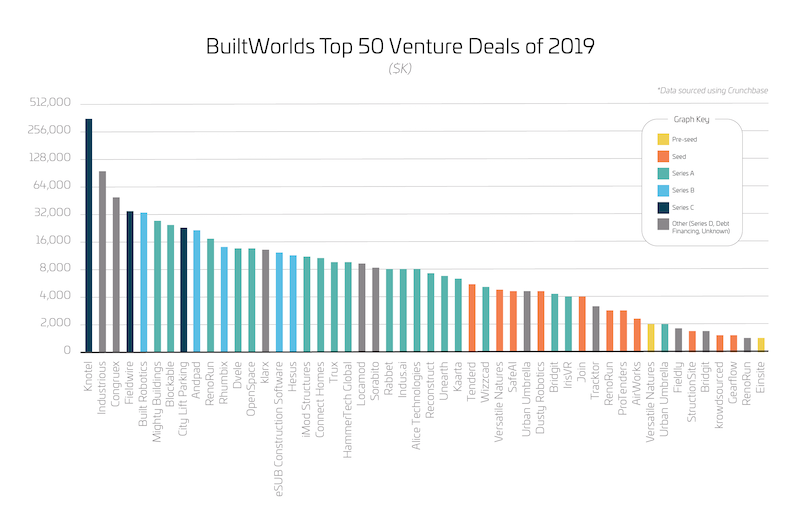

The top 50 venture capital investments in Built Industry Technology totaled just under $1 billion in 2019, about one-tenth of the top 50 deals the previous year.

That’s according to Builtworlds’ latest ranking of seed and early-stage investments in ConTech and real estate enterprises. While there were no blockbuster deals like SoftBank’s $865 million investment in Katerra in 2018, investors haven’t stopped looking for that idea or product that will move the industry’s dial forward.

In 2019, the top 50 venture deals totaled $967.8 million, compared to just under $10 billion that were raised in the top 50 deals in 2018. The latest ranking includes several familiar ConTech names such as Blokable, Rhumbix, Dvele, eSUB Construction Software, ALICE Technologies, and IrisVR. (The full list of deals can be viewed at http://bit.ly/2SPiMwD.)

Ironically, in a year marked by WeWork’s failed initial public offering, investors still showed interest in workplace solutions. Two companies that specialize in offering customized flexible workspaces captured the top two deals on Builtworld’s list.

The top 50 Contech investment deals were with companies that, for the most part, are beyond the startup phase. Chart: Builtworlds

The top 50 Contech investment deals were with companies that, for the most part, are beyond the startup phase. Chart: Builtworlds

New York-based Knotel, which actively pitches itself as a steadier alternative to WeWork, last summer raised $400 million through a Series C funding round from an investment group that included Kuwait-based Wafra Inc., and Japan-based Mori Trust, Itochu Corp., and Mercuria Investments. The fundraising was in exchange for 15% to 30% of the closely held company, and increased Knotel’s valuation to at least $1.3 billion, according to Bloomberg (https://bloom.bg/39XmYjS).

Knotel recently topped 5 million sf in global workspace, according to Yahoo! Finance (https://yhoo.it/2VfkTf0). It differs from WeWork in that it doesn’t do coworking: its clients include corporations ranging from Starbucks to AT&T. It also does a mix of direct leases and revenue share deals.

Knotel was followed on Builtworlds’ ranking by Industrious, another workspace company with more than 95 locations across 45 U.S. cities offering turnkey spec suites, private offices, and community memberships that can be bought on a month-to-month basis. Last August, Industrious announced it had raised $80 million in Series D financing from investors that included Wells Fargo Strategic Capital, TF Cornerstone, Riverwood Capital, Granite Properties, Equinox Fitness, Canada Pension Plan, Fifth Wall, and Brookfield Properties Retail. In this latest round, Industrious raised over $220 million.

Industrious last year redirected its business model toward revenue-sharing deals with landlords. Its CEO Jamie Hodari told Reuters (https://reut.rs/2PekzJm) that the company expects to be profitable in 2020.

No. 3 on Builtworlds’ ranking was Congreux, founded in 2017, a national provider of design, engineering, construction management and maintenance services to broadband service providers. Last July, Congruex completed its sixth acquisition with the purchase of HHS Construction, which offers infrastructure services to telecommunications and cable providers, mostly in Southern California. Last August, Congruex disclosed that it had raised $48.9 million in private equity financing from an investor group led by Crestview Partners, which has had a strategic alliance with Congruex for the past three years.

Next on Builtworlds’ list is Fieldwire, which last September said it had raised $33.5 million in Series C financing from investors that included Menlo Park Ventures, Peak State Ventures, Formation 8, Hilti Group, and Brick & Mortar Ventures. Founded in 2013, Fieldwire claims to power over 750,000 jobsites worldwide with cloud-based jobsite management software accessible by construction teams through a app. It told Tech Crunch last September (https://tcrn.ch/2vaKb30) that it had 2,000 paying customers (including Clark Construction Group, which last year rolled out Fieldwire companywide to manage project documents), and was starting to make inroads into Europe.

Built Robotics is ready to introduce the first fully autonomous construction equipment. Image credit: Built Robotics

Built Robotics is ready to introduce the first fully autonomous construction equipment. Image credit: Built Robotics

Rounding out Builtworlds’ top 5 venture deals is Built Robotics, which on September 16 announced it had raised $33 million in Series B funding from investors led by Next47 and including Presidio Ventures, New Enterprise Associates, Lemnos VC, Founders Fund, and Building Ventures.

Built Robotics, founded in 2016, is dedicated to construction automation. BD+C reported last year that Built Robotics had formed a partnership with Mortenson to develop a suite of autonomous equipment. Next month, Built Robotics will exhibit at the CONEXPO-CON/AGG construction trade show in Las Vegas, where the company plans to unveil what it’s calling the first commercially deployed autonomous construction equipment. Show attendees will be able to operate a Built robot located in Houston to perform such tasks as digging trenches or grading building pads. Built Robotics asserts that its AI guidance system can be installed onto existing equipment from any manufacturer.

Related Stories

AEC Tech Innovation | May 12, 2023

Meet Diverge, Hensel Phelps' new ConTech investment company

Thai Nguyen, Director of Innovation with Hensel Phelps, discusses the construction giant's new startup investment platform, Diverge.

AEC Tech | May 9, 2023

4 insights on building product manufacturers getting ‘smart’

Overall, half of building product manufacturers plan to invest in one or more areas of technology in the next three years.

Sustainability | May 1, 2023

Increased focus on sustainability is good for business and attracting employees

A recent study, 2023 State of Design & Make by software developer Autodesk, contains some interesting takeaways for the design and construction industry. Respondents to a survey of industry leaders from the architecture, engineering, construction, product design, manufacturing, and entertainment spheres strongly support the idea that improving their organization’s sustainability practices is good for business.

AEC Tech | May 1, 2023

Utilizing computer vision, AI technology for visual jobsite tasks

Burns & McDonnell breaks down three ways computer vision can effectively assist workers on the job site, from project progress to safety measures.

AEC Tech Innovation | Apr 27, 2023

Does your firm use ChatGPT?

Is your firm having success utilizing ChatGPT (or other AI chat tools) on your building projects or as part of your business operations? If so, we want to hear from you.

Design Innovation Report | Apr 19, 2023

HDR uses artificial intelligence tools to help design a vital health clinic in India

Architects from HDR worked pro bono with iKure, a technology-centric healthcare provider, to build a healthcare clinic in rural India.

Resiliency | Apr 18, 2023

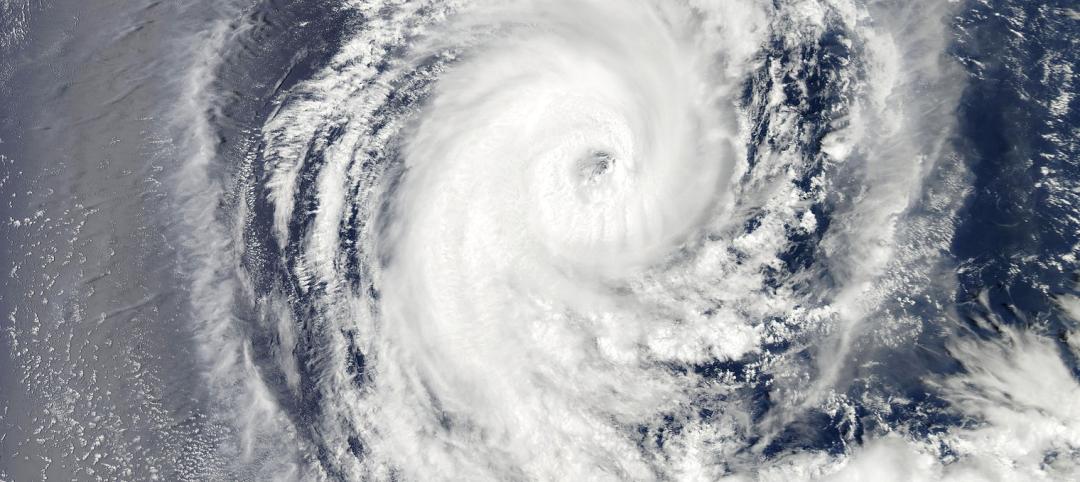

AI-simulated hurricanes could aid in designing more resilient buildings

Researchers at the National Institute of Standards and Technology (NIST) have devised a new method of digitally simulating hurricanes in an effort to create more resilient buildings. A recent study asserts that the simulations can accurately represent the trajectory and wind speeds of a collection of actual storms.

3D Printing | Apr 11, 2023

University of Michigan’s DART Laboratory unveils Shell Wall—a concrete wall that’s lightweight and freeform 3D printed

The University of Michigan’s DART Laboratory has unveiled a new product called Shell Wall—which the organization describes as the first lightweight, freeform 3D printed and structurally reinforced concrete wall. The innovative product leverages DART Laboratory’s research and development on the use of 3D-printing technology to build structures that require less concrete.

Smart Buildings | Apr 7, 2023

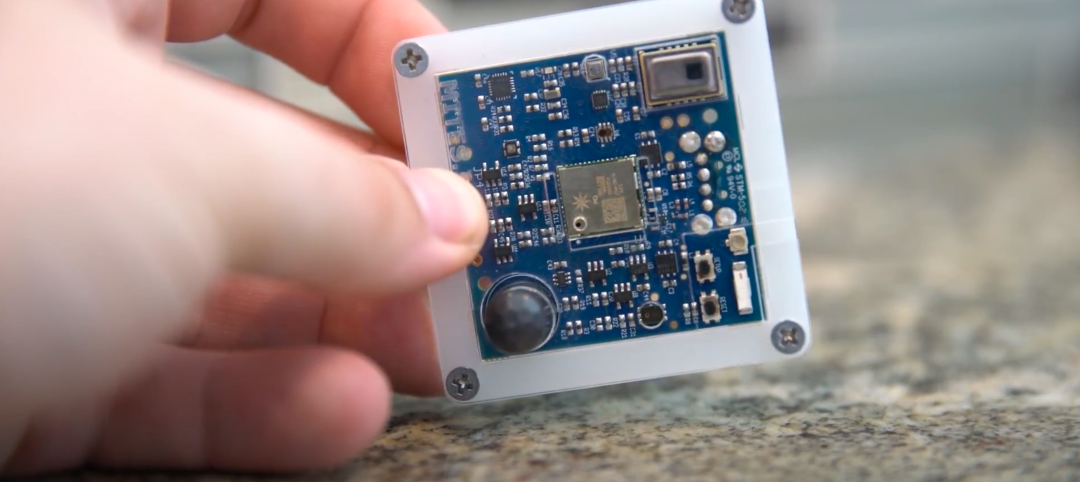

Carnegie Mellon University's research on advanced building sensors provokes heated controversy

A research project to test next-generation building sensors at Carnegie Mellon University provoked intense debate over the privacy implications of widespread deployment of the devices in a new 90,000-sf building. The light-switch-size devices, capable of measuring 12 types of data including motion and sound, were mounted in more than 300 locations throughout the building.

Architects | Apr 6, 2023

New tool from Perkins&Will will make public health data more accessible to designers and architects

Called PRECEDE, the dashboard is an open-source tool developed by Perkins&Will that draws on federal data to identify and assess community health priorities within the U.S. by location. The firm was recently awarded a $30,000 ASID Foundation Grant to enhance the tool.