Construction employment continued to show strength across much of the United States through November 2017, when there were 191,000 more workers in the construction industry than during the same month a year earlier, and the construction unemployment rate fell by 0.7% to 5%, the lowest it’s been on record for the month of November, according to estimates released yesterday by Associated Builders and Contractors, a national trade group representing more than 21,000 members.

However, the industry still struggles with labor shortages that could be inhibiting investment and new construction.

During the first nine months of 2017, month-by-month employment growth was “minimal,” due primarily to “historically low unemployment” that limited the new construction talent pool, according to JLL’s Construction Outlook for the third quarter of 2017, which the market research and consulting firm released late last month.

During the third quarter of 2017, construction-related spending inched up by only 1.9% from the same period in 2016. “While topline spending is still increasing, consecutive quarters are demonstrating smaller and smaller gains over past years—underlining the trajectory towards a mature and stable industry,” JLL writes. Percentage growth of year-over-year spending decreased for nine out of the preceding 11 months, but was still above zero, “pointing to a tapering growth curve.”

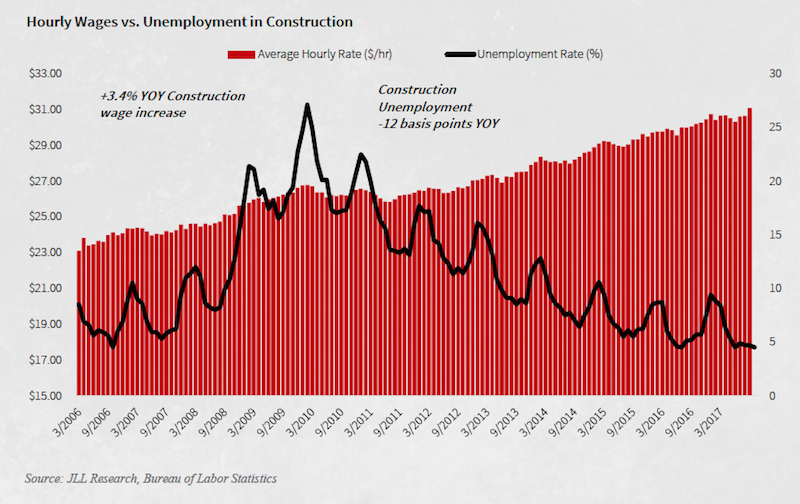

With qualified construction workers being harder to find, labor costs were volatile through the first nine months of last year. Image: JLL Research

Citing Census Bureau estimates, Associated Builders and Contractors posted that nonresidential construction spending declined in November by 1.3%, to $719.2 billion, compared to the same month a year earlier. Private nonres spending was down by 3.1%, while public-sector nonres spending grew by 1.7%. The gainers included commercial, educational, lodging, transportation, healthcare, and public safety. Manufacturing construction took the biggest hit, down 15.6%.

Commercial real estate has proven over the past several years that it can perform well regardless of how the economy in general is growing. “Right now we see little in fundamentals to cause concern about real estate as an asset class,” JLL writes.

Public construction, infrastructure and public works projects picked up steam during the third quarter of 2017, while single-family home construction grew at nearly double-digit annualized growth, which is expected to continue in 2018. Multifamily starts, on the other hand, dipped.

While the groundbreaking of large scale private commercial projects began to scale back due to stretched-out timelines, commercial renovation and fit-out work strengthened, and should prevail through the next several quarters and beyond into 2019, JLL predicts.

The cost of building slowed in the third quarter, up by just 3% from third quarter 2016. But it still grew faster than construction spending primarily because of increasing labor costs. (Wages grew by nearly 3.4%, on an annualized basis, in the third quarter of 2017.) Indeed, JLL expects labor shortages to persist through 2018, at least, and for construction costs to be up another 3% this year. JLL expects wage growth to accelerate, potentially hitting 5% or higher during peak building seasons.

The severe weather events that hit certain areas of the country had a surprisingly minor impact on the availability of most building materials. Nevertheless, materials costs rose by 3% in the third quarter compared to the same period a year ago, and those costs “are beginning to outpace current demand,” says JLL. Impending tariffs on Canadian lumber imports could jack up lumber prices for U.S. purchasers by 20% this year.

Manpower shortages, and the prospect that labor and products will cost more, could finally push the construction industry to embrace technology to a greater degree than it has done so to this point. JLL sees BIM, artificial intelligence and big data, and prefab and offsite construction as the three technologies that show the most promise this year.

Related Stories

Apartments | Mar 13, 2024

A landscaped canyon runs through this luxury apartment development in Denver

Set to open in April, One River North is a 16-story, 187-unit luxury apartment building with private, open-air terraces located in Denver’s RiNo arts district. Biophilic design plays a central role throughout the building, allowing residents to connect with nature and providing a distinctive living experience.

Affordable Housing | Mar 12, 2024

An all-electric affordable housing project in Southern California offers 48 apartments plus community spaces

In Santa Monica, Calif., Brunson Terrace is an all-electric, 100% affordable housing project that’s over eight times more energy efficient than similar buildings, according to architect Brooks + Scarpa. Located across the street from Santa Monica College, the net zero building has been certified LEED Platinum.

Contractors | Mar 12, 2024

The average U.S. contractor has 8.1 months worth of construction work in the pipeline, as of February 2024

Associated Builders and Contractors reported that its Construction Backlog Indicator declined to 8.1 months in February, according to an ABC member survey conducted Feb. 20 to March 5. The reading is down 1.1 months from February 2023.

Museums | Mar 11, 2024

Nebraska’s Joslyn Art Museum to reopen this summer with new Snøhetta-designed pavilion

In Omaha, Neb., the Joslyn Art Museum, which displays art from ancient times to the present, has announced it will reopen on September 10, following the completion of its new 42,000-sf Rhonda & Howard Hawks Pavilion. Designed in collaboration with Snøhetta and Alley Poyner Macchietto Architecture, the Hawks Pavilion is part of a museum overhaul that will expand the gallery space by more than 40%.

Affordable Housing | Mar 11, 2024

Los Angeles’s streamlined approval policies leading to boom in affordable housing plans

Since December 2022, Los Angeles’s planning department has received plans for more than 13,770 affordable units. The number of units put in the approval pipeline in roughly one year is just below the total number of affordable units approved in Los Angeles in 2020, 2021, and 2022 combined.

BIM and Information Technology | Mar 11, 2024

BIM at LOD400: Why Level of Development 400 matters for design and virtual construction

As construction projects grow more complex, producing a building information model at Level of Development 400 (LOD400) can accelerate schedules, increase savings, and reduce risk, writes Stephen E. Blumenbaum, PE, SE, Walter P Moore's Director of Construction Engineering.

AEC Tech | Mar 9, 2024

9 steps for implementing digital transformation in your AEC business

Regardless of a businesses size and type, digital solutions like workflow automation software, AI-based analytics, and integrations can significantly enhance efficiency, productivity, and competitiveness.

Sports and Recreational Facilities | Mar 7, 2024

Bjarke Ingels’ design for the Oakland A’s new Las Vegas ballpark resembles ‘a spherical armadillo’

Designed by Bjarke Ingels Group (BIG) in collaboration with HNTB, the new ballpark for the Oakland Athletics Major League Baseball team will be located on the Las Vegas Strip and offer panoramic views of the city skyline. The 33,000-capacity covered, climate-controlled stadium will sit on nine acres on Las Vegas Boulevard.

Adaptive Reuse | Mar 7, 2024

3 key considerations when converting a warehouse to a laboratory

Does your warehouse facility fit the profile for a successful laboratory conversion that can demand higher rents and lower vacancy rates? Here are three important considerations to factor before proceeding.

Shopping Centers | Mar 7, 2024

How shopping centers can foster strong community connections

In today's retail landscape, shopping centers are evolving beyond mere shopping destinations to become vibrant hubs of community life. Here are three strategies from Nadel Architecture + Planning for creating strong local connections.