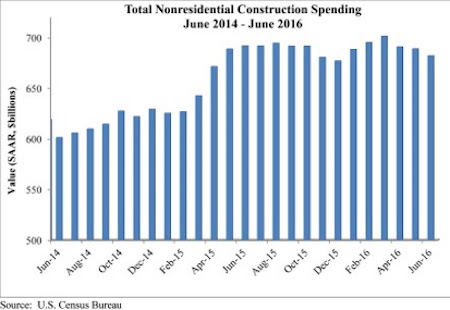

Nonresidential construction spending dipped 1 percent in June and has now contracted for three consecutive months according to analysis of U.S. Census Bureau data released today by Associated Builders and Contractors (ABC). Nonresidential spending, which totaled $682 billion on a seasonally adjusted, annualized rate, has fallen 1.1 percent on a year-over-year basis, marking the first time nonresidential spending has declined on an annual basis since July 2013.

“On a monthly basis, the numbers are not as bad as they seem, as May’s nonresidential construction spending estimate was revised higher. However, this fails to explain the first year-over-year decline in nearly three years,” says ABC Chief Economist Anirban Basu.

“Thanks in part to the investment of foreign capital in America, spending related to office space and lodging are up by more than 16 percent year-over-year,” says Basu. The global economy is weak, and international investors are searching for yield and stability. U.S. commercial real estate has become a popular destination for foreign capital. However, the weakness of the global economy may also help explain the decline in manufacturing-related construction spending of nearly 5 percent for the month and more than 10 percent year-over-year.

Consumer spending is the only significant driver of economic growth in America right now and public sector spending does not look like it will accelerate in the near future, despite a federal highway bill that was pasted last year, Basu explains.

Precisely half of the 16 nonresidential subsectors expanded in June. Two of the largest subsectors—manufacturing and commercial—experienced significant contractions in June, however, and were responsible for a majority of the dip in spending.

Tepid spending by public agencies also continues to shape the data. Despite a monthly pick-up in spending, water-supply construction spending is down 14 percent on a year-over-year basis. Public safety construction spending is down 8.4 percent from a year ago, sewage and waste disposal by nearly 15 percent, highway and street by about 6 percent, education by 4 percent and transportation by more than 3 percent.

Related Stories

Apartments | Jan 26, 2024

New apartment supply: Top 5 metros delivering in 2024

Nationally, the total new apartment supply amounts to around 1.4 million units—well exceeding the apartment development historical average of 980,000 units.

Self-Storage Facilities | Jan 25, 2024

One-quarter of self-storage renters are Millennials

Interest in self-storage has increased in over 75% of the top metros according to the latest StorageCafe survey of self-storage preferences. Today, Millennials make up 25% of all self-storage renters.

Industry Research | Jan 23, 2024

Leading economists forecast 4% growth in construction spending for nonresidential buildings in 2024

Spending on nonresidential buildings will see a modest 4% increase in 2024, after increasing by more than 20% last year according to The American Institute of Architects’ latest Consensus Construction Forecast. The pace will slow to just over 1% growth in 2025, a marked difference from the strong performance in 2023.

Adaptive Reuse | Jan 23, 2024

Adaptive reuse report shows 55K impact of office-to-residential conversions

The latest RentCafe annual Adaptive Reuse report shows that there are 55,300 office-to-residential units in the pipeline as of 2024—four times as much compared to 2021.

Construction Costs | Jan 22, 2024

Construction material prices continue to normalize despite ongoing challenges

Gordian’s most recent Quarterly Construction Cost Insights Report for Q4 2023 describes an industry still attempting to recover from the impact of COVID. This was complicated by inflation, weather, and geopolitical factors that resulted in widespread pricing adjustments throughout the construction materials industries.

Multifamily Housing | Jan 15, 2024

Multifamily rent growth rate unchanged at 0.3%

The National Multifamily Report by Yardi Matrix highlights the highs and lows of the multifamily market in 2023. Despite strong demand, rent growth remained unchanged at 0.3 percent.

Apartments | Jan 9, 2024

Apartment developer survey indicates dramatic decrease in starts this year

Over 56 developers, operators, and investors across the country were surveyed in John Burns Research and Consulting's recently-launched Apartment Developer and Investor Survey.

Self-Storage Facilities | Jan 5, 2024

The state of self-storage in early 2024

As the housing market cools down, storage facilities suffer from lower occupancy and falling rates, according to the December 2023 Yardi Matrix National Self Storage Report.

Urban Planning | Dec 18, 2023

The impacts of affordability, remote work, and personal safety on urban life

Data from Gensler's City Pulse Survey shows that although people are satisfied with their city's experience, it may not be enough.

MFPRO+ News | Dec 11, 2023

U.S. poorly prepared to house growing number of older adults

The U.S. is ill-prepared to provide adequate housing for the growing ranks of older people, according to a report from Harvard University’s Joint Center for Housing Studies. Over the next decade, the U.S. population older than 75 will increase by 45%, growing from 17 million to nearly 25 million, with many expected to struggle financially.