Forty-four states and the District of Columbia added construction jobs between October 2017 and October 2018, while 36 states and D.C. added construction jobs between September and October, according to an analysis recently released by the Associated General Contractors of America of Labor Department data. Association officials said that firms in most parts of the country are adding staff to keep pace with growing demand for construction, but cautioned that rising labor and materials costs could undermine future demand.

"Construction activity continues to expand at a steady clip, with employment growing by more than 10% during the past year in five states and by more than 5% in another 18 states," said chief economist Ken Simonson. "As contractors pay more for labor and most of the materials they use to build, construction costs will climb, potentially dampening future demand for their services."

Texas added the most construction jobs during the past year (49,900 jobs, 6.9%). Other states adding a large number of new construction jobs for the past 12 months include Florida (43,400 jobs, 8.5%), California (30,000 jobs, 3.6%), Georgia (21,600 jobs, 11.6%), Arizona (18,000 jobs, 12.1%) and New York (15,600 jobs, 4.1%). Arizona added the highest percentage of new construction jobs during the past year, followed by Georgia, Nevada (11.4%, 9,500 jobs), Oregon (10.5%, 10,400 jobs), New Hampshire (10.3%, 2,800 jobs) and Florida. Construction employment reached a record high in five states: Massachusetts, New York, Oregon, Texas and Washington.

Six states shed construction jobs between October 2017 and 2018. The largest declines and steepest percentage losses occurred in New Jersey (-3,800 jobs, -2.5%), followed by South Carolina (-1,700 jobs, -1.7%), Oklahoma (-500 jobs, -0.6%), Hawaii (-300 jobs, -0.8%) and Mississippi (-300 jobs, -0.7%).

Among the 36 states with one-month job gains between September and October, Florida (3,000 jobs, 0.5%) and California (3,000 jobs, 0.4%) had the largest gains, followed by Arizona (2,500 jobs, 1.5%), Georgia (2,500 jobs, 1.2%), Washington (2,500 jobs, 1.2%) and New York (2,500 jobs, 0.6%). Iowa added the highest percentage of construction jobs for the month (2.0%, 1,600 jobs), followed by Wyoming (1.9%, 400 jobs) and Rhode Island (1.6%, 300 jobs).

From September to October, construction employment declined in 12 states and was unchanged in Connecticut and Maine. Louisiana lost the most construction jobs (-1,900 jobs, -1.3%), followed by Oklahoma (-900 jobs, -1.2%) and Michigan (-900 jobs, -0.5%). Mississippi lost the highest percentage of construction jobs in October (-1.6%, -700 jobs), followed by Montana (-1.4%, -400 jobs), Louisiana and Oklahoma.

Association officials said widespread construction employment gains are a sign of strong demand for construction services in most parts of the country. But they cautioned that without new investments in career and technical education, immigration reform and swift resolution of trade disputes, labor and materials costs will continue to climb.

"Firms in many parts of the country are hiring as fast as they can find qualified workers to bring onboard just to keep pace with demand," said Stephen E. Sandherr, the association's chief executive officer. "But at some point, the increasing costs of labor and construction materials are going to drive construction prices to the point where many customers reschedule or rethink their projects."

View the state employment data by rank, state and peaks. View the state employment map.

Related Stories

Giants 400 | Sep 5, 2023

Top 80 Construction Management Firms for 2023

Alfa Tech, CBRE Group, Skyline Construction, Hill International, and JLL top the rankings of the nation's largest construction management (as agent) and program/project management firms for nonresidential buildings and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Sep 5, 2023

Top 150 Contractors for 2023

Turner Construction, STO Building Group, DPR Construction, Whiting-Turner Contracting Co., and Clark Group head the ranking of the nation's largest general contractors, CM at risk firms, and design-builders for nonresidential buildings and multifamily buildings work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Market Data | Sep 5, 2023

Nonresidential construction spending increased 0.1% in July 2023

National nonresidential construction spending grew 0.1% in July, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.08 trillion and is up 16.5% year over year.

Giants 400 | Aug 31, 2023

Top 35 Engineering Architecture Firms for 2023

Jacobs, AECOM, Alfa Tech, Burns & McDonnell, and Ramboll top the rankings of the nation's largest engineering architecture (EA) firms for nonresidential buildings and multifamily buildings work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Aug 22, 2023

Top 115 Architecture Engineering Firms for 2023

Stantec, HDR, Page, HOK, and Arcadis North America top the rankings of the nation's largest architecture engineering (AE) firms for nonresidential building and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Aug 22, 2023

2023 Giants 400 Report: Ranking the nation's largest architecture, engineering, and construction firms

A record 552 AEC firms submitted data for BD+C's 2023 Giants 400 Report. The final report includes 137 rankings across 25 building sectors and specialty categories.

Giants 400 | Aug 22, 2023

Top 175 Architecture Firms for 2023

Gensler, HKS, Perkins&Will, Corgan, and Perkins Eastman top the rankings of the nation's largest architecture firms for nonresidential building and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Apartments | Aug 22, 2023

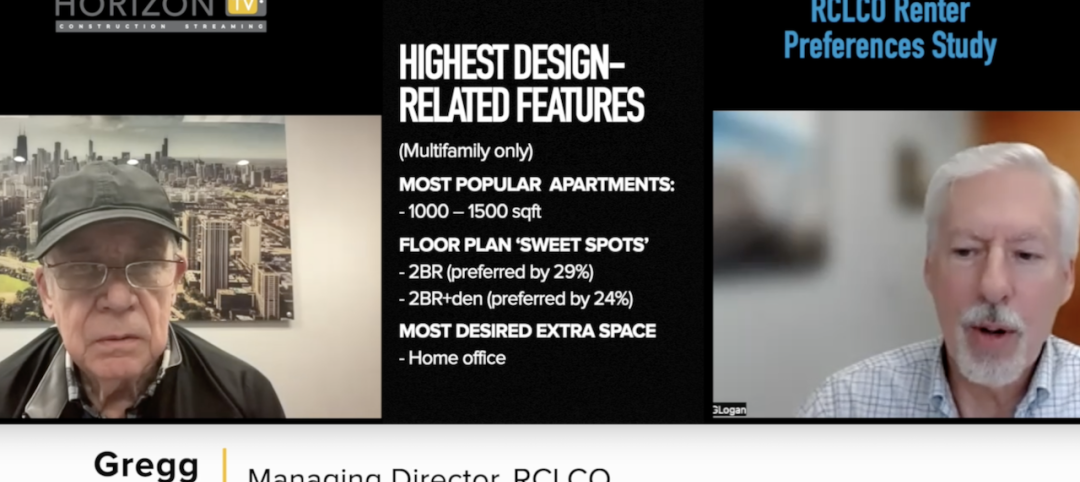

Key takeaways from RCLCO's 2023 apartment renter preferences study

Gregg Logan, Managing Director of real estate consulting firm RCLCO, reveals the highlights of RCLCO's new research study, “2023 Rental Consumer Preferences Report.” Logan speaks with BD+C's Robert Cassidy.

Market Data | Aug 18, 2023

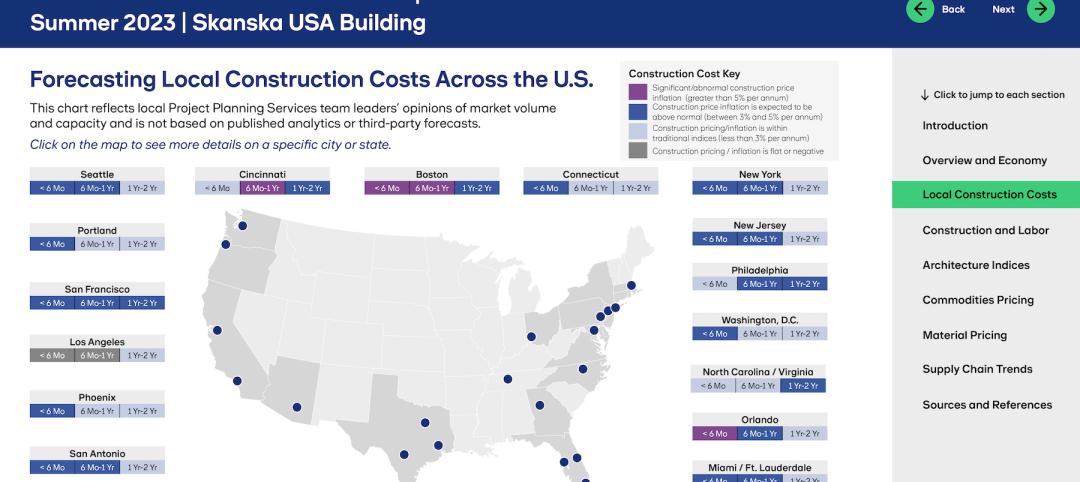

Construction soldiers on, despite rising materials and labor costs

Quarterly analyses from Skanska, Mortenson, and Gordian show nonresidential building still subject to materials and labor volatility, and regional disparities.

Apartments | Aug 14, 2023

Yardi Matrix updates near-term multifamily supply forecast

The multifamily housing supply could increase by up to nearly 7% by the end of 2023, states the latest Multifamily Supply Forecast from Yardi Matrix.