Construction employment declined by 975,000 jobs in April as a new survey by the Associated General Contractors of America and data from construction technology firm Procore show deteriorating demand for construction, officials with the association announced today. The new economic data underscores the need for new federal measures to help the construction industry recover, including infrastructure funding, safe harbor provisions and fixes to the Paycheck Protection Program guidance, association officials added.

“Today’s jobs report, our new survey results and Procore’s data make it clear that the construction industry is not immune to the economic damage being inflicted on our country by the pandemic,” said Ken Simonson, the association’s chief economist. “Without new federal help, it is hard to see a scenario where the construction industry will be able to recover any time soon.”

The economist said the loss of 975,000 construction jobs from March to April constituted nearly 13% of the industry’s employment and was, by far, the worst one-month decline ever. He added that unemployment among workers with recent construction experience soared by 1.1 million from a year earlier, to 1,531,000, while the unemployment rate in construction jumped from 4.7% in April 2019 to 16.6%.

Simonson noted that a survey of over 800 construction firms the association released today found that while only 30% of firms report projects have been halted by government order – down from 35% two weeks ago – 37% say their owners have voluntarily halted work out of fears of the pandemic. Thirty-one percent report that owners have canceled projects because of a predicted reduction in demand. And 21% report having projects canceled as a result of a loss of private funding.

All told, 67% of firms report having a project canceled or delayed since the start of the outbreak in early March. These cancellations have forced some firms to cut staff. Twenty-three percent, for example, report cutting staff in March and 22% cut staff in April. Yet the economist said the job losses would likely have been worse if not for the federal government’s Paycheck Protection Program loans, noting that 80% of respondents report having applied for the loans and most having been approved.

The association economist cautioned, however, that recent revisions by the Treasury Department to its guidance for the loans have prompted quite a few firms to consider returning the funds. Eighteen percent of firms report they are considering returning the funds because of the vague guidance, and most of these will be forced to cut staff as a result. Simonson added that is one reason why 12% of firms report they plan to make additional layoffs within the next four weeks.

“Unfortunately, our survey indicates that layoffs are continuing to occur throughout the nation,” Simonson added. “Between March 1 and May 1, 39% of responding firms reduced their headcount. Reductions were particularly severe in the Northeast, where 53% of firms terminated or furloughed employees. The South had the fewest firms reporting staff reductions—29%, while 38% of firms in the Midwest and 45% in the West reduced headcount.”

In addition to the new survey results, the association also shared new data released by construction technology firm Procore. The data is based on the transactions logged via the company’s software by tens of thousands of construction firms across the country. That data is available here and shows how demand and hours-worked have declined in most states since the start of the pandemic. Procore also released a new blog post about the data that can be found here.

“We realized that the construction industry primarily gathers data through surveys, which can take a long time, and it’s pretty tough to get a quick visualization or snapshot of what’s going on with construction at a national and state level. So we decided to do something about it,” said Kristopher Lengieza, Senior Director of Business Development at Procore. “These insights are helping industry organizations and economists analyze trends, debate potential courses of action, and decide on the best path forward, in an effort to support the construction industry through the current pandemic.”

Simonson noted that the construction association was calling on federal officials to take additional steps to prevent additional industry layoffs. Among those steps are clarifying the guidance regarding the paycheck protection program. He also noted that 61% of survey respondents say Congress should enact a “safe harbor” set of protocols to provide firms that are following safe practices with protection from tort or employment liability for failing to prevent a Covid-19 infection.

In addition, 43% of survey respondents hope for a larger federal investment in infrastructure, which will be especially vital as budget constraints force many state and local officials to curtail capital expenditures. And 32% of firms report they would like Washington to enact a Covid-19 business and employee continuity and recovery fund. And an equal percent wants Congress to fill state highway transportation departments’ immediate, $50 billion funding gap.

“Federal officials can, and should, take additional steps to help avoid more layoffs and economic hardship,” Simonson added. “The construction industry’s job losses have little to do with temporary work-stoppages, but a lot to do with longer-term economic problems that will not end with the stay-at-home orders.”

Click here for the association’s survey results and here for a video summary of the survey responses. Click here for Procore’s new construction data.

Related Stories

Student Housing | Feb 21, 2024

Student housing preleasing continues to grow at record pace

Student housing preleasing continues to be robust even as rent growth has decelerated, according to the latest Yardi Matrix National Student Housing Report.

Architects | Feb 21, 2024

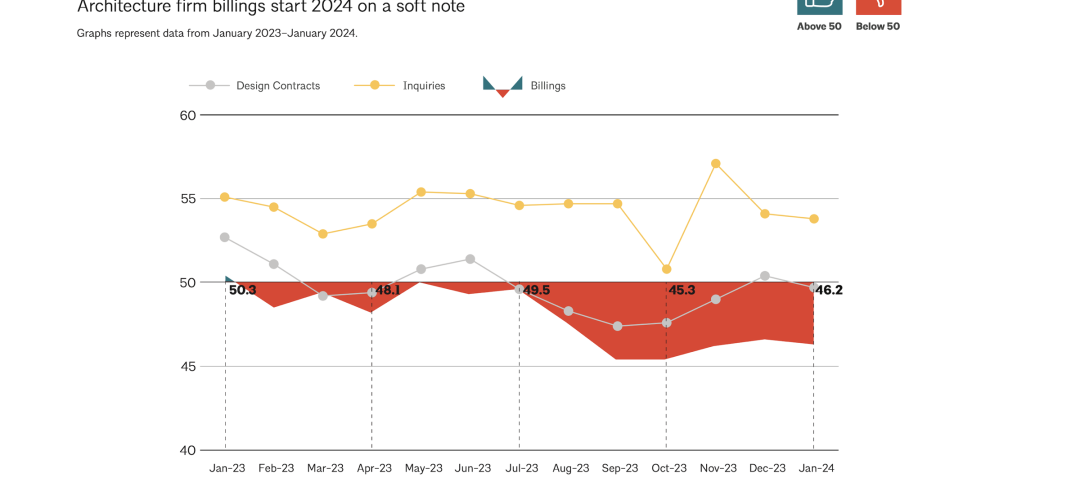

Architecture Billings Index remains in 'declining billings' state in January 2024

Architecture firm billings remained soft entering into 2024, with an AIA/Deltek Architecture Billings Index (ABI) score of 46.2 in January. Any score below 50.0 indicates decreasing business conditions.

Multifamily Housing | Feb 14, 2024

Multifamily rent remains flat at $1,710 in January

The multifamily market was stable at the start of 2024, despite the pressure of a supply boom in some markets, according to the latest Yardi Matrix National Multifamily Report.

Student Housing | Feb 13, 2024

Student housing market expected to improve in 2024

The past year has brought tough times for student housing investment sales due to unfavorable debt markets. However, 2024 offers a brighter outlook if debt conditions improve as predicted.

Contractors | Feb 13, 2024

The average U.S. contractor has 8.4 months worth of construction work in the pipeline, as of January 2024

Associated Builders and Contractors reported today that its Construction Backlog Indicator declined to 8.4 months in January, according to an ABC member survey conducted from Jan. 22 to Feb. 4. The reading is down 0.6 months from January 2023.

Industry Research | Feb 8, 2024

New multifamily development in 2023 exceeded expectations

Despite a problematic financing environment, 2023 multifamily construction starts held up “remarkably well” according to the latest Yardi Matrix report.

Market Data | Feb 7, 2024

New download: BD+C's February 2024 Market Intelligence Report

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.

Industry Research | Jan 31, 2024

ASID identifies 11 design trends coming in 2024

The Trends Outlook Report by the American Society of Interior Designers (ASID) is the first of a three-part outlook series on interior design. This design trends report demonstrates the importance of connection and authenticity.

Apartments | Jan 26, 2024

New apartment supply: Top 5 metros delivering in 2024

Nationally, the total new apartment supply amounts to around 1.4 million units—well exceeding the apartment development historical average of 980,000 units.

Self-Storage Facilities | Jan 25, 2024

One-quarter of self-storage renters are Millennials

Interest in self-storage has increased in over 75% of the top metros according to the latest StorageCafe survey of self-storage preferences. Today, Millennials make up 25% of all self-storage renters.