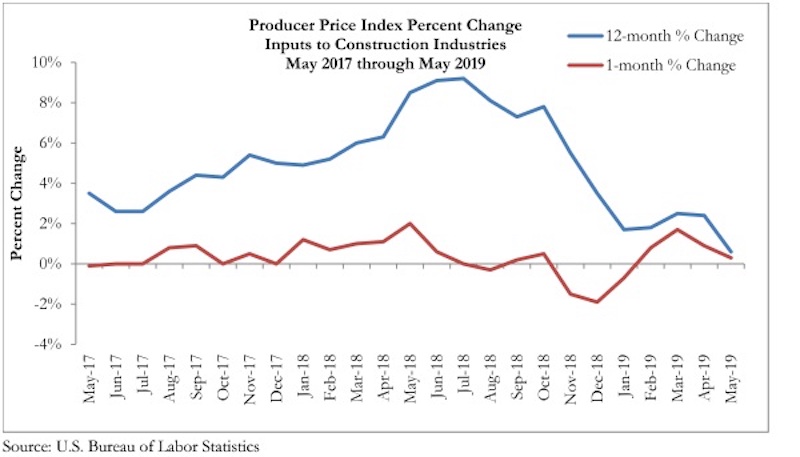

Construction input prices rose slightly by 0.3% in May on a monthly basis and are up 0.6% over the last 12 months, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics data released today. Nonresidential input prices were also up 0.3% compared to the previous month and are 1.1% higher than they were a year ago.

Among the 11 subcategories, six saw prices fall last month, with the largest decreases in natural gas (-15.2%), unprocessed energy materials (-8.2%) and crude petroleum (-6.2%). Of the remaining five subcategories, only two experienced price increases greater than 1%: nonferrous wire and cable (+1.2%) and prepared asphalt, tar roofing and siding products (+1.1%), which also had the largest year-over-year price increase at 6.3%.

“Based on a variety of factors, materials prices should be escalating in the United States, yet nonresidential construction materials prices remain relatively stable,” said ABC Chief Economist Anirban Basu. “First, demand for materials remains high in the context of ongoing growth in nonresidential construction spending. This is especially true for a number of construction material intensive segments like highway and street. Indeed, prepared asphalt is the only category of construction materials that this report monitors that experienced a price increase exceeding 6% over the past year.

“Second, there is the issue of tariffs, including those that have impacted steel and aluminum prices in recent months,” said Basu. “Despite those surcharges on imported goods, no related categories are associated with significant inflationary pressure, though the price of fabricated steel products is up by a somewhat-above-average 2.8% over the past year. Third, there have been active attempts by certain groups of suppliers, including OPEC members, to truncate supply in an effort to raise prices. In large measure, those efforts have failed, with a host of commodity prices, including oil prices, declining recently.

“There are many factors that have helped to limit materials price increases, including a weakening global economy and the emergence of goods-producing nations like Vietnam and Indonesia,” said Basu. "A strong U.S. dollar has also helped to limit the commodity price increases encountered by America’s construction firms.

“For contractors, this comes as good news,” said Basu. “While U.S. construction firms will continue to wrestle with rising compensation costs, materials prices are likely to remain well behaved over the near term. There is little evidence that the global economy is reaccelerating. Moreover, the Trump administration recently removed tariffs on steel and aluminum with respect to Canada and Mexico. Finally, while public construction spending growth has been robust of late, there is some evidence that spending growth has become less intense in a number of private construction segments, which would have the effect of limiting demand for certain materials, all things being equal.”

Related Stories

Architects | Apr 21, 2023

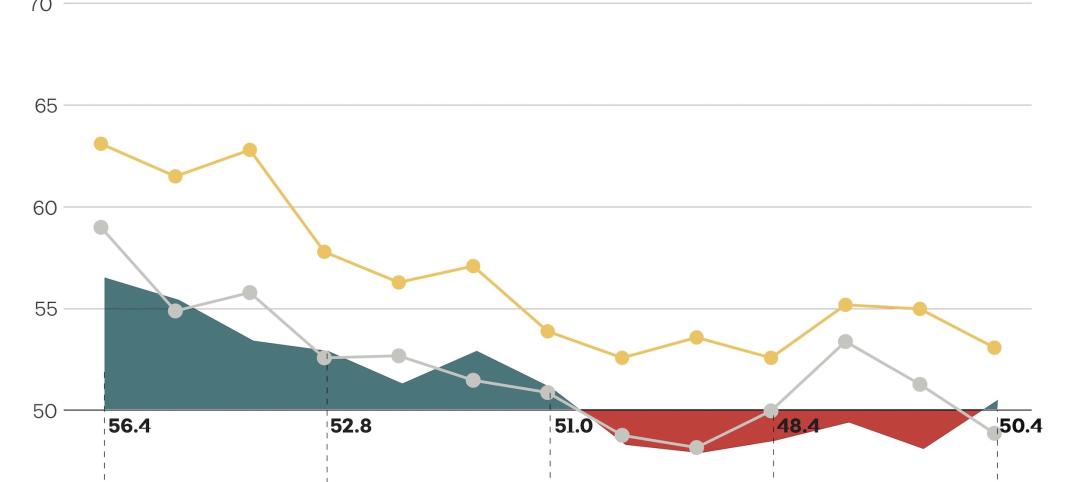

Architecture billings improve slightly in March

Architecture firms reported a modest increase in March billings. This positive news was tempered by a slight decrease in new design contracts according to a new report released today from The American Institute of Architects (AIA). March was the first time since last September in which billings improved.

Contractors | Apr 19, 2023

Rising labor, material prices cost subcontractors $97 billion in unplanned expenses

Subcontractors continue to bear the brunt of rising input costs for materials and labor, according to a survey of nearly 900 commercial construction professionals.

Data Centers | Apr 14, 2023

JLL's data center outlook: Cloud computing, AI driving exponential growth for data center industry

According to JLL’s new Global Data Center Outlook, the mass adoption of cloud computing and artificial intelligence (AI) is driving exponential growth for the data center industry, with hyperscale and edge computing leading investor demand.

Healthcare Facilities | Apr 13, 2023

Healthcare construction costs for 2023

Data from Gordian breaks down the average cost per square foot for a three-story hospital across 10 U.S. cities.

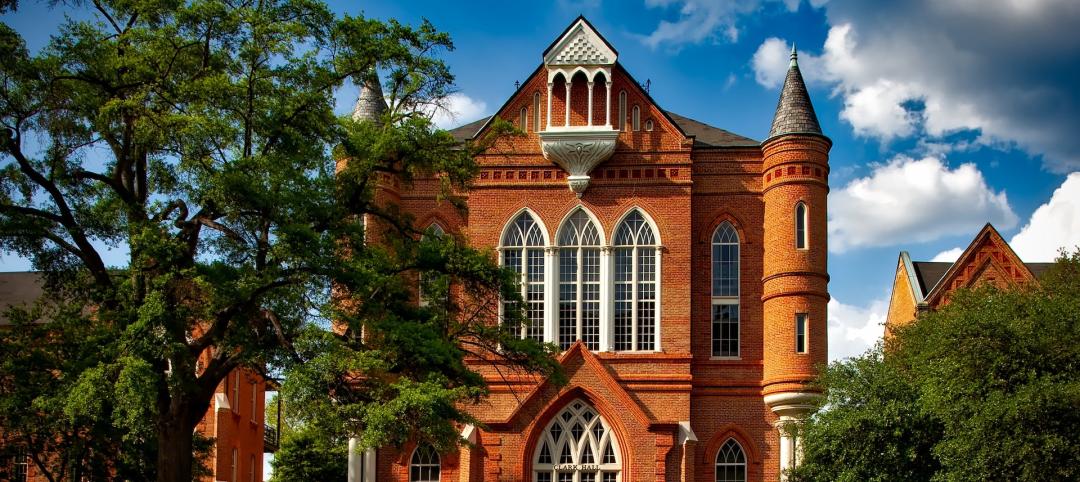

Higher Education | Apr 13, 2023

Higher education construction costs for 2023

Fresh data from Gordian breaks down the average cost per square foot for a two-story college classroom building across 10 U.S. cities.

Market Data | Apr 13, 2023

Construction input prices down year-over-year for first time since August 2020

Construction input prices increased 0.2% in March, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics Producer Price Index data released today. Nonresidential construction input prices rose 0.4% for the month.

Market Data | Apr 11, 2023

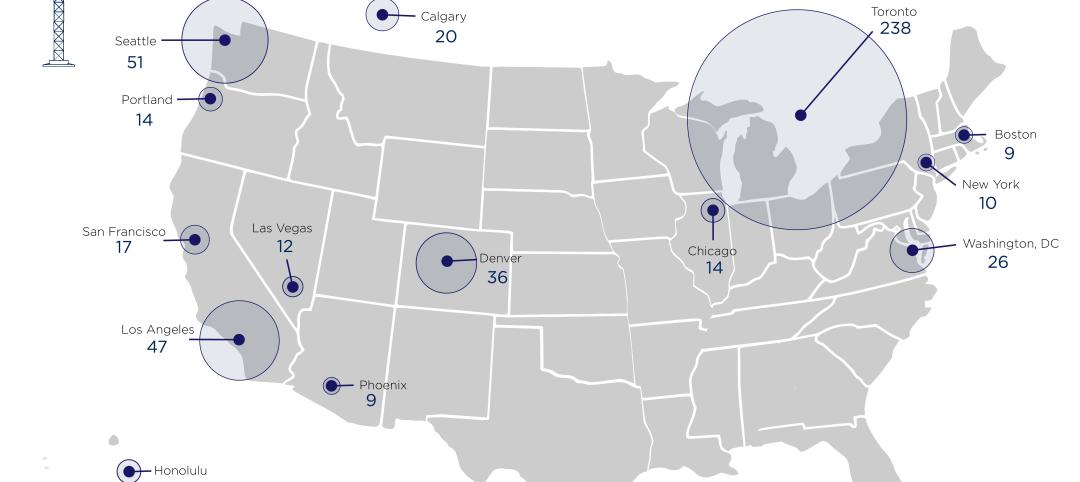

Construction crane count reaches all-time high in Q1 2023

Toronto, Seattle, Los Angeles, and Denver top the list of U.S/Canadian cities with the greatest number of fixed cranes on construction sites, according to Rider Levett Bucknall's RLB Crane Index for North America for Q1 2023.

Contractors | Apr 11, 2023

The average U.S. contractor has 8.7 months worth of construction work in the pipeline, as of March 2023

Associated Builders and Contractors reported that its Construction Backlog Indicator declined to 8.7 months in March, according to an ABC member survey conducted March 20 to April 3. The reading is 0.4 months higher than in March 2022.

Market Data | Apr 6, 2023

JLL’s 2023 Construction Outlook foresees growth tempered by cost increases

The easing of supply chain snags for some product categories, and the dispensing with global COVID measures, have returned the North American construction sector to a sense of normal. However, that return is proving to be complicated, with the construction industry remaining exceptionally busy at a time when labor and materials cost inflation continues to put pricing pressure on projects, leading to caution in anticipation of a possible downturn. That’s the prognosis of JLL’s just-released 2023 U.S. and Canada Construction Outlook.

Market Data | Apr 4, 2023

Nonresidential construction spending up 0.4% in February 2023

National nonresidential construction spending increased 0.4% in February, according to an Associated Builders and Contractors analysis of data published by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $982.2 billion for the month, up 16.8% from the previous year.