Construction employment increased in nearly two out of three U.S. metro areas in 2021, according to an analysis by the Associated General Contractors of America of new government employment data. Yet association officials noted that labor shortages likely kept many firms from adding even more workers.

“Construction employment topped year-earlier levels in almost two-thirds of metros for the past few months,” said Ken Simonson, the association’s chief economist. “But contractors in many areas say they would have hired even more workers if qualified candidates were available.”

Job openings in construction totaled 273,000 at the end of December, an increase of 62,000 or nearly 30% from December 2020, according to the government’s latest Job Openings and Labor Turnover Survey. That figure exceeded the 220,000 employees that construction firms were able to hire in December, implying firms would have added over twice as many workers if they had been able to fill all openings, Simonson pointed out.

Construction employment rose in 231 or 65% of 358 metro areas in 2021. Houston-The Woodlands-Sugar Land, Texas added the most construction jobs (8,800 jobs, 4%), followed by Chicago-Naperville-Arlington Heights, Ill. (6,500 jobs, 5%) and Los Angeles-Long Beach-Glendale, Calif. (6,300 jobs, 4%). Sioux Falls, S.D. had the highest percentage gain (24%, 2,100 jobs), followed by Beaumont-Port Arthur, Texas (18%, 3,000 jobs) and Atlantic City-Hammonton, N.J. (18%, 900 jobs).

Construction employment declined from a year earlier in 76 metros and was flat in 51. Nassau County-Suffolk County, N.Y. lost the most jobs (-5,700 or -7%), followed by New York City (-4,200 jobs, -3%) and Baltimore-Columbia-Towson, Md. (-3,800 jobs, -5%). The largest percentage declines were in Evansville, Ind.-Ky. (-18%, -1,700 jobs); Napa, Calif. (-15%, -600 jobs); Anchorage, Alaska (-14%, -1,400 jobs); and Lewiston, Idaho-Wash. (-13%, -200 jobs). Seven areas set all-time lows for December, while 57 metros reached new December highs for construction jobs.

Association officials said that the growing number of job openings in the industry was a clear sign that labor shortages are getting worse. They noted that the association’s recently released 2022 Construction Hiring and Business Outlook found that 83% of contractors report having a hard time finding qualified workers to hire. They urged Congress and the Biden administration to boost funding for career and technical education to help recruit and prepare more people for high-paying construction careers.

“For every dollar the federal government currently invests in career and technical education, it spends six urging students to attend college and work in an office,” said Stephen E. Sandherr, the association’s chief executive officer. “Narrowing that funding gap will help more people understand that there are multiple paths to success.”

View the metro employment data, rankings, top 10, and new highs and lows.

Related Stories

Market Data | Mar 22, 2017

Architecture Billings Index rebounds into positive territory

Business conditions projected to solidify moving into the spring and summer.

Market Data | Mar 15, 2017

ABC's Construction Backlog Indicator fell to end 2016

Contractors in each segment surveyed all saw lower backlog during the fourth quarter, with firms in the heavy industrial segment experiencing the largest drop.

Market Data | Feb 28, 2017

Leopardo’s 2017 Construction Economics Report shows year-over-year construction spending increase of 4.2%

The pace of growth was slower than in 2015, however.

Market Data | Feb 23, 2017

Entering 2017, architecture billings slip modestly

Despite minor slowdown in overall billings, commercial/ industrial and institutional sectors post strongest gains in over 12 months.

Market Data | Feb 16, 2017

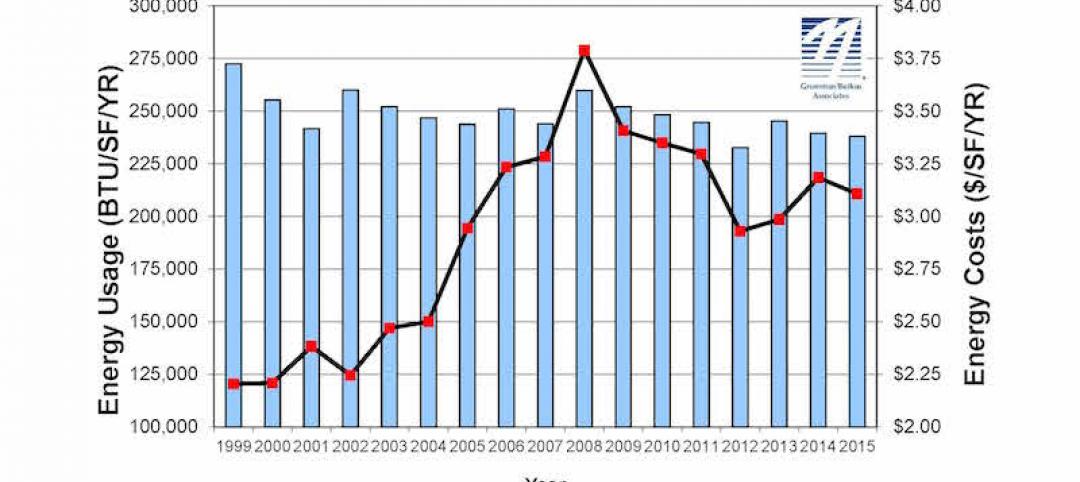

How does your hospital stack up? Grumman/Butkus Associates 2016 Hospital Benchmarking Survey

Report examines electricity, fossil fuel, water/sewer, and carbon footprint.

Market Data | Feb 1, 2017

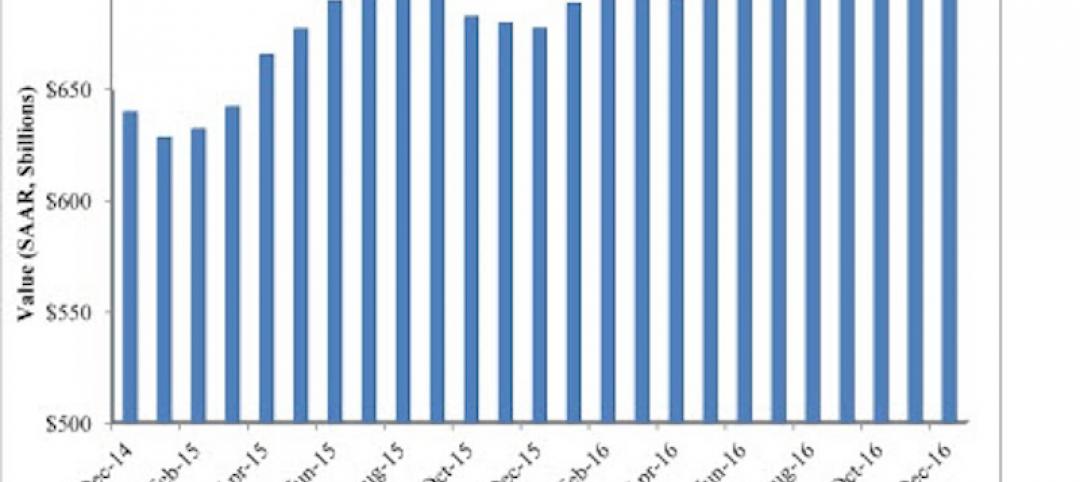

Nonresidential spending falters slightly to end 2016

Nonresidential spending decreased from $713.1 billion in November to $708.2 billion in December.

Market Data | Jan 31, 2017

AIA foresees nonres building spending increasing, but at a slower pace than in 2016

Expects another double-digit growth year for office construction, but a more modest uptick for health-related building.

High-rise Construction | Jan 23, 2017

Growth spurt: A record-breaking 128 buildings of 200 meters or taller were completed in 2016

This marks the third consecutive record-breaking year for building completions over 200 meters.

Market Data | Jan 18, 2017

Fraud and risk incidents on the rise for construction, engineering, and infrastructure businesses

Seven of the 10 executives in the sector surveyed in the report said their company fell victim to fraud in the past year.

Market Data | Jan 18, 2017

Architecture Billings Index ends year on positive note

Architecture firms close 2016 with the strongest performance of the year.