The commercial property and casualty (P&C) market is driven by two powerful, albeit conflicting, forces: large catastrophic losses and excess capital. As a substantial part of real estate development is happening in areas exposed to floods, wildfires, severe storms, hurricanes and earthquakes, insurance companies are rethinking how to deploy their capital to manage aggregation in catastrophe exposed areas.

USI Insurance Services, a global insurance brokerage and consulting firm, recently released its 2019 Commercial Property & Casualty Market Outlook, which provides insight into the current dynamics of the property and casualty insurance market, as well as a deeper dive into covered sectors that include commercial real estate and construction, transportation, manufacturing/distribution, environmental, and aviation.

The report found a stable P&C industry in 2018, despite it having experienced five of the 15 costliest global catastrophes in the past two years, coupled with multiple large wildfires and other major loss events, which collectively caused in excess of $125 billion in total insured damages.

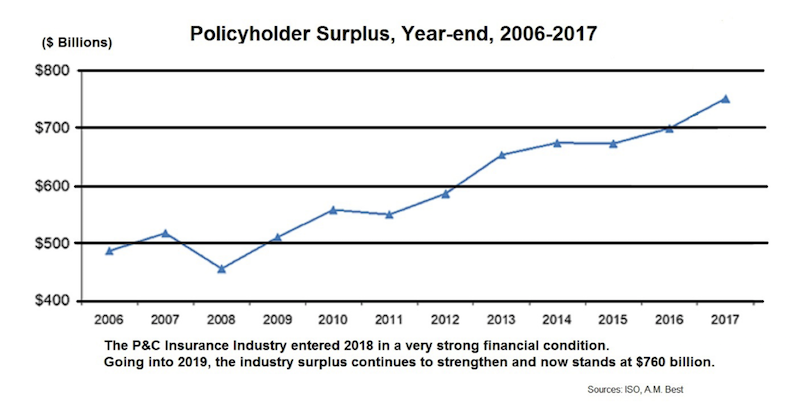

The P&C industry remains well capitalized, and its surplus now stands at $760 billion. Consequently, the industry has resisted significant and sustained market-wide rate increases, even as insured property losses from U.S. catastrophes alone went from $14.3 billion for 2.4 million claims from 33 catastrophes in 2010 to $101.9 billion for 5.2 million claims from 46 catastrophes in 2017, according to Property Claims Services and the U.S. Bureau of Economic Analysis.

It remains to be seen whether such restraint is sustainable if catastrophic events continue to increase and wreak havoc. USI says while most insureds should expect a flat to plus-5% rate change, but cautions that current rate trends will be difficult to maintain if the frequency and severity of catastrophes don’t abate.

The report notes specifically that pricing challenges are likely to persist in specific coverage lines such as property-exposed accounts in wind-prone areas, habitational risks, and large commercial trucking fleets.

Carriers, says USI, are also more likely to ask for moderate-to-high rate increases for many insureds in the public company directors’ and officers’ space, employment practices liability and medical malpractice for healthcare providers in certain classes.

Within the commercial real estate sector, multifamily properties could have the hardest time finding willing insurers. Beyond the natural catastrophe losses in 2017 and 2018, multifamily portfolios are producing fire and water damage losses, causing some carriers to either exit this risk class entirely, or increase rates and deductibles even for low-loss level insureds. With overall segment capacity shrinking, insureds with exposures to natural catastrophe and below average loss history can expect significant rate increases.

This could be especially true for frame construction, due to numerous large fire losses in recent years.

Despite the frequency of catastrophic events, insurers have so far resisted steady and high rate increases. Image: USI

The prospects are a bit brighter for nonresidential commercial properties, whose owners, developers, and managers have a distinct advantage, says USI: Quality risks remain the focus of carrier capacity offerings. Nevertheless, portfolios exposed to natural catastrophe will require a disciplined approach to achieve an optimal outcome in the marketplace.

USI joins other market observers in its expectation that spending on commercial construction will rise in 2019. Total construction spending may produce a 4% increase in insurance premiums in 2019, compared to 2018, while rates remain mostly flat in certain jurisdictions.

For larger construction projects, safety, specialization, timeliness, and staying within budget remain the biggest risks. “With good risk management and the use of Controlled Insurance Programs (CIPs), insureds can avoid disruptions, reduce loss costs, and meet expectations of all parties who have an insurable risk,” USI’s states.

Its report found in commercial construction a greater emphasis on jobsite safety to reduce claims per man-hour. The widespread application of BIM is fostering open collaboration and new ideas that are helping to mitigate risk, too.

USI also comments on the renewed interest in modular and prefabricated construction, which brings with it benefits of quality control and worker safety. However, those methods also raise insurance-related concerns, such as how a general liability insurance policy would respond to a potential claim, and how employees should be categories within their workers compensation programs.

Related Stories

| Aug 11, 2010

USGBC’s Greenbuild 2009 brings global ideas to local main streets

Save the planet with indigenous knowledge. Make permanent water part of your life. Dive deep water for clues to environmental success. Connect site selection to successful creative concepting. Explore the unknown with Discovery Channel’s best known guide. These are but a few of the big ideas participants can connect to at USGBC’s Greenbuild International Conference and Expo, taking place on November 11-13, 2009 in Phoenix, Ariz.

| Aug 11, 2010

Goettsch Partners wins design competition for Soochow Securities HQ in China

Goettsch Partners (GP) has been selected as the winning firm in the competition to design the Soochow Securities Headquarters, the new office and stock exchange building for Soochow Securities Co. Ltd. The 21-story, 441,300-square-foot project includes 344,400 square feet of office space, an 86,100-square-foot stock exchange, meeting rooms, classrooms, a cafeteria, and underground parking for 400 cars and 800 bicycles.

| Aug 11, 2010

Urban Land Institute honors five 'outstanding' developments in Europe, Middle East, and Africa

Five outstanding developments have been selected as winners of the Urban Land Institute (ULI) 2009 Awards for Excellence: Europe, Middle East, and Africa (EMEA) competition. This year, the competition also included the announcement of two special award winners. The Awards for Excellence competition is widely regarded as the land use industry’s most prestigious recognition program.

| Aug 11, 2010

Design firms slash IT spending in 2009

Over half of architecture, engineering, and environmental consulting firms (55%) are budgeting less for information technology in 2009 than they did in 2008, according to a new report from ZweigWhite. The 2009 Information Technology Survey reports that firms' 2009 IT budgets are a median of 3.3% of net service revenue, down from 3.6% in 2008. Firms planning to decrease spending are expected to do so by a median of 20%.

| Aug 11, 2010

Thom Mayne unveils 'floating cube' design for the Perot Museum of Nature and Science in Dallas

Calling it a “living educational tool featuring architecture inspired by nature and science,” Pritzker Prize Laureate Thom Mayne and leaders from the Museum of Nature & Science unveiled the schematic designs and building model for the Perot Museum of Nature & Science at Victory Park. Groundbreaking on the approximately $185 million project will be held later this fall, and the Museum is expected to open by early 2013.

| Aug 11, 2010

10 tips for mitigating influenza in buildings

Adopting simple, common-sense measures and proper maintenance protocols can help mitigate the spread of influenza in buildings. In addition, there are system upgrades that can be performed to further mitigate risks. Trane Commercial Systems offers 10 tips to consider during the cold and flu season.

| Aug 11, 2010

Reed Construction Data files corporate espionage lawsuit against McGraw-Hill Construction Dodge

Reed Construction Data (RCD), a leading construction information provider and a wholly-owned subsidiary of Reed Elsevier (NYSE:RUK, NYSE:ENL), today filed suit in federal court against McGraw-Hill Construction Dodge, a unit of The McGraw-Hill Companies, Inc. (NYSE:MHP). The suit charges that Dodge has unlawfully accessed confidential and trade secret information from RCD since 2002 by using a series of fake companies to pose as RCD customers.

| Aug 11, 2010

Jacobs, HOK top BD+C's ranking of the 75 largest state/local government design firms

A ranking of the Top 75 State/Local Government Design Firms based on Building Design+Construction's 2009 Giants 300 survey. For more Giants 300 rankings, visit http://www.BDCnetwork.com/Giants