The Associated General Contractors of America today announced that the Trump administration released new guidance that now allows firms with 500 or fewer employees to qualify for the new Paycheck Protection Program Loans. Association officials noted that the administration released the new guidance after the association raised concerns over the weekend that many firms that employ 500 or fewer employees appeared to be excluded from the program.

“Administration officials have done the right thing and revised their guidance to allow, as Congress intended, for firms that employ 500 or fewer people to qualify for the Paycheck Protection Program loans,” said Stephen E. Sandherr, the Association’s chief executive officer. “This change means the program is now more likely to help smaller firms continue to operate and retain staff.”

On April 2, the Small Business Administration issued an “interim final rule” to the effect that a business must have 500 or fewer employees and fall below the agency’s small business size standards—which for construction businesses are generally determined by an average annual income threshold, not number of employees threshold—in order to qualify for the new Paycheck Protection Program. Congress, however, declared that the program shall be open to all businesses that have 500 or fewer employees or fall below those size standards. Over the weekend, AGC of America alerted the Trump Administration to the problem, and late last night the U.S. Department of Treasury released new guidance about the Paycheck Protection Program loans that now allows firms with 500 or fewer employees to qualify.

Specifically, the new guidance includes the following:

Question: Does my business have to qualify as a small business concern (as defined in section 3 of the Small Business Act, 15 U.S.C. 632) in order to participate in the PPP?

Answer: No. In addition to small business concerns, a business is eligible for a PPP loan if the business has 500 or fewer employees whose principal place of residence is in the United States, or the business meets the SBA employee-based size standards for the industry in which it operates (if applicable).

The new guidance also states that “[b]orrowers . . . may rely on the guidance provided in this document as SBA’s interpretation of the CARES Act” and its interim final rule. At the time it posted this guidance, the Treasury Department also notified the association of its action. Here is a copy of that notice.

The new Treasury Department guidance appears to clear the way for construction firms that employ 500 or fewer people to qualify for the new Paycheck Protection Program loans. They added that the association will work with administration officials to ensure that the Small Business Administration’s regulations and guidance are harmonized with this new Treasury guidance.

Related Stories

Coronavirus | Oct 1, 2020

The Weekly show: Decarbonizing Chicago, re-evaluating delayed projects, and the future of the jobsite

The October 1 episode of BD+C's "The Weekly" is available for viewing on demand.

Coronavirus | Sep 28, 2020

Cities to boost spending on green initiatives after the pandemic

More bikeways, car restrictions, mass transit, climate resilience are on tap.

Coronavirus | Sep 28, 2020

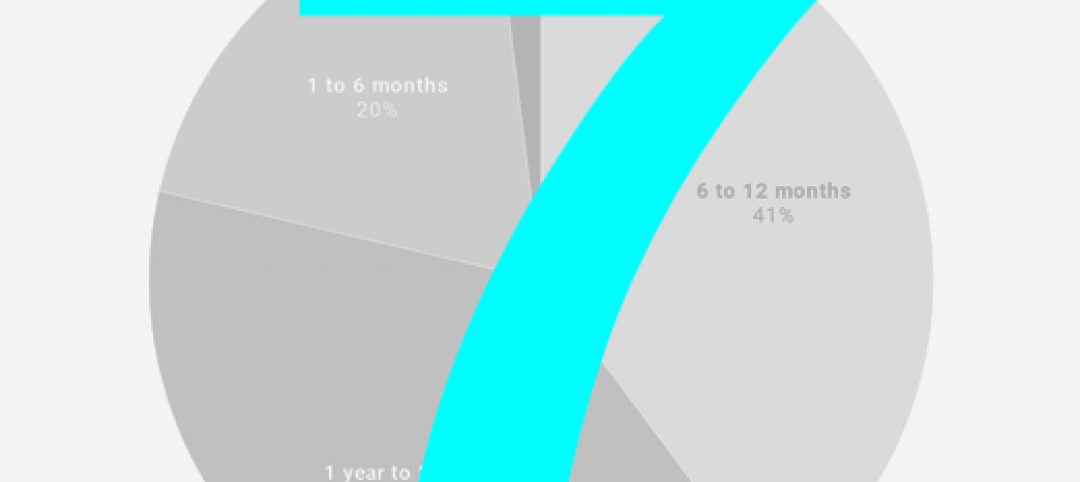

Evaluating and investing resources to navigate past the COVID-19 pandemic

As AEC firm leaders consider worst-case scenarios and explore possible solutions to surmount them, they learn to become nimble, quick, and ready to pivot as circumstances demand.

Coronavirus | Sep 24, 2020

The Weekly show: Building optimization tech, the future of smart cities, and storm shelter design

The September 24 episode of BD+C's "The Weekly" is available for viewing on demand.

Coronavirus | Sep 10, 2020

Mobile ordering is a centerpiece of Burger King’s new design

Its reimagined restaurants are 60% smaller, with several pickup options.

Coronavirus | Sep 9, 2020

Prefab: Construction’s secret weapon against COVID-19

How to know if offsite production is right for your project.

Coronavirus | Sep 3, 2020

The Weekly show: JLL's construction outlook for 2020, and COVID-19's impact on sustainability

The September 3 episode of BD+C's "The Weekly" is available for viewing on demand.

Coronavirus | Sep 1, 2020

6 must reads for the AEC industry today: September 1, 2020

Co-working developers pivot to survive the pandemic, and the rise of inquiry-based learning in K-12 communities.

Coronavirus | Aug 28, 2020

7 must reads for the AEC industry today: August 28, 2020

Hotel occupancy likely to dip by 29%, and pandemic helps cannabis industry gain firmer footing.

Coronavirus | Aug 27, 2020

8 must reads for the AEC industry today: August 27, 2020

Extended-stay hotels are the lodging sector's safest bet, and industrial real estate faces short-term decline.