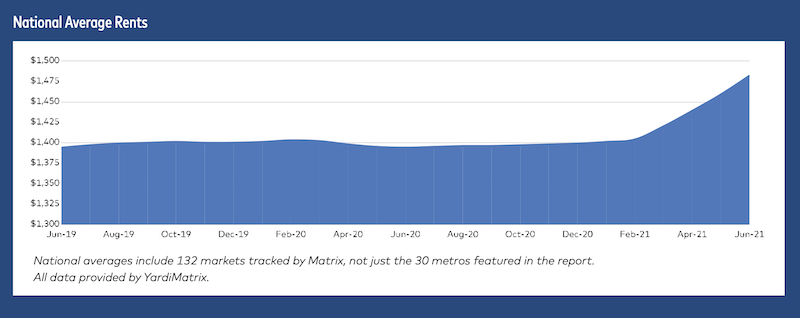

Multifamily asking rents jumped an average of 6.3% year-over-year in June, the largest leap ever recorded by Yardi Matrix, a leading industry data tracker. The national average apartment rent increased $23 last month to $1,482, another record, and single-family home rents were up 11% year-over-year.

“These are the largest year-over-year and monthly increases in the history of our data set,” said Jeff Adler, vice president of Yardi Matrix. Analysts point to increased household savings and government stimulus funding as factors that have kept the multifamily industry stable during the pandemic period, and now able to rebound as the economy improves.

The newly released data is an economic indicator of post-pandemic recovery across the U.S. The largest increases were documented in the lifestyle apartment sector. Renters are also now returning to many gateway markets that saw outbound migration for most of the last year. A supercharged housing market is also pricing out some potential buyers, leading residents to remain in apartments.

“Rent growth will not be able to continue at these levels indefinitely, but conditions for above-average growth are likely to persist for months,” Adler said. The increases reflect growth in what landlords are asking for unleased apartments. Renters renewing leases may also be seeing increased rents, but at lower levels.

Migration is pushing up rents in Southwest and Southeast metros like Phoenix (17.0%), Tampa and California’s Inland Empire (both 15.1%), Las Vegas (14.6%) and Atlanta (13.3%). These metros were lower cost compared to larger gateway metros.

Some takeaways from the Yardi Matrix report:

• Multifamily asking rents increased by 6.3% on a year-over-year basis in June, the largest YoY increase in the history of our data set. Out of our top 30 markets, 27 had positive YoY rent growth.

• Rents grew an astonishing $23 in June to $1,482—another record-breaking increase. Lifestyle rents are growing at a faster pace than Renter-by-Necessity rents, something we have not seen since 2011 and another sign of a hot market.

• Phoenix (17.0%), Tampa and the Inland Empire (both 15.1%) topped the list with unprecedented year-over-year rent growth. Nine of the top 30 markets had double-digit YoY rent growth in June, driven by strong migration to these metros.

• Year-over-year Lifestyle rents (7.2%) grew faster than Renter-by-Necessity rents (5.8%) in June for the first time since 2011. Renters have benefited from increased government support, strong wage growth and increased

• Single-family (Built-to-Rent) rents grew even faster, at an 11% year-over-year pace

• Rents increased nationally by 1.6% in June on a month-over-month basis. For the third month in a row, all 30 metros had positive month-over-month rent growth.

• Tampa, Phoenix (both 2.5%), Austin (2.4%), and Miami (2.3%) had the strongest MoM gains.

Related Stories

| Jan 21, 2011

Harlem facility combines social services with retail, office space

Harlem is one of the first neighborhoods in New York City to combine retail with assisted living. The six-story, 50,000-sf building provides assisted living for residents with disabilities and a nonprofit group offering services to minority groups, plus retail and office space.

| Jan 21, 2011

Nothing dinky about these residences for Golden Gophers

The Sydney Hall Student Apartments combines 125 student residences with 15,000 sf of retail space in the University of Minnesota’s historic Dinkytown neighborhood, in Minneapolis.

| Jan 21, 2011

Revamped hotel-turned-condominium building holds on to historic style

The historic 89,000-sf Hotel Stowell in Los Angeles was reincarnated as the El Dorado, a 65-unit loft condominium building with retail and restaurant space. Rockefeller Partners Architects, El Segundo, Calif., aimed to preserve the building’s Gothic-Art Nouveau combination style while updating it for modern living.

| Jan 21, 2011

Upscale apartments offer residents a twist on modern history

The Goodwynn at Town: Brookhaven, a 433,300-sf residential and retail building in DeKalb County, Ga., combines a historic look with modern amenities. Atlanta-based project architect Niles Bolton Associates used contemporary materials in historic patterns and colors on the exterior, while concealing a six-level parking structure on the interior.

| Jan 20, 2011

Worship center design offers warm and welcoming atmosphere

The Worship Place Studio of local firm Ziegler Cooper Architects designed a new 46,000-sf church complex for the Pare de Sufrir parish in Houston.

| Jan 19, 2011

Baltimore mixed-use development combines working, living, and shopping

The Shoppes at McHenry Row, a $117 million mixed-use complex developed by 28 Walker Associates for downtown Baltimore, will include 65,000 sf of office space, 250 apartments, and two parking garages. The 48,000 sf of main street retail space currently is 65% occupied, with space for small shops and a restaurant remaining.

| Jan 7, 2011

Mixed-Use on Steroids

Mixed-use development has been one of the few bright spots in real estate in the last few years. Successful mixed-use projects are almost always located in dense urban or suburban areas, usually close to public transportation. It’s a sign of the times that the residential component tends to be rental rather than for-sale.

| Jan 4, 2011

An official bargain, White House loses $79 million in property value

One of the most famous office buildings in the world—and the official the residence of the President of the United States—is now worth only $251.6 million. At the top of the housing boom, the 132-room complex was valued at $331.5 million (still sounds like a bargain), according to Zillow, the online real estate marketplace. That reflects a decline in property value of about 24%.

| Jan 4, 2011

Grubb & Ellis predicts commercial real estate recovery

Grubb & Ellis Company, a leading real estate services and investment firm, released its 2011 Real Estate Forecast, which foresees the start of a slow recovery in the leasing market for all property types in the coming year.