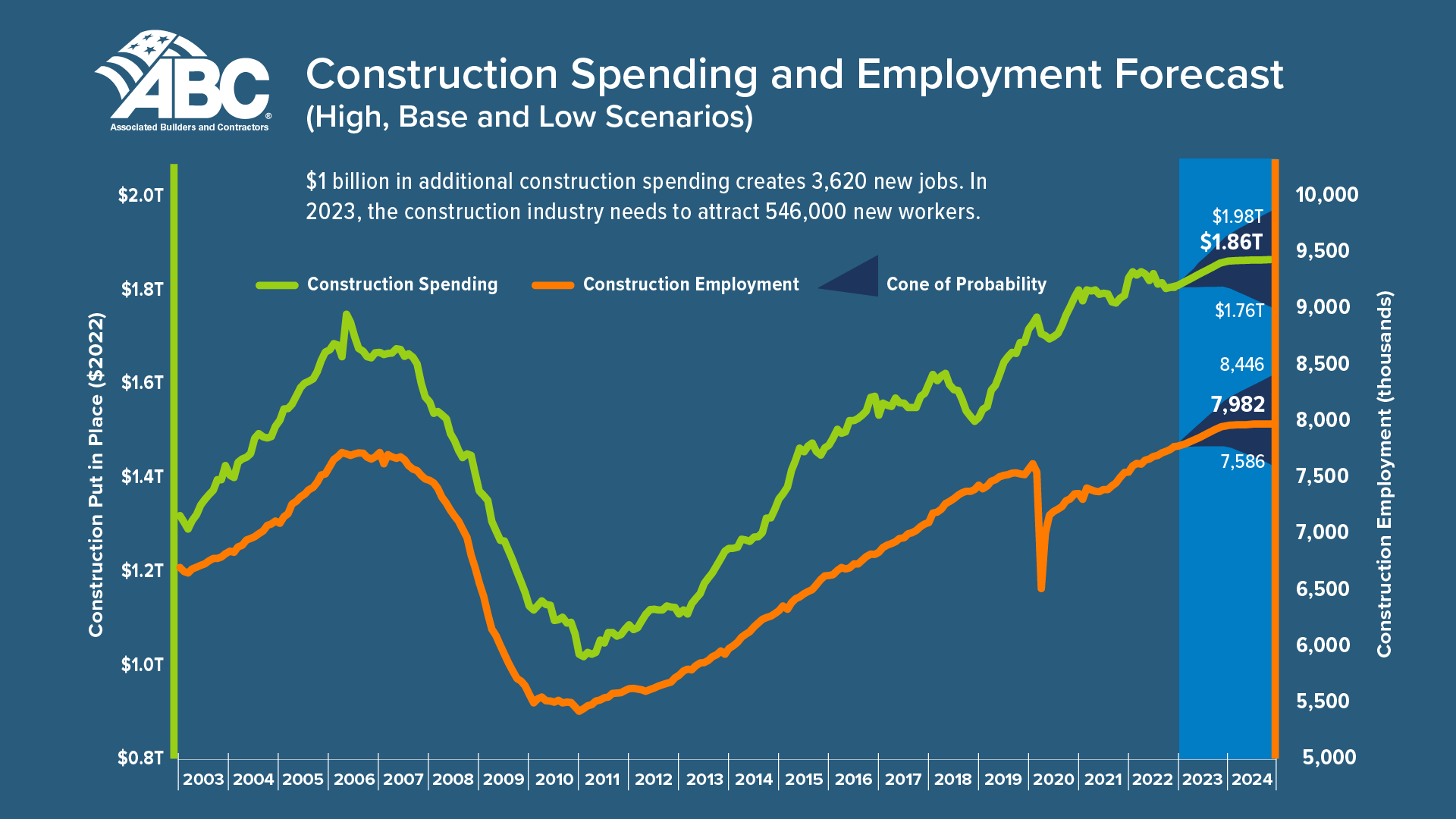

The U.S. construction industry needs to attract an estimated 546,000 additional workers on top of the normal pace of hiring in 2023 to meet demand for labor, according to a model developed by Associated Builders and Contractors.

The construction industry averaged more than 390,000 job openings per month in 2022, the highest level on record, and the industry unemployment rate of 4.6% in 2022 was the second lowest on record. National payroll construction employment was 231,000 higher in December 2022 than in December 2021.

ABC predicts demand for labor to increase by 3,620 new jobs for every $1 billion in new construction spending. New funding for large projects such as chip manufacturing plants, clean energy facilities, and infrastructure upgrades will continue to put pressure on the job market.

ABC predicts that in 2024, the industry will need to hire 324,000 new workers on top of its normal pacing, and that assumes overall construction spending slows significantly. The number of workers with licensed skills hasn’t been enough to keep up with demand, and the ranks of licensed carpenters has actually declined in the last decade.

Here is full release from Associated Builders and Contractors:

The U.S. construction industry will need to attract an estimated 546,000 additional workers on top of the normal pace of hiring in 2023 to meet the demand for labor, according to a proprietary model developed by Associated Builders and Contractors.

“The construction industry must recruit hundreds of thousands of qualified, skilled construction professionals each year to build the places where we live, work, play, worship, learn and heal,” said Michael Bellaman, ABC president and CEO. “As the demand for construction services remains high, filling these roles with skilled craft professionals is vital to America’s economy and infrastructure rebuilding initiatives.”

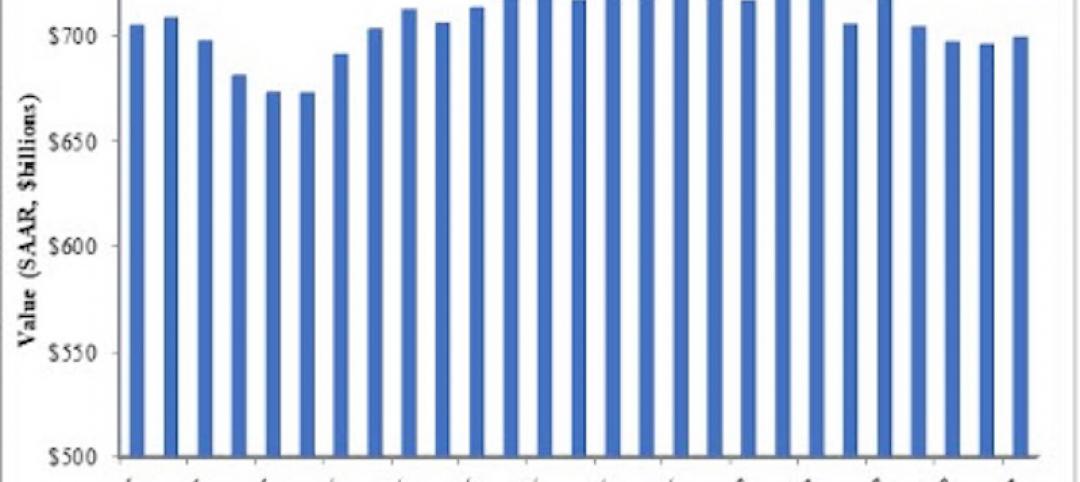

ABC’s proprietary model uses the historical relationship between inflation-adjusted construction spending growth, sourced from the U.S. Census Bureau’s Construction Put in Place survey, as well as payroll construction employment, sourced from the U.S. Bureau of Labor Statistics, to convert anticipated increases in construction outlays into demand for construction labor at a rate of approximately 3,620 new jobs per billion dollars of additional construction spending. This increased demand is added to the current level of above-average job openings. Projected industry retirements, shifts to other industries and other forms of anticipated separation are also embodied within computations.

The construction industry averaged more than 390,000 job openings per month in 2022, the highest level on record, and the industry unemployment rate of 4.6% in 2022 was the second lowest on record, higher than only the 4.5% unemployment rate observed in 2019. National payroll construction employment was 231,000 higher in December 2022 than in December 2021.

“Despite sharp increases in interest rates over the past year, the shortage of construction workers will not disappear in the near future,” said ABC Chief Economist Anirban Basu. “First, while single-family home building activity has moderated, many contractors continue to experience substantial demand from a growing number of mega-projects associated with chip manufacturing plants, clean energy facilities and infrastructure. Second, too few younger workers are entering the skilled trades, meaning this is not only a construction labor shortage but also a skills shortage.

“With nearly 1 in 4 construction workers older than 55, retirements will continue to whittle away at the construction workforce,” said Basu. “Many of these older construction workers are also the most productive, refining their skills over time. The number of construction laborers, the most entry-level occupational title, has accounted for nearly 4 out of every 10 new construction workers since 2012. Meanwhile, the number of skilled workers has grown at a much slower pace or, in the case of certain occupations like carpenter, declined.

“To fill these important roles, ABC is working hard to recruit, educate and upskill the construction workforce through our national network of more than 800 apprenticeship, craft, safety and management education programs—including more than 300 government-registered apprenticeship programs across 20 different construction occupations—to build the people who build America,” said Bellaman. “ABC members invested $1.6 billion in 2021 to educate 1.3 million course attendees to build a construction workforce that is safe, skilled and productive.”

In 2024, the industry will need to bring in more than 342,000 new workers on top of normal hiring to meet industry demand, and that’s presuming that construction spending growth slows significantly next year.

View ABC’s methodology in creating the workforce shortage model.

Related Stories

Market Data | Dec 11, 2017

Global hotel construction pipeline is growing

The Total Pipeline stands at 12,427 Projects/2,084,940 Rooms.

Market Data | Dec 11, 2017

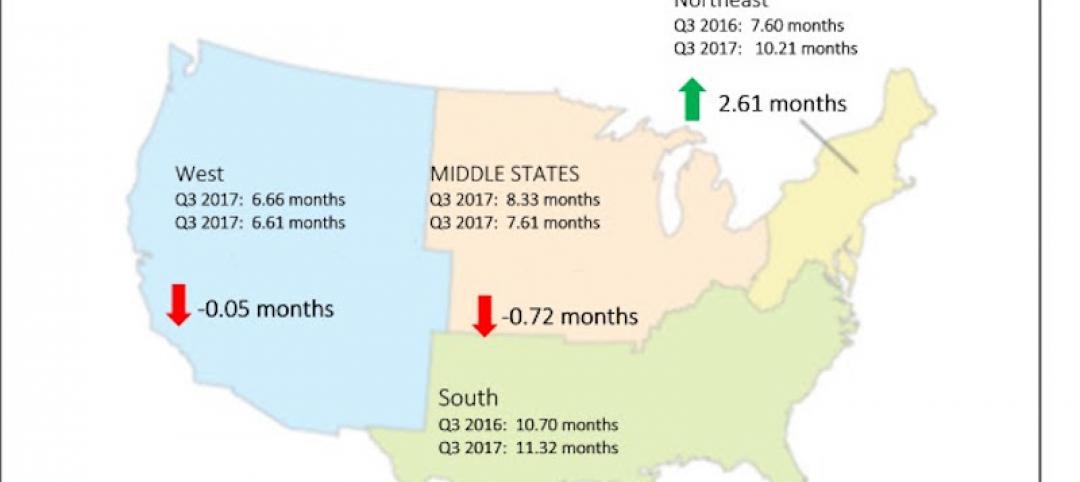

Construction backlog surges, sets record in third quarter

CBI is a leading economic indicator that reflects the amount of construction work under contract, but not yet completed.

Market Data | Dec 7, 2017

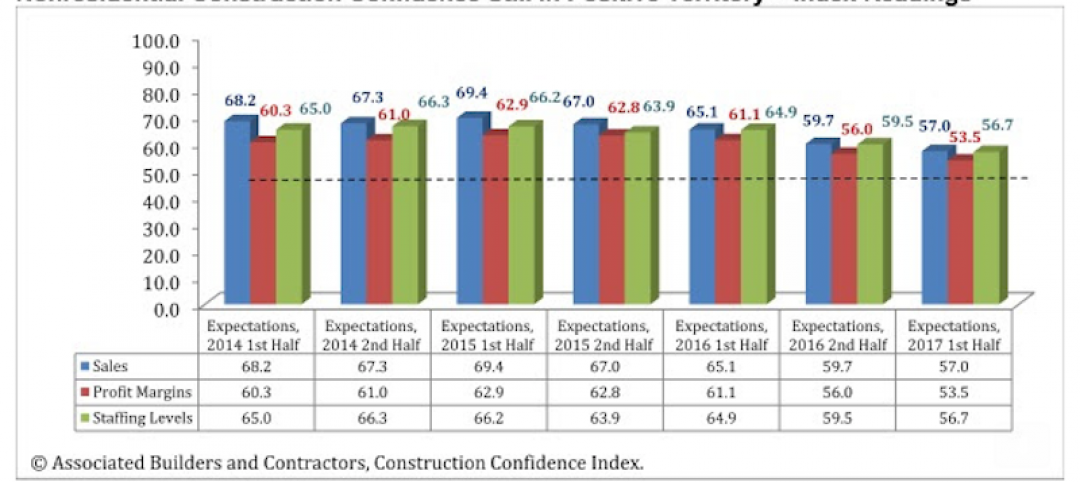

Buoyed by healthy economy, ABC Index finds contractors upbeat

Despite rising construction labor and materials costs, 55% of contractors expect their profit margins to expand in the first half of 2018.

Industry Research | Nov 28, 2017

2018 outlook: Economists point to slowdown, AEC professionals say ‘no way’

Multifamily housing and senior living developments head the list of the hottest sectors heading into 2018, according a survey of 356 AEC professionals.

Architects | Nov 28, 2017

Adding value through integrated technology requires a human touch

To help strike that delicate balance between the human and the high-tech, we must first have an in-depth understanding of our client’s needs as well as a manufacturer’s capabilities.

Market Data | Nov 27, 2017

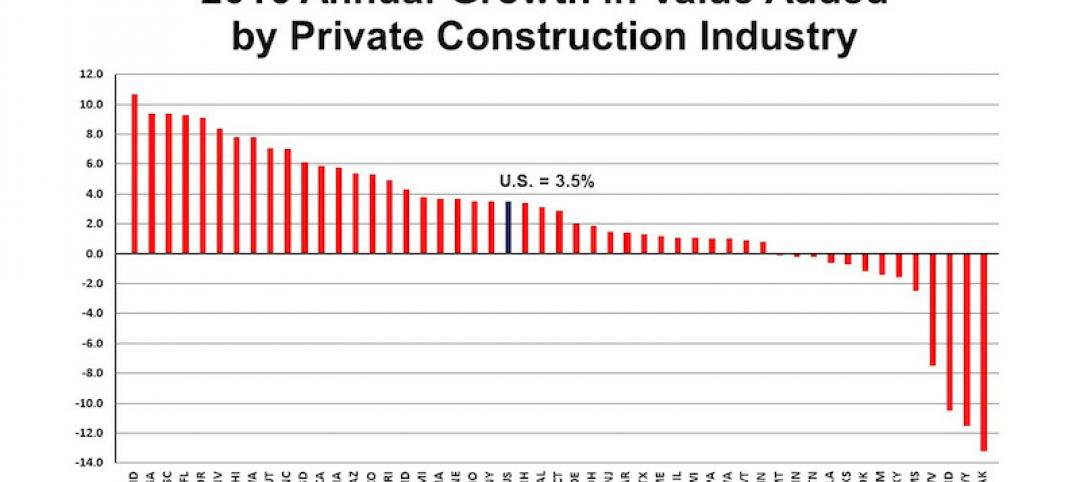

Construction's contribution to U.S. economy highest in seven years

Thirty-seven states benefited from the rise in construction activity in their state, while 13 states experienced a reduction in activity.

Market Data | Nov 15, 2017

Architecture Billings bounce back

Business conditions remain uneven across regions.

Market Data | Nov 14, 2017

U.S. construction starts had three consecutive quarters of positive growth in 2017

ConstructConnect’s quarterly report shows the most significant annual growth in the civil engineering and residential sectors.

Market Data | Nov 3, 2017

New construction starts in 2018 to increase 3% to $765 billion: Dodge report

Dodge Outlook Report predicts deceleration but still growth, reflecting a mixed pattern by project type.

Market Data | Nov 2, 2017

Construction spending up in September; Down on a YOY basis

Nonresidential construction spending is down 2.9% on a year-over-year basis.