The cost of goods and services used in construction climbed by a record-setting 4.3% in May and 24.3% over the past 12 months, jeopardizing contractors’ solvency and construction workers’ employment, according to an analysis by the Associated General Contractors of America of government data released today. Association officials urged the Biden administration to move more quickly to end tariffs and quotas that are adding to construction materials costs and availability problems.

“The increase in producer prices for construction materials over the past year far outstrips contractors’ ability to charge more for projects,” said Ken Simonson, the association’s chief economist. “That gap means contractors are being hit with huge costs that they did not anticipate and cannot pass on.”

The 24.3% increase in prices for materials used in construction from May 2020 to last month was nearly twice as great as in any previous year, Simonson said. Meanwhile, the producer price index for new nonresidential construction—a measure of what contractors say they would charge to erect five types of nonresidential buildings—rose only 2.8% over the past 12 months, as contractors held their profit expectations down in order to compete for a limited number of new projects.

Items with especially steep price increases over the past year covered a wide range of materials, including products made from wood, metals, plastics, and gypsum. The producer price index for lumber and plywood more than doubled—rocketing 111% from May 2020 to last month. The index for steel mill products climbed 75.6%, while the index for copper and brass mill shapes rose 60.4% and the index for aluminum mill shapes increased 28.6%. The index for plastic construction products rose 17.5%. The index for gypsum products such as wallboard climbed 14.1%. Fuel costs, which contractors pay directly to operate their own trucks and off-road equipment, as well as through surcharges on freight deliveries, have also jumped.

Association officials said the Biden administration can provide immediate relief from some of the price pressures by ending tariffs on Canadian lumber, along with tariffs and quotas on steel and aluminum from numerous countries. Officials said the administration took a first step today by announcing agreement on a working group with the European Union that will aim to end to tariffs on steel and aluminum from the EU by the end of 2021 but that much more tariff relief is needed, and sooner. The administration should also end the duty on Canadian softwood lumber, instead of doubling the rate, as the Commerce Department has proposed, the officials added.

“The administration is right to recognize that ending tariffs on our allies is good policy,” said Stephen E. Sandherr, the association’s chief executive officer. “But there is no reason to wait six months to adopt good measures. The president should go further, by ending tariffs and quotas on steel and aluminum from other trading partners as well as the European Union.”

View producer price index data. View chart of gap between input costs and bid prices.

Related Stories

Market Data | Mar 22, 2017

Architecture Billings Index rebounds into positive territory

Business conditions projected to solidify moving into the spring and summer.

Market Data | Mar 15, 2017

ABC's Construction Backlog Indicator fell to end 2016

Contractors in each segment surveyed all saw lower backlog during the fourth quarter, with firms in the heavy industrial segment experiencing the largest drop.

Market Data | Feb 28, 2017

Leopardo’s 2017 Construction Economics Report shows year-over-year construction spending increase of 4.2%

The pace of growth was slower than in 2015, however.

Market Data | Feb 23, 2017

Entering 2017, architecture billings slip modestly

Despite minor slowdown in overall billings, commercial/ industrial and institutional sectors post strongest gains in over 12 months.

Market Data | Feb 16, 2017

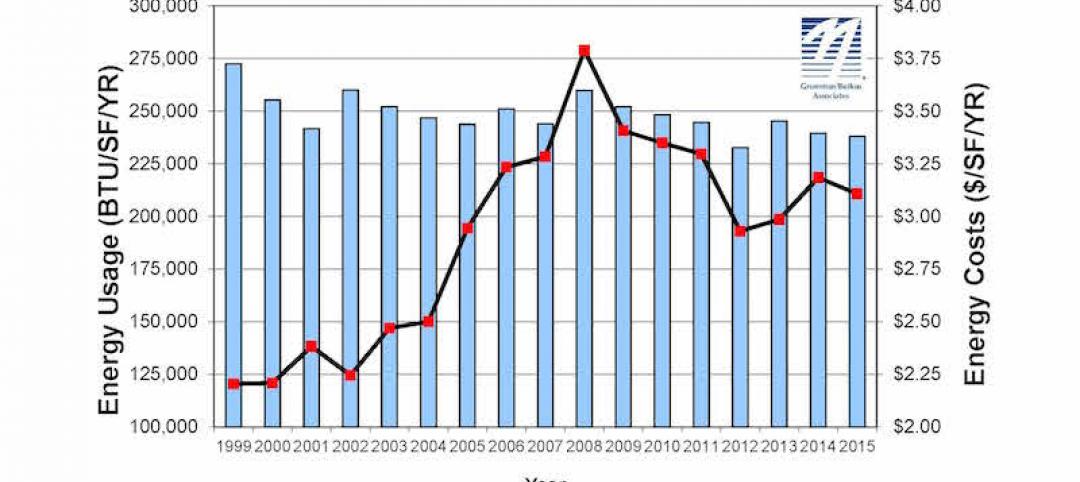

How does your hospital stack up? Grumman/Butkus Associates 2016 Hospital Benchmarking Survey

Report examines electricity, fossil fuel, water/sewer, and carbon footprint.

Market Data | Feb 1, 2017

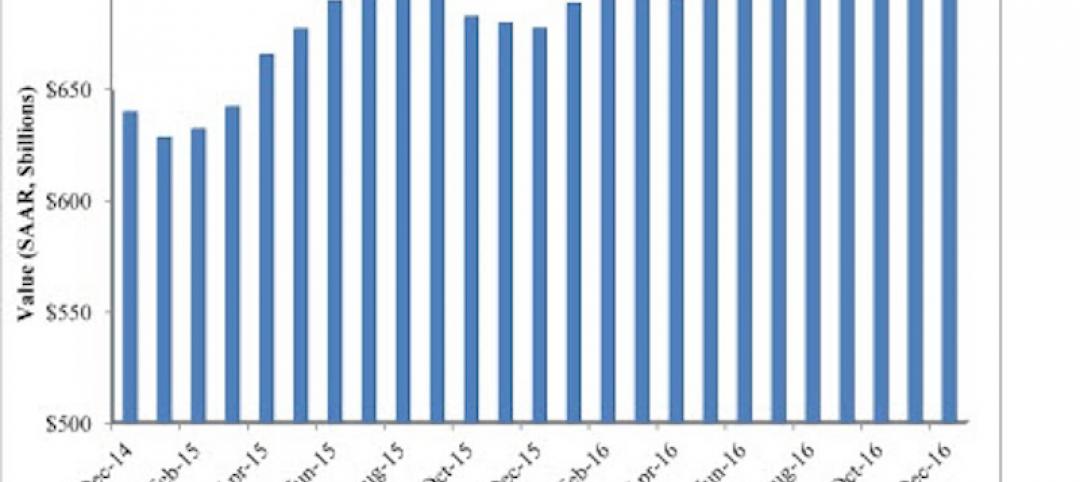

Nonresidential spending falters slightly to end 2016

Nonresidential spending decreased from $713.1 billion in November to $708.2 billion in December.

Market Data | Jan 31, 2017

AIA foresees nonres building spending increasing, but at a slower pace than in 2016

Expects another double-digit growth year for office construction, but a more modest uptick for health-related building.

High-rise Construction | Jan 23, 2017

Growth spurt: A record-breaking 128 buildings of 200 meters or taller were completed in 2016

This marks the third consecutive record-breaking year for building completions over 200 meters.

Market Data | Jan 18, 2017

Fraud and risk incidents on the rise for construction, engineering, and infrastructure businesses

Seven of the 10 executives in the sector surveyed in the report said their company fell victim to fraud in the past year.

Market Data | Jan 18, 2017

Architecture Billings Index ends year on positive note

Architecture firms close 2016 with the strongest performance of the year.