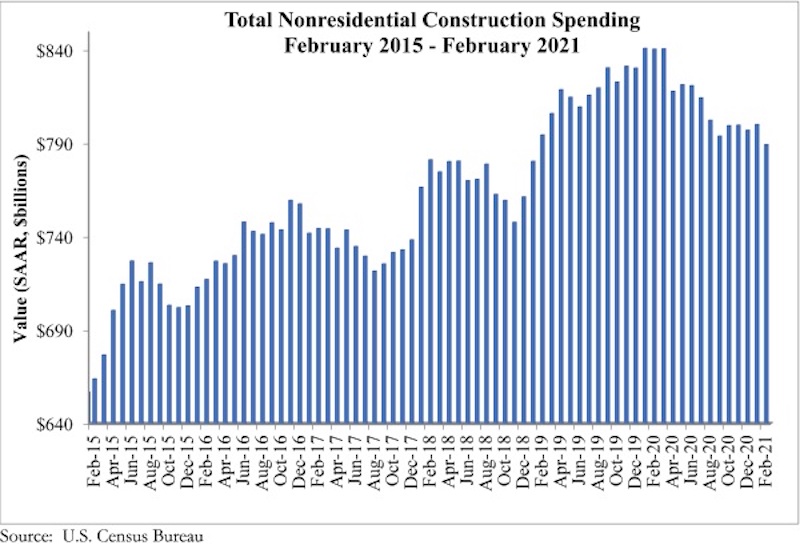

National nonresidential construction spending declined 1.3% in February, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $789.5 billion for the month.

On a monthly basis, spending was down in 13 of 16 nonresidential subcategories. Private nonresidential spending was down 1.0%, while public nonresidential construction spending fell 1.8% in February. Nonresidential construction spending has declined by 6.1% from the same time last year.

“We remain in the midst of the COVID-19 pandemic, which has shattered commercial real estate fundamentals,” said ABC Chief Economist Anirban Basu. “This too shall pass, but there continues to be downward pressure on nonresidential construction activity, and that was apparent in February, when weakness in spending was apparent in private and public segments alike.

“But past is not prologue in this instance,” said Basu. “America is about to experience a massive resurgence in economic growth as vaccinations proceed. Many ABC members report that backlog has already been climbing as projects that had been postponed earlier in the crisis come back to life. While some residual weakness may persist in the next few months, nonresidential construction spending is poised to stabilize during the summer and enter 2022 with substantial momentum, though some private construction segments will continue to lag.

“Consequently, the nature of the challenges facing contractors will shift dramatically during the months ahead,” said Basu. “While many contractors have indicated that demand for construction services has been among their leading sources of concern during the pandemic, by the end of this year, the greatest challenge for many will be securing a sufficient workforce with which to compete for and complete projects. This will likely be even more of an issue in 2022 and 2023 as the pace of economic recovery progresses.”

Related Stories

Hotel Facilities | Jan 22, 2024

U.S. hotel construction is booming, with a record-high 5,964 projects in the pipeline

The hotel construction pipeline hit record project counts at Q4, with the addition of 260 projects and 21,287 rooms over last quarter, according to Lodging Econometrics.

Multifamily Housing | Jan 15, 2024

Multifamily rent growth rate unchanged at 0.3%

The National Multifamily Report by Yardi Matrix highlights the highs and lows of the multifamily market in 2023. Despite strong demand, rent growth remained unchanged at 0.3 percent.

Self-Storage Facilities | Jan 5, 2024

The state of self-storage in early 2024

As the housing market cools down, storage facilities suffer from lower occupancy and falling rates, according to the December 2023 Yardi Matrix National Self Storage Report.

Designers | Dec 25, 2023

Redefining the workplace is a central theme in Gensler’s latest Design Report

The firm identifies eight mega trends that mostly stress human connections.

Contractors | Dec 12, 2023

The average U.S. contractor has 8.5 months worth of construction work in the pipeline, as of November 2023

Associated Builders and Contractors reported today that its Construction Backlog Indicator inched up to 8.5 months in November from 8.4 months in October, according to an ABC member survey conducted Nov. 20 to Dec. 4. The reading is down 0.7 months from November 2022.

Market Data | Nov 27, 2023

Number of employees returning to the office varies significantly by city

While the return-to-the-office trend is felt across the country, the percentage of employees moving back to their offices varies significantly according to geography, according to Eptura’s Q3 Workplace Index.

Market Data | Nov 14, 2023

The average U.S. contractor has 8.4 months worth of construction work in the pipeline, as of September 2023

Associated Builders and Contractors reported that its Construction Backlog Indicator declined to 8.4 months in October from 9.0 months in September, according to an ABC member survey conducted from Oct. 19 to Nov. 2. The reading is down 0.4 months from October 2022. Backlog now stands at its lowest level since the first quarter of 2022.

Multifamily Housing | Nov 9, 2023

Multifamily project completions forecast to slow starting 2026

Yardi Matrix has released its Q4 2023 Multifamily Supply Forecast, emphasizing a short-term spike and plateau of new construction.

Contractors | Nov 1, 2023

Nonresidential construction spending increases for the 16th straight month, in September 2023

National nonresidential construction spending increased 0.3% in September, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.1 trillion.

Market Data | Oct 23, 2023

New data finds that the majority of renters are cost-burdened

The most recent data derived from the 2022 Census American Community Survey reveals that the proportion of American renters facing housing cost burdens has reached its highest point since 2012, undoing the progress made in the ten years leading up to the pandemic.