Gilbane has released its Spring 2014 edition of the periodic report "Construction Economics: Market Conditions in Construction" (download the full report).

Among the findings from the Executive Summary:

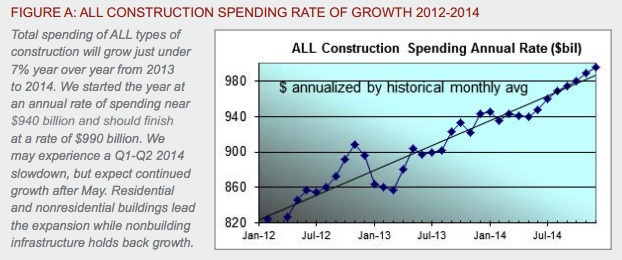

CONSTRUCTION GROWTH IS LOOKING UP

- Construction Spending for 2014 will finish the year 6.6% higher than 2013. Nonresidential buildings will contribute substantially to the growth.

- The Architecture Billings Index (ABI) in 2013 dropped below 50 in April, November and December briefly, indicating declining workload. Overall the ABI portrays a good leading indicator for future new construction work.

- Selling price data for 2013 shows contractors adding to their margins.

- Construction jobs grew by 156,000 in 2013, less than anticipated. However, hours worked also grew by 3%, the equivalent of another 150,000+ jobs.

SOME ECONOMIC FACTORS ARE STILL NEGATIVE

- We are experiencing a slight slowdown in construction spending that could last through May, influenced by a slight dip in nonresidential buildings and a brief flattening in residential, but more so by a steep decline in nonbuilding infrastructure spending. The monthly rate of spending for nonbuilding infrastructure may decline by 10% through Q3 2014.

- The construction workforce and hours worked is still 22% below the 2006 peak. At peak average growth rates, it will take a minimum of five more years to return to previous peak levels.

- Construction volume is 23% below peak inflation adjusted spending, which was almost constant from 2000 through 2006. At average peak growth rates of 8% per year, and factoring out inflation to get real volume growth, it will take eight more years to regain previous peak volume levels.

- As workload expands in the next few years, a shortage of available skilled workers may have a detrimental effect on cost, productivity and the ability to readily increase construction volume.

THE EFFECTS OF GROWTH

- Construction spending during the first five months of 2013 declined from the rate of spending in Q4 2012. Growth has been inconsistent, even in the booming residential sector, which has seen recent declines. We see more consistent growth in 2014 for buildings.

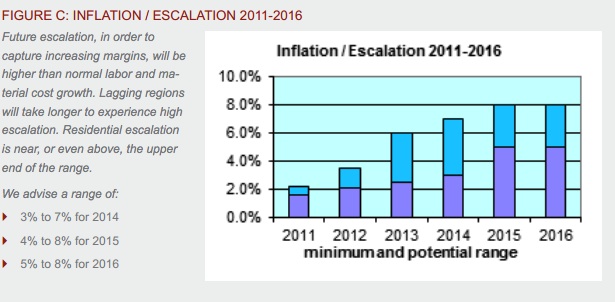

- As spending continues to increase, contractors gain more ability to pass along costs and increase margins. The growth in contractor margins slowed since last year. However, expected increases in volume should reverse that in 2014.

- ENR’s Third Quarter 2013 Cost Report shows general purpose and material cost indices increased on average about 2% to 2.5% year over year. However, selling price indices increased 4% on average. The difference between these indices is increased margins.

IMPACT OF RECENT EVENTS

- There are several reasons why spending is not rapidly increasing: public sector construction remains depressed as sequestration continues; the government is spending less on schools and infrastructure; lenders are just beginning to loosen lending criteria; consumers are still cautious about increasing debt load, including the consumers’ share of public debt and we may be constrained by a skilled labor shortage.

- Supported by overall positive growth trends for year 2014, Gilbane expects margins and overall escalation to climb more rapidly than we have seen in six years.

- Growth in nonresidential buildings and residential construction in 2014 will lead to more significant labor demand, resulting in labor shortages and productivity losses. Margins regained a positive footing in 2012 and extended those gains in 2013. Expect margins to grow stronger in 2014. When activity picks up in all sectors, escalation will begin to advance rapidly.

Click here to download the complete report and a list of data sources.

ABOUT THIS REPORT

Gilbane Inc. is a full service construction and real estate development company, composed of Gilbane Building Company and Gilbane Development Company. The company (www.gilbaneco.com) is one of the nation’s largest construction and program managers providing a full slate of facilities related services for clients in education, healthcare, life sciences, mission critical, corporate, sports and recreation, criminal justice, public and aviation markets. Gilbane has more than 50 offices worldwide, with its corporate office located in Providence, Rhode Island. The information in this report is not specific to any one region.

Related Stories

Cultural Facilities | Mar 27, 2024

Kansas City’s new Sobela Ocean Aquarium home to nearly 8,000 animals in 34 habitats

Kansas City’s new Sobela Ocean Aquarium is a world-class facility home to nearly 8,000 animals in 34 habitats ranging from small tanks to a giant 400,000-gallon shark tank.

Market Data | Mar 26, 2024

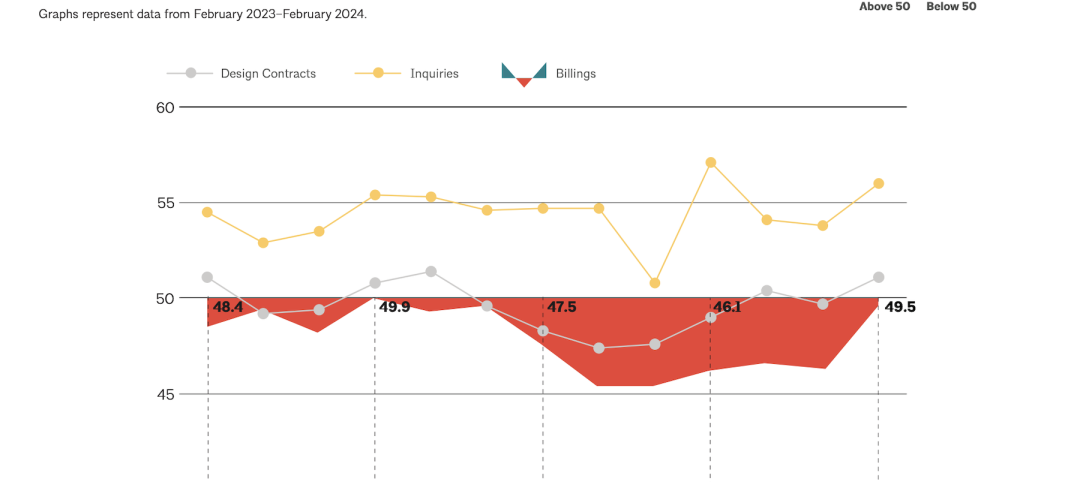

Architecture firm billings see modest easing in February

Architecture firm billings continued to decline in February, with an AIA/Deltek Architecture Billings Index (ABI) score of 49.5 for the month. However, February’s score marks the most modest easing in billings since July 2023 and suggests that the recent slowdown may be receding.

Cultural Facilities | Mar 26, 2024

Renovation restores century-old Brooklyn Paramount Theater to its original use

The renovation of the iconic Brooklyn Paramount Theater restored the building to its original purpose as a movie theater and music performance venue. Long Island University had acquired the venue in the 1960s and repurposed it as the school’s basketball court.

Adaptive Reuse | Mar 26, 2024

Adaptive Reuse Scorecard released to help developers assess project viability

Lamar Johnson Collaborative announced the debut of the firm’s Adaptive Reuse Scorecard, a proprietary methodology to quickly analyze the viability of converting buildings to other uses.

Security and Life Safety | Mar 26, 2024

Safeguarding our schools: Strategies to protect students and keep campuses safe

HMC Architects' PreK-12 Principal in Charge, Sherry Sajadpour, shares insights from school security experts and advisors on PreK-12 design strategies.

Green | Mar 25, 2024

Zero-carbon multifamily development designed for transactive energy

Living EmPower House, which is set to be the first zero-carbon, replicable, and equitable multifamily development designed for transactive energy, recently was awarded a $9 million Next EPIC Grant Construction Loan from the State of California.

Museums | Mar 25, 2024

Chrysler Museum of Art’s newly expanded Perry Glass Studio will display the art of glassmaking

In Norfolk, Va., the Chrysler Museum of Art’s Perry Glass Studio, an educational facility for glassmaking, will open a new addition in May. That will be followed by a renovation of the existing building scheduled for completion in December.

Sustainability | Mar 21, 2024

World’s first TRUE-certified building project completed in California

GENESIS Marina, an expansive laboratory and office campus in Brisbane, Calif., is the world’s first Total Resource Use and Efficiency (TRUE)-certified construction endeavor. The certification recognizes projects that achieve outstanding levels of resource efficiency through waste reduction, reuse, and recycling practices.

Office Buildings | Mar 21, 2024

Corporate carbon reduction pledges will have big impact on office market

Corporate carbon reduction commitments will have a significant impact on office leasing over the next few years. Businesses that have pledged to reduce their organization’s impact on climate change must ensure their next lease allows them to show material progress on their goals, according to a report by JLL.