Construction employment rebounded from April to May in 45 states and the District of Columbia, following the loss of nearly one million construction jobs nationwide in April, but the gains may be short-lived, according to an analysis by the Associated General Contractors of America of government data released today and a survey the association released on Thursday. Association officials urged officials in Washington to promptly enact measures to fund infrastructure projects and plug looming state and local budget deficits to avoid a “second wave” of job losses.

“The widespread uptick in construction employment in May is welcome news following a month in which industry employment shrank in all but one state,” said Ken Simonson, the association’s chief economist. “Our association’s latest survey shows many firms have been recalling or adding employees in recent weeks, thanks in part to rapid receipt of Paycheck Protection Program loans. But only about one-fifth of firms report winning new or expanded projects, while almost one-third of firms say an upcoming project has been canceled.”

Simonson noted that the association’s latest survey found that nearly one-fourth of contractors reported a project that was scheduled to start in June or later had been canceled. He added that with most states and localities starting a new fiscal year on July 1, even more public construction is likely to be canceled unless the federal government makes up for some of their lost revenue and unbudgeted expenses.

Of the 45 states with construction job gains over the month, Pennsylvania had the largest increase (77,400 jobs or 48.9%). Michigan had the largest percentage increase (51.4%, 50,500 construction jobs). Construction employment declined from April to May in five states. Hawaii lost the largest number and highest percentage of construction jobs (-700 jobs, -1.9%).

From May 2019 to May 2020, 12 states added construction jobs while 38 states and D.C lost jobs. Utah added the most construction jobs over the year (8,200 jobs, 7.6%). South Dakota—the only state to add construction jobs in April—had the largest year-over-year percentage increase (10.3%, 2,400 jobs). Both states set new highs for construction employment, in a series dating to 1990. New York lost the most construction jobs over the year (105,300 jobs, -25.9%). The largest percentage decline occurred in Vermont (-26.1%, -4,000 jobs).

Association officials cautioned that even as the immediate impacts of the coronavirus appear to be easing, the industry is just beginning to appreciate the longer-term impacts of the pandemic. They warned that without new federal recovery measures, the industry was likely to experience a second wave of job losses. They urged Congress and the Trump administration to enact liability reform, pass new infrastructure funding measures, and find a way to incentivize laid-off employees to return to work.

“The economic boost that comes with lifting economic lockdowns will not be enough to sustain long-term growth for the industry,” said Stephen E. Sandherr, the association’s chief executive officer. “Boosting infrastructure spending, protecting firms that are operating safely and encouraging people to return to work will help convert short-term gains into longer-term growth.”

View the state employment data, rankings, map and high and lows. Click here for the association’s survey results and here for a video summary of the survey responses.

Related Stories

Market Data | Apr 4, 2016

ABC: Nonresidential spending slip in February no cause for alarm

Spending in the nonresidential sector totaled $690.3 billion on a seasonally adjusted, annualized basis in February. The figure is a step back but still significantly higher than one year ago.

Market Data | Mar 30, 2016

10 trends for commercial real estate: JLL report

The report looks at global threats and opportunities, and how CRE firms are managing their expectations for growth.

Market Data | Mar 23, 2016

AIA: Modest expansion for Architecture Billings Index

Business conditions softening most in Midwest in recent months.

Retail Centers | Mar 16, 2016

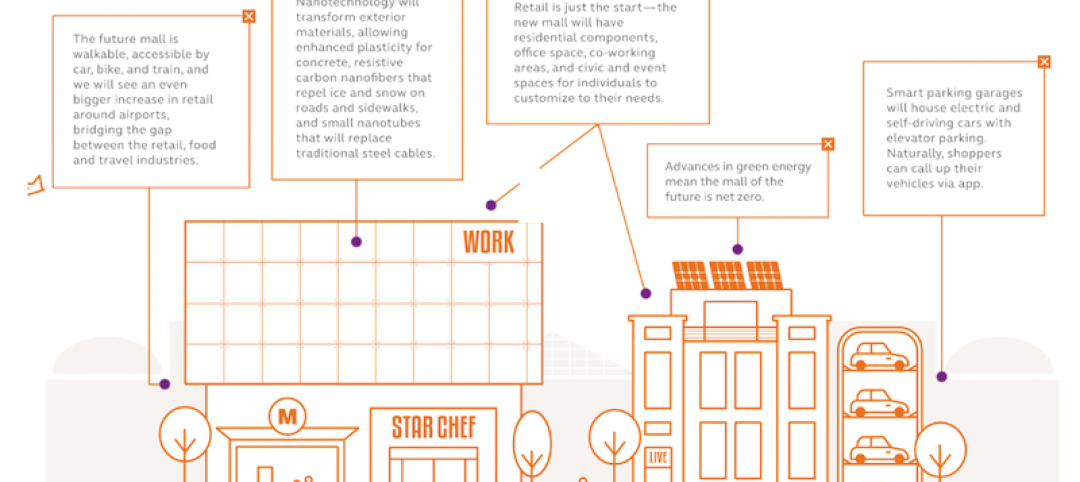

Food and technology will help tomorrow’s malls survive, says CallisonRTKL

CallisonRTKL foresees future retail centers as hubs with live/work/play components.

Market Data | Mar 6, 2016

Real estate execs measure success by how well they manage ‘talent,’ costs, and growth

A new CBRE survey finds more companies leaning toward “smarter” workspaces.

Market Data | Mar 1, 2016

ABC: Nonresidential spending regains momentum in January

Nonresidential construction spending expanded 2.5% on a monthly basis and 12.3% on a yearly basis, totaling $701.9 billion. Spending increased in January in 10 of 16 nonresidential construction sectors.

Market Data | Mar 1, 2016

Leopardo releases 2016 Construction Economics Report

This year’s report shows that spending in 2015 reached the highest level since the Great Recession. Total spending on U.S. construction grew 10.5% to $1.1 trillion, the largest year-over-year gain since 2007.

Market Data | Feb 26, 2016

JLL upbeat about construction through 2016

Its latest report cautions about ongoing cost increases related to finding skilled laborers.

Market Data | Feb 17, 2016

AIA reports slight contraction in Architecture Billings Index

Multifamily residential sector improving after sluggish 2015.

Market Data | Feb 11, 2016

AIA: Continued growth expected in nonresidential construction

The American Institute of Architects’ semi-annual Consensus Construction Forecast indicates a growth of 8% in construction spending in 2016, and 6.7% the following year.