Multifamily housing investors are gravitating toward Sun Belt markets with strong job and population growth, according to new research from Yardi Matrix.

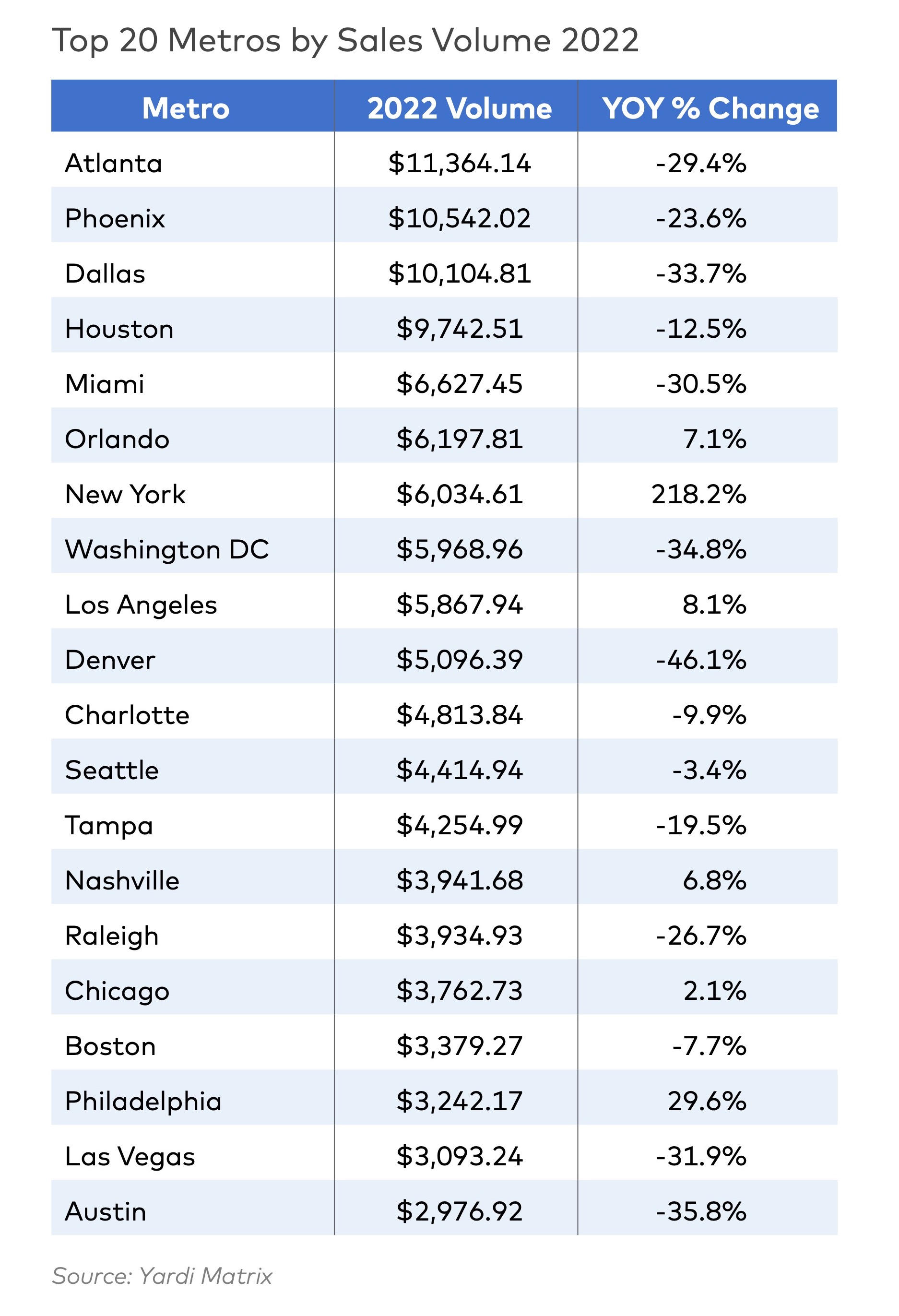

Despite a sharp second-half slowdown, last year’s nationwide $187 billion transaction volume was the second-highest annual total ever. In 2022, multifamily sales volume was paced by Atlanta, Phoenix, Dallas, Houston, Miami, and Orlando, Fla. The Southeast, Southwest, and West regions accounted for $148 billion of sales in 2022, 79% of the total.

The multifamily housing investment market faces significant head winds in 2023 in the form of higher financing costs, rising debt service payments, and a slowdown in rent growth. Even with the current wave of market uncertainty, though, many investors still “view multifamily as a safer place to park capital than other investment products or other commercial property classes such as office or retail,” the research says.

From the Yardi Matri report (download for free):

"Multifamily investors are increasingly favoring markets that not only provide population and job growth but also have less political risk. Large coastal states have more areas subject to rent controls and are more likely to pass new laws that impact investors’ bottom lines. Los Angeles, for example, passed a local ballot initiative last year that will create a new “mansion tax” of 4-5% on property transfers above $5 million. Sharp rent growth has made rent control a nationwide is- sue, even in Florida, where Orange County legis- lators passed a rent control measure. However, a Florida court invalidated the law, which remains on appeal."

"The investment market will start 2023 the way it ended in 2022, with relatively few deals. Buyers are cautious, facing higher financing costs and downgraded projections of future rent growth. Cap rates averaged 5.0% at year-end 2022, up from the low- to mid-4% range at the beginning of the year, per Matrix. Meanwhile, most apartment owners are holding on to properties unless there is a reason to sell, such as a death, the dissolution of a partnership or a capital event like a maturing mortgage that creates a need for restructuring."

"Indeed, the biggest question the market faces is not whether we will see more distressed assets but by how much distress will increase. Banks have become conservative with the prospect of a widely projected economic downturn, so borrow- ers are facing both rising rates and less leverage."

Related Stories

Mixed-Use | Sep 20, 2023

Tampa Bay Rays, Hines finalize deal for a stadium-anchored multiuse district in St. Petersburg, Fla.

The Tampa Bay Rays Major League Baseball team announced that it has reached an agreement with St. Petersburg and Pinellas County on a $6.5 billion, 86-acre mixed-use development that will include a new 30,000-seat ballpark and an array of office, housing, hotel, retail, and restaurant space totaling 8 million sf.

Engineers | Sep 15, 2023

NIST investigation of Champlain Towers South collapse indicates no sinkhole

Investigators from the National Institute of Standards and Technology (NIST) say they have found no evidence of underground voids on the site of the Champlain Towers South collapse, according to a new NIST report. The team of investigators have studied the site’s subsurface conditions to determine if sinkholes or excessive settling of the pile foundations might have caused the collapse.

MFPRO+ Research | Sep 11, 2023

Conversions of multifamily dwellings to ‘mansions’ leading to dwindling affordable stock

Small multifamily homes have historically provided inexpensive housing for renters and buyers, but developers have converted many of them in recent decades into larger, single-family units. This has worsened the affordable housing crisis, say researchers.

Adaptive Reuse | Aug 31, 2023

New York City creates team to accelerate office-to-residential conversions

New York City has a new Office Conversion Accelerator Team that provides a single point of contact within city government to help speed adaptive reuse projects. Projects that create 50 or more housing units from office buildings are eligible for this new program.

Multifamily Housing | Aug 24, 2023

A multifamily design for multigenerational living

KTGY’s Family Flat concept showcases the benefits of multigenerational living through a multifamily design lens.

Multifamily Housing | Aug 23, 2023

Constructing multifamily housing buildings to Passive House standards can be done at cost parity

All-electric multi-family Passive House projects can be built at the same cost or close to the same cost as conventionally designed buildings, according to a report by the Passive House Network. The report included a survey of 45 multi-family Passive House buildings in New York and Massachusetts in recent years.

Apartments | Aug 22, 2023

Key takeaways from RCLCO's 2023 apartment renter preferences study

Gregg Logan, Managing Director of real estate consulting firm RCLCO, reveals the highlights of RCLCO's new research study, “2023 Rental Consumer Preferences Report.” Logan speaks with BD+C's Robert Cassidy.

Adaptive Reuse | Aug 16, 2023

One of New York’s largest office-to-residential conversions kicks off soon

One of New York City’s largest office-to-residential conversions will soon be underway in lower Manhattan. 55 Broad Street, which served as the headquarters for Goldman Sachs from 1967 until 1983, will be reborn as a residence with 571 market rate apartments. The 30-story building will offer a wealth of amenities including a private club, wellness and fitness activities.

Sustainability | Aug 15, 2023

Carbon management platform offers free carbon emissions assessment for NYC buildings

nZero, developer of a real-time carbon accounting and management platform, is offering free carbon emissions assessments for buildings in New York City. The offer is intended to help building owners prepare for the city’s upcoming Local Law 97 reporting requirements and compliance. This law will soon assess monetary fines for buildings with emissions that are in non-compliance.