An aging, diversifying U.S. population is prompting developers to shift their multifamily expansion plans to accommodate changing lifestyle preferences.

“As Millennials mature, they’re looking to invest in homes for themselves or have families,” says Daun St. Amand, AIA, LEED AP BD+C, Senior Vice President and Global Residential Sector Leader at CallisonRTKL. “In many cases, they’re moving back to the suburbs to find larger, more affordable space.”

But relocating from the city may mean a longer commute and loss of access to cultural facilities and nightlife. “The trend now is to identify suburban locations where we can design mixed-use projects that offer a bit of urbanism, including transit-oriented development and socialization opportunities,” says St. Amand.

See also: Top 150 Multifamily Architecture + AE Firms - 2018 Giants 300 rankings

See also: Top 70 Multifamily Engineering + EA Firms - 2018 Giants 300 rankings

See also: Top 70 Multifamily Construction + CM Firms - 2018 Giants 300 rankings

Sponsored by ZIP System sheathing and tape

At the same time, a growing cohort of Baby Boomers and other empty nesters are opting to downsize and relocate from suburban to urban environments, often choosing to rent instead of buy.

The National Multifamily Housing Council projects these demographic shifts will create demand for 4.6 million new apartment units by 2030.

There’s also growing demand for more affordable urban living options that will appeal to younger clientele.

Consider the 35-story Perla on Broadway condo tower under construction in downtown Los Angeles's historic theater district—the first residential high-rise built in the historic core in more than a century. Its modestly sized units and reasonable price points are intended to appeal to first-time homebuyers. It emphasizes pedestrian-oriented activities and outdoor amenity spaces such as a pool, dog walk, and active rooftop garden.

“There was a lot of thinking about each of the outdoor spaces—noise levels, socialization opportunities, and especially the ability to get away to a quiet space and decompress,” says St. Amand.

Cash-strapped Millennials looking to save on rent have a growing selection of co-living alternatives that offer tenants serviced rooms in shared apartments with communal lounges, kitchens, and bathrooms. In Chicago’s South Loop, the 30 East apartment community features 255 beds within 134 economically sized residential units.

“We are working on more projects that are incorporating the concept of renting by the bed, rather than by the unit,” says Clara Wineberg, AIA, LEED AP, Principal, Solomon Cordwell Buenz. “This building type is at an interesting intersection between student housing and urban multifamily residential projects.”

At the other end of the affordability spectrum are luxury condo towers such as the 62-story One Thousand Museum project under construction in Miami. Designed by the late Zaha Hadid, the building’s undulating exoskeleton is composed of 5,000 pieces of lightweight glass-fiber reinforced concrete imported from Dubai.

“The use of GFRC as a permanent formwork system is a first in high-rise construction, and it increases efficiency throughout the process,” says Brad Meltzer, President of Plaza Construction. This unusual construction method consists of lightweight, hollow panels that come together to form a structure core-filled with concrete and steel.

The terrace lounge at 30 East. Photo © Darris Lee Harris

“It allows the construction team to space the building’s columns up to 40 feet apart, embracing the concept of the free plan and giving residences and communal areas an open look and feel,” says Meltzer.

Lendlease reports a growing demand for complex multifamily designs that feature sloping walls, high slab heights, and large floor-to-ceiling views.

In New York City’s Tribeca neighborhood, the newly opened 56 Leonard Street condominium development features atypical floor plates, cantilevered floors, and irregular balcony spacing. Each of the building’s 146 condo units is equipped with its own private outdoor space, but the unusual layout of each floor created significant logistical challenges for the construction team.

“We had to bring a unique strategy to the project and reposition all of our equipment on each floor when pouring the concrete,” says Jeff Arfsten, Managing Director and Chief Operating Officer with Lendlease Americas. “Through these innovative designs, developers are able to provide residents with superior and unique living experiences to meet their evolving needs.”

GROWING—and changing—IN PLACE

Tenants are looking for flexible living spaces and the ability to personalize their home environment. NMHC's 2018 Consumer Housing Insights Survey found that 83% of respondents believed it’s important to have a space that evolves through different stages of their lives; 78% said it’s important to have a space that can change to meet changing needs.

“We’re starting to design residential units differently than we have in the past, because we want to aid that ability to personalize the space and use it differently as time goes on,” says St. Amand.

These units might integrate side-by-side living spaces with a sliding wall that can be reconfigured into an open environment, or “plus one” space that can be converted into a temporary bedroom or workroom.

There’s also a move toward encouraging socialization among tenants via active lobbies, expanded food and beverage offerings, and numerous activity spaces.

“If you have friends in the building, you’re more likely to renew your lease, and renewing leases is a major part of making pro formas work,” says St. Amand.

Some of today’s most popular amenities emphasize convenience, such as built-in vestibules or valet closets to accommodate package deliveries right at the unit rather than in centralized lockers near the lobby.

“Another trend we’re seeing is the use of smart appliances, locks, and outlets that can be controlled remotely,” says Lendlease's Arfsten. “In prior years, you would see this technology only used in condominiums, but now it’s increasingly used throughout rental properties.”

Architects and engineers are also starting to incorporate drone landing pads and security in preparation for the use of drones for transporting not only packages, but even people.

“Given that drone transportation is not yet fully developed or legally approved, it poses an opportunity for us to solve this anticipated innovation for the industry,” says Mark Humphreys, CEO, Humphreys & Partners Architects.

Related Stories

MFPRO+ News | Nov 21, 2023

Renters value amenities that support a mobile, connected lifestyle

Multifamily renters prioritize features and amenities that reflect a mobile, connected lifestyle, according to the National Multifamily Housing Council (NMHC) and Grace Hill 2024 Renter Preferences Survey.

Sustainability | Nov 20, 2023

8 strategies for multifamily passive house design projects

Stantec's Brett Lambert, Principal of Architecture and Passive House Certified Consultant, uses the Northland Newton Development project to guide designers with eight tips for designing multifamily passive house projects.

MFPRO+ News | Nov 15, 2023

Average U.S multifamily rents drop $3 to $1,718 in October 2023: Yardi Matrix

Multifamily fundamentals continued to soften and impact rents last month, according to the latest Yardi Matrix National Multifamily Report. The average U.S. asking rent dropped $3 to $1,718 in October, with year-over-year growth moderating to 0.4%, down 40 basis points from September. Occupancy slid to 94.9%, marking the first decline in four months.

Industrial Facilities | Nov 14, 2023

Some AEC firms are plugging into EV charging market

Decentralized electrical distribution is broadening recharger installation to several building types.

MFPRO+ Special Reports | Nov 14, 2023

Register today! Key trends in the multifamily housing market for 2024 - BD+C Live Webinar

Join the BD+C and Multifamily Pro+ editorial team for this live webinar on key trends and innovations in the $110 billion U.S. multifamily housing market. A trio of multifamily design and construction experts will present their latest projects, trends, innovations, and data/research on the three primary multifamily sub-sectors: rental housing, senior living, and student housing.

Multifamily Housing | Nov 9, 2023

Multifamily project completions forecast to slow starting 2026

Yardi Matrix has released its Q4 2023 Multifamily Supply Forecast, emphasizing a short-term spike and plateau of new construction.

MFPRO+ News | Nov 1, 2023

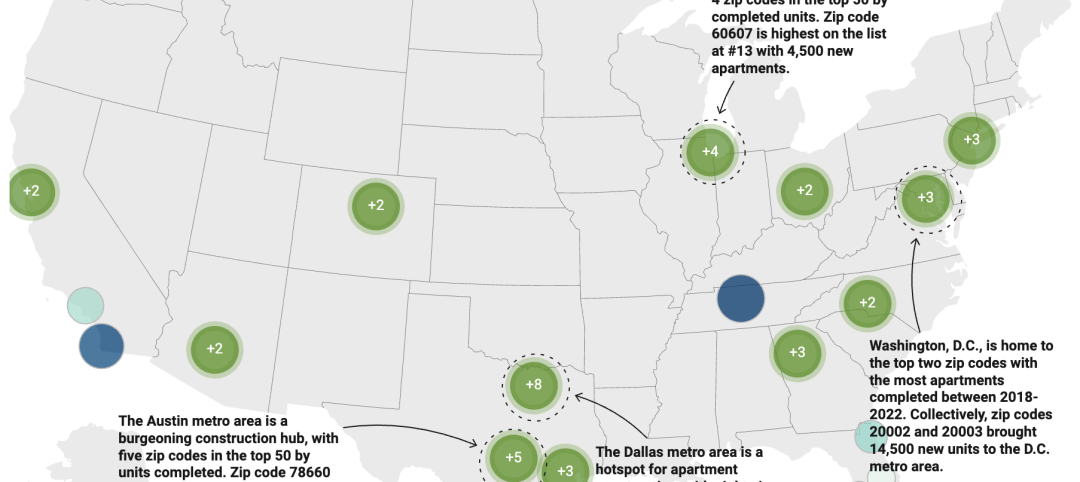

Washington, D.C., Queens, N.Y., lead nation in number of new apartments by zip code

A study of new apartment construction by zip code showed Washington D.C., and the Queens borough of New York City are the hottest multifamily markets since 2018, according to RentCafe.

Adaptive Reuse | Nov 1, 2023

Biden Administration reveals plan to spur more office-to-residential conversions

The Biden Administration recently announced plans to encourage more office buildings to be converted to residential use. The plan includes using federal money to lend to developers for conversion projects and selling government property that is suitable for conversions.

Sponsored | MFPRO+ Course | Oct 30, 2023

For the Multifamily Sector, Product Innovations Boost Design and Construction Success

This course covers emerging trends in exterior design and products/systems selection in the low- and mid-rise market-rate and luxury multifamily rental market. Topics include facade design, cladding material trends, fenestration trends/innovations, indoor/outdoor connection, and rooftop spaces.