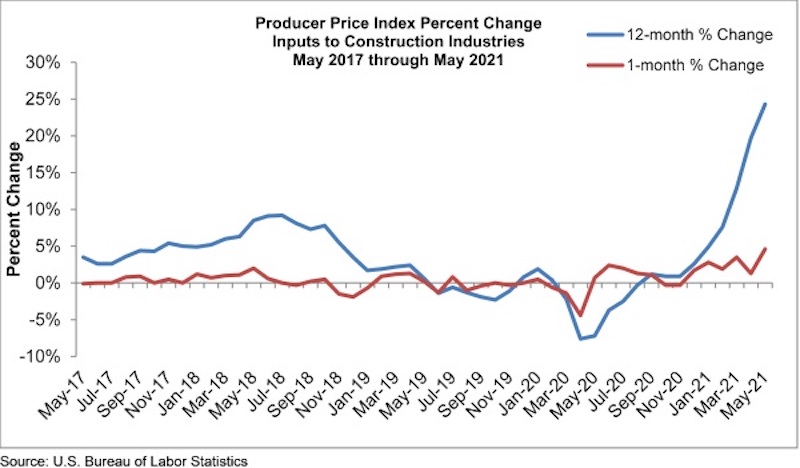

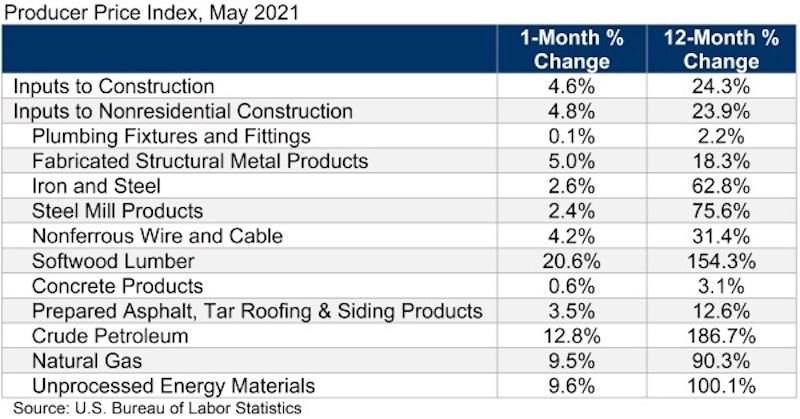

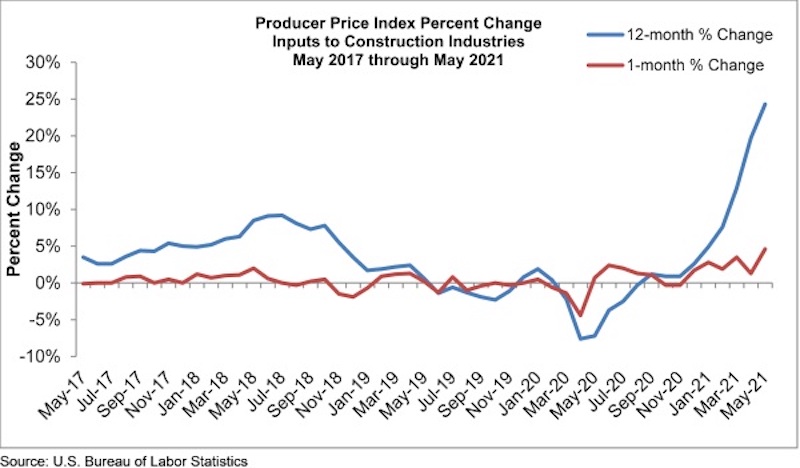

Construction input prices increased 4.6% in May compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data released today. Nonresidential construction input prices increased 4.8% for the month.

Construction input prices are 24.3% higher than a year ago, while nonresidential construction input prices increased 23.9% over that span. Similar to last month, all three energy subcategories registered significant year-over-year price increases. Crude petroleum has risen 187%, while the prices of unprocessed energy materials and natural gas have increased 100% and 90%, respectively. The price of softwood lumber has expanded 154% over the past year.

“The specter of elevated construction input prices will not end anytime soon,” said ABC Chief Economic Anirban Basu. “While global supply chains should become more orderly over time as the pandemic fades into memory, global demand for inputs will be overwhelming as the global economy comes back to life. Domestically, contractors expect sales to rise over the next six months, as indicated by ABC’s Construction Confidence Index. This means that project owners who delayed the onset of construction for a few months in order to secure lower bids may come to regret that decision.

“Many economists continue to believe that the surge in prices is temporary, the result of an economic reopening shock,” said Basu. “To a large extent, they are correct. The cure for high prices is high prices. When prices are elevated, suppliers have greater incentive to boost capacity and bolster output. That dynamic eventually results in a downward shift in prices. Operations at input producers should also become smoother over time as staff is brought back and standard operating procedures are reestablished.

“Still, there are some things that have changed during the pandemic and will not shift back,” said Basu. “For instance, money supply around the world has expanded significantly. Governments have been running large deficits. This means that some of the inflationary pressure that contractors and others are experiencing may not be temporary, and that inflation and interest rates may not be as low during the decade ahead as they were during the decade leading up to the pandemic.”

Related Stories

Market Data | Mar 23, 2016

AIA: Modest expansion for Architecture Billings Index

Business conditions softening most in Midwest in recent months.

Retail Centers | Mar 16, 2016

Food and technology will help tomorrow’s malls survive, says CallisonRTKL

CallisonRTKL foresees future retail centers as hubs with live/work/play components.

Market Data | Mar 6, 2016

Real estate execs measure success by how well they manage ‘talent,’ costs, and growth

A new CBRE survey finds more companies leaning toward “smarter” workspaces.

Market Data | Mar 1, 2016

ABC: Nonresidential spending regains momentum in January

Nonresidential construction spending expanded 2.5% on a monthly basis and 12.3% on a yearly basis, totaling $701.9 billion. Spending increased in January in 10 of 16 nonresidential construction sectors.

Market Data | Mar 1, 2016

Leopardo releases 2016 Construction Economics Report

This year’s report shows that spending in 2015 reached the highest level since the Great Recession. Total spending on U.S. construction grew 10.5% to $1.1 trillion, the largest year-over-year gain since 2007.

Market Data | Feb 26, 2016

JLL upbeat about construction through 2016

Its latest report cautions about ongoing cost increases related to finding skilled laborers.

Market Data | Feb 17, 2016

AIA reports slight contraction in Architecture Billings Index

Multifamily residential sector improving after sluggish 2015.

Market Data | Feb 11, 2016

AIA: Continued growth expected in nonresidential construction

The American Institute of Architects’ semi-annual Consensus Construction Forecast indicates a growth of 8% in construction spending in 2016, and 6.7% the following year.

Market Data | Feb 10, 2016

Nonresidential building starts and spending should see solid gains in 2016: Gilbane report

But finding skilled workers continues to be a problem and could inflate a project's costs.

Market Data | Feb 9, 2016

Cushman & Wakefield is bullish on U.S. economy and its property markets

Sees positive signs for construction and investment growth in warehouses, offices, and retail