Having weathered the coronavirus pandemic somewhat better than the single-family home construction sector, new supply of multifamily housing delivered in 2021 is expected to increase by around 17% to 334,000 units, according to Yardi Matrix’s latest U.S. Outlook.

“Some 174,000 units were absorbed nationally through May, which puts 2021 on track to be among the hottest years since the 2008 recession,” states the report.

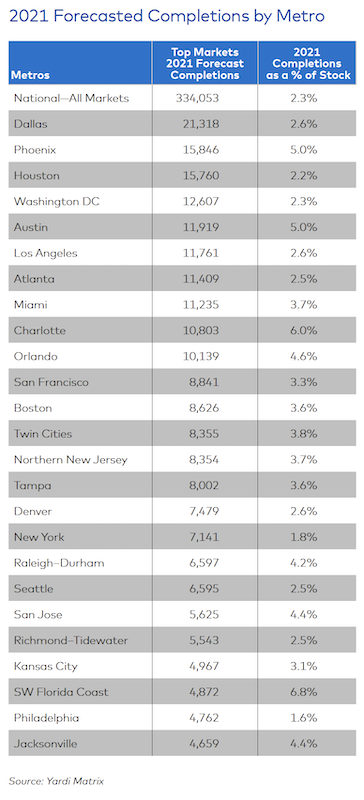

As of mid-year, some 863,500 multifamily units were under construction, representing 6% of the existing U.S. stock. That’s good and bad news, suggests Yardi Matrix, because such a large number of projects could impede the overall rent recovery in so-called “gateway” markets like Miami, whose forecasted deliveries are projected to equal 3.7% of its existing stock; Boston (3.6% of existing stock), San Francisco (3.3%), Los Angeles (2.6%), Washington D.C. (2.3%), New York (1.8%) and Chicago (1.3%).

“These new projects might have a difficult time leasing up, as there is already much supply in these metros with limited new demand, especially in the Lifestyle segment,” states the report.

The leaders in multifamily completions over the past 12 months include Austin (4.4% of total stock), Charlotte (4.3%), Minneapolis-St. Paul (3.7%) and Raleigh (3.6%). Yardi Matrix points out that among these four metros, Charlotte has been the only one able to sustain strong rent growth and deliveries simultaneously. Still, rents in all four metros have picked up in recent months, driven by a surge in migration and demand for apartments.

Yardi Matrix foresees Dallas leading the country in multifamily completions this year. Image: Yardi Matrix

SMALLER MARKETS, BIGGER DEMAND

Yardi Matrix looked at 136 markets, and found robust growth in tertiary metros like Northwest Arkansas (home to Walmart’s headquarters city of Bentonville) that led the list with 8.8% of its stock expected to be delivered this year from new construction. Next were Wilmington, N.C. (with 7% of its stock expected to be delivered), and the Southwest Florida Coast (6.8%). These metros had limited existing multifamily housing stock to begin with.

Measured by sheer units, Dallas is forecast to have the highest number of completions in 2021 (21,318 units), followed by Phoenix, Houston, Washington DC, Austin, L.A., Atlanta, and Miami. Yardi Matrix believes that while Dallas, Phoenix, and Houston should have little trouble absorbing new deliveries, “Washington DC might struggle,” because demand is lagging in part due to remote work requirements or preferences, and out-migration.

Material price hikes are the “wild card” in prognostications about apartment development, says Yardi Matrix. The extreme volatility of lumber prices over the past several months, coupled with increases in the cost of other building materials, could slow new starts and force developers “to choose between raising rents and reducing profit margins.”

RENTS RISING AT UNSUSTAINABLE RATES

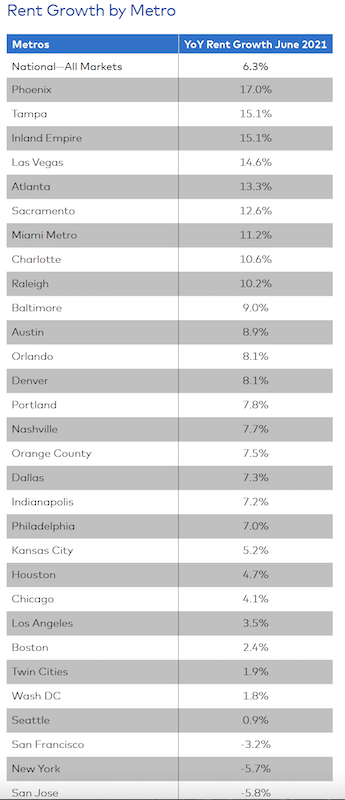

Through the first six months of 2021, national asking rents rose 5.8%. Yardi Matrix estimates that year-over-year asking rent growth, as of June, stood at 6.3%, “well above the [country’s] pre-pandemic performance.” Rent inflation is even more pronounced in tech hubs and tertiary metros, and asking rent growth in the Southwest and Southeast has been at levels “not seen in decades.”

While this escalation for multifamily units probably isn’t sustainable, Yardi Matrix expects conditions for above-average rent growth to persist in many metros “for months.” The report points out that rents are driven by “buoyant” demand. In the 12 months through May, 378,000 multifamily units were absorbed nationwide. The top markets for absorption as a percentage of total inventories were Miami (8,500 units, or 2.7% of stock), Charlotte (4,500, 2.4%) and Orlando (4,900, 2.1%).

Through June of this year, rent growth in Phoenix was nearly three times the national average. And despite its year-to-year rent decline, New York bounced back in the first half of 2021. Image: Yardi Matrix

By units, Chicago topped the list with almost 7,800 multifamily units absorbed, or 2.2 % of the Windy City’s stock. And for all the talk about New Yorkers evacuating in droves during the pandemic, rents actually rose by 6% during the first half of this year, and more companies are now requiring employees to return to office work. Rent recoveries through the first half of 2021 were also in “full swing” in Chicago (up 6.5%), Miami (6.4%), Boston (5%), Los Angeles (4%) and D.C. (3.3%).

Yardi Matrix’s report offers an economic outlook that foresees a flat labor participation market, and questions about rising inflation. Economic volatility “is likely to continue” globally until markets get a handle on controlling their virus outbreaks. “However, that does not mean there won’t be strong economic growth in certain sectors and geographies in the short term,” the report states.

Related Stories

| Jan 20, 2011

Worship center design offers warm and welcoming atmosphere

The Worship Place Studio of local firm Ziegler Cooper Architects designed a new 46,000-sf church complex for the Pare de Sufrir parish in Houston.

| Jan 19, 2011

Baltimore mixed-use development combines working, living, and shopping

The Shoppes at McHenry Row, a $117 million mixed-use complex developed by 28 Walker Associates for downtown Baltimore, will include 65,000 sf of office space, 250 apartments, and two parking garages. The 48,000 sf of main street retail space currently is 65% occupied, with space for small shops and a restaurant remaining.

| Jan 7, 2011

Mixed-Use on Steroids

Mixed-use development has been one of the few bright spots in real estate in the last few years. Successful mixed-use projects are almost always located in dense urban or suburban areas, usually close to public transportation. It’s a sign of the times that the residential component tends to be rental rather than for-sale.

| Jan 4, 2011

An official bargain, White House loses $79 million in property value

One of the most famous office buildings in the world—and the official the residence of the President of the United States—is now worth only $251.6 million. At the top of the housing boom, the 132-room complex was valued at $331.5 million (still sounds like a bargain), according to Zillow, the online real estate marketplace. That reflects a decline in property value of about 24%.

| Jan 4, 2011

Grubb & Ellis predicts commercial real estate recovery

Grubb & Ellis Company, a leading real estate services and investment firm, released its 2011 Real Estate Forecast, which foresees the start of a slow recovery in the leasing market for all property types in the coming year.

| Dec 17, 2010

Condominium and retail building offers luxury and elegance

The 58-story Austonian in Austin, Texas, is the tallest residential building in the western U.S. Benchmark Development, along with Ziegler Cooper Architects and Balfour Beatty (GC), created the 850,000-sf tower with 178 residences, retail space, a 6,000-sf fitness center, and a 10th-floor outdoor area with a 75-foot saltwater lap pool and spa, private cabanas, outdoor kitchens, and pet exercise and grooming areas.

| Dec 17, 2010

Luxury condos built for privacy

A new luxury condominium tower in Los Angeles, The Carlyle has 24 floors with 78 units. Each of the four units on each floor has a private elevator foyer. The top three floors house six 5,000-sf penthouses that offer residents both indoor and outdoor living space. KMD Architects designed the 310,000-sf structure, and Elad Properties was project developer.

| Dec 17, 2010

Vietnam business center will combine office and residential space

The 300,000-sm VietinBank Business Center in Hanoi, Vietnam, designed by Foster + Partners, will have two commercial towers: the first, a 68-story, 362-meter office tower for the international headquarters of VietinBank; the second, a five-star hotel, spa, and serviced apartments. A seven-story podium with conference facilities, retail space, restaurants, and rooftop garden will connect the two towers. Eco-friendly features include using recycled heat from the center’s power plant to provide hot water, and installing water features and plants to improve indoor air quality. Turner Construction Co. is the general contractor.

| Dec 17, 2010

Toronto church converted for condos and shopping

Reserve Properties is transforming a 20th-century church into Bellefair Kew Beach Residences, a residential/retail complex in The Beach neighborhood of Toronto. Local architecture firm RAWdesign adapted the late Gothic-style church into a five-story condominium with 23 one- and two-bedroom units, including two-story penthouse suites. Six three-story townhouses also will be incorporated. The project will afford residents views of nearby Kew Gardens and Lake Ontario. One façade of the church was updated for retail shops.