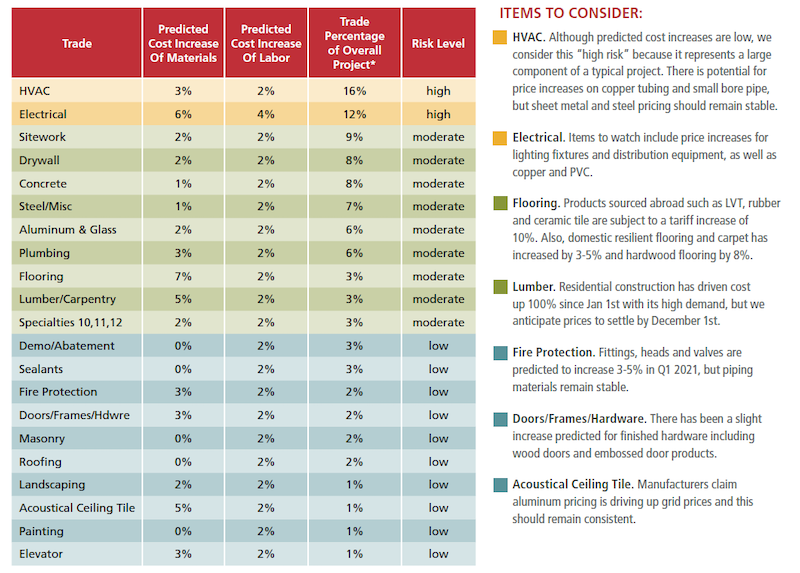

The contractor Consigli Construction has released its latest breakdown of predictions about materials and labor pricing for 21 categories, based on the firm’s survey of more than 200 subcontractors working in the Northeast.

From that polling, Consigli considers HVAC and electrical trades to be at the greatest risk for price increases, based on their projected percentage of a project’s total cost. The firm elaborates that there is potential for price hikes in copper tubing and small-bore pipe, as well as lighting fixtures, copper and PVC, and distribution equipment.

Consigli breaks down pricing risks by 21 categories. Image: Consigli

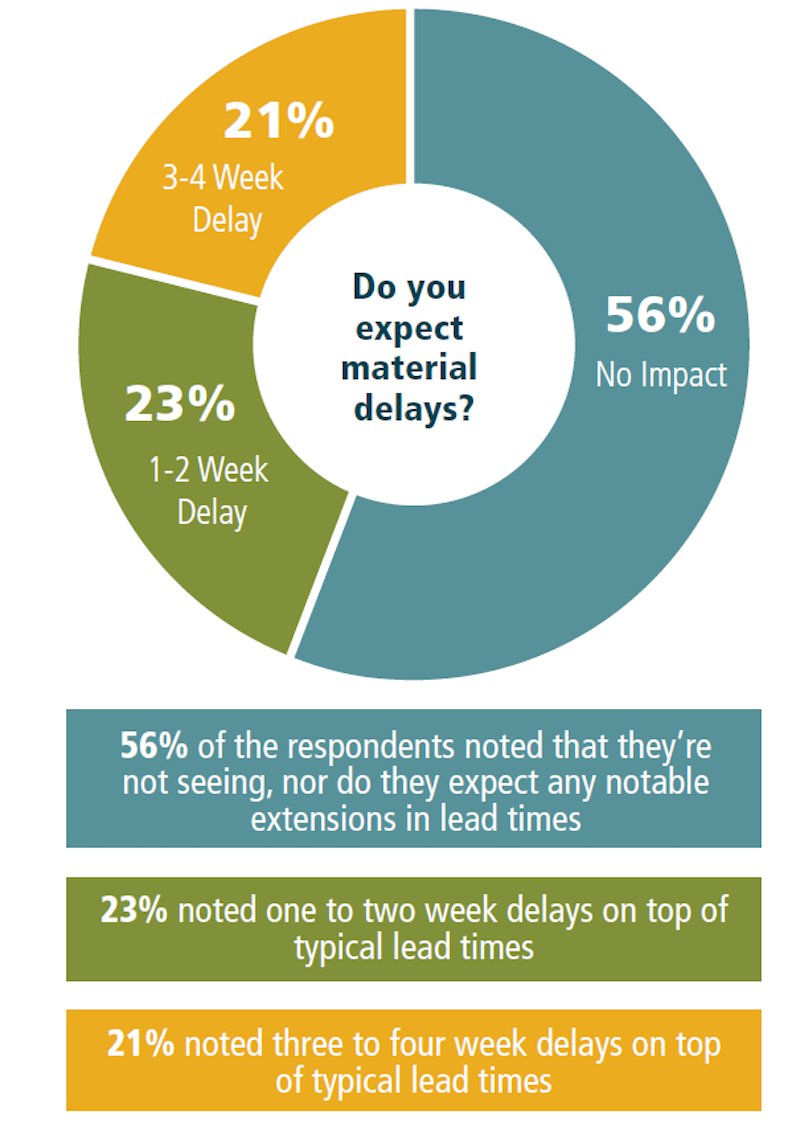

The good news is that 56% of the subs polled said they were experiencing no major increases in lead times as a result of the coronavirus pandemic. That being said, “subcontractors are continuing to place focus on ordering materials as soon as possible to prevent schedule delays,” says Peter Capone, Consigli’s Director of Purchasing.

The firm singles out glass and aluminum, lumber, distribution and transportation issues, electrical lighting/PVC, and custom fabricated materials as “risks to watch for” in the future. Concerning lumber, which has been in short supply across North America, the report states that suppliers “should catch up” with demand by this winter and next Spring, when homebuilding shifts into a higher gear.

WORKER AVAILABILITY SHOULDN’T HAMPER PROJECTS

More than half of the subs polled weren't having lead time problems. Image: Consigli Construction

Consigli notes that, lately, it has experienced “better than normal” bid coverage and aggressive pricing in nearly every trade. Despite their healthy backlogs, subs are still looking to book work for next year and beyond. And most of the subs polled—93%—are confident they will be able to hire more workers to meet work demand.

“There is potential when the COVID-19 vaccine is developed, the construction market may start trending back toward pre-COVID-19 levels of activity,” which could add product and labor costs. “Therefore, now is the time to move forward with upcoming projects,” writes Capone.

Related Stories

| Aug 11, 2010

PCA partners with MIT on concrete research center

MIT today announced the creation of the Concrete Sustainability Hub, a research center established at MIT in collaboration with the Portland Cement Association (PCA) and Ready Mixed Concrete (RMC) Research & Education Foundation.

| Aug 11, 2010

Study explains the financial value of green commercial buildings

Green building may be booming, especially in the Northwest, but the claims made for high-performance buildings have been slow to gain traction in the financial community. Appraisers, lenders, investors and brokers have found it difficult to confirm the value of high-performance green features and related savings. A new study of office buildings identifies how high-performance green features and systems can increase the value of commercial buildings.

| Aug 11, 2010

Architecture Billings Index drops to lowest level since June

Another stall in the recovery for the construction industry as the Architecture Billings Index (ABI) dropped to its lowest level since June. The American Institute of Architects (AIA) reported the August ABI rating was 41.7, down slightly from 43.1 in July. This score indicates a decline in demand for design services (any score above 50 indicates an increase in billings).

| Aug 11, 2010

Construction employment declined in 333 of 352 metro areas in June

Construction employment declined in all but 19 communities nationwide this June as compared to June-2008, according to a new analysis of metropolitan-area employment data released today by the Associated General Contractors of America. The analysis shows that few places in America have been spared the widespread downturn in construction employment over the past year.

| Aug 11, 2010

Jacobs, Hensel Phelps among the nation's 50 largest design-build contractors

A ranking of the Top 50 Design-Build Contractors based on Building Design+Construction's 2009 Giants 300 survey. For more Giants 300 rankings, visit http://www.BDCnetwork.com/Giants

| Aug 11, 2010

Balfour Beatty agrees to acquire Parsons Brinckerhoff for $626 million

Balfour Beatty, the international engineering, construction, investment and services group, has agreed to acquire Parsons Brinckerhoff for $626 million. Balfour Beatty executives believe the merger will be a major step forward in accomplishing a number of Balfour Beatty’s objectives, including establishing a global professional services business of scale, creating a leading position in U.S. civil infrastructure, particularly in the transportation sector, and enhancing its global reach.

| Aug 11, 2010

Construction unemployment rises to 17.1% as another 64,000 construction workers are laid off in September

The national unemployment rate for the construction industry rose to 17.1 percent as another 64,000 construction workers lost their jobs in September, according to an analysis of new employment data released today. With 80 percent of layoffs occurring in nonresidential construction, Ken Simonson, chief economist for the Associated General Contractors of America, said the decline in nonresidential construction has eclipsed housing’s problems.