Nonresidential construction spending contracted 1.6% on a monthly basis in June, according to an Associated Builders and Contractors analysis of U.S. Census Bureau data released today. Spending totaled $742.4 billion on a seasonally adjusted annual rate for the month, a 4.2% increase from the same time one year ago. Private nonresidential spending fell 0.3% in June, while public nonresidential spending contracted by 3.5%.

“The hope is that June’s construction spending setback is merely a statistical aberration,” said ABC Chief Economist Anirban Basu. “That is certainly a possibility given the recent second quarter gross domestic product report, which among other things indicated extraordinarily rapid growth in the construction of structures. Other data, including ABC’s Construction Backlog Indicator, indicate ongoing elevated levels of demand for construction services. Construction employment statistics are also consistent with industry expansion.

“But as tempting as it is to simply relegate June spending data to the back burner, there are other less benign explanations,” said Basu. “One relates to worker productivity. With construction firms suffering grave difficulty finding skilled workers, it may simply be a case of slowed construction service delivery. However, this is not an especially compelling explanation for one month of data. The shortage of human capital is long-lived, and the recent pace of construction hiring has been rapid.

“A more likely explanation is that the recent surge in construction materials prices is resulting in material acquisition delays,” said Basu. “This has the effect of lengthening projects as contractors painstakingly search for the most affordable sources of steel, lumber or other inputs. Since monthly construction spending declines were apparent in both private and public segments, it is also possible that certain projects have been put on hold, with the hope that input prices will eventually decline to lower levels.”

Related Stories

Contractors | Jun 13, 2023

The average U.S. contractor has 8.9 months worth of construction work in the pipeline, as of May 2023

Associated Builders and Contractors reported that its Construction Backlog Indicator remained unchanged at 8.9 months in May, according to an ABC member survey conducted May 20 to June 7. The reading is 0.1 months lower than in May 2022. Backlog in the infrastructure category ticked up again and has now returned to May 2022 levels. On a regional basis, backlog increased in every region but the Northeast.

Industry Research | Jun 13, 2023

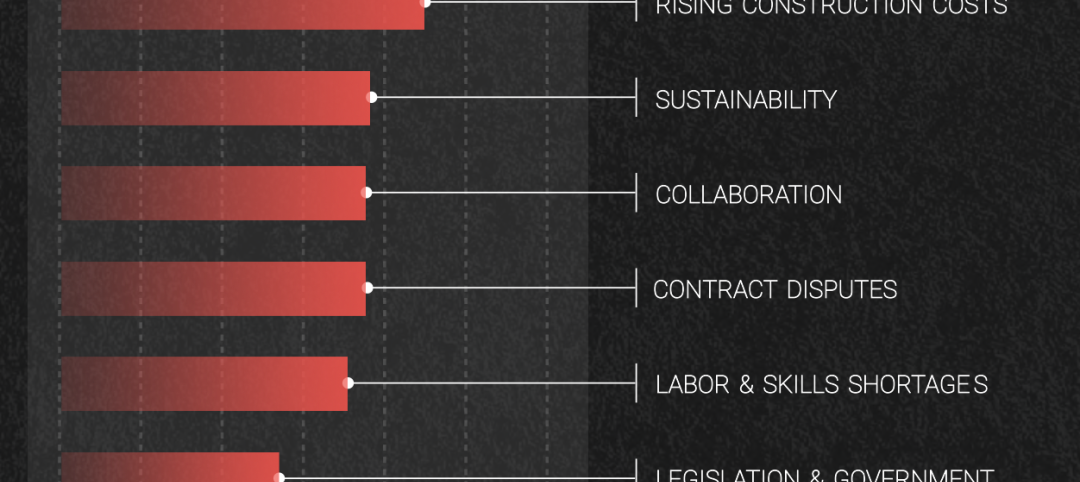

Two new surveys track how the construction industry, in the U.S. and globally, is navigating market disruption and volatility

The surveys, conducted by XYZ Reality and KPMG International, found greater willingness to embrace technology, workplace diversity, and ESG precepts.

| Jun 5, 2023

Communication is the key to AEC firms’ mental health programs and training

The core of recent awareness efforts—and their greatest challenge—is getting workers to come forward and share stories.

Contractors | May 24, 2023

The average U.S. contractor has 8.9 months worth of construction work in the pipeline, as of April 2023

Contractor backlogs climbed slightly in April, from a seven-month low the previous month, according to Associated Builders and Contractors.

Multifamily Housing | May 23, 2023

One out of three office buildings in largest U.S. cities are suitable for residential conversion

Roughly one in three office buildings in the largest U.S. cities are well suited to be converted to multifamily residential properties, according to a study by global real estate firm Avison Young. Some 6,206 buildings across 10 U.S. cities present viable opportunities for conversion to residential use.

Industry Research | May 22, 2023

2023 High Growth Study shares tips for finding success in uncertain times

Lee Frederiksen, Managing Partner, Hinge, reveals key takeaways from the firm's recent High Growth study.

Multifamily Housing | May 8, 2023

The average multifamily rent was $1,709 in April 2023, up for the second straight month

Despite economic headwinds, the multifamily housing market continues to demonstrate resilience, according to a new Yardi Matrix report.

Market Data | May 2, 2023

Nonresidential construction spending up 0.7% in March 2023 versus previous month

National nonresidential construction spending increased by 0.7% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $997.1 billion for the month.

Hotel Facilities | May 2, 2023

U.S. hotel construction up 9% in the first quarter of 2023, led by Marriott and Hilton

In the latest United States Construction Pipeline Trend Report from Lodging Econometrics (LE), analysts report that construction pipeline projects in the U.S. continue to increase, standing at 5,545 projects/658,207 rooms at the close of Q1 2023. Up 9% by both projects and rooms year-over-year (YOY); project totals at Q1 ‘23 are just 338 projects, or 5.7%, behind the all-time high of 5,883 projects recorded in Q2 2008.

Market Data | May 1, 2023

AEC firm proposal activity rebounds in the first quarter of 2023: PSMJ report

Proposal activity for architecture, engineering and construction (A/E/C) firms increased significantly in the 1st Quarter of 2023, according to PSMJ’s Quarterly Market Forecast (QMF) survey. The predictive measure of the industry’s health rebounded to a net plus/minus index (NPMI) of 32.8 in the first three months of the year.