Prices of construction materials jumped nearly 20% in 2021 despite moderating in December, according to an analysis by the Associated General Contractors of America of government data released today. Association officials said contractors rate materials costs as a top concern for 2022, according to a survey predicting the industry’s outlook for the industry the association released yesterday.

“Costs may not rise as steeply in 2022 as they did last year but they are likely to remain volatile, with unpredictable prices and delivery dates for key materials,” said Ken Simonson, the association’s chief economist. “That volatility can be as hard to cope with as steadily rising prices and lead times.”

In the association’s 2022 Construction Hiring and Business Outlook Survey, material costs were listed as a top concern by 86% of contractors, more than any concern. Availability of materials and supply chain disruptions were the second most frequent concern, listed by 77% of the more than 1000 respondents.

The producer price index for inputs to new nonresidential construction—the prices charged by goods producers and service providers such as distributors and transportation firms—increased by 0.5% in December and 19.6% in 2021 as a whole. Those gains topped the rise in the index for new nonresidential construction—a measure of what contractors say they would charge to erect five types of nonresidential buildings, Simonson noted. That index climbed by 0.3% for the month and 12.5% from a year earlier.

Prices moderated for some construction materials in December but still ended the year with large gains, Simonson observed. The price index for steel mill products rose 0.2% in December, its smallest rise in 15 months, but soared 127.2% over 12 months. The index for diesel fuel declined 5.3% for the month but increased 54.9% for the year. The index for aluminum mill shapes slid 4.9% in December but rose 29.8% over 12 months, while the index for copper and brass mill shapes fell 3.3% in December but rose 23.4% over the year.

Some prices accelerated in December. The index for plastic construction products climbed 1.3% for the month and 34.0% over 12 months. The index for lumber and plywood rose 12.7% and 17.6%.

Association officials said rising materials prices threaten to undermine what is otherwise a strong outlook for the construction industry in 2022. They urged the Biden administration to reconsider its plans to double tariffs on Canadian lumber and leave other trade barriers in place that artificially inflate the costs of key construction materials.

“Making lumber and other materials even more expensive will not tame inflation, boost supplies of affordable housing or help the economy grow,” said Stephen E. Sandherr, the association’s chief executive officer. “Instead, the administration should be removing tariffs and beating inflation.”

View producer price index data. View chart of gap between input costs and bid prices. View the 2022 AGC/Sage Construction Hiring and Business Outlook Survey.

Related Stories

Market Data | Oct 30, 2018

Construction projects planned and ongoing by world’s megacities valued at $4.2trn

The report states that Dubai tops the list with total project values amounting to US$374.2bn.

Market Data | Oct 26, 2018

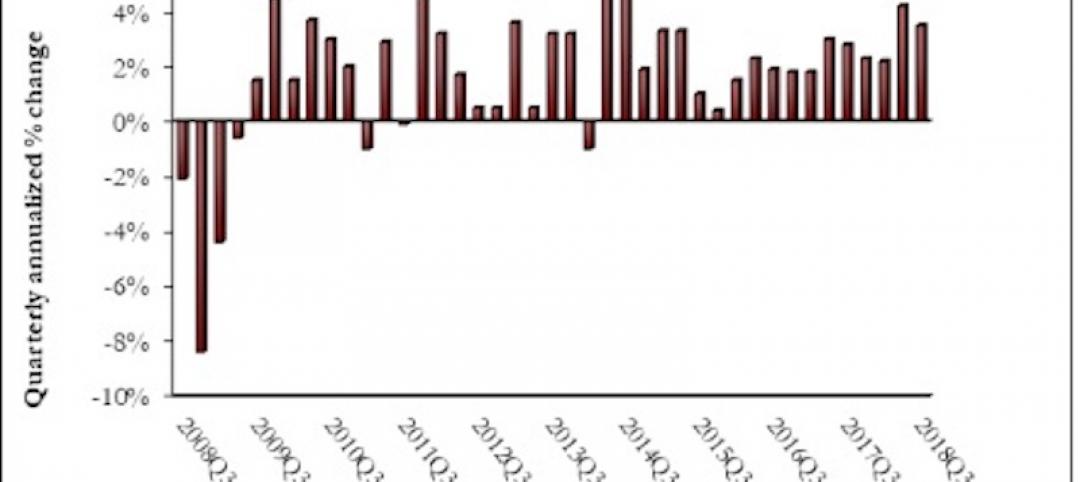

Nonresidential fixed investment returns to earth in Q3

Despite the broader economic growth, fixed investment inched 0.3% lower in the third quarter.

Market Data | Oct 24, 2018

Architecture firm billings slow but remain positive in September

Billings growth slows but is stable across sectors.

Market Data | Oct 19, 2018

New York’s five-year construction spending boom could be slowing over the next two years

Nonresidential building could still add more than 90 million sf through 2020.

Market Data | Oct 8, 2018

Global construction set to rise to US$12.9 trillion by 2022, driven by Asia Pacific, Africa and the Middle East

The pace of global construction growth is set to improve slightly to 3.7% between 2019 and 2020.

Market Data | Sep 25, 2018

Contractors remain upbeat in Q2, according to ABC’s latest Construction Confidence Index

More than three in four construction firms expect that sales will continue to rise over the next six months, while three in five expect higher profit margins.

Market Data | Sep 24, 2018

Hotel construction pipeline reaches record highs

There are 5,988 projects/1,133,017 rooms currently under construction worldwide.

Market Data | Sep 21, 2018

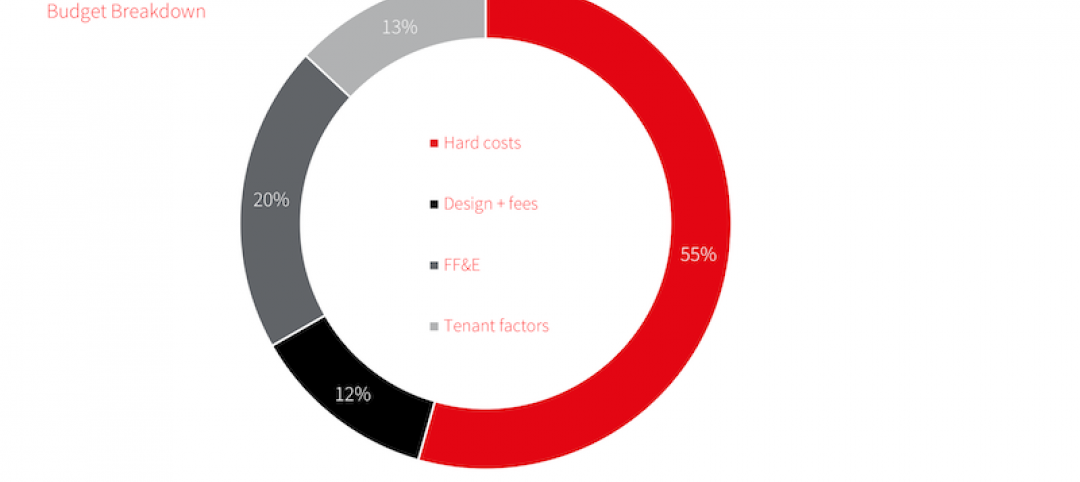

JLL fit out report portrays a hot but tenant-favorable office market

This year’s analysis draws from 2,800 projects.

Market Data | Sep 21, 2018

Mid-year forecast: No end in sight for growth cycle

The AIA Consensus Construction Forecast is projecting 4.7% growth in nonresidential construction spending in 2018.

Market Data | Sep 19, 2018

August architecture firm billings rebound as building investment spurt continues

Southern region, multifamily residential sector lead growth.