Over the first half of 2017, the national median rent fluctuated, but it ended up exactly where it began: $1,016 for a one-bedroom. Prices fell from January to March, bottoming out at $1,003 before creeping back up in the spring. In all, the national median rent always stayed within 1.3% of its starting value.

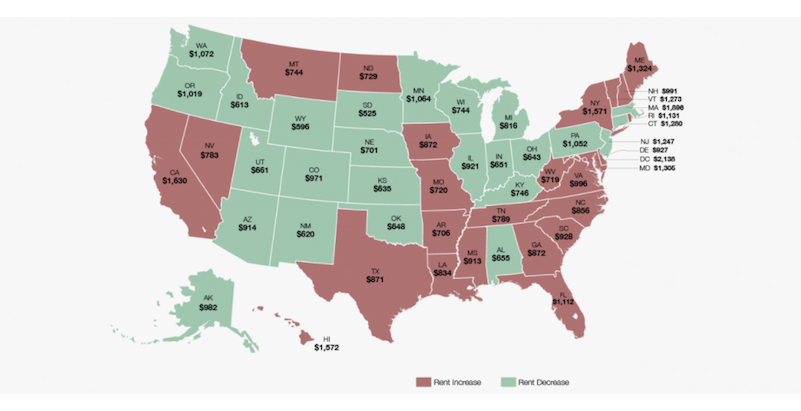

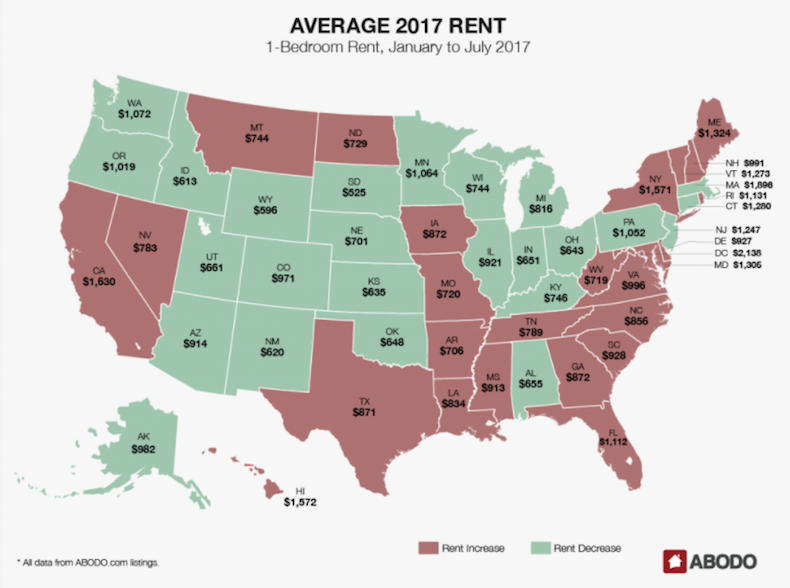

A slight majority of states (26, plus the District of Columbia) saw rental increases over the first six months of 2017, with the largest average percent changes coming in South Carolina (7.3%), Maine (7.3%), Vermont (7.2%), and Rhode Island (7.0%), Abodo's Midyear Rent Report reports. The greatest average decreases were significantly lower: Utah (-4.4%), Oklahoma (-3.3%), Pennsylvania (-2.7%), Connecticut (-2.3%).

The majority of states, 31, saw average changes in rent price of 1.3% or lower.

The states with the highest average rents will surprise no one. The District of Columbia had the highest average rent from January to July, with one-bedrooms going for $2,138 per month. Massachusetts ($1,896), California ($1,630), Hawaii ($1,572), and New York ($1,571) followed. The four states with the lowest average rents were all in the West or Southwest: South Dakota ($525), Wyoming ($596), Idaho ($613), and New Mexico ($620).

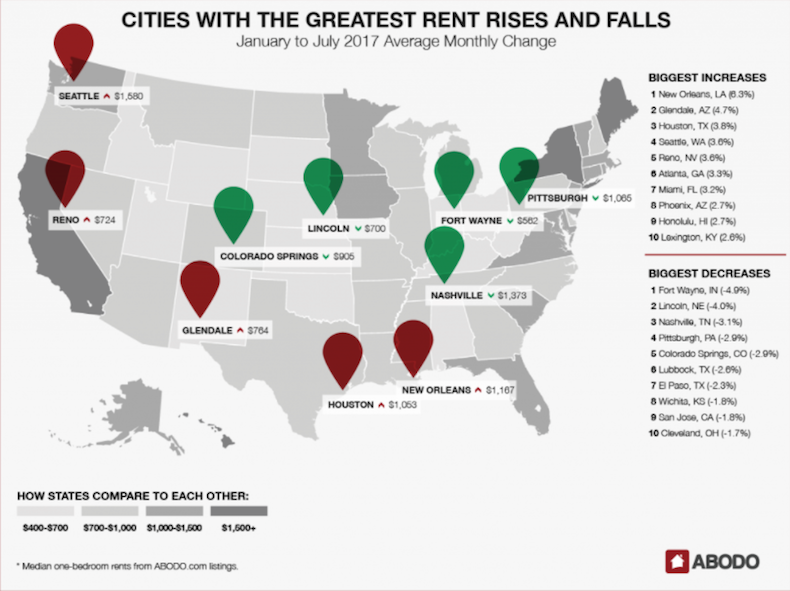

In December, our annual rent report noted that many of the cities with the fastest-growing rents were between the coasts. That trend continued in the first half of 2017: Eight of the top 10 cities for rental hikes were in the South or Southwest. New Orleans led the way, with an average monthly change of 6.3% and an average rent of $1,167. Glendale, Ariz. (4.7%, $764), and Houston (3.8%; $1,053), followed closely behind, with Reno, N.V., Atlanta, Miami, Phoenix, and Lexington, Ky., also making appearances.

The only geographic outliers were Seattle, which saw rents rise an average of 3.6% over the first half of the year, and Honolulu (2.6%).

The biggest drops in rent also continued to veer west and south. Fort Wayne, Ind., saw the largest rent drop, with an average decline of 4.9% per month and an average rent of $562. Lincoln, Neb., where the average rent is $700, experienced an average decline of 4% per month. And booming Nashville, Tenn., where the average one-bedroom rents for $1,373, saw an average drop of 3.1% per month.

From June to July, the biggest rental hike was in Newark, N.J., which saw its one-bedroom rent increase 10.2% to $1,120. Philadelphia (8.5%; $1,305) and Honolulu (8%; $1,654) rounded out the top three. In June, Reno saw its rent rise 6.7% to $832, and New Orleans jumped 5.8% to $1,397, continuing the months-long upward trend that landed them on the list for highest year-to-date change.

For the second month in a row, Buffalo, N.Y., and St. Paul, Minn., experienced the largest drops in rent in the country. This month, the order was reversed: St. Paul leads the way, with a 7.4% decrease to $1,233. Buffalo saw its rent drop 7.2% to $939. Glendale, which over the first six months of 2017 had the second-highest average monthly increase in rent, saw its median one-bedroom decrease 6.8% over the month of June, bottoming out at $833.

The cities with the highest rents are largely unchanged since last month’s report. San Francisco rents dropped $40 to $3,240, but that wasn’t enough to bump the city from its spot atop the rankings. As usual, New York City ($2,913) and San Jose ($2,378) rounded out the top three. The only real movement in the list of the country’s highest rents was near the bottom: Chicago ($1,861) superseded Miami ($1,855) for eighth place.

Nationally, rental prices were relatively stable through the first six months of 2017. Rent is rising in just over half of the nation’s states, and certain cities are seeing sustained increases in rent month to month. Cities where rent was already high—New York, D.C., Los Angeles—are still high, but the most notable rental increases are in growing markets in the South and Southwest, a continuation of a trend we noticed in our 2016 Annual Report.

In the next six months, rental prices in those markets will be a good barometer for how well new development is keeping up with what appears to be continued—and rising—demand for rentals.

Related Stories

Sustainability | Aug 15, 2023

Carbon management platform offers free carbon emissions assessment for NYC buildings

nZero, developer of a real-time carbon accounting and management platform, is offering free carbon emissions assessments for buildings in New York City. The offer is intended to help building owners prepare for the city’s upcoming Local Law 97 reporting requirements and compliance. This law will soon assess monetary fines for buildings with emissions that are in non-compliance.

Sponsored | Multifamily Housing | Aug 15, 2023

Embracing Integrations: When Access Control Becomes Greater Than the Sum of Its Parts

Multifamily Housing | Aug 11, 2023

Hotels extend market reach with branded multifamily residences

The line separating hospitality and residential living keeps getting thinner. Multifamily developers are attracting renters and owners to their properties with hotel-like amenities and services. Post-COVID, more business travelers are building in extra days to their trips for leisure. Buildings that mix hotel rooms with for-sale or rental apartments are increasingly common.

MFPRO+ New Projects | Aug 10, 2023

Atlanta’s Old Fourth Ward gets a 21-story, 162-unit multifamily residential building

East of downtown Atlanta, a new residential building called Signal House will provide the city with 162 units ranging from one to three bedrooms. Located on the Atlanta BeltLine, a former railway corridor, the 21-story building is part of the latest phase of Ponce City Market, a onetime Sears building and now a mixed-use complex.

Senior Living Design | Aug 7, 2023

Putting 9 senior living market trends into perspective

Brad Perkins, FAIA, a veteran of more than four decades in the planning and design of senior living communities, looks at where the market is heading in the immediate future.

Multifamily Housing | Jul 31, 2023

6 multifamily housing projects win 2023 LEED Homes Awards

The 2023 LEED Homes Awards winners in the multifamily space represent green, LEED-certified buildings designed to provide clean indoor air and reduced energy consumption.

MFPRO+ New Projects | Jul 27, 2023

OMA, Beyer Blinder Belle design a pair of sculptural residential towers in Brooklyn

Eagle + West, composed of two sculptural residential towers with complementary shapes, have added 745 rental units to a post-industrial waterfront in Brooklyn, N.Y. Rising from a mixed-use podium on an expansive site, the towers include luxury penthouses on the top floors, numerous market rate rental units, and 30% of units designated for affordable housing.

Affordable Housing | Jul 27, 2023

Houston to soon have 50 new residential units for youth leaving foster care

Houston will soon have 50 new residential units for youth leaving the foster care system and entering adulthood. The Houston Alumni and Youth (HAY) Center has broken ground on its 59,000-sf campus, with completion expected by July 2024. The HAY Center is a nonprofit program of Harris County Resources for Children and Adults and for foster youth ages 14-25 transitioning to adulthood in the Houston community.

Adaptive Reuse | Jul 27, 2023

Number of U.S. adaptive reuse projects jumps to 122,000 from 77,000

The number of adaptive reuse projects in the pipeline grew to a record 122,000 in 2023 from 77,000 registered last year, according to RentCafe’s annual Adaptive Reuse Report. Of the 122,000 apartments currently undergoing conversion, 45,000 are the result of office repurposing, representing 37% of the total, followed by hotels (23% of future projects).

Multifamily Housing | Jul 25, 2023

San Francisco seeks proposals for adaptive reuse of underutilized downtown office buildings

The City of San Francisco released a Request For Interest to identify office building conversions that city officials could help expedite with zoning changes, regulatory measures, and financial incentives.