On Wednesday, the U.S. Treasury Department and the Internal Revenue Service released new regulations and guidelines for investments in the 8,700 distressed or lower-income census tracts that governors across the country have designated as Opportunity Zones (OZs).

The new regulations, which expand upon the initial round that came out last October, are meant to provide greater clarity for investors and developers about how funds raised for such investments might qualify for tax breaks.

“This round of regulations removes some of the most significant impediments keeping capital on the sidelines, especially as it relates to operating businesses,” John Lettieri, president of the Economic Innovation Group, a Washington research organization that developed and championed the Opportunity Zone concept, told the New York Times.

The new round of regs is timely, as the maximum tax benefit of the legislation requires an Opportunity Zone investment be completed by December 31.

While the federal government has projected $100 billion in Opportunity Zone investments, some developers so far have held back from jumping into this program—which was part of the tax overhaul that Congress approved in 2017—because of uncertainties about qualifications of both buildings and businesses to invest in.

The logic behind OZs is that wealth generated by capital gains could be better used for investments in neighborhoods that typically lack access to that money for redevelopment. The goal of OZs is to spur economic growth. But some skeptics had contended that the program’s regulatory structure was too lax, and that the government, through tax breaks, would end up subsidizing developments in areas that were already attractive to investors.

There are also concerns about gentrification, as the Opportunity Zone concept hasn’t always worked as intended, or at least to the direct benefit of low-income residents. Zillow Economic Research reported in March that prices for homes within Opportunity Zones rose by 25.3% last year, versus 8.4% for census tracts that were eligible but not selected as OZs, and 2.5% for tracts not eligible.

HUD’s Secretary Ben Carson told The Real Deal last month that his agency cannot mandate affordable housing in the zones. It will, however, give preference for developers who apply for certain federal grants to build affordable housing within Opportunity Zones.

Money flowing to Opportunity Zones has mostly gone toward real estate investments, particularly on both coasts. Treasury Secretary Steven Mnuchin has emphasized that the program is also geared toward other types of businesses as well.

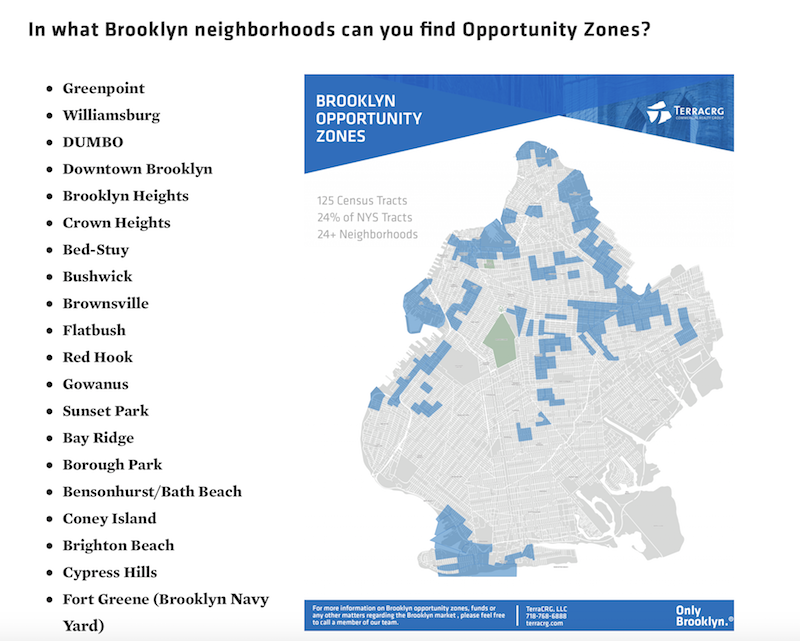

The New York City borough of Brooklyn is where New York State has designated 125 of its 514 Opportunity Zones. Nationwide, governors have designated 8,700 OZs. Image: TerraCRG

The new regulations spell out in greater detail the program’s investment and tax-break mechanism.

For one thing, new regulations create tax benefits for leased property, according to Law.com. Investors essentially can take their capital gains from any venture, real estate or otherwise, and put them into a qualified opportunity zone fund that then, likely through a fund manager, seeks eligible projects. The earlier version gave investors 180 days from the date they realized capital gains to put the money into an opportunity zone fund. If they keep their money in the fund for five years, 10% of their deferred gain is eliminated. An additional 5% of their capital gains would be untaxed if they keep their money in the fund for seven years.

The biggest tax benefit from this program accrues to investors and developers who hold their money in an Opportunity Zone for at least a decade. By doing so, they forgo paying tax on capital gains from those investments altogether.

Opportunity Funds raised by investors get a 12-month grace period to sell assets in Opportunity Zones and then reinvest those proceeds in the Zone. There was some concern previously that this reinvestment had to be made immediately.

The Times reports that investors will be allowed to share their stakes in funds that invest in the zones, and to sell, say, a start-up in an Opportunity Zone as long as the money is reinvested in another qualifying business or asset. Real estate investors will be allowed to lease and refinance their properties.

However, the proposal also allows Treasury officials to revoke a tax break for any Opportunity Zone project “if a significant purpose of a transaction is to achieve a tax result that is inconsistent with the purposes” of the program.

Investors have been concerned about earlier guidance that stated a business that wanted to qualify for the Opportunity Zone program had to derive at least half of its gross income from the Zone itself. Joshua Pollard, a contributing writer for Forbes, points out that the new guidance assuages those concerns by creating four distinct tests for businesses to qualify:

•Total hours worked by employees or independent contractors in a Zone must equal at least 50% of the company’s total hours worked;

•Half of total dollars paid to those employees or contractors must be for services performed in the Zone. The Times reports that provisions in the new regulations allow investors to qualify for tax breaks even if the businesses they fund export goods or services, or if the domestic market for those goods is outside of the zone.

•A business’s management and operational staff, and the tangible property of the business, that are in the Opportunity Zone must be essential to at least half of the business’s gross income; and

•A fourth, intentionally ambiguous, category, “Facts and circumstances,” leaves a lot of wriggle room for businesses to make their case to the IRS, says Pollard.

Pollard notes that outside of the 169-page guidance document, the White House Opportunity and Revitalization Council, made up of nearly 20 federal agencies, has added so-called “preference points,” or tie-breaker considerations, for projects and applicants in Opportunity Zones this year, with the explicit goal of eliminating federal bureaucracy. Ultimately this could give a leg up to as many as 150 programs.

Related Stories

Multifamily Housing | Mar 24, 2023

Multifamily developers offering new car-free projects in car-centric cities

Cities in the South and Southwest have eased zoning rules with parking space mandates in recent years to allow developers to build new housing with less parking.

Multifamily Housing | Mar 24, 2023

Coastal multifamily developers, owners expect huge jump in insurance costs

In Texas and Florida, where Hurricane Ian caused $50 billion in damage last year, insurance costs are nearly 50% higher than in 2022.

Building Tech | Mar 14, 2023

Reaping the benefits of offsite construction, with ICC's Ryan Colker

Ryan Colker, VP of Innovation at the International Code Council, discusses how municipal regulations and inspections are keeping up with the expansion of off-site manufacturing for commercial construction. Colker speaks with BD+C's John Caulfield.

Adaptive Reuse | Mar 5, 2023

Pittsburgh offers funds for office-to-residential conversions

The City of Pittsburgh’s redevelopment agency is accepting applications for funding from developers on projects to convert office buildings into affordable housing. The city’s goals are to improve downtown vitality, make better use of underutilized and vacant commercial office space, and alleviate a housing shortage.

Student Housing | Mar 5, 2023

Calif. governor Gavin Newsom seeks to reform environmental law used to block student housing

California Gov. Gavin Newsom wants to reform a landmark state environmental law that he says was weaponized by wealthy homeowners to block badly needed housing for students at the University of California, Berkeley.

Green Renovation | Mar 5, 2023

Dept. of Energy offers $22 million for energy efficiency and building electrification upgrades

The Buildings Upgrade Prize (Buildings UP) sponsored by the U.S. Department of Energy is offering more than $22 million in cash prizes and technical assistance to teams across America. Prize recipients will be selected based on their ideas to accelerate widespread, equitable energy efficiency and building electrification upgrades.

Codes | Mar 2, 2023

Biden Administration’s proposed building materials rules increase domestic requirements

The Biden Administration’s proposal on building materials rules used on federal construction and federally funded state and local buildings would significantly boost the made-in-America mandate. In the past, products could qualify as domestically made if at least 55% of the value of their components were from the U.S.

Sustainability | Mar 2, 2023

The next steps for a sustainable, decarbonized future

For building owners and developers, the push to net zero energy and carbon neutrality is no longer an academic discussion.

Sustainability | Feb 9, 2023

New guide for planning, designing, and operating onsite water reuse systems

The Pacific Institute, a global nonpartisan water think tank, has released guidance for developers to plan, design, and operate onsite water reuse systems. The Guide for Developing Onsite Water Systems to Support Regional Water Resilience advances circular, localized approaches to managing water that reduce a site’s water footprint, improve its resilience to water shortage or other disruptions, and provide benefits for local communities and regional water systems.

Codes and Standards | Feb 1, 2023

New Jersey to allow private firms to conduct construction inspections

New Jersey recently passed a law that will allow towns to supplement construction code enforcement with help from the private sector. The legislation, which received bipartisan support, also allows municipalities to enter into shared service agreements with neighboring towns for construction inspections.