Construction employment declined by 61,000 in February, while the sector’s unemployment rate soared to 9.6% amid severe winter weather and continuing weakness in new nonresidential projects, according to an analysis by the Associated General Contractors of America of government data released today. Association officials urged Congress and the Biden administration to focus on new infrastructure funding, address rising materials prices and avoid disruptive measures like the PRO Act to stem further construction job losses.

“The steep decline in construction employment in February continues a downward trend in nonresidential activity that began before the disruptions caused by last month’s freezes and power losses,” said Ken Simonson, the association’s chief economist. “Despite recovery in some parts of the economy, private nonresidential construction is still experiencing many canceled and postponed projects and few new starts.”

Construction employment slumped by 61,000 from January to February, the first overall decline since April 2020. Employment totaled 7,340,000, a decrease of 308,000 or 4.0% from the most recent peak in February 2020.

The job loss was concentrated in nonresidential construction, with a decline of 60,800 jobs in February, following a dip of 400 jobs in January. The February 2021 total was 316,000 jobs or 6.8% less than a year earlier. Only half the jobs lost in the first two months of the pandemic had been regained by February. In the latest month, nonresidential building contractors shed 3,300 jobs and nonresidential specialty trade contractors lost 5,500 workers, while heavy and civil engineering construction firms—the category most likely to be affected by winter storms—lost 20,800 employees.

Residential construction employment—comprising residential building and specialty trade contractors—inched down by 200 jobs in February. But the sector’s employment remained slightly higher than a year ago.

Unemployment in construction soared over the past 12 months. A total of 921,000 former construction workers were unemployed, up from 531,000 a year earlier and the highest for February since 2014. The industry’s unemployment rate in February was 9.6%, compared to 5.5% in February 2020.

Association officials urged members of Congress to work with the Biden administration to quickly pass needed new infrastructure investments. They also urged the president to take steps to address soaring construction materials prices, including for lumber and steel, by easing tariffs and exploring steps to boost domestic production. They added that Congress should drop plans to impose the PRO Act, which would harm workers and undermine the fragile economic recovery.

“Washington officials can’t change the weather, but they can help boost demand for infrastructure, address spiking steel and lumber prices and avoid anti-recovery measures like the PRO Act,” said Stephen E. Sandherr, the association’s chief executive officer. “Stripping workers of their privacy and denying them the absolute right to secret ballot elections, as the PRO Act does, won’t boost demand for construction or put more people to work.”

Related Stories

Market Data | Aug 2, 2017

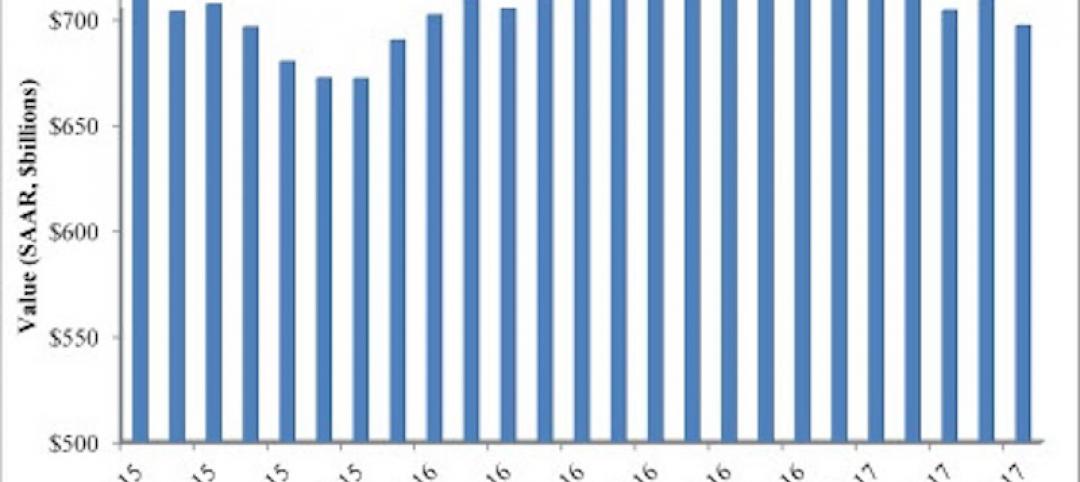

Nonresidential Construction Spending falls in June, driven by public sector

June’s weak construction spending report can be largely attributed to the public sector.

Market Data | Jul 31, 2017

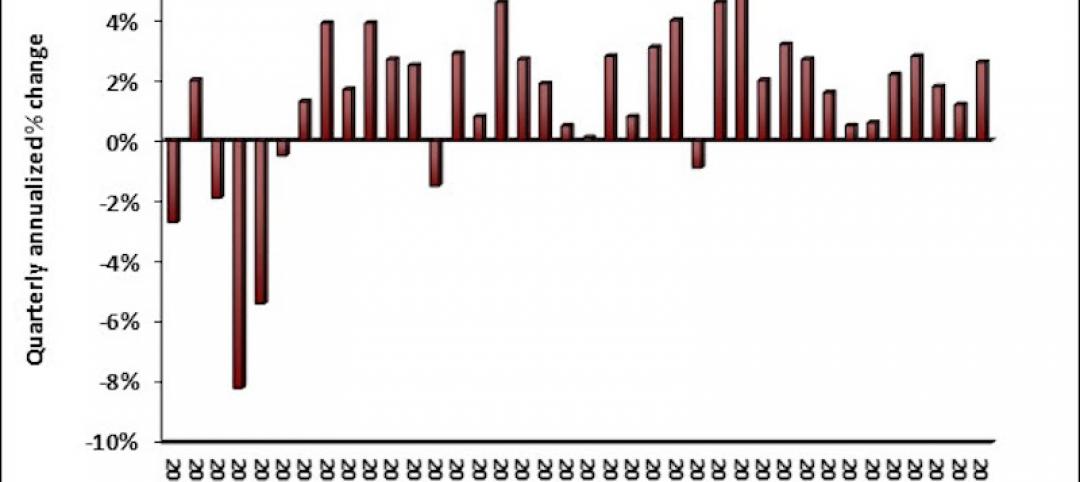

U.S. economic growth accelerates in second quarter; Nonresidential fixed investment maintains momentum

Nonresidential fixed investment, a category of GDP embodying nonresidential construction activity, expanded at a 5.2% seasonally adjusted annual rate.

Multifamily Housing | Jul 27, 2017

Apartment market index: Business conditions soften, but still solid

Despite some softness at the high end of the apartment market, demand for apartments will continue to be substantial for years to come, according to the National Multifamily Housing Council.

Market Data | Jul 25, 2017

What's your employer value proposition?

Hiring and retaining talent is one of the top challenges faced by most professional services firms.

Market Data | Jul 25, 2017

Moderating economic growth triggers construction forecast downgrade for 2017 and 2018

Prospects for the construction industry have weakened with developments over the first half of the year.

Industry Research | Jul 6, 2017

The four types of strategic real estate amenities

From swimming pools to pirate ships, amenities (even crazy ones) aren’t just perks, but assets to enhance performance.

Market Data | Jun 29, 2017

Silicon Valley, Long Island among the priciest places for office fitouts

Coming out on top as the most expensive market to build out an office is Silicon Valley, Calif., with an out-of-pocket cost of $199.22.

Market Data | Jun 26, 2017

Construction disputes were slightly less contentious last year

But poorly written and administered contracts are still problems, says latest Arcadis report.

Industry Research | Jun 26, 2017

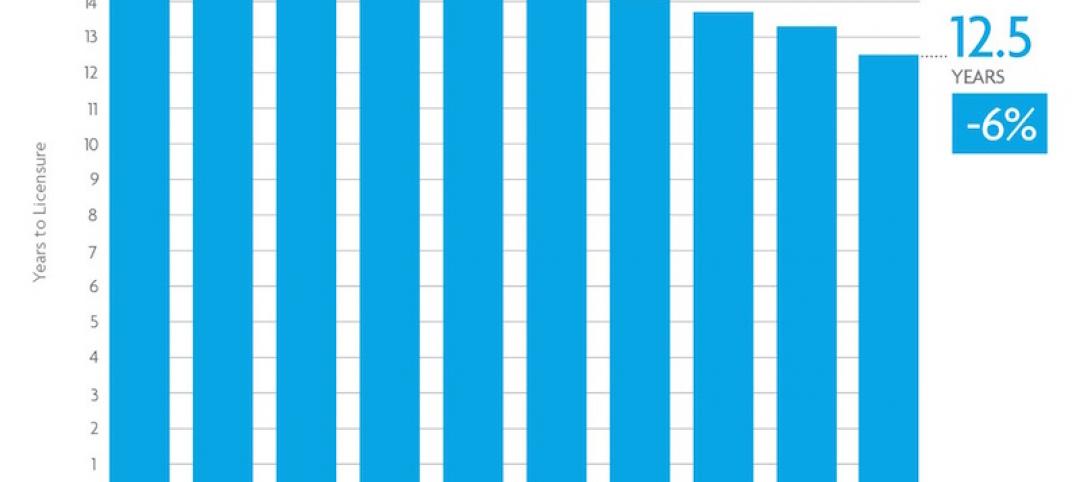

Time to earn an architecture license continues to drop

This trend is driven by candidates completing the experience and examination programs concurrently and more quickly.

Industry Research | Jun 22, 2017

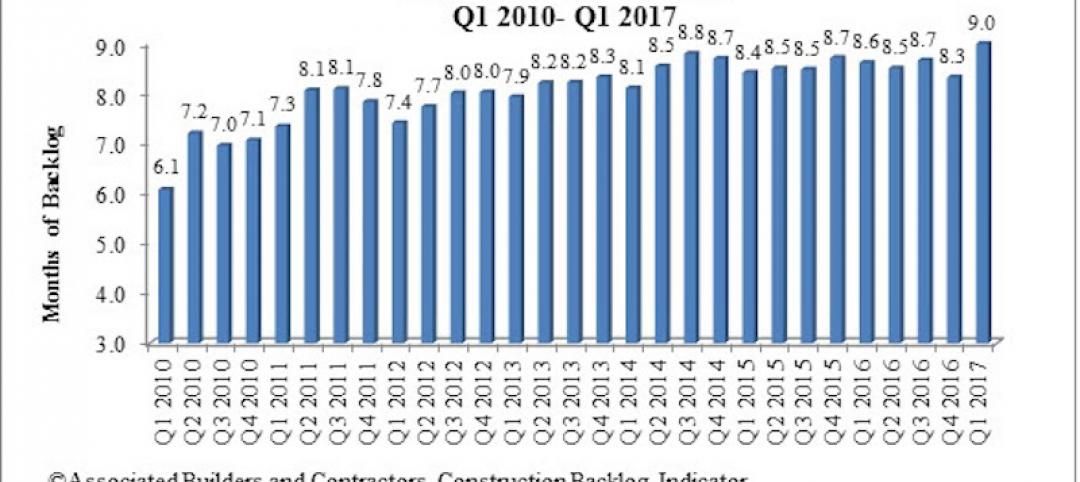

ABC's Construction Backlog Indicator rebounds in 2017

The first quarter showed gains in all categories.