Between 2011 and 2016, the U.S. population age 50 years or older grew by 10.5 million to more than 112 million. While the vast majority of older Americans owns homes, homeownership rates are lower than the past, and a significant number of adults drawing closer to retirement might not have the financial wherewithal to afford to either buy or rent where they want to live.

That is the primary concern expressed by the latest Joint Center for Housing Studies’ report “Housing America’s Older Adults 2018,” which releases today.

The study relies mostly on data up to 2016, and reiterates a common theme in many of the Joint Center’s past papers: that America’s affordable housing stock is woefully inadequate to address demographic and economic trends that continue to reshape this country, especially in light of other trends in healthcare and the social safety net.

There are 65 million older households in the U.S. The homeownership rate for those headed by someone 50 years or older is 76.2%, and 78.7% of households headed by someone 65 or older.

The Joint Center’s report notes that the majority of older households are white, and live in single-family homes. The demographic profile of older Americans, however, is likely to get more racially and ethnically diverse. And more older adults have been moving into multifamily housing, possibly because larger buildings are more likely to offer accessibility features.

More older households now consist of older unmarried adults who are doubling up, or living in multigenerational households. This is especially true among people age 65-79.

Perhaps The Joint Center’s greatest concern is the steady decline, since 2004, in the rate for households age 50–64, and an even sharper dip for adults approaching age 50. “Since this younger group is unlikely to match the homeownership rates of previous generations, many of these households will be unable to generate the same levels of wealth for retirement through equity building,” the report posits.

Nearly a quarter of households age 50 or older rent. Given that the median income of older renters ($28,000) is less than half that of older owners ($61,000), the decision to rent often comes out of necessity. Most of the 43% growth in the number of older renters since 2006 has, in fact, been among households earning under $30,000 per year.

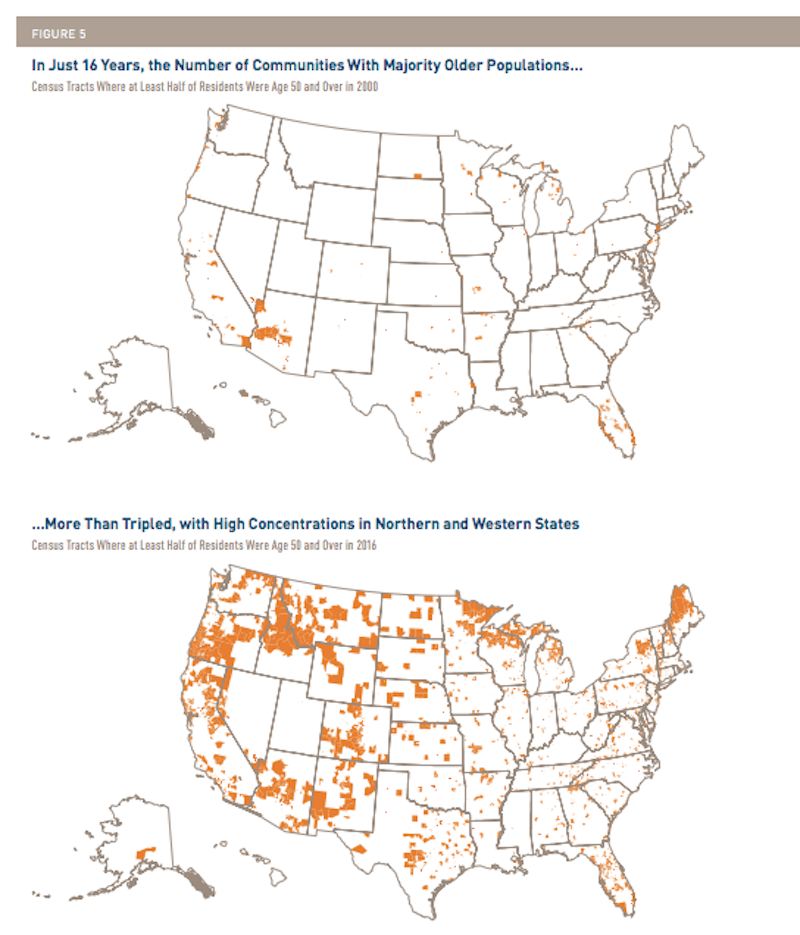

Where people reside is an important factor in this analysis. Although the number of people age 65 and over living in dense urban areas grew by nearly 800,000 between 2000 and 2016, the share of all older adults living in such neighborhoods actually fell. Meanwhile, the shares living in low-density metro tracts rose significantly, from 24% to 32%—an increase of more than six million. The growing presence of older adults in lower-density communities largely results from aging in place.

The implication here is that it might be harder for older adults to find the healthcare and services they require as they age.

More seniors at a financial precipice

The U.S. housing market is ill-prepared to cope with the explosion of seniors across the country, a sizable proportion of whom are nearing retirement facing financial uncertainty. Image: Joint Center for Housign Studies

The median homeowner aged 50–64 had a net worth of $292,000 in 2016—almost 60 times that of the same-age median renter. Even excluding home equity, the net worth of owner households aged 50–64 was still nearly 30 times higher than that of same-age renters, while the net worth of owners age 65 and over was more than 24 times higher.

This disparity might explain why more Americans are working past 65. Over the past three decades, the labor force participation rate rose 12.8 percentage points for 65–69 year olds, and 9.5 points for 70–74 year olds. In 2017, 8.3% of the population age 75 and over was either employed or actively looking for work—nearly double the share 30 years ago.

It’s a good thing they’re working because more than two-fifths of owners 65 or older still have mortgages to pay off. Between 1989 and 2016, the loan-to-vale rations doubled to 51% for mortgage holders aged 50-64, and tripled to 39% for those age 65 or older.

The number of households age 65 and over with housing cost burdens continues to climb. In 2016, 9.7 million households in this age group—nearly a third—spent more than 30% of their incomes for housing. About 4.9 million were severely burdened, paying at least half their incomes for housing

Although the cost-burdened share of 50–64 year olds did decline a fraction of a point to 19.9% in 2014–2016, a total of 10.2 million households in this age group still faced at least moderate cost burdens, and nearly half of those households had severe burdens.

Social Security payments accounted for 69% of the income for the median older household in 2016. But between 2006 and 2016, Social Security payments rose just 6% in real terms while the median rent for households age 65 and over climbed at twice that rate. Looking ahead, the ability of many older adults to afford their housing will be closely tied to the fate of the Social Security program.

The financial precariousness of older Americans is exacerbated by healthcare concerns and costs that might limit their housing options. In 2016, 26% of households age 50 and over included a member with at least one vision, hearing, cognitive, self-care, mobility, or independent living difficulty. Difficulty climbing stairs or walking is the most common disability, affecting 17% of these households. Minority households are more likely than same-age white households to have at least one difficulty, although differences narrow over time.

Consider these statistics in light of the fact that few homes in the U.S. are accessible to people with mobility problems, particularly those requiring a wheelchair.

The good news is that that some older owners have come to grips with their possible debilities. The American Housing Survey shows that among owners age 65 and over who reported home-improvement spending in 2016–2017, 11% indicated that at least one of their projects was related to accessibility. Households in the 55-and-over age group already account for more than half of home improvement spending, and Joint Center projections suggest they will drive more than three-quarters of the growth in renovation spending in 2015–2025.

But renters, as well as owners with little wealth, may require government assistance to make their homes more accessible.

As if all this weren’t daunting enough, the Joint Center states that climate change doesn’t bode well for older adults who are much more at risk from extreme weather events and natural disasters than younger age groups.

The report’s outlook is another warning shot: Many households currently in their 50s and early 60s are not financially prepared for retirement, with lower homeownership rates than their predecessors and meager gains in income and wealth. In addition, many older adults live in low-density areas and in single-family homes, which adds to the pressures on their communities to provide new housing and transportation options for households in need. And as the baby boomers begin to turn 80 in the decade ahead, growing numbers of households will require affordable, accessible housing as well as supportive services.

State and local governments, as well as the private and nonprofit sectors, all have roles to play in developing more affordable and suitable housing for older households. Families and individuals also have a responsibility to plan for the future and to advocate for more age-friendly housing and communities. But given the current and growing scale of need, addressing the challenges of housing America’s older adults must also be a federal priority.

Related Stories

| Aug 11, 2010

And the world's tallest building is…

At more than 2,600 feet high, the Burj Dubai (right) can still lay claim to the title of world's tallest building—although like all other super-tall buildings, its exact height will have to be recalculated now that the Council on Tall Buildings and Urban Habitat (CTBUH) announced a change to its height criteria.

| Aug 11, 2010

Luxury high-rise meets major milestone

A topping off ceremony was held in late October for 400 Fifth Avenue, a 57,000-sf high-rise that includes a 214-room luxury hotel and 190 high-end residential condominiums. Developed by Bizzi & Partners Development and designed by Gwathmey Siegel & Associates Architects, the 60-story tower in midtown Manhattan sits atop a smaller-scale 10-story base, which creates a street façade t...

| Aug 11, 2010

Mixed-use Seattle high-rise earns LEED Gold

Seattle’s 2201 Westlake development became the city’s first mixed-use and high-rise residential project to earn LEED Gold. Located in Seattle’s South Lake Union neighborhood, the newly completed 450,000-sf complex includes 300,000 sf of Class A office space, 135 luxury condominiums (known as Enso), and 25,000 sf of retail space.

| Aug 11, 2010

Triangular tower targets travelers

Chicago-based Goettsch Partners is designing a new mixed-use high-rise for the Chinese city of Dalian, located on the Yellow Sea coast. Developed by Hong Kong-based China Resources Land Limited, the tower will have almost 1.1 million sf, which includes a 377-room Grand Hyatt hotel, 84 apartments, three restaurants, banquet space, and a spa and fitness center.

| Aug 11, 2010

Brooklyn's tallest building reaches 514 feet

With the Brooklyner now topped off, the 514-foot-high apartment tower is Brooklyn's tallest building. Designed by New York-based Gerner Kronick + Valcarcel Architects and developed by The Clarett Group, the soaring 51-story tower is constructed of cast-in-place concrete and clad with window walls and decorative metal panels.

| Aug 11, 2010

RMJM unveils design details for $1B green development in Turkey

RMJM has unveiled the design for the $1 billion Varyap Meridian development it is master planning in Istanbul, Turkey's Atasehir district, a new residential and business district. Set on a highly visible site that features panoramic views stretching from the Bosporus Strait in the west to the Sea of Marmara to the south, the 372,000-square-meter development includes a 60-story tower, 1,500 resi...

| Aug 11, 2010

'Feebate' program to reward green buildings in Portland, Ore.

Officials in Portland, Ore., have proposed a green building incentive program that would be the first of its kind in the U.S. Under the program, new commercial buildings, 20,000 sf or larger, that meet Oregon's state building code would be assessed a fee by the city of up to $3.46/sf. The fee would be waived for buildings that achieve LEED Silver certification from the U.

| Aug 11, 2010

Colonnade fixes setback problem in Brooklyn condo project

The New York firm Scarano Architects was brought in by the developers of Olive Park condominiums in the Williamsburg section of Brooklyn to bring the facility up to code after frame out was completed. The architects designed colonnades along the building's perimeter to create the 15-foot setback required by the New York City Planning Commission.

| Aug 11, 2010

U.S. firm designing massive Taiwan project

MulvannyG2 Architecture is designing one of Taipei, Taiwan's largest urban redevelopment projects. The Bellevue, Wash., firm is working with developer The Global Team Group to create Aquapearl, a mixed-use complex that's part of the Taipei government's "Good Looking Taipei 2010" initiative to spur redevelopment of the city's Songjian District.

| Aug 11, 2010

Recycled Pavers Elevate Rooftop Patio

The new three-story building at 3015 16th Street in Minot, N.D., houses the headquarters of building owner Investors Real Estate Trust (IRET), as well as ground-floor retail space and 71 rental apartments. The 215,000-sf mixed-use building occupies most of the small site, while parking takes up the remainder.