Spending on nonresidential building construction is expected to increase almost four percent this year and more than two percent in 2020, according to a new consensus forecast from The American Institute of Architects (AIA).

Continued volatility has not impacted construction spending as the projections by the AIA Consensus Construction Forecast Panel—consisting of leading economic forecasters—are largely unchanged from where they stood at the beginning of the year. While some individual construction sectors are projected to see declines over the next 18 months, the consensus projects overall building construction activity will continue to expand.

“Outlook showing nonresidential construction activity continuing to expand reflects the underlying strength of the economy, even this late in the business cycle,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “However, there are several potential threats to continued healthy growth in the broader economy as well as in the construction industry that would point to slower economic growth in future quarters.”

The AIA Consensus Forecast is computed as an average of the forecasts provided by the panelists that submit forecasts for each of the included building categories.

There are no standard definition of some nonresidential building categories, so panelists may define a given category somewhat differently.

Panelists may forecast only a portion of a category (e.g public buildings but not private buldings); these forecasts are treated like other forecasts in computing the consensus.

All forecasts are presented in current (non-inflation adjusted) dollars.

Related Stories

Industry Research | Apr 28, 2017

A/E Industry lacks planning, but still spending large on hiring

The average 200-person A/E Firm is spending $200,000 on hiring, and not budgeting at all.

Market Data | Apr 19, 2017

Architecture Billings Index continues to strengthen

Balanced growth results in billings gains in all regions.

Market Data | Apr 13, 2017

2016’s top 10 states for commercial development

Three new states creep into the top 10 while first and second place remain unchanged.

Market Data | Apr 6, 2017

Architecture marketing: 5 tools to measure success

We’ve identified five architecture marketing tools that will help your firm evaluate if it’s on the track to more leads, higher growth, and broader brand visibility.

Market Data | Apr 3, 2017

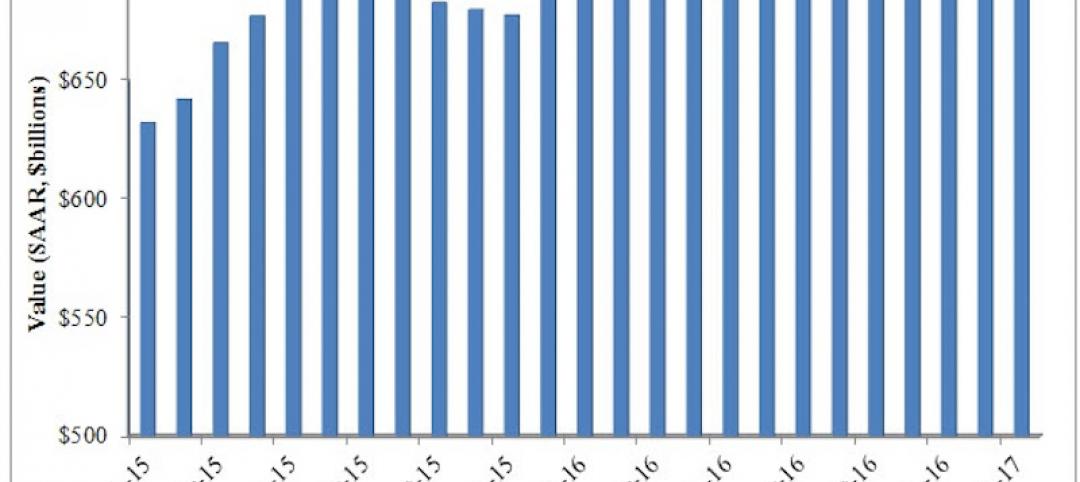

Public nonresidential construction spending rebounds; overall spending unchanged in February

The segment totaled $701.9 billion on a seasonally adjusted annualized rate for the month, marking the seventh consecutive month in which nonresidential spending sat above the $700 billion threshold.

Market Data | Mar 29, 2017

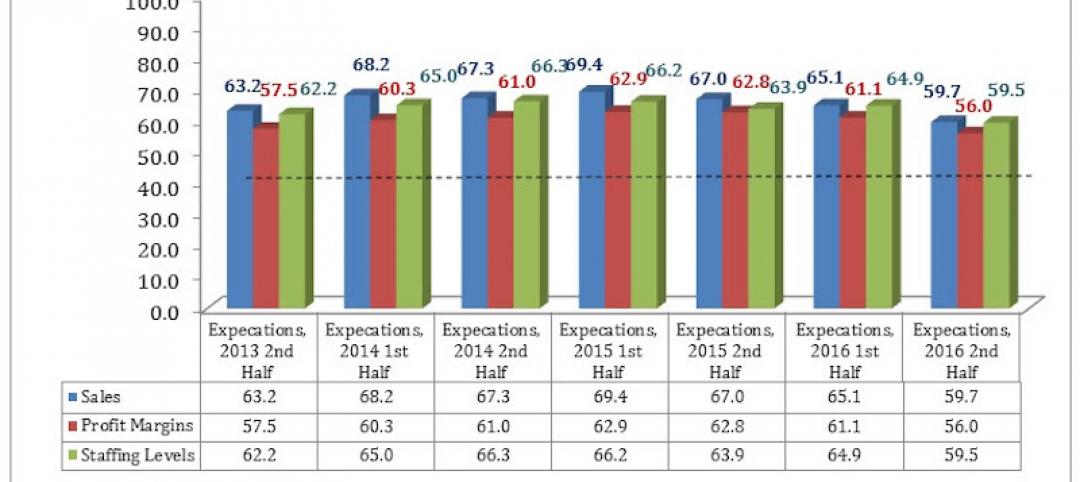

Contractor confidence ends 2016 down but still in positive territory

Although all three diffusion indices in the survey fell by more than five points they remain well above the threshold of 50, which signals that construction activity will continue to be one of the few significant drivers of economic growth.

Market Data | Mar 24, 2017

These are the most and least innovative states for 2017

Connecticut, Virginia, and Maryland are all in the top 10 most innovative states, but none of them were able to claim the number one spot.

Market Data | Mar 22, 2017

After a strong year, construction industry anxious about Washington’s proposed policy shifts

Impacts on labor and materials costs at issue, according to latest JLL report.

Market Data | Mar 22, 2017

Architecture Billings Index rebounds into positive territory

Business conditions projected to solidify moving into the spring and summer.

Market Data | Mar 15, 2017

ABC's Construction Backlog Indicator fell to end 2016

Contractors in each segment surveyed all saw lower backlog during the fourth quarter, with firms in the heavy industrial segment experiencing the largest drop.