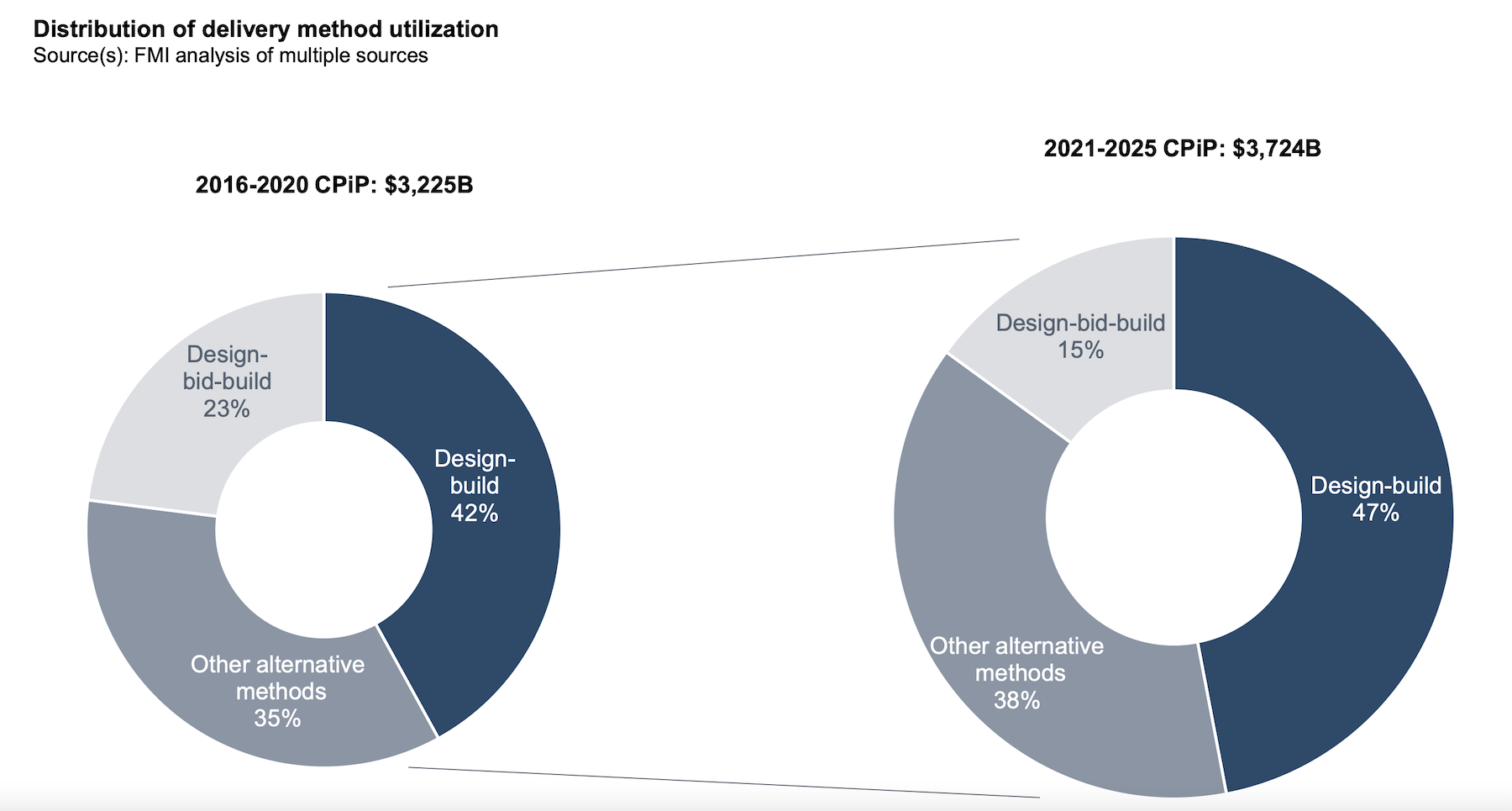

Design-build delivered projects will account for nearly half of all construction spending by 2025, according to the consulting and investment firm FMI’s latest market research on design-built utilization.

FMI’s research for its 50-page report is based on a survey of 279 industry stakeholders and 46 interviews. FMI conducted the study in partnership with the Design-Build Institute of America (DBIA), and piggybacks on research in 2018 that confirmed design-build was no longer just an alternative delivery method, but one that had been embraced by a growing number of owner-developers and their AEC partners.

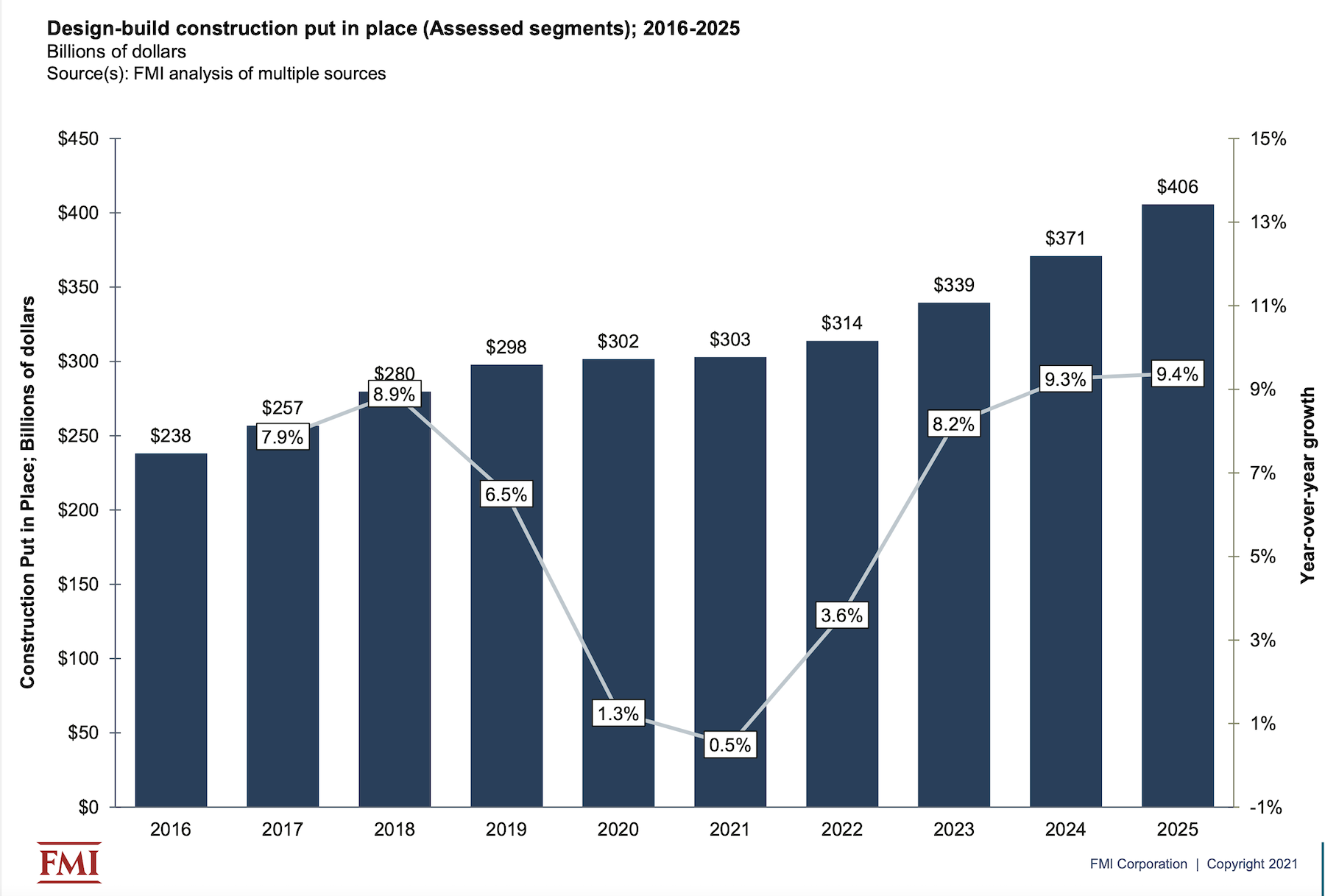

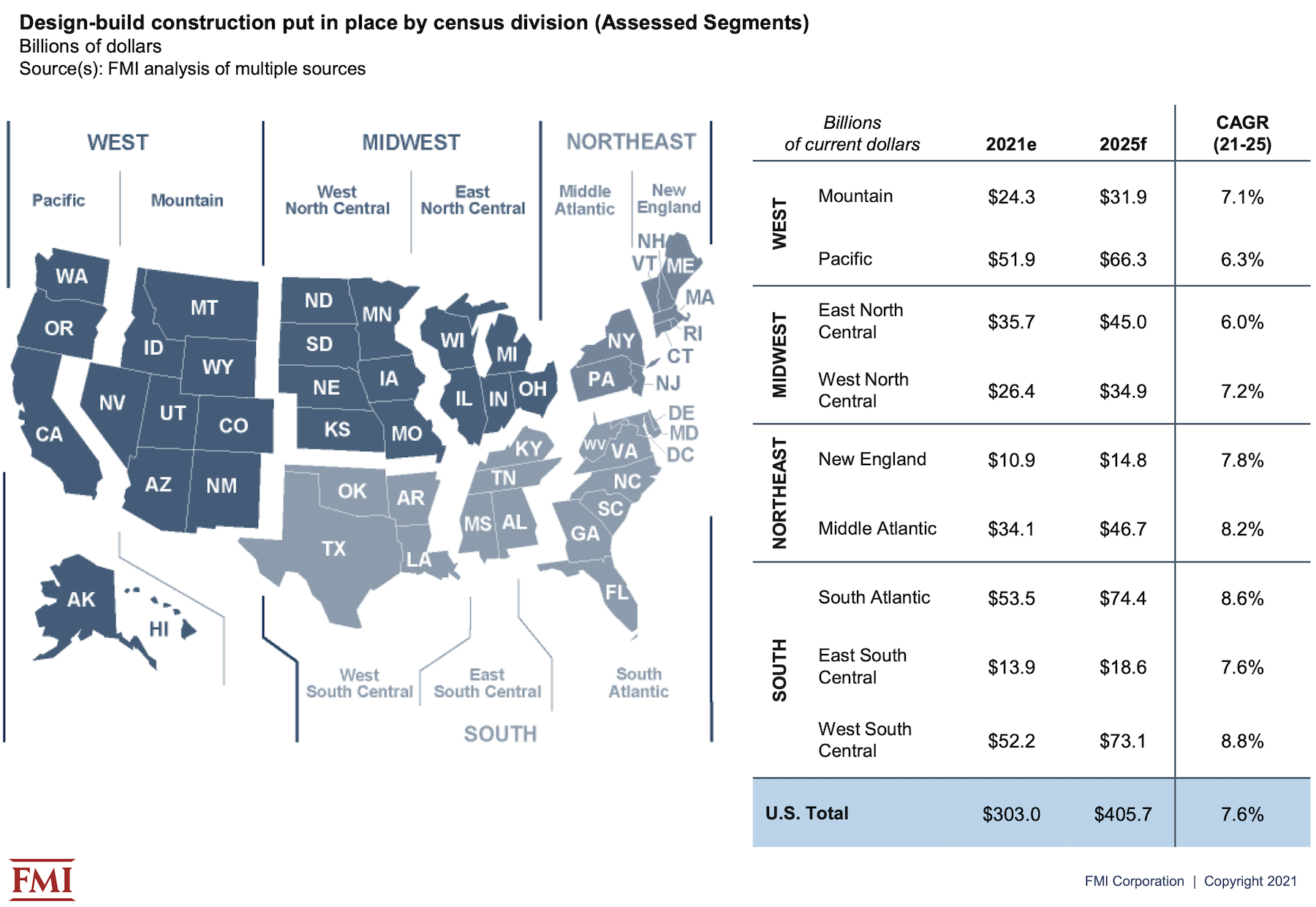

FMI’s latest report, which it releases today, forecasts that spending for design-build construction put in place will grow at a compound annual rate of 7.6% over the years 2021 through 2025, and hit $405.7 billion in 2025, or 47% of total construction spending that year, vs 42% of the total in 2021.

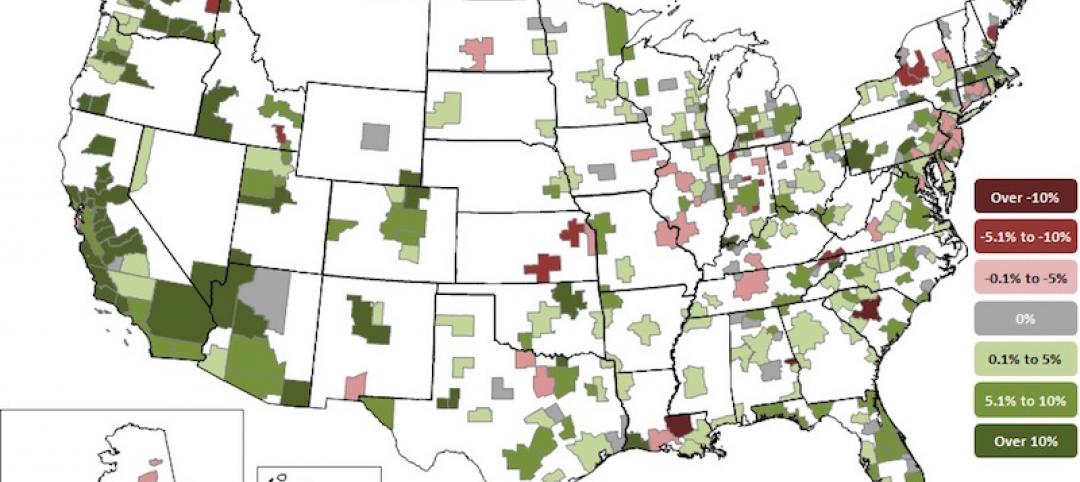

FMI expects the five-year rate of growth to be higher than the national average in the West South Central, South Atlantic, Middle Atlantic, and New England regions.

CERTAIN SECTORS MORE DISPOSED TOWARD DESIGN-BUILD

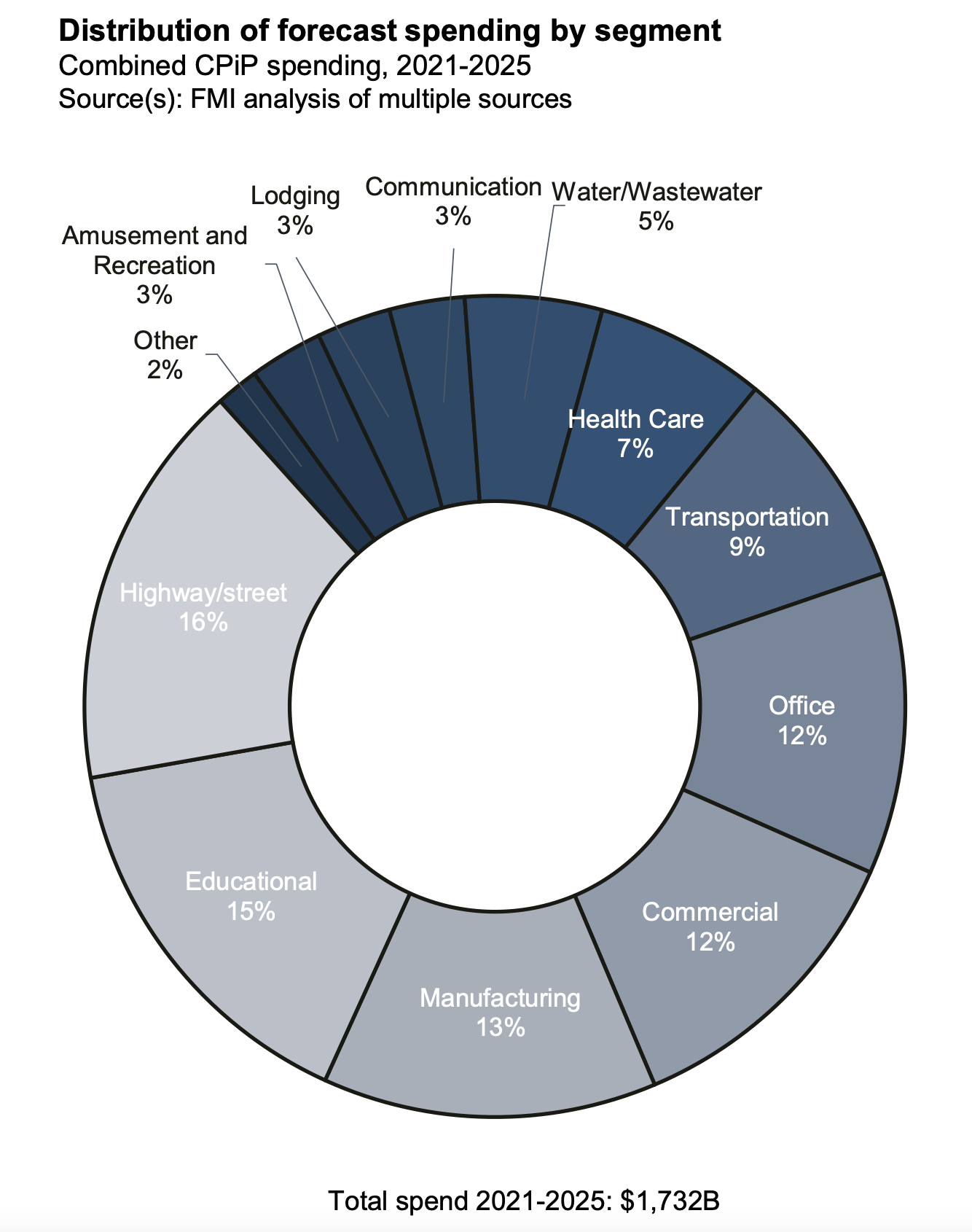

Over the forecast years, FMI estimates that the aggregate spending on projects delivered via design-build will be $1.732 trillion, or 46.2% of the $3.742 trillion spent on all construction projects. Highway and street projects will account for 16% of the design-build spending, followed by Education (15%), Manufacturing (13%) and Commercial and Office (12% each). Spending on design-build water/wastewater projects is expected to show the highest annual growth rate—11.1%—although that sector will represent only 5% of total design-build project spending over the forecast years.

Design-build rated highest across all project delivery methods, with 77% of the report’s respondents having “very good” or “excellent” experiences with the method. The 2021 study found that 60% of respondents identified “owner goals and objectives” as an influence on their choice of delivery methods, following by 50% who identified a project’s complexity and innovation, and 46% who cited “delivery schedule” or “contractor experience.”

HIGH FAVORABILITY QUOTIENT

Seventy-seven percent of the study’s respondents thought that the design-build delivery method would increase over the next five years. “We have seen significantly more design-build work,” stated one respondent quoted in the report. “Virtually everything in our geography is going design-build,” said another.

Conversely, respondents with less favorable experiences with design-build delivery noted that some owners still see this method as a way of transferring risk to the building team, and underestimate the commitment needed to make this delivery method work.

Most respondents, however, saw myriad benefits in design-build. For example, 76% of architects, designers, and engineers, and 89% of GCs and CMs, cited increased collaboration and creativity. Greater project and design control was cited by 88% of GCs/CMs and 84% of specialty trade contractors. GCs/CMs (who represented 31% of the study’s respondents) like the opportunities to innovate that design-build methods afford them, as do 90% of owner’s reps.

Nearly half—47%—of organizations that responded to FMI’s survey use fixed price/lump sum contracts for their design-build projects, compared to 39% that use guaranteed max price contracts.

Related Stories

Market Data | Apr 4, 2018

Construction employment increases in 257 metro areas between February 2017 & 2018 as construction firms continue to expand amid strong demand

Riverside-San Bernardino-Ontario, Calif. and Merced, Calif. experience largest year-over-year gains; Baton Rouge, La. and Auburn-Opelika, Ala. have biggest annual declines in construction employment.

Market Data | Apr 2, 2018

Construction spending in February inches up from January

Association officials urge federal, state and local officials to work quickly to put recently enacted funding increases to work to improve aging and over-burdened infrastructure, offset public-sector spending drops.

Market Data | Mar 29, 2018

AIA and the University of Minnesota partner to develop Guides for Equitable Practice

The Guides for Equitable Practice will be developed and implemented in three phase.

Market Data | Mar 22, 2018

Architecture billings continue to hold positive in 2018

Billings particularly strong at firms in the West and Midwest regions.

Market Data | Mar 21, 2018

Construction employment increases in 248 metro areas as new metal tariffs threaten future sector job gains

Riverside-San Bernardino-Ontario, Calif., and Merced, Calif., experience largest year-over-year gains; Baton Rouge, La., and Auburn-Opelika, Ala., have biggest annual declines in construction employment.

Market Data | Mar 19, 2018

ABC's Construction Backlog Indicator hits a new high: 2018 poised to be a very strong year for construction spending

CBI is up by 1.36 months, or 16.3%, on a year-over-year basis.

Market Data | Mar 15, 2018

ABC: Construction materials prices continue to expand briskly in February

Compared to February 2017, prices are up 5.2%.

Market Data | Mar 14, 2018

AGC: Tariff increases threaten to make many project unaffordable

Construction costs escalated in February, driven by price increases for a wide range of building materials, including steel and aluminum.

Market Data | Mar 12, 2018

Construction employers add 61,000 jobs in February and 254,000 over the year

Hourly earnings rise 3.3% as sector strives to draw in new workers.

Steel Buildings | Mar 9, 2018

New steel and aluminum tariffs will hurt construction firms by raising materials costs; potential trade war will dampen demand, says AGC of America

Independent studies suggest the construction industry could lose nearly 30,000 jobs as a result of administration's new tariffs as many firms will be forced to absorb increased costs.