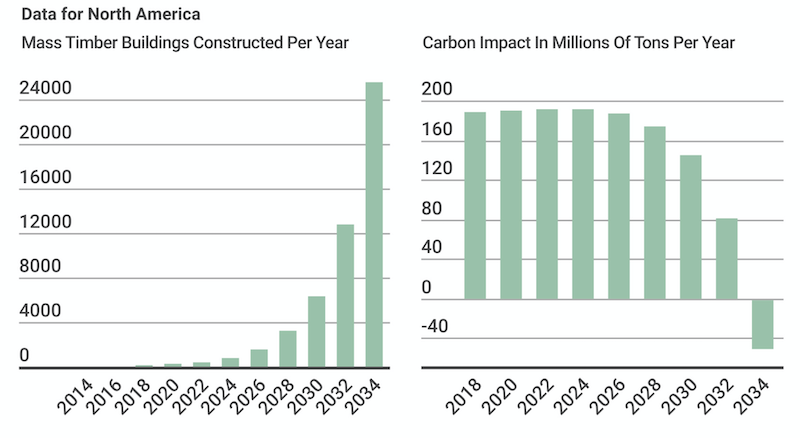

Last year, contractors used mass timber to construct an estimated 78 buildings in the U.S., representing 4 million sf of space. A comprehensive new report on the North American mass timber market projects that the number of mass timber buildings could double every two years. By 2034, there would be new demand for 12.9 billion board feet of lumber that would require the establishment of nearly 77 million acres of new forestland.

The 156-page mass timber report—produced by The Beck Group, Forest Business Network, Treesource, and Kaiser + Path, a real estate developer/builder and architect—takes a deep dive into current and possible future supply and demand for mass timber components and panels for the U.S. and Canada. Its primary argument is that significant growth in the use of mass timber as a building material is achievable without serious deforestation. The report also justifies its forecasts about mass timber’s expanded use as a building product on the premise that the products would deliver myriad benefits, vis-a-vis other materials, to owners, builders, designers, occupants, and the environment.

(If mass timber use expands as predicted, the report contends that, by 2034, the North American building industry will store more carbon than it emits.)

Also see: Vermont’s Burr and Burton Academy expansion will feature mass timber and flexible spaces

WILL SUPPLY KEEP UP WITH MASS TIMBER DEMAND?

The number of mass timber buildings is expected to double every two years through 2034, at which point the construction industry would be storing more carbon than it emits. Charts and images: North American Mass Timber Report: 2020 State of the Industry

Some of the report’s assumptions rest on incomplete data. For example, when it discusses overharvesting, the report’s conclusions are drawn from so-called “growth to drain” estimates that, for the U.S., stop at the year 2012, and at 2016 for Canada, where the report says more active forest management is needed to make Canada’s lumber more resilient to climate change and infestation.

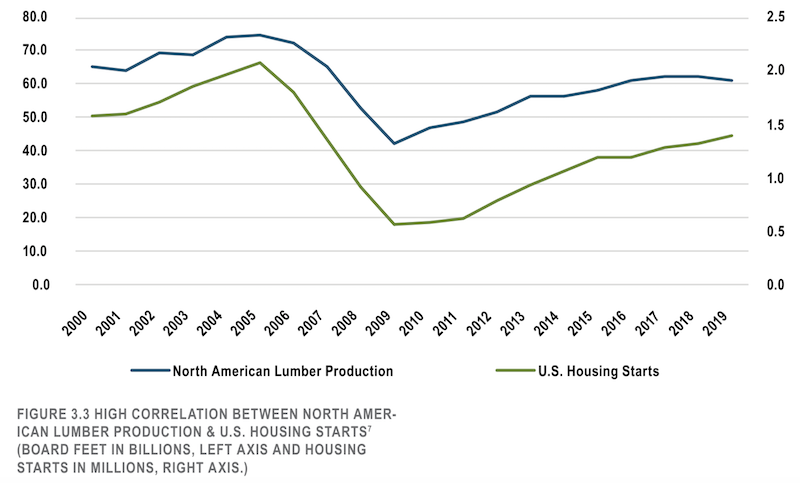

Nevertheless, the report places mass timber within the larger context of available construction materials. To produce a cubic foot of mass timber raw material requires about 22.5 board feet of lumber. The estimated demand for mass timber products last year was between 20 million and 25 million cubic feet. The 450-500 million board feet of softwood lumber consumed for North American mass timber in 2019 represented less that 1% of the total softwood lumber produced that year.

“Even if the lumber demand expands to 3 billion board feet per year (more than six times the current level), it would represent only a 5% share of today’s lumber production,” the report states. “The mass timber industry can expand several times its current size before it will make a significant impact on the North American lumber industry.” The report also believes the expansion of North American lumber capacity will help absorb new demand expected from increased mass timber construction.

Also see: Mass timber construction grows up

However, the report acknowledges that the industry’s capacity to produce mass timber is nowhere close yet to meeting future demand. For example, the report estimates that by 2034 North American buildings could consume 576 million cubic feet of mass timber panels annually. That means manufacturers would need to boost their current capacities by a factor of nearly 40 to meet those demand projections.

(That’s not inconceivable, though: the report notes that panel manufacturing capacity in North America increased by more than 1,000% between 2010 and 2020.)

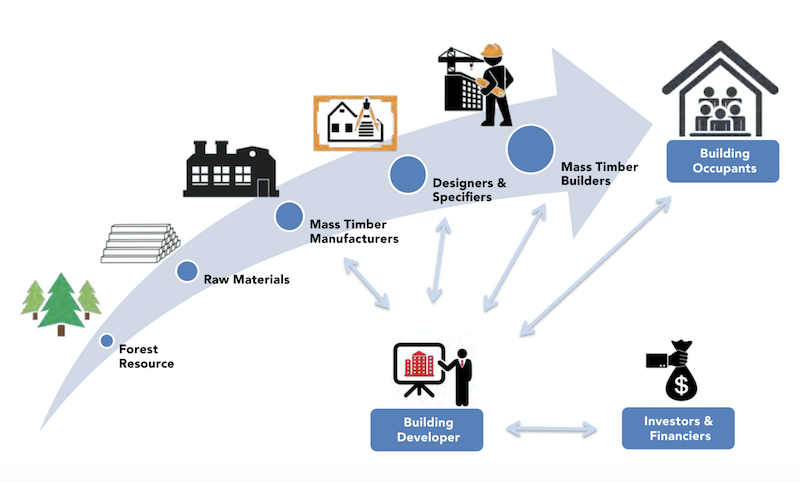

The current supply chain in North America needs to expand its production capacity to meet the mass timber demand projected by the report.

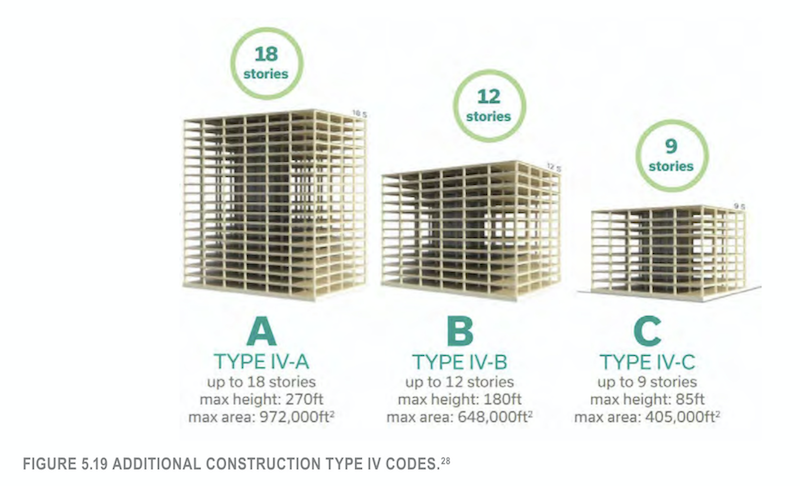

Manufacturer investment in new capacity is worth the risk, the report contends, given recent code changes that will allow the use of mass timber for buildings up to 18 stories, as well as efficiency improvements, government incentives and support, and product standardization. Mass timber can also burnish a supplier’s and owner’s environmental rep, as there’s an estimated 0.023 tons of carbon offset for every building that uses mass timber instead of steel or concrete; and 0.0047 net tons of carbon is sequestered by mass timber for every square foot of a building.

STILL A SLIVER OF NONRES CONSTRUCTION

Mass timber has a long road to hoe to make serious inroads into nonresidential construction, which currently accounts for only around 5% of mass timber consumption, versus 70-75% that’s consumed by homebuilding and residential renovation.

Cost remains a factor, as it’s still cheaper to use wood and concrete than cross-laminated timber (CLT) components to build with. (Lumber represents about half of the total production cost for cross-laminated timber, and operating costs for production range from $5-7 per cubic foot.)

Also see: More mass timber beam and column options available in the U.S.

Homebuilding and renovation account for between 70-75% of the mass timber consumed annually. But the use of mass timber in nonresidential construction continues to grow.

But the nonresidential application of mass timber keeps growing. In Portland, Ore., an urban infill project completed in April called Sideyard—a 20,000-ft wedge-shaped building that reconnects a roadway to that city’s Burnside Bridge—features a new CLT structural system with an open ground-level commuter-oriented retail space that’s geared toward guests and tenants. The Building Team included Skylab (architect), Anderson Construction (GC), Harper Houf Peterson Righellis (CE), catean engineers (SE), and PAE (mechanical engineer). DR Johnson supplied the CLT panels and glulam members, and Freres Lumber supplied the mass plywood panels.

The report also points to Lendlease’s 50-year agreement to provide lodging for the U.S. Army. The contractor has built hotels on more than 40 installations and joint bases, including Redstone Arsenal in Alabama where Lendlease built with mass timber and completed the project 37% faster and with 44% fewer worker hours than the other hotels.

Mass timber demand is greatest in California, where there were 32 mass timber buildings completed and 68 in design as of 2019. The next closest states were Washington (28 built, 44 in design), and Texas (17 and 37). All told, there were 248 mass timber buildings completed and 460 in design in the U.S. by the end of last year.

The International Code Council's 2021 building code would allow the use of mass timber in buildings up to 18 stories tall. Codes changes are one of the report's justifications for recommending that manufacturers invest in production capacity.

INSURERS ARE SKEPTICAL

The report claims that occupants in buildings made with mass timber benefit from better air quality and thermal comfort. (The report references research establishing links between wood and human health.) Owners might benefit as “the carbon impact of an investment will factor into market value,” as well as from reduced construction time and carrying costs, resilience (including seismic), and opportunities to reuse mass timber after demolition.

One caveat, the report notes, is that these and other benefits, such as better fire resistance, don’t always register with insurers that still tend to view all wood buildings similarly for liability risk.

Related Stories

| Sep 27, 2011

Steel Joist Institute announces October webinar on Open Web Steel Joists

Webinar participants can earn 0.15 CEUs or 1.5 PDHs.

| Sep 14, 2011

More than 200 events planned for third annual SteelDay September 23

Special events in major cities including New York City, Chicago, Washington, D.C., and more.

| Sep 12, 2011

Construction waste management

Best practices for an environmentally optimized job site.

| Sep 12, 2011

Morgan Thermal Ceramics’ system for installing grease duct enclosures achieves UL listing

Updated installation results in 33% space savings.

| Apr 12, 2011

Spray Foam Applications on the Rise

New uses for spray polyurethane foam enable Building Teams to achieve greater longevity and sustainability in their projects.

| Feb 15, 2011

New 2030 Challenge to include carbon footprint of building materials and products

Architecture 2030 has just broadened the scope of its 2030 Challenge, issuing an additional challenge regarding the climate impact of building products. The 2030 Challenge for Products aims to reduce the embodied carbon (meaning the carbon emissions equivalent) of building products 50% by 2030.

| Feb 3, 2011

Duro-Last Roofing, Inc. Adds Standing Seam Metal Product Line

Duro-Last Roofing, Inc. is adding a standing seam metal product line to its roofing system offerings. With five profiles and more than thirty colors to choose from, the new line will enable authorized Duro-Last contractors to provide a standing seam roofing installation to meet virtually any aesthetic requirements.

| Jan 19, 2011

Large-Scale Concrete Reconstruction Solid Thinking

Driven by both current economic conditions and sustainable building trends, Building Teams are looking more and more to retrofits and reconstruction as the most viable alternative to new construction. In that context, large-scale concrete restoration projects are playing an important role within this growing specialty.

| Jan 7, 2011

How Building Teams Choose Roofing Systems

A roofing survey emailed to a representative sample of BD+C’s subscriber list revealed such key findings as: Respondents named metal (56%) and EPDM (50%) as the roofing systems they (or their firms) employed most in projects. Also, new construction and retrofits were fairly evenly split among respondents’ roofing-related projects over the last couple of years.