In the five months since the pandemic-driven real estate shut downs began, the BD+C editorial team has authored or posted more than 135 articles dedicated to COVID-19 and its impact on the AEC market and the built environment. We’ve curated well more than 250 research reports, on-demand webinars, white papers, and articles from third-party sources in our coronavirus newsfeed. We’ve interviewed nearly two dozen AEC experts about their team’s and clients’ coronavirus response on our new streaming video show, The Weekly.

Through all of this reporting, a single common theme bubbled to the surface: Buildings are part of the problem in controlling a global health pandemic. Yet buildings—and the AEC professionals that design, engineer, and construct them—are also a major part of the solution.

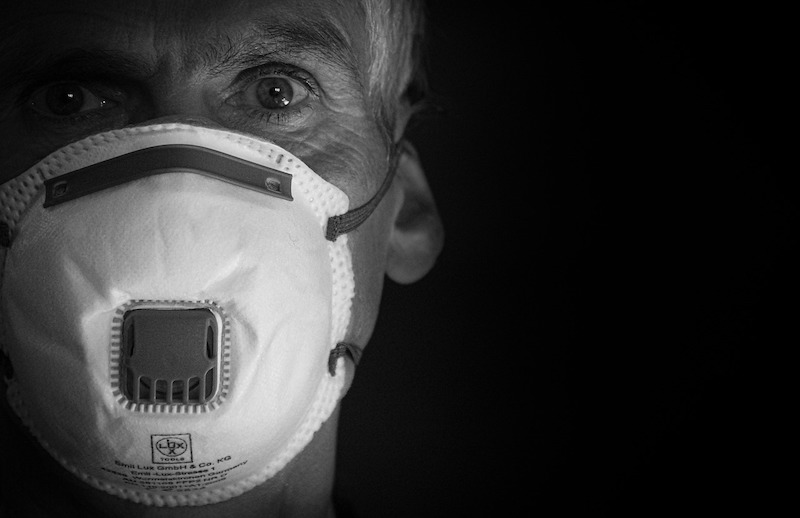

From infection control strategies to 3D-printed PPE equipment to pop-up isolation units and COVID-19 testing stations, AEC firms are delivering practical, innovative solutions to complex problems during a time when their clients need it most. The axiom “innovation loves a good crisis” is playing out right in front of our eyes.

Not since 9/11 has a single event so severely rocked the foundation of the commercial building industry. As owners, developers, and property and facility managers scramble to re-open their properties and create protocols for maintaining safe and healthy interior spaces, they are turning to their AEC firm partners for guidance and support.

And much like the post-9/11 response from the AEC community, many of the best practices and innovations being instituted in response to the COVID-19 pandemic will become permanent fixtures in the built environment (codified, or otherwise).

Take, for example, MEP design, especially for commercial office buildings. Forget the fitness centers, food trucks, and spacious lobbies—the hottest office building amenities are indoor air quality and touchless design. Technologies and design approaches that were on the fringe—bipolar ionization, UV light disinfection, enhanced air filtration—are being pushed to the forefront. Clients are investing in these systems in an effort to retain and attract tenants. These design approaches have been added to the “cost of doing business” list for commercial office owners and developers.

One side effect of the coming MEP spending boom, says Andrew Horning, Vice President with Bala Consulting Engineers, is higher energy bills for building owners. He explains COVID-19’s impact on sustainability and energy efficiency in the July 23rd episode of The Weekly. Watch on demand at: BDCnetwork.com/horizontv.

Related Stories

Market Data | Feb 17, 2016

AIA reports slight contraction in Architecture Billings Index

Multifamily residential sector improving after sluggish 2015.

Market Data | Feb 11, 2016

AIA: Continued growth expected in nonresidential construction

The American Institute of Architects’ semi-annual Consensus Construction Forecast indicates a growth of 8% in construction spending in 2016, and 6.7% the following year.

Market Data | Feb 10, 2016

Nonresidential building starts and spending should see solid gains in 2016: Gilbane report

But finding skilled workers continues to be a problem and could inflate a project's costs.

Market Data | Feb 9, 2016

Cushman & Wakefield is bullish on U.S. economy and its property markets

Sees positive signs for construction and investment growth in warehouses, offices, and retail

Market Data | Feb 5, 2016

CMD/Oxford forecast: Nonresidential building growth will recover modestly in 2016

Increased government spending on infrastructure projects should help.

Market Data | Feb 4, 2016

Mortenson: Nonresidential construction costs expected to increase in six major metros

The Construction Cost Index, from Mortenson Construction, indicated rises between 3 and 4% on average.

Contractors | Feb 1, 2016

ABC: Tepid GDP growth a sign construction spending may sputter

Though the economy did not have a strong ending to 2015, the data does not suggest that nonresidential construction spending is set to decline.

Data Centers | Jan 28, 2016

Top 10 markets for data center construction

JLL’s latest outlook foresees a maturation in certain metros.

Market Data | Jan 20, 2016

Nonresidential building starts sag in 2015

CDM Research finds only a few positive signs among the leading sectors.

Market Data | Jan 20, 2016

Architecture Billings Index ends year on positive note

While volatility persists, architecture firms reported healthy performance for 2015.