Nonresidential construction spending in New York City is projected to reach $39 billion in 2018, a nearly 66% increase over the previous year. However, spending is also expected to tail off significantly during the following two years, according to a new report, Construction Outlook 2018-2020, released today by the New York Building Congress.

Spending for all types construction in New York City is in its fifth year of growth and could hit a record $61.8 billion this year, 25% more than in 2017. That growth is attributable in part to several large-scale projects. The New York Building Congress forecasts that, despite some anticipated falloff over the next two years, total construction spending through 2020 will total $177 billion.

Nonresidential construction alone—which includes offices, institutional, government buildings, sports and entertainment, and hotels—is forecast to add a record 39 million gross sf this year, followed by 30.4 million sf and 23.4 million sf in 2019 and 2020, respectively. The projected decrease in construction spending for nonresidential buildings over the next two years can be pegged to the completion of several big projects by 2020, such as the 58-story 1,401-ft-tall One Vanderbilt, and three buildings within the $20 billion Hudson Yards redevelopment.

(All this new floor space is coming at a time when New York’s office vacancy rate hovers around 13%, according to the website Optimal Spaces.)

Residential construction spending—which in New York is primarily for multifamily buildings—will total $14 billion in 2018, up 6% from the previous year. Next year, residential construction spending is expected to hit $15 billion, and then recede to $10.6 billion in 2020. (The totals include renovations and alterations.)

Over the three years, 60,000 housing units and 107.2 million gross sf will be added, states the report. The average annual unit count, though, would be off from the 27,898 housing units added to the city in 2017.

The report states that construction employment will show growth for the seventh consecutive year in 2018, and top 150,000 jobs for the second consecutive year. While the Building Congress predicts an employment dip—to 145,600 in 2019 and to 147,700 in 2020—those numbers would still be higher than the average for the last five years.

Related Stories

Giants 400 | Sep 5, 2023

Top 80 Construction Management Firms for 2023

Alfa Tech, CBRE Group, Skyline Construction, Hill International, and JLL top the rankings of the nation's largest construction management (as agent) and program/project management firms for nonresidential buildings and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Sep 5, 2023

Top 150 Contractors for 2023

Turner Construction, STO Building Group, DPR Construction, Whiting-Turner Contracting Co., and Clark Group head the ranking of the nation's largest general contractors, CM at risk firms, and design-builders for nonresidential buildings and multifamily buildings work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Market Data | Sep 5, 2023

Nonresidential construction spending increased 0.1% in July 2023

National nonresidential construction spending grew 0.1% in July, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.08 trillion and is up 16.5% year over year.

Giants 400 | Aug 31, 2023

Top 35 Engineering Architecture Firms for 2023

Jacobs, AECOM, Alfa Tech, Burns & McDonnell, and Ramboll top the rankings of the nation's largest engineering architecture (EA) firms for nonresidential buildings and multifamily buildings work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Aug 22, 2023

Top 115 Architecture Engineering Firms for 2023

Stantec, HDR, Page, HOK, and Arcadis North America top the rankings of the nation's largest architecture engineering (AE) firms for nonresidential building and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Aug 22, 2023

2023 Giants 400 Report: Ranking the nation's largest architecture, engineering, and construction firms

A record 552 AEC firms submitted data for BD+C's 2023 Giants 400 Report. The final report includes 137 rankings across 25 building sectors and specialty categories.

Giants 400 | Aug 22, 2023

Top 175 Architecture Firms for 2023

Gensler, HKS, Perkins&Will, Corgan, and Perkins Eastman top the rankings of the nation's largest architecture firms for nonresidential building and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Apartments | Aug 22, 2023

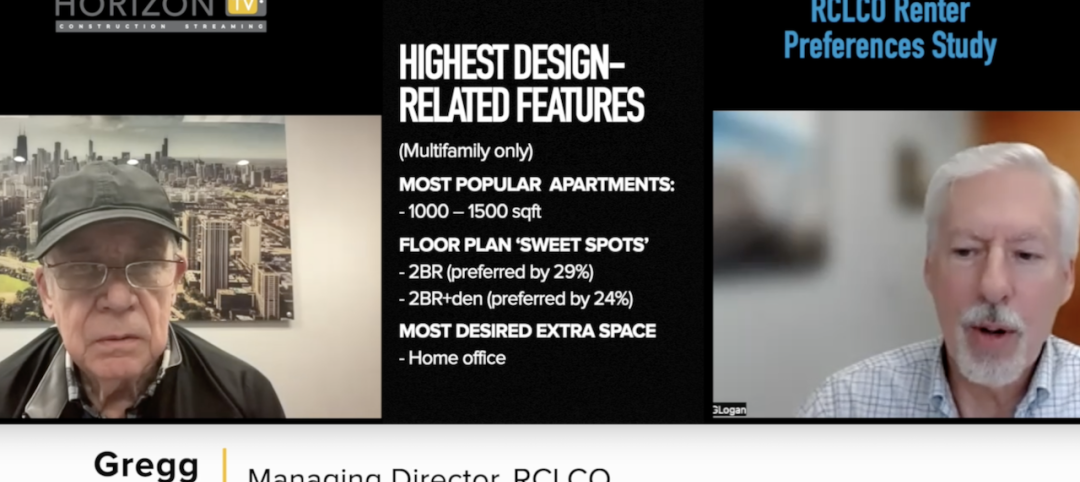

Key takeaways from RCLCO's 2023 apartment renter preferences study

Gregg Logan, Managing Director of real estate consulting firm RCLCO, reveals the highlights of RCLCO's new research study, “2023 Rental Consumer Preferences Report.” Logan speaks with BD+C's Robert Cassidy.

Market Data | Aug 18, 2023

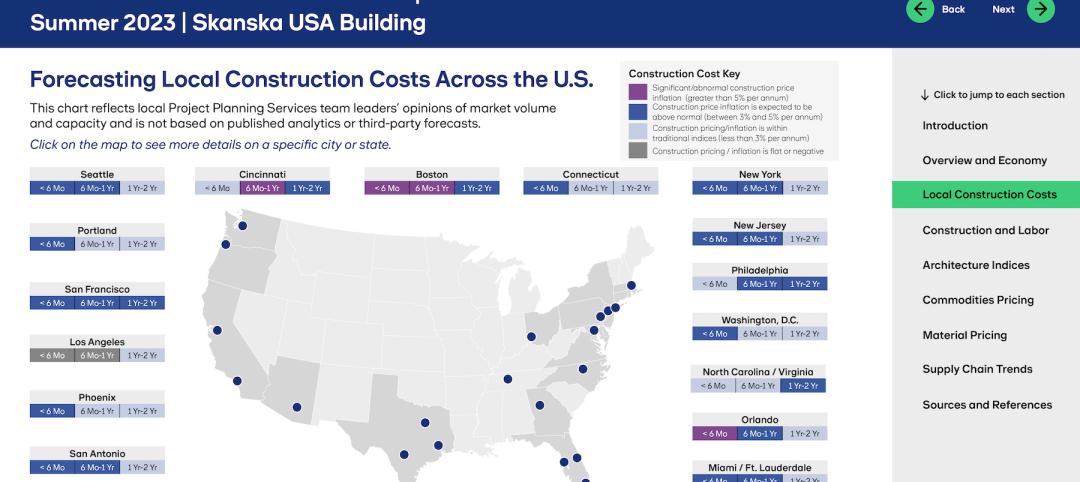

Construction soldiers on, despite rising materials and labor costs

Quarterly analyses from Skanska, Mortenson, and Gordian show nonresidential building still subject to materials and labor volatility, and regional disparities.

Apartments | Aug 14, 2023

Yardi Matrix updates near-term multifamily supply forecast

The multifamily housing supply could increase by up to nearly 7% by the end of 2023, states the latest Multifamily Supply Forecast from Yardi Matrix.