Nationally, rent prices increased slightly in April, with the median one-bedroom rent rising to $1,012 per month. That’s the highest it’s been since January’s figure of $1,016, and represents an overall decline since the beginning of the year of .39%.

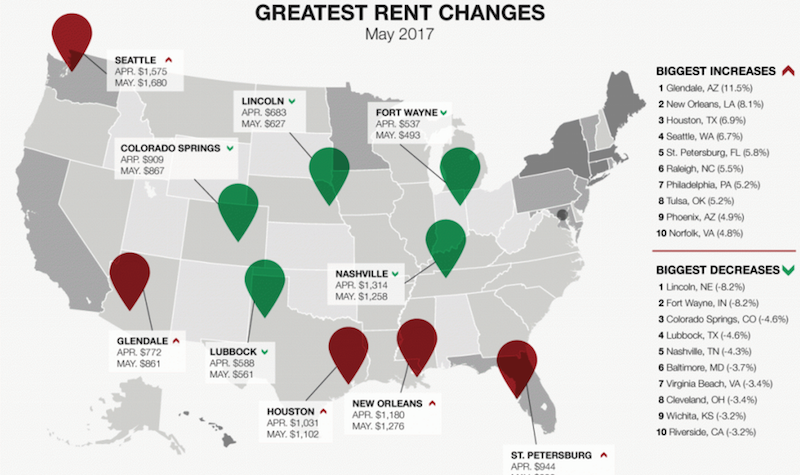

When it came to the steepest rent drops, two familiar faces led the way: Lincoln, Neb., and Fort Wayne, Ind. Each city’s rent dropped 8.2%, to continue a months-long slide. Lincoln’s median rent of $627 represents a 21% decrease from its January rent of $801, and Fort Wayne’s $493 is a 26.4% decline from its year-opening rent of $671 per month.

Those declines might seem steep. One explanation: In order to better approximate what an apartment-seeker would experience when looking for a place to rent, ABODO collects data only on active listings currently on the market, which can vary widely month-to-month, depending on supply.

The rest of the biggest decreases were more minor, between 3% and 5%. A number of cities — Lubbock, Texas (-4.6%); Nashville, Tenn. (-4.3%); Cleveland, Ohio (-3.4%); and Riverside, Calif. (-3.2%) — reprised their places on the list of greatest decreases for the second month in a row. In fact, this marks the third straight month that Nashville, Cleveland, and Riverside appeared on the list of greatest rental falls.

The nation’s largest rental hike came in Glendale, AZ, where one-bedroom median rents rose 11.5% to $861. That marks the continuation of a months-long trend: Glendale rents have increased every month since January, and currently they’re 26% higher than they were at the beginning of the year. New Orleans (8.1%), Seattle (6.7%), and Phoenix (4.9%) also reprise their places on the list of biggest rent increases.

The list of cities with the nation’s highest rents in April is largely unchanged from our last report. San Francisco’s $3,415 price tag still leads the way, followed by New York City, N.Y. ($2,705), San Jose, Calif. ($2,459); and Boston, Mass. ($2,398). The only newcomer is Seattle, whose 6.7% rental jump to $1,680 puts it at the tenth-highest in the country.

For the full report and to view associated infographics and charts, click here.

Related Stories

MFPRO+ News | Nov 21, 2023

Underused strip malls offer great potential for conversions to residential use

Replacing moribund strip malls with multifamily housing could make a notable dent in the housing shortage and revitalize under-used properties across the country, according to a report from housing nonprofit Enterprise Community Partners.

MFPRO+ News | Nov 21, 2023

Renters value amenities that support a mobile, connected lifestyle

Multifamily renters prioritize features and amenities that reflect a mobile, connected lifestyle, according to the National Multifamily Housing Council (NMHC) and Grace Hill 2024 Renter Preferences Survey.

Sustainability | Nov 20, 2023

8 strategies for multifamily passive house design projects

Stantec's Brett Lambert, Principal of Architecture and Passive House Certified Consultant, uses the Northland Newton Development project to guide designers with eight tips for designing multifamily passive house projects.

MFPRO+ News | Nov 15, 2023

Average U.S multifamily rents drop $3 to $1,718 in October 2023: Yardi Matrix

Multifamily fundamentals continued to soften and impact rents last month, according to the latest Yardi Matrix National Multifamily Report. The average U.S. asking rent dropped $3 to $1,718 in October, with year-over-year growth moderating to 0.4%, down 40 basis points from September. Occupancy slid to 94.9%, marking the first decline in four months.

Industrial Facilities | Nov 14, 2023

Some AEC firms are plugging into EV charging market

Decentralized electrical distribution is broadening recharger installation to several building types.

MFPRO+ Special Reports | Nov 14, 2023

Register today! Key trends in the multifamily housing market for 2024 - BD+C Live Webinar

Join the BD+C and Multifamily Pro+ editorial team for this live webinar on key trends and innovations in the $110 billion U.S. multifamily housing market. A trio of multifamily design and construction experts will present their latest projects, trends, innovations, and data/research on the three primary multifamily sub-sectors: rental housing, senior living, and student housing.

Multifamily Housing | Nov 9, 2023

Multifamily project completions forecast to slow starting 2026

Yardi Matrix has released its Q4 2023 Multifamily Supply Forecast, emphasizing a short-term spike and plateau of new construction.

MFPRO+ News | Nov 1, 2023

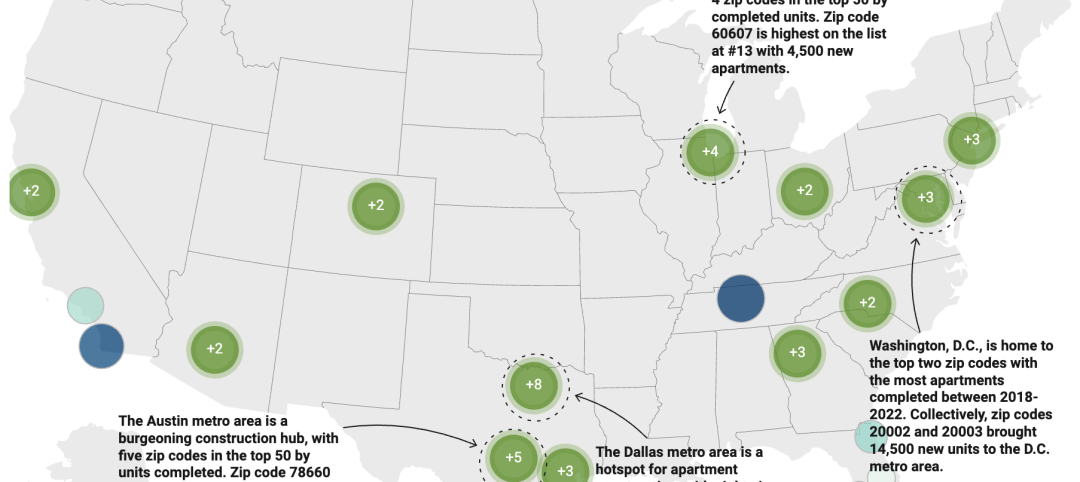

Washington, D.C., Queens, N.Y., lead nation in number of new apartments by zip code

A study of new apartment construction by zip code showed Washington D.C., and the Queens borough of New York City are the hottest multifamily markets since 2018, according to RentCafe.

Adaptive Reuse | Nov 1, 2023

Biden Administration reveals plan to spur more office-to-residential conversions

The Biden Administration recently announced plans to encourage more office buildings to be converted to residential use. The plan includes using federal money to lend to developers for conversion projects and selling government property that is suitable for conversions.