Enabling talent, managing cost, and expanding influence are the three primary mandates that corporate real estate (CRE) executives are grappling with in their companies.

In its inaugural Americas Occupier Survey 2015/16, the CBRE Institute polled 229 executives about their strategies priorities, and practices. Forty-five percent of those respondents are in the Banking and Finance or in Tech and Telecom industries.

The majority (56%) of CRE executives say they are evaluated on the value and satisfaction they create among internal stakeholders. Throughout the survey, executives noted that their roles require them to address shortages in skilled labor, escalating costs, and economic uncertainties. Not surprisingly, uncertainties for execs in the Banking and Finance sectors revolve around tighter regulations.

CRE execs are dealing with a workforce that is more culturally, generationally, and ethnically diverse than ever. That workforce “strives to connect, integrate, and find community among peers in a world that is increasingly online” the report’s authors observe. Indeed, the highest portion of the survey’s respondents, 44%, says that connectivity to partners and supports is the most important factor to their labor forces, followed by flexible working hours, flexible space, and amenities.

Fifty-seven percent of respondents say their workplace strategies are driven by employee attraction and retention. And employers of choice are delivering the ideal work experience by linking their corporate real estate missions with human resources and information technology. Such “hyper-customized” environments emphasize brand, functionality, freedom of work style and community connectivity.

But CRE executives also insist that their strategic goals are thwarted when they don’t have support from their companies’ corporate suite. Productive and flexible workspaces and greater capital expenditure for real estate investment also rank high among the factors that give CRE execs the wherewithal to accomplish their objectives.

And when it comes to data, the majority of executives say they need information that enables data visualization and decision support. “Our research indicates that an optimal approach to CRE decisions will involve selective and discriminating use of analytics, paired with the irreplaceable role of a leader’s intuition and experience,” the report says.

CRE executives often manage their firms’ portfolio costs. A remarkable 85% of those polled said their companies had used space restructuring as a lever to reduce costs in the previous 12 months. But the pendulum is swinging away from smaller workstations and lower rents to smarter workplaces and agile leasing structures The survey finds that 31% of respondents’ companies are currently using shared office facilities, and another 15% say they are considering the merits of sharing space.

An emerging co-worker model “offers environments that inspire new levels of energy and connectivity that eluded earlier incarnations of the shared workplace model.”

Lease negotiation seems preferable to relocation as a cost-saving measure. For one out of every two companies, “talent determines the market; cost pinpoints the location,” the report says. However, expansion still dictates some moving decisions, as two out of five executives polled say accessing new markets and customers drive their companies’ relocation strategies.

AEC firms, take note: building and floorplan design is a leading decision driver when real estate executives are selecting a building to move into, even more important that real estate costs, lease options, or the quality of the location’s infrastructure or amenities.

Other findings of note from the survey include:

- 70% of CRE execs say their companies use external partnerships to deliver at least one function, like project or facilities management.

- Three quarters of CRE executives say their companies operate centrally.

- Half of the companies polled—which are all based in the Americas—favor India and Southeast Asia as expansion destinations.

Related Stories

Giants 400 | Sep 5, 2023

Top 80 Construction Management Firms for 2023

Alfa Tech, CBRE Group, Skyline Construction, Hill International, and JLL top the rankings of the nation's largest construction management (as agent) and program/project management firms for nonresidential buildings and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Sep 5, 2023

Top 150 Contractors for 2023

Turner Construction, STO Building Group, DPR Construction, Whiting-Turner Contracting Co., and Clark Group head the ranking of the nation's largest general contractors, CM at risk firms, and design-builders for nonresidential buildings and multifamily buildings work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Market Data | Sep 5, 2023

Nonresidential construction spending increased 0.1% in July 2023

National nonresidential construction spending grew 0.1% in July, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.08 trillion and is up 16.5% year over year.

Giants 400 | Aug 31, 2023

Top 35 Engineering Architecture Firms for 2023

Jacobs, AECOM, Alfa Tech, Burns & McDonnell, and Ramboll top the rankings of the nation's largest engineering architecture (EA) firms for nonresidential buildings and multifamily buildings work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Aug 22, 2023

Top 115 Architecture Engineering Firms for 2023

Stantec, HDR, Page, HOK, and Arcadis North America top the rankings of the nation's largest architecture engineering (AE) firms for nonresidential building and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Aug 22, 2023

2023 Giants 400 Report: Ranking the nation's largest architecture, engineering, and construction firms

A record 552 AEC firms submitted data for BD+C's 2023 Giants 400 Report. The final report includes 137 rankings across 25 building sectors and specialty categories.

Giants 400 | Aug 22, 2023

Top 175 Architecture Firms for 2023

Gensler, HKS, Perkins&Will, Corgan, and Perkins Eastman top the rankings of the nation's largest architecture firms for nonresidential building and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

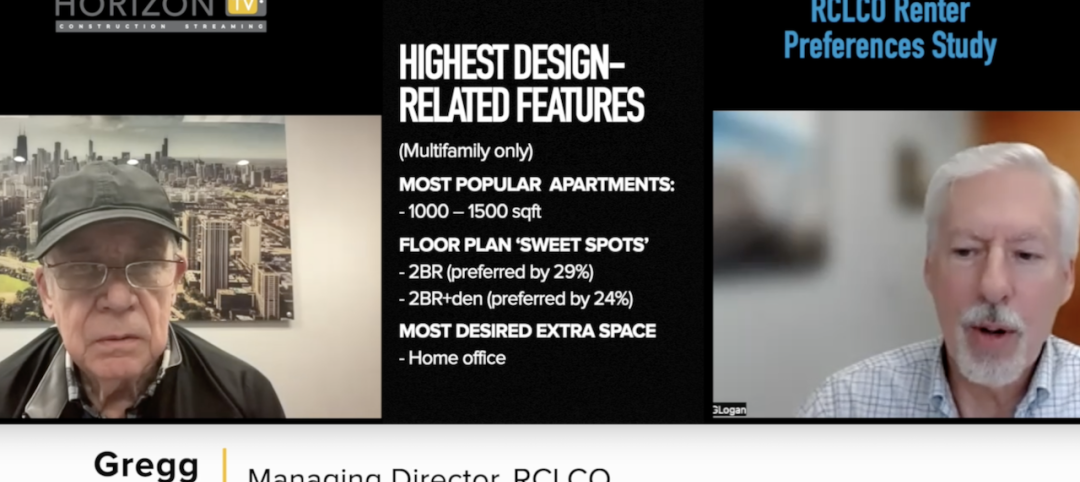

Apartments | Aug 22, 2023

Key takeaways from RCLCO's 2023 apartment renter preferences study

Gregg Logan, Managing Director of real estate consulting firm RCLCO, reveals the highlights of RCLCO's new research study, “2023 Rental Consumer Preferences Report.” Logan speaks with BD+C's Robert Cassidy.

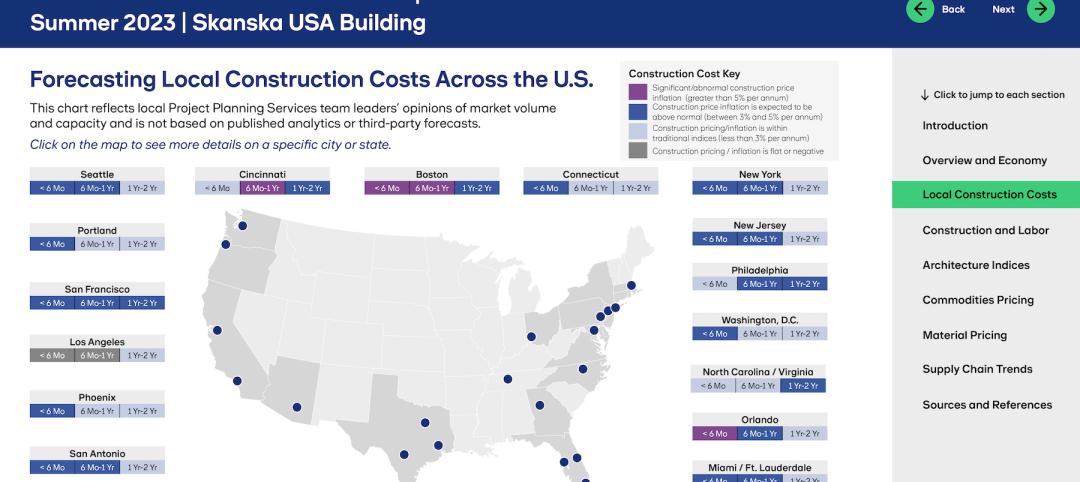

Market Data | Aug 18, 2023

Construction soldiers on, despite rising materials and labor costs

Quarterly analyses from Skanska, Mortenson, and Gordian show nonresidential building still subject to materials and labor volatility, and regional disparities.

Apartments | Aug 14, 2023

Yardi Matrix updates near-term multifamily supply forecast

The multifamily housing supply could increase by up to nearly 7% by the end of 2023, states the latest Multifamily Supply Forecast from Yardi Matrix.