 14, 2024

Download BD+C's March 2024 Market Intelligence Report

U.S. construction spending on buildings-related work rose 1.4% in January, but project teams continue to face headwinds related to inflation, interest rates, and supply chain issues, according to Building Design+Construction's March 2024 Market Intelligence Report (free PDF download).

Apartments | Mar 13, 2024

A landscaped canyon runs through this luxury apartment development in Denver

Set to open in April, One River North is a 16-story, 187-unit luxury apartment building with private, open-air terraces located in Denver’s RiNo arts district. Biophilic design plays a central role throughout the building, allowing residents to connect with nature and providing a distinctive living experience.

Sustainability | Mar 13, 2024

Trends to watch shaping the future of ESG

Gensler’s Climate Action & Sustainability Services Leaders Anthony Brower, Juliette Morgan, and Kirsten Ritchie discuss trends shaping the future of environmental, social, and governance (ESG).

Affordable Housing | Mar 12, 2024

An all-electric affordable housing project in Southern California offers 48 apartments plus community spaces

In Santa Monica, Calif., Brunson Terrace is an all-electric, 100% affordable housing project that’s over eight times more energy efficient than similar buildings, according to architect Brooks + Scarpa. Located across the street from Santa Monica College, the net zero building has been certified LEED Platinum.

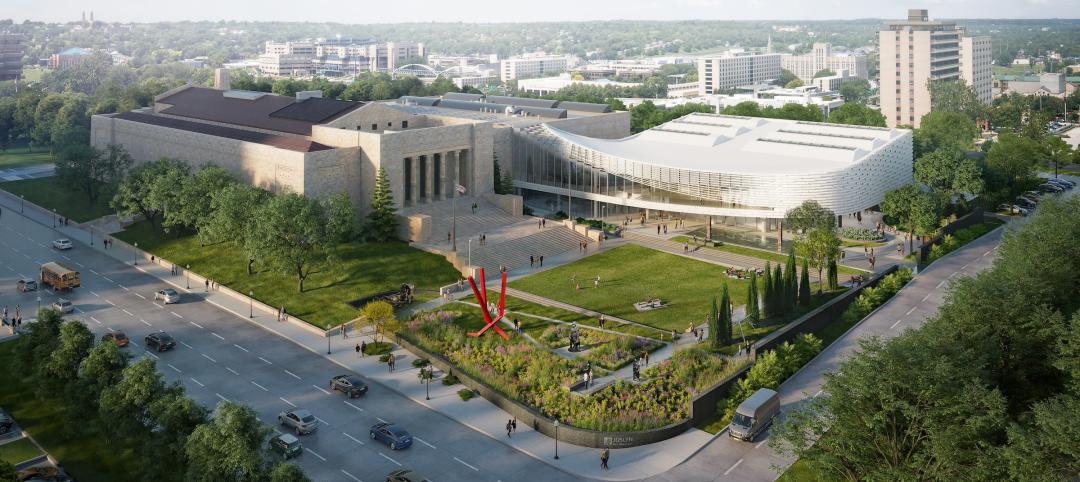

Museums | Mar 11, 2024

Nebraska’s Joslyn Art Museum to reopen this summer with new Snøhetta-designed pavilion

In Omaha, Neb., the Joslyn Art Museum, which displays art from ancient times to the present, has announced it will reopen on September 10, following the completion of its new 42,000-sf Rhonda & Howard Hawks Pavilion. Designed in collaboration with Snøhetta and Alley Poyner Macchietto Architecture, the Hawks Pavilion is part of a museum overhaul that will expand the gallery space by more than 40%.

Affordable Housing | Mar 11, 2024

Los Angeles’s streamlined approval policies leading to boom in affordable housing plans

Since December 2022, Los Angeles’s planning department has received plans for more than 13,770 affordable units. The number of units put in the approval pipeline in roughly one year is just below the total number of affordable units approved in Los Angeles in 2020, 2021, and 2022 combined.