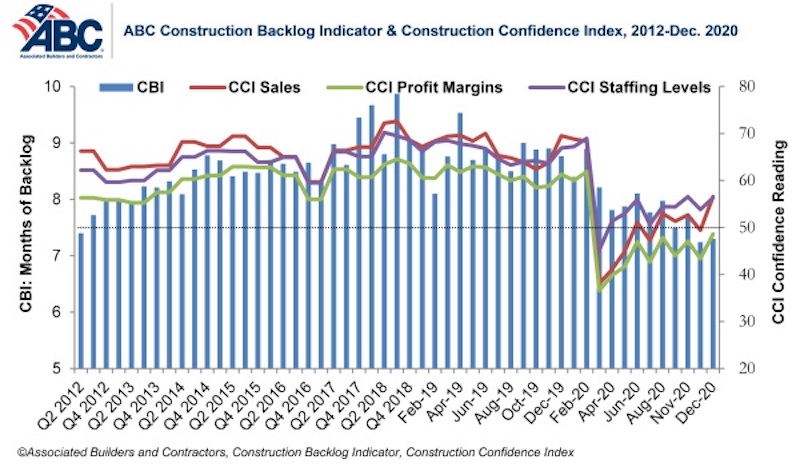

Associated Builders and Contractors reported today that its Construction Backlog Indicator rebounded modestly to 7.3 months in December, an increase of 0.1 months from November’s reading, according to an ABC member survey conducted from Dec. 18 to Jan. 5. Backlog is 1.5 months lower than in December 2019.

ABC’s Construction Confidence Index readings for sales, profit margins, and staffing levels increased in December. The sales index climbed above the threshold of 50, indicating contractors expect to grow sales over the next six months. The index reading for profit margins remained below that threshold. The staffing level index increased to 56.3 but remains well below its December 2019 reading.

“While many contractors enter 2021 with significant trepidation, the most recent backlog and confidence readings suggest that the onset of vaccinations has generally led to more upbeat assessments regarding nonresidential construction’s future,” said ABC Chief Economist Anirban Basu. “Backlog is down substantially from its year-ago level and profit margins remain under pressure, yet many contractors expect to enjoy higher sales and to support more staff six months from now.

“The baseline expectation is that by the spring, the U.S. economy will blossom,” said Basu. “With many households sitting on mounds of savings and sustaining pent-up demand for many goods and services, the U.S. economy is set for rapid growth as it reopens more fully during mid to late 2021. While it will take time for that to fully translate into new construction projects, some that were postponed earlier during the pandemic are likely to come back to life over the next several months. That should help many contractors begin to rebuild backlog, and to eagerly await 2022.”

Note: The reference months for the Construction Backlog Indicator and Construction Confidence Index data series were revised on May 12 to better reflect the survey period. CBI quantifies the previous month’s work under contract based on the latest financials available, while CCI measures contractors’ outlook for the next six months.

Related Stories

Codes and Standards | Oct 26, 2022

‘Landmark study’ offers key recommendations for design-build delivery

The ACEC Research Institute and the University of Colorado Boulder released what the White House called a “landmark study” on the design-build delivery method.

Building Team | Oct 26, 2022

The U.S. hotel construction pipeline shows positive growth year-over-year at Q3 2022 close

According to the third quarter Construction Pipeline Trend Report for the United States from Lodging Econometrics (LE), the U.S. construction pipeline stands at 5,317 projects/629,489 rooms, up 10% by projects and 6% rooms Year-Over-Year (YOY).

Designers | Oct 19, 2022

Architecture Billings Index moderates but remains healthy

For the twentieth consecutive month architecture firms reported increasing demand for design services in September, according to a new report today from The American Institute of Architects (AIA).

Market Data | Oct 17, 2022

Calling all AEC professionals! BD+C editors need your expertise for our 2023 market forecast survey

The BD+C editorial team needs your help with an important research project. We are conducting research to understand the current state of the U.S. design and construction industry.

Market Data | Oct 14, 2022

ABC’s Construction Backlog Indicator Jumps in September; Contractor Confidence Remains Steady

Associated Builders and Contractors reports today that its Construction Backlog Indicator increased to 9.0 months in September, according to an ABC member survey conducted Sept. 20 to Oct. 5.

Market Data | Oct 12, 2022

ABC: Construction Input Prices Inched Down in September; Up 41% Since February 2020

Construction input prices dipped 0.1% in September compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data released today.

Laboratories | Oct 5, 2022

Bigger is better for a maturing life sciences sector

CRB's latest report predicts more diversification and vertical integration in research and production.

Market Data | Aug 25, 2022

‘Disruptions’ will moderate construction spending through next year

JLL’s latest outlook predicts continued pricing volatility due to shortages in materials and labor

Market Data | Aug 2, 2022

Nonresidential construction spending falls 0.5% in June, says ABC

National nonresidential construction spending was down by 0.5% in June, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau.

Market Data | Jul 28, 2022

The latest Beck Group report sees earlier project collaboration as one way out of the inflation/supply chain malaise

In the first six months of 2022, quarter-to-quarter inflation for construction materials showed signs of easing, but only slightly.