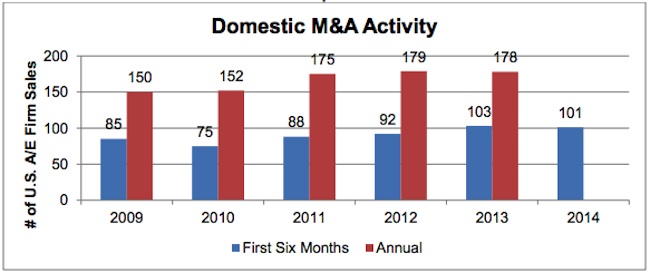

Through the first six months of 2014, Morrissey Goodale tracked 101 sales of U.S.-based architecture and engineering (AE) firms, roughly the same amount as during the first six months of 2013, and putting 2014 on pace for another strong year for domestic AE M&A activity. This positive momentum has continued into the second half of the year with AECOM’s recently announced agreement to acquire URS.

The deal is one of the most significant in the history of the AE space and creates a global firm with more than 95,000 employees. International deals, on the other hand, lagged through the first six months, with just 43 sales of internationally-based AE firms so far in 2014 compared to 54 during the first six months of 2013. Overall, activity remains strong and hot spots for dealmaking are tracking broader positive economic trends in the U.S. and abroad.

Domestic M&A Activity on Pace for Strong 2014

Domestic M&A activity through the first six months of 2014 was generally on pace with the first six months of 2013 (Graph 1, top). The pace of domestic AE industry consolidation, which accelerated coming out of the great recession in 2011 and carried forward into 2013, has remained relatively steady into 2014.

Industry firms appear to remain cautiously optimistic, with deal activity in 2014 on pace to rise to levels similar to 2012 and 2013 by year end. Firms continue to make bets on the positive economic climate in the U.S. The question will be whether this momentum continues into the back half of the year, as firms work to integrate recent acquisitions and continue to assess the U.S. market. With six months to go in the year, we anticipate domestic M&A activity to be in the 180 to 200 deal range.

Texas and California Lead States in M&A Activity

Regionally, Texas led all states in deal activity with 16 Texas-based AE firm sales through June 30, 2014 (Graph 2). Deals in the Lone Star State continue to be driven by a combination of strong economic growth and oil and gas activity. California, a perennial top state for industry dealmaking, followed with 12 firm sales. Colorado, which was among the top states for firm sales in 2013 with 11, saw seven firms based in the state sell so far in 2014. Notable among the top states was Washington, where we only observed one firm sale in all of 2013, and by comparison has produced 6 firm sales so far in 2014.

The U.K. and Canada Lead International Destinations

The United Kingdom and Canada were the top destinations for international firm sales through the first half of 2014 (Graph 3). Australia, New Zealand, and South Africa were also bright spots. With the Eurozone and BRIC countries continuing to face economic challenges, buyers looked to more stable markets for M&A opportunities.

The Megadeal is Back

On the heels of several large deals in the back half of 2013, megadeals continued into the first half of 2014. AE firms continued to seek transformational opportunities to differentiate their businesses. A few of the notable large deals so far in 2014 included:

-

AECOM’s agreement to acquire 50,000-person URS

-

AMEC’s agreement to acquire 14,000-person Foster Wheeler

-

3,000-person Conestoga-Rovers’ merger with 5,500-person GHD

-

Cardno’s acquisition of 760-person PPI Group

-

WSP Group’s acquisition of 1,700-person Focus Group

-

Parsons’ acquisition of 800-person Delcan

It remains to be seen how large scale consolidation will play out as the industry landscape continues to evolve.

Oil & Gas Driving Activity

Oil and gas has been a major driver of AE dealmaking, particularly in the U.S. Industry firms have sought to capitalize on a boom in domestic production and transportation of fossil fuels in places like Texas, Pennsylvania, Ohio, Colorado, and North Dakota. Just a few of the notable oil and gas related deals through June 30th included: Jacobs’ acquisition of Eagleton Engineering, Halff Associates’ acquisition of TriTex Technologies, Zachry’s acquisition of Commonwealth Engineering and Construction, NV5’s acquisition of AK Environmental, and GZA’s acquisition of Laurel Oil and Gas Corp.

One of the largest deals in the space was defense contractor Huntington Ingalls Industries’ acquisition of Universal Pegasus – a play to further diversify into the red hot oil and gas market.

Related Stories

Adaptive Reuse | Mar 21, 2024

Massachusetts launches program to spur office-to-residential conversions statewide

Massachusetts Gov. Maura Healey recently launched a program to help cities across the state identify underused office buildings that are best suited for residential conversions.

Legislation | Mar 21, 2024

Bill would mandate solar panels on public buildings in New York City

A recently introduced bill in the New York City Council would mandate solar panel installations on the roofs of all city-owned buildings. The legislation would require 100 MW of solar photovoltaic systems be installed on public buildings by the end of 2025.

Office Buildings | Mar 21, 2024

BOMA updates floor measurement standard for office buildings

The Building Owners and Managers Association (BOMA) International has released its latest floor measurement standard for office buildings, BOMA 2024 for Office Buildings – ANSI/BOMA Z65.1-2024.

Healthcare Facilities | Mar 18, 2024

A modular construction solution to the mental healthcare crisis

Maria Ionescu, Senior Medical Planner, Stantec, shares a tested solution for the overburdened emergency department: Modular hub-and-spoke design.

Codes and Standards | Mar 18, 2024

New urban stormwater policies treat rainwater as a resource

U.S. cities are revamping how they handle stormwater to reduce flooding and capture rainfall and recharge aquifers. New policies reflect a change in mindset from treating stormwater as a nuisance to be quickly diverted away to capturing it as a resource.

Plumbing | Mar 18, 2024

EPA to revise criteria for WaterSense faucets and faucet accessories

The U.S. Environmental Protection Agency (EPA) plans to revise its criteria for faucets and faucet accessories to earn the WaterSense label. The specification launched in 2007; since then, most faucets now sold in the U.S. meet or exceed the current WaterSense maximum flow rate of 1.5 gallons per minute (gpm).

MFPRO+ New Projects | Mar 18, 2024

Luxury apartments in New York restore and renovate a century-old residential building

COOKFOX Architects has completed a luxury apartment building at 378 West End Avenue in New York City. The project restored and renovated the original residence built in 1915, while extending a new structure east on West 78th Street.

Multifamily Housing | Mar 18, 2024

YWCA building in Boston’s Back Bay converted into 210 affordable rental apartments

Renovation of YWCA at 140 Clarendon Street will serve 111 previously unhoused families and individuals.

Healthcare Facilities | Mar 17, 2024

5 criteria to optimize medical office design

Healthcare designers need to consider privacy, separate areas for practitioners, natural light, outdoor spaces, and thoughtful selection of materials for medical office buildings.

Construction Costs | Mar 15, 2024

Retail center construction costs for 2024

Data from Gordian shows the most recent costs per square foot for restaurants, social clubs, one-story department stores, retail stores and movie theaters in select cities.