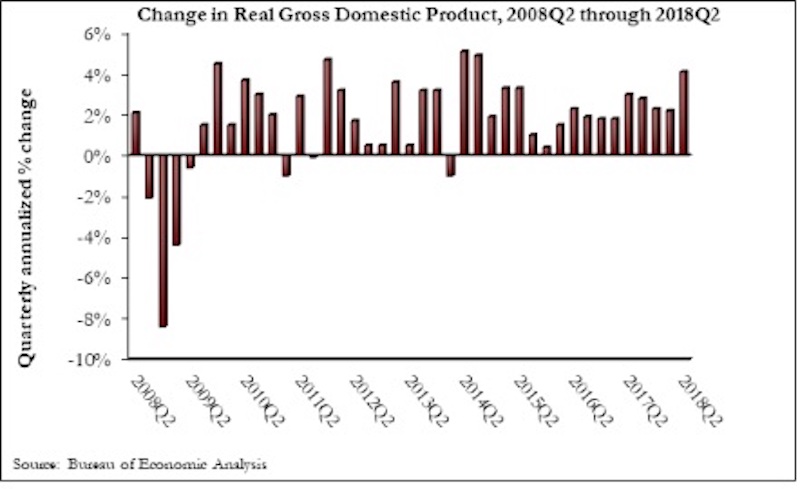

The U.S. economy expanded at an annualized 4.1% rate during the second quarter of 2018—the fastest rate of quarterly growth since the second quarter of 2014, according to an Associated Builders and Contractors analysis of U.S. Bureau of Economic Analysis data released today.

Nonresidential fixed investment represented an especially important element of second quarter strength in the advance estimate. While overall fixed investment expanded at a 5.4% annualized pace, nonresidential fixed investment grew 7.3%. The nonresidential sub-component exhibiting the most upward force was structures, which grew at a 13.3% annualized pace and by 13.9% during the year’s initial quarter.

Today’s data release helps explain why nonresidential contractors continue to report hefty backlog and scramble for human capital. By contrast, the residential segment, which continues to be impacted by rising mortgage rates and the lowest level of housing affordability in a decade, contracted at a 1.1% annualized rate and has now shrunk during three of the previous four quarters.

“It is quite remarkable that an economy now in its 10th year of economic expansion is actually gaining steam,” said ABC Chief Economist Anirban Basu. “A host of forces are at work, including elevated levels of confidence among business owners, developers and others who drive investment in America. Meanwhile, the consumer, supported by the strongest labor market in about two decades, continues to reliably contribute to economic growth. The result is an economy that is now on its way to a potential 3% growth year.

“As always, there are reasons to temper optimism,” said Basu. “Some of second quarter growth was driven by aggressive purchases of American output (e.g. soybeans) in advance of the imposition of retaliatory tariffs. That helped bulk up exports, but that pattern may not continue during the third quarter. The rapidly expanding economy is also serving to exacerbate inflationary pressures, which in turn are likely to drive borrowing costs higher. In other words, today’s strong economic growth may translate into weaker economic growth at some point in the future, and there is plenty of precedent for such a dynamic.

“Contractors can rest assured that the economy will retain its momentum through the balance of the year,” said Basu. “While financial markets may remain volatile and the global news cycle will undoubtedly continue to swirl, leading indicators, including those related to the level of observable activity among engineers, architects and other design professionals, suggest that another wave of building construction is on the way. The tax cuts passed late last year are just now beginning to have an impact. The hope is that tax reform will trigger a structural shift in the U.S. economy by helping to expand productivity and the economy’s long-term growth potential.The other possibility is that the tax reform’s primary effects will be to lift short-term growth, expand federal budget deficits, and ultimately give way to a countervailing reform at some point in the future.”

Related Stories

Industry Research | Jan 23, 2024

Leading economists forecast 4% growth in construction spending for nonresidential buildings in 2024

Spending on nonresidential buildings will see a modest 4% increase in 2024, after increasing by more than 20% last year according to The American Institute of Architects’ latest Consensus Construction Forecast. The pace will slow to just over 1% growth in 2025, a marked difference from the strong performance in 2023.

Construction Costs | Jan 22, 2024

Construction material prices continue to normalize despite ongoing challenges

Gordian’s most recent Quarterly Construction Cost Insights Report for Q4 2023 describes an industry still attempting to recover from the impact of COVID. This was complicated by inflation, weather, and geopolitical factors that resulted in widespread pricing adjustments throughout the construction materials industries.

Hotel Facilities | Jan 22, 2024

U.S. hotel construction is booming, with a record-high 5,964 projects in the pipeline

The hotel construction pipeline hit record project counts at Q4, with the addition of 260 projects and 21,287 rooms over last quarter, according to Lodging Econometrics.

Multifamily Housing | Jan 15, 2024

Multifamily rent growth rate unchanged at 0.3%

The National Multifamily Report by Yardi Matrix highlights the highs and lows of the multifamily market in 2023. Despite strong demand, rent growth remained unchanged at 0.3 percent.

Self-Storage Facilities | Jan 5, 2024

The state of self-storage in early 2024

As the housing market cools down, storage facilities suffer from lower occupancy and falling rates, according to the December 2023 Yardi Matrix National Self Storage Report.

Designers | Dec 25, 2023

Redefining the workplace is a central theme in Gensler’s latest Design Report

The firm identifies eight mega trends that mostly stress human connections.

Contractors | Dec 12, 2023

The average U.S. contractor has 8.5 months worth of construction work in the pipeline, as of November 2023

Associated Builders and Contractors reported today that its Construction Backlog Indicator inched up to 8.5 months in November from 8.4 months in October, according to an ABC member survey conducted Nov. 20 to Dec. 4. The reading is down 0.7 months from November 2022.

Market Data | Nov 27, 2023

Number of employees returning to the office varies significantly by city

While the return-to-the-office trend is felt across the country, the percentage of employees moving back to their offices varies significantly according to geography, according to Eptura’s Q3 Workplace Index.

Market Data | Nov 14, 2023

The average U.S. contractor has 8.4 months worth of construction work in the pipeline, as of September 2023

Associated Builders and Contractors reported that its Construction Backlog Indicator declined to 8.4 months in October from 9.0 months in September, according to an ABC member survey conducted from Oct. 19 to Nov. 2. The reading is down 0.4 months from October 2022. Backlog now stands at its lowest level since the first quarter of 2022.

Multifamily Housing | Nov 9, 2023

Multifamily project completions forecast to slow starting 2026

Yardi Matrix has released its Q4 2023 Multifamily Supply Forecast, emphasizing a short-term spike and plateau of new construction.