Construction employment continued to show strength across much of the United States through November 2017, when there were 191,000 more workers in the construction industry than during the same month a year earlier, and the construction unemployment rate fell by 0.7% to 5%, the lowest it’s been on record for the month of November, according to estimates released yesterday by Associated Builders and Contractors, a national trade group representing more than 21,000 members.

However, the industry still struggles with labor shortages that could be inhibiting investment and new construction.

During the first nine months of 2017, month-by-month employment growth was “minimal,” due primarily to “historically low unemployment” that limited the new construction talent pool, according to JLL’s Construction Outlook for the third quarter of 2017, which the market research and consulting firm released late last month.

During the third quarter of 2017, construction-related spending inched up by only 1.9% from the same period in 2016. “While topline spending is still increasing, consecutive quarters are demonstrating smaller and smaller gains over past years—underlining the trajectory towards a mature and stable industry,” JLL writes. Percentage growth of year-over-year spending decreased for nine out of the preceding 11 months, but was still above zero, “pointing to a tapering growth curve.”

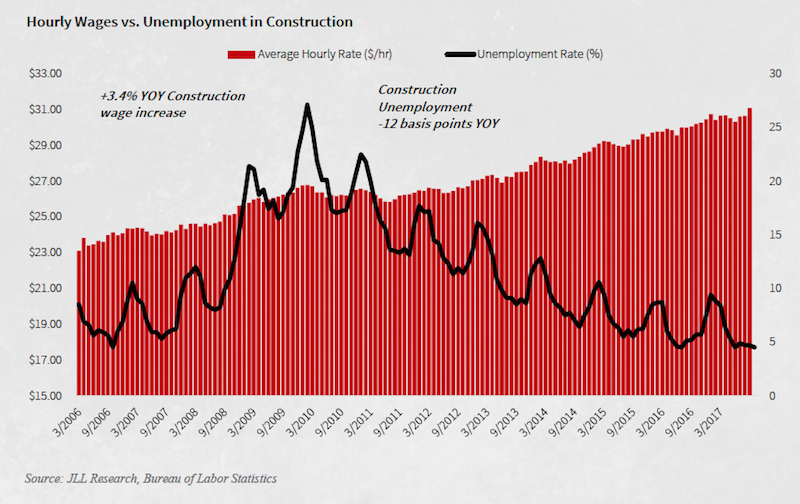

With qualified construction workers being harder to find, labor costs were volatile through the first nine months of last year. Image: JLL Research

Citing Census Bureau estimates, Associated Builders and Contractors posted that nonresidential construction spending declined in November by 1.3%, to $719.2 billion, compared to the same month a year earlier. Private nonres spending was down by 3.1%, while public-sector nonres spending grew by 1.7%. The gainers included commercial, educational, lodging, transportation, healthcare, and public safety. Manufacturing construction took the biggest hit, down 15.6%.

Commercial real estate has proven over the past several years that it can perform well regardless of how the economy in general is growing. “Right now we see little in fundamentals to cause concern about real estate as an asset class,” JLL writes.

Public construction, infrastructure and public works projects picked up steam during the third quarter of 2017, while single-family home construction grew at nearly double-digit annualized growth, which is expected to continue in 2018. Multifamily starts, on the other hand, dipped.

While the groundbreaking of large scale private commercial projects began to scale back due to stretched-out timelines, commercial renovation and fit-out work strengthened, and should prevail through the next several quarters and beyond into 2019, JLL predicts.

The cost of building slowed in the third quarter, up by just 3% from third quarter 2016. But it still grew faster than construction spending primarily because of increasing labor costs. (Wages grew by nearly 3.4%, on an annualized basis, in the third quarter of 2017.) Indeed, JLL expects labor shortages to persist through 2018, at least, and for construction costs to be up another 3% this year. JLL expects wage growth to accelerate, potentially hitting 5% or higher during peak building seasons.

The severe weather events that hit certain areas of the country had a surprisingly minor impact on the availability of most building materials. Nevertheless, materials costs rose by 3% in the third quarter compared to the same period a year ago, and those costs “are beginning to outpace current demand,” says JLL. Impending tariffs on Canadian lumber imports could jack up lumber prices for U.S. purchasers by 20% this year.

Manpower shortages, and the prospect that labor and products will cost more, could finally push the construction industry to embrace technology to a greater degree than it has done so to this point. JLL sees BIM, artificial intelligence and big data, and prefab and offsite construction as the three technologies that show the most promise this year.

Related Stories

| Aug 11, 2010

Carpenters' union helping build its own headquarters

The New England Regional Council of Carpenters headquarters in Dorchester, Mass., is taking shape within a 1940s industrial building. The Building Team of ADD Inc., RDK Engineers, Suffolk Construction, and the carpenters' Joint Apprenticeship Training Committee, is giving the old facility a modern makeover by converting the existing two-story structure into a three-story, 75,000-sf, LEED-certif...

| Aug 11, 2010

Wisconsin becomes the first state to require BIM on public projects

As of July 1, the Wisconsin Division of State Facilities will require all state projects with a total budget of $5 million or more and all new construction with a budget of $2.5 million or more to have their designs begin with a Building Information Model. The new guidelines and standards require A/E services in a design-bid-build project delivery format to use BIM and 3D software from initial ...

| Aug 11, 2010

News Briefs: GBCI begins testing for new LEED professional credentials... Architects rank durability over 'green' in product attributes... ABI falls slightly in April, but shows market improvement

News Briefs: GBCI begins testing for new LEED professional credentials... Architects rank durability over 'green' in product attributes... ABI falls slightly in April, but shows market improvement

| Aug 11, 2010

University of Florida's traditionally modern graduate building

The University of Florida's Hough Hall Graduate Studies Building was designed by Rowe Architects, Tampa, and Sasaki Associates, Boston, to blend with the school's traditional collegiate gothic architecture outside, but reflect a 21st-century education facility inside. Tallahassee-based Ajax Building Corporation is constructing the $19 million facility, which will have traditional exterior detai...

| Aug 11, 2010

Florida International University's cantilevered design

Suffolk Construction's Miami-Dade business unit is serving as GC for the $14 million School of International and Public Affairs building at the University Park Campus of Florida International University. Designed by Arquitectonica, Miami, the five-story, 58,408-sf building will have a café and three auditoriums on the ground level; the largest auditorium will have a 40-foot cantilever abov...

| Aug 11, 2010

Restoration gives new life to New Formalism icon

The $30 million upgrade, restoration, and expansion of the Mark Taper Forum in Los Angeles was completed by the team of Rios Clementi Hale Studios (architect), Harley Ellis Devereaux (executive architect/MEP), KPFF (structural engineer), and Taisei Construction (GC). Work on the Welton Becket-designed 1967 complex included an overhaul of the auditorium, lighting, and acoustics.

| Aug 11, 2010

Best AEC Firms to Work For

2006 FreemanWhite Hnedak Bobo Group McCarthy Building Companies, Inc. Shawmut Design and Construction Walter P Moore 2007 Anshen+Allen Arup Bovis Lend Lease Cannon Design Jones Lang LaSalle Perkins+Will SmithGroup SSOE, Inc. Timothy Haahs & Associates, Inc. 2008 Gilbane Building Co. HDR KJWW Engineering Consultants Lord, Aeck & Sargent Mark G.

| Aug 11, 2010

Great Solutions: Business Management

22. Commercial Properties Repositioned for University USE Tocci Building Companies is finding success in repositioning commercial properties for university use, and it expects the trend to continue. The firm's Capital Cove project in Providence, R.I., for instance, was originally designed by Elkus Manfredi (with design continued by HDS Architects) to be a mixed-use complex with private, market-...

| Aug 11, 2010

AIA Course: Historic Masonry — Restoration and Renovation

Historic restoration and preservation efforts are accelerating throughout the U.S., thanks in part to available tax credits, awards programs, and green building trends. While these projects entail many different building components and systems, façade restoration—as the public face of these older structures—is a key focus. Earn 1.0 AIA learning unit by taking this free course from Building Design+Construction.