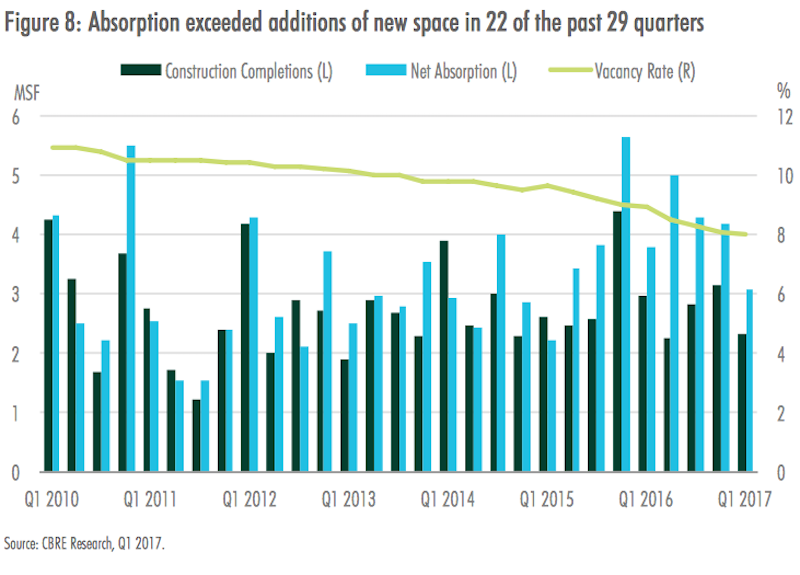

National construction of medical office buildings (MOBs) stood at 12.5 million sf in the first quarter of 2017, down slightly from a few years ago but still well above recession-era levels. However, construction continues to be outpaced by net absorptions, which between 2015 and Q1 2017 totaled 35.4 million sf, or 38% higher than completions over that same period.

In its first-ever report on U.S. Medical Office Buildings, CBRE notes that the vacancy rate for MOBs has “tightened steadily” since 2010, to its current level of 8%, a record low for this sector and well below the 13% vacancy rate for the U.S. office market.

To assess what’s driving MOB demand and development, CBRE took looked at Class A and B buildings with at least 10,000 sf of rentable area specifically designated as medical office space in 30 metros, with detailed investment and demographic profiles of each city.

It found a “resilient” MOB market that continues to benefit from several factors, not the least of which being the population growth of senior citizens. The U.S. Census Bureau estimates that the 65-plus population will nearly double between 2015 and 2055 to more than 92 million, and comprise nearly 23% of the country’s total population.

“The steep increase in both the 65+ population and anticipated greater need for in-office physician services by this group signal a continued increase in demand for health care services and medical office space in the decades ahead,” CBRE states.

Markets where the 65+ population is expected to grow strongest over the next five years include Las Vegas, Phoenix, Atlanta, Dallas-Fort Worth, Houston, and South Florida, according to Moody’s Analytics.

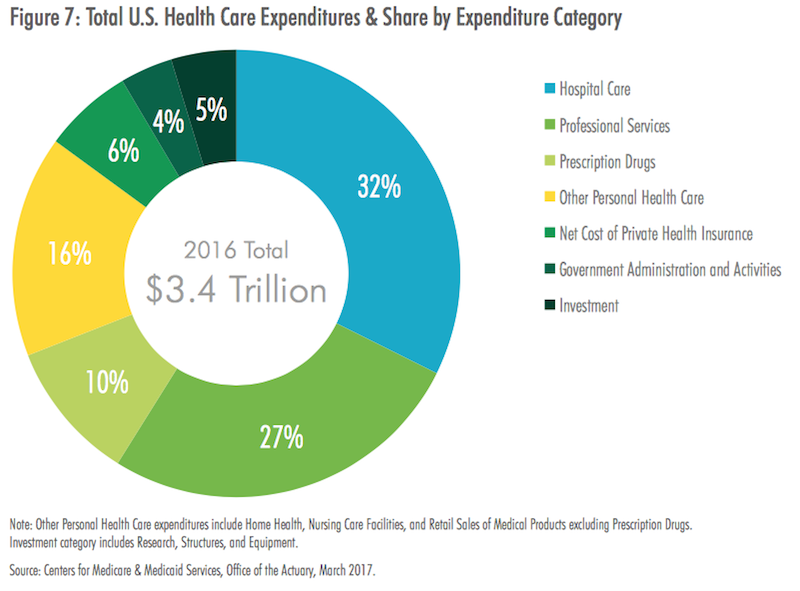

CBRE observes that providers are attempting to stem perennially increasing healthcare expenditures by moving more patient volume away from hospitals and toward more cost-effective outpatient facilities, such as MOBs and urgent-care centers.

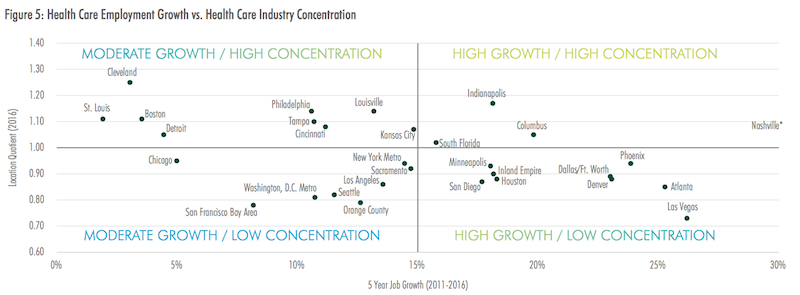

Health care jobs, particularly physicians, have been added at a much faster pace than jobs overall. Image: CBRE

Another cost-cutting trend that’s impacting healthcare real estate, says CBRE, has been the “significant uptick” in mergers and acquisitions. Consolidation among physician medical groups has been particularly strong, with deal volume surging by 19% in 2016 and 109% year-over-year in Q1 2017, according to PwC.

Outpatient professional services are not as expensive as hospital care, but they still accounted for nealry $900 billion in 2016. Image: CBRE.

Overall asking rents for medical office properties have remained relatively stable over the past seven years, ranging between $22 and $23 per sf per year. CBRE explains that the high cost of tenant build-outs, as well as the importance of proximity to a provider’s patient base and ancillary medical services, compel many tenants to remain in place for long periods of time.

But rent appreciation varies widely by market; average rents in New York, for example, grew by 83% since Q1 2010 to over $68 per sf in Q1 2017. Indeed, almost all of the 30 markets examined registered rent increases over the past year. And investors surveyed expect MOB rents to increase between 1% and 3% this year.

Low vacancy rates in this sector are attributed, in part, to the widening gap between completions and absorptions over the past three years.

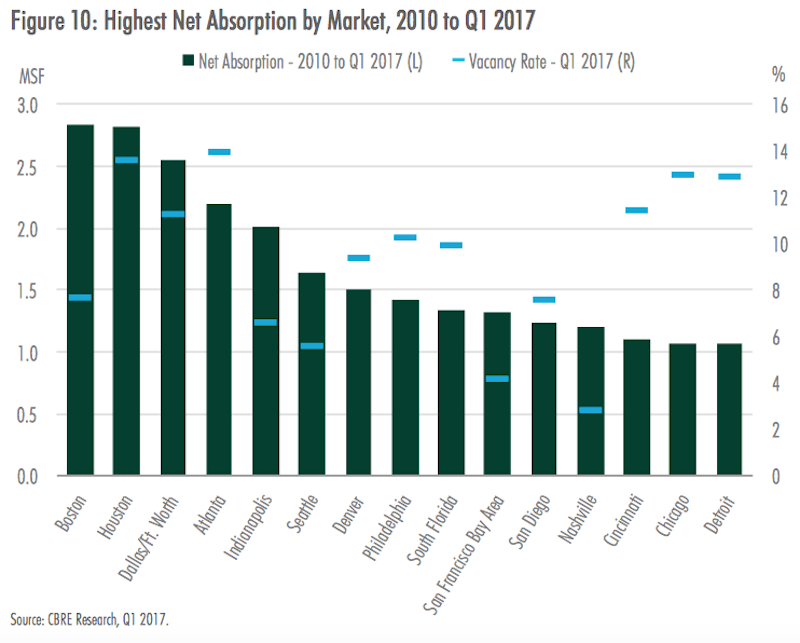

On a yearly basis, net absorption has been increasing since 2011 when it totaled 8.1 million sf. Since then, annual absorption grew by 114% to 17.2 million sf in 2016. Four of the five markets with the most positive net absorption in 2016 were located in the South or West: Houston (436,300 sf) Tampa (413,800 sf) Phoenix (314,400 sf) and South Florida (310,703 sf). Indianapolis was the lone top market not located in the Sun Belt, ranking third with 383,700 sf of positive absorption.

This chart compares cities' net absorptions of MOBs with their vacancy rates for that building type. Image: CBRE

New construction of MOBs is not keeping up with demand, based on net absorption rates for 30 large metros. Image: CBRE

CBRE found that as investors’ appetites for healthcare-related properties have increased, MOBs “have emerged as the most popular property type within the niche.” Ninety-seven percent of investors surveyed in 2017 were most interested in medical office properties among all health care-related real estate that met their investment criteria.

CBRE cites Real Capital Analytics research that estimates total U.S. investment volume in MOBs of at least 10,000 sf at $10.2 billion in 2016, compared to just under $4 billion in 2010. The investment total in 2016 exceeded the previous annual peak of $7.3 billion in 2006.

The Southeast and Western regions have captured a combined 44% of total MOB investment since 2010. California accounted for 56% of the western region MOB investment, with Greater Los Angeles alone representing 37% of the region’s total.

Consolidation has been a major driver of new medical office construction in recent years, as many markets lacked enough large blocks of space to meet the requirements of newly expanded health care provider groups, particularly within close to hospital campuses.

Construction has been abetted by the healthcare systems’ focus on value-based care rather than a fee-for-service approach, which has amplified the need for effective communication across provider teams, driving the need for efficient space that facilitates collaboration.

Over the past two years, completions were highest in the medical hubs of Boston and Houston, each with more than 1.2 million sf of new product delivered. Conversely, only four of the 30 markets analyzed—New York, San Francisco, Orange County, Calif., and Louisville—have had no new completions since Q2 2015.

Related Stories

Designers | Jul 25, 2023

The latest 'five in focus' healthcare interior design trends

HMC Architects’ Five in Focus blog series explores the latest trends, ideas, and innovations shaping the future of healthcare design.

Market Data | Jul 24, 2023

Leading economists call for 2% increase in building construction spending in 2024

Following a 19.7% surge in spending for commercial, institutional, and industrial buildings in 2023, leading construction industry economists expect spending growth to come back to earth in 2024, according to the July 2023 AIA Consensus Construction Forecast Panel.

Healthcare Facilities | Jul 19, 2023

World’s first prefab operating room with fully automated disinfection technology opens in New York

The first prefabricated operating room in the world with fully automated disinfection technology opened recently at the University of Rochester Medicine Orthopedics Surgery Center in Henrietta, N.Y. The facility, developed in a former Sears store, features a system designed by Synergy Med, called Clean Cube, that had never been applied to an operating space before. The components of the Clean Cube operating room were custom premanufactured and then shipped to the site to be assembled.

Sponsored | | Jul 12, 2023

Keyless Security for Medical Offices

Keeping patient data secure is a serious concern for medical professionals. Traditional lock-and-key systems do very little to help manage this problem, and create additional issues of their own. “Fortunately, wireless access control — a keyless alternative — eliminates the need for traditional physical keys while providing a higher level of security and centralized control,” says Cliff Brady, Salto Director of Industry Sectors Engagement, North America. Let’s explore how that works.

Healthcare Facilities | Jul 10, 2023

The latest pediatric design solutions for our tiniest patients

Pediatric design leaders Julia Jude and Kristie Alexander share several of CannonDesign's latest pediatric projects.

Healthcare Facilities | Jun 27, 2023

Convenience ranks highly when patients seek healthcare

Healthcare consumers are just as likely to factor in convenience as they do cost when deciding where to seek care and from whom, according to a new survey of 4,037 American adults about their attitudes and preferences as patients. The survey, conducted from April 19-28 by JLL, in many ways confirms the obvious: that older generations seek preventive care more often than younger generations; that insurance coverage is a primary driver for choosing a provider or hospital; and that the quality of service affects the patient experience.

Healthcare Facilities | Jun 27, 2023

A woman-led CM team manages the expansion and renovation of a woman-focused hospital in Nashville

This design-build project includes adding six floors for future growth.

Standards | Jun 26, 2023

New Wi-Fi standard boosts indoor navigation, tracking accuracy in buildings

The recently released Wi-Fi standard, IEEE 802.11az enables more refined and accurate indoor location capabilities. As technology manufacturers incorporate the new standard in various devices, it will enable buildings, including malls, arenas, and stadiums, to provide new wayfinding and tracking features.

Healthcare Facilities | Jun 14, 2023

Design considerations for behavioral health patients

The surrounding environment plays a huge role in the mental state of the occupants of a space, especially behavioral health patients whose perception of safety can be heightened. When patients do not feel comfortable in a space, the relationships between patients and therapists are negatively affected.

Engineers | Jun 14, 2023

The high cost of low maintenance

Walter P Moore’s Javier Balma, PhD, PE, SE, and Webb Wright, PE, identify the primary causes of engineering failures, define proactive versus reactive maintenance, recognize the reasons for deferred maintenance, and identify the financial and safety risks related to deferred maintenance.