Thirty-eight states and the District of Columbia added construction jobs between April 2017 and April 2018, while 29 states added construction jobs between March and April, according to an analysis by the Associated General Contractors of America of Labor Department data released today. Association officials said the employment growth likely would have been higher if firms could find more qualified workers to hire.

"Firms in many parts of the country are working to keep pace with growing demand for construction services," said chief economist Ken Simonson. "Many of those firms are having a hard time finding and hiring enough qualified workers as the pool of available workers remains very tight."

California added the most construction jobs (59,500 jobs, 7.4%) during the past year. Other states adding a large number of new construction jobs for the past 12 months include Texas (40,600 jobs, 5.7%); Florida (34,900 jobs, 7.0%); Georgia (13,900 jobs, 7.6%) and Arizona (11,700 jobs, 8.2%). West Virginia (11.6%, 3,500 jobs) added the highest percentage of new construction jobs during the past year, followed by Nevada (9.8 percent, 8,200 jobs); Arizona; Utah (8.1%, 7,700 jobs) and Idaho (7.9%, 3,500 jobs).

Eleven states shed construction jobs between April 2017 and April 2018 while construction employment was unchanged in Montana. North Dakota lost the highest total and percentage of construction jobs (-4,900 jobs, -17.0%), followed by Iowa (-2,500 jobs, -3.2%); Missouri (-1,500 jobs, -1.2%); South Carolina (-1,400 jobs, -1.4%) and Nebraska (-1,100 jobs, -2.1%). In addition to North Dakota, other states that lost a high percentage of construction jobs for the month included South Dakota (-3.3%, -800 jobs); Iowa; Nebraska and Hawaii (-1.9%, -700 jobs).

Twenty-nine states added construction jobs between March and April. California added the most (10,000 jobs, 1.2%), followed by Texas (4,100 jobs, 0.6%); Louisiana (2,200 jobs, 1.5%); Georgia (2,100 jobs, 1.1%) and Washington (2,100 jobs, 1.0%). Louisiana added the highest percentage of construction jobs for the month, followed by Kentucky (1.4%, 1,100 jobs); New Hampshire (1.4%, 400 jobs); Alaska (1.3%, 200 jobs) and Vermont (1.3%, 200 jobs). Employment set an all-time high in Texas.

Nineteen states lost construction jobs from March to April, while construction employment was unchanged in Mississippi, Montana and the District of Columbia. Indiana lost the most construction jobs for the month (-2,300 jobs, -1.6%), followed by Wisconsin (-2,000 jobs, -1.6%); South Carolina (-1,300 jobs, -1.3%); Massachusetts (-1,300 jobs, -0.8%) and Michigan (-1,100 jobs, -0.6%). North Dakota lost the highest percentage of construction jobs (-2.8%, -700 jobs), followed by Delaware (-1.7%, -400 jobs); Wisconsin; Indiana; South Carolina and South Dakota (-1.3%, -300 jobs).

Association officials said strong demand, particularly from the private-sector, was prompting firms in most states to add staff. But they cautioned that relatively few young workers appear to be entering the construction industry. They said the strong economy was increasing competition for most workers and construction recruiting is hampered by the fact relatively few schools offer instruction in construction skills or counsel students to consider high-paying construction careers.

"The collective cultural fixation on urging every student to go to college and seek office jobs means relatively few young adults are ever encouraged to consider careers in construction," said Stephen E. Sandherr, the association's chief executive officer. View the state employment data by rank, state, and peak. View the state employment map.

Related Stories

Giants 400 | Sep 5, 2023

Top 80 Construction Management Firms for 2023

Alfa Tech, CBRE Group, Skyline Construction, Hill International, and JLL top the rankings of the nation's largest construction management (as agent) and program/project management firms for nonresidential buildings and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Sep 5, 2023

Top 150 Contractors for 2023

Turner Construction, STO Building Group, DPR Construction, Whiting-Turner Contracting Co., and Clark Group head the ranking of the nation's largest general contractors, CM at risk firms, and design-builders for nonresidential buildings and multifamily buildings work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Market Data | Sep 5, 2023

Nonresidential construction spending increased 0.1% in July 2023

National nonresidential construction spending grew 0.1% in July, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.08 trillion and is up 16.5% year over year.

Giants 400 | Aug 31, 2023

Top 35 Engineering Architecture Firms for 2023

Jacobs, AECOM, Alfa Tech, Burns & McDonnell, and Ramboll top the rankings of the nation's largest engineering architecture (EA) firms for nonresidential buildings and multifamily buildings work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Aug 22, 2023

Top 115 Architecture Engineering Firms for 2023

Stantec, HDR, Page, HOK, and Arcadis North America top the rankings of the nation's largest architecture engineering (AE) firms for nonresidential building and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Aug 22, 2023

2023 Giants 400 Report: Ranking the nation's largest architecture, engineering, and construction firms

A record 552 AEC firms submitted data for BD+C's 2023 Giants 400 Report. The final report includes 137 rankings across 25 building sectors and specialty categories.

Giants 400 | Aug 22, 2023

Top 175 Architecture Firms for 2023

Gensler, HKS, Perkins&Will, Corgan, and Perkins Eastman top the rankings of the nation's largest architecture firms for nonresidential building and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Apartments | Aug 22, 2023

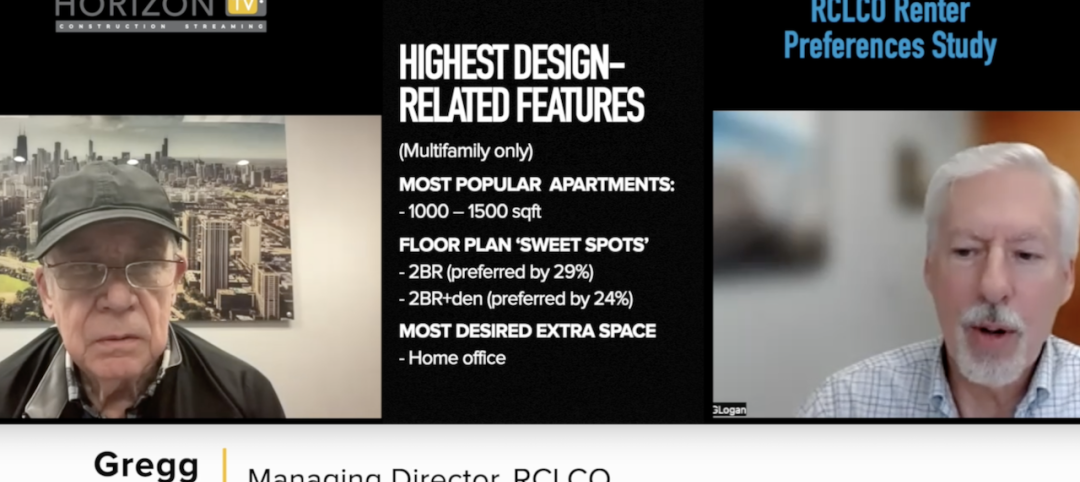

Key takeaways from RCLCO's 2023 apartment renter preferences study

Gregg Logan, Managing Director of real estate consulting firm RCLCO, reveals the highlights of RCLCO's new research study, “2023 Rental Consumer Preferences Report.” Logan speaks with BD+C's Robert Cassidy.

Market Data | Aug 18, 2023

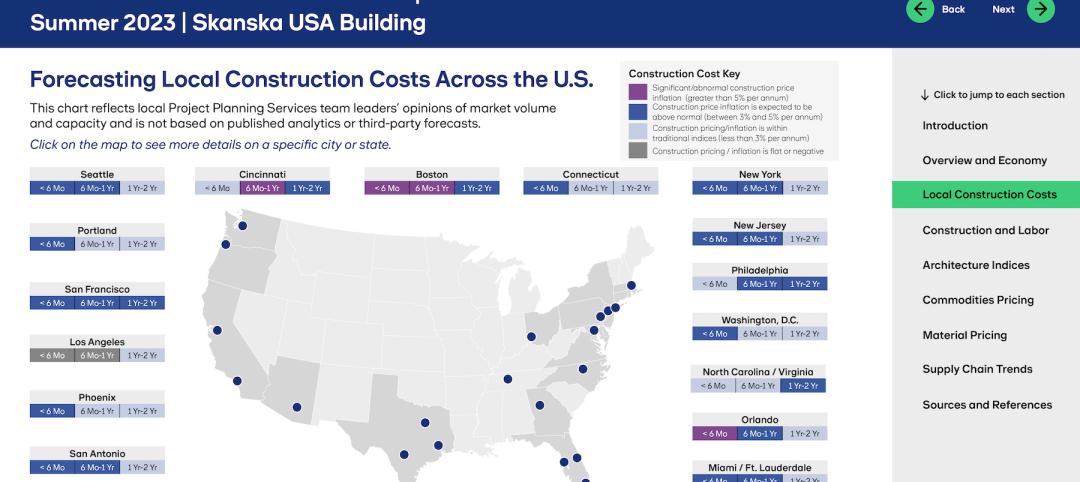

Construction soldiers on, despite rising materials and labor costs

Quarterly analyses from Skanska, Mortenson, and Gordian show nonresidential building still subject to materials and labor volatility, and regional disparities.

Apartments | Aug 14, 2023

Yardi Matrix updates near-term multifamily supply forecast

The multifamily housing supply could increase by up to nearly 7% by the end of 2023, states the latest Multifamily Supply Forecast from Yardi Matrix.