Construction employment in May remained below the April level in 40 states and the District of Columbia, according to an analysis by the Associated General Contractors of America of government employment data released today. Association officials said skyrocketing materials prices and excessive delays in receiving key construction supplies were holding back the industry’s recovery.

“Today’s numbers show that impacts from the pandemic on demand for projects and on materials costs and the supply chain are weighing down construction in most parts of the country,” said Ken Simonson, the association’s chief economist. “In the few states where industry employment has topped the pre-pandemic levels of February 2020, most gains are likely attributable more to demand for homebuilding and remodeling than to most categories of nonresidential building and infrastructure projects.”

From April to May, construction employment decreased in 40 states and D.C., increased in only eight states, and held steady in Maryland and Utah. The largest decline over the month occurred in New York, which lost 5,900 construction jobs or 1.6%, followed by Illinois (-5,600 jobs, -2.5%) and Pennsylvania (-3,300 jobs, -1.3%). The steepest percentage declines since April occurred in Vermont (-3.9%, -600 jobs), followed by Maine (-3.5%, -1,100 jobs) and Delaware (-3.0%, -300 jobs).

Florida added the most construction jobs between April and May (3,700 jobs, 0.6%), followed by Michigan (1,600 jobs, 0.9%) and Minnesota (1,200 jobs, 0.9%). Oklahoma had the largest percentage gain for the month (1.3%, 1,000 jobs), followed by Minnesota and Michigan.

Employment declined from the pre-pandemic peak month of February 2020 in 42 states and D.C. Texas lost the most construction jobs over the period (-49,100 jobs or -6.3%), followed by New York (-45,200 jobs, -11.1%) and California (-30,800 jobs, -3.4%). Wyoming recorded the largest percentage loss (-15.3%, -3,500 jobs), followed by Louisiana (-15.1%, -20,700 jobs) and New York.

Among the eight states that added construction jobs since February 2020, the largest pickup occurred in Utah (5,000 jobs, 4.4%), followed by Idaho (3,400 jobs, 6.2%) and South Dakota (1,200 jobs, 5.0%). The largest percentage gain was in Idaho, followed by South Dakota and Utah.

Association officials noted that cost increases and extended lead times for producing many construction materials are exacerbating a slow recovery for construction. They urged the Biden administration to accelerate its timetable for reaching agreement with allies on removing tariffs on steel and aluminum, and to initiate talks to end tariffs on Canadian lumber.

“Federal officials can help get more construction workers employed by removing tariffs on essential construction materials such as lumber, steel and aluminum,” said Stephen E. Sandherr, the association’s chief executive officer. “These tariffs are causing unnecessary harm to construction workers and firms, as well as to the administration’s goals of building more affordable housing and infrastructure.”

View state February 2020-May 2021 data, 15-month rankings, 1-month rankings.

Related Stories

Market Data | Aug 2, 2017

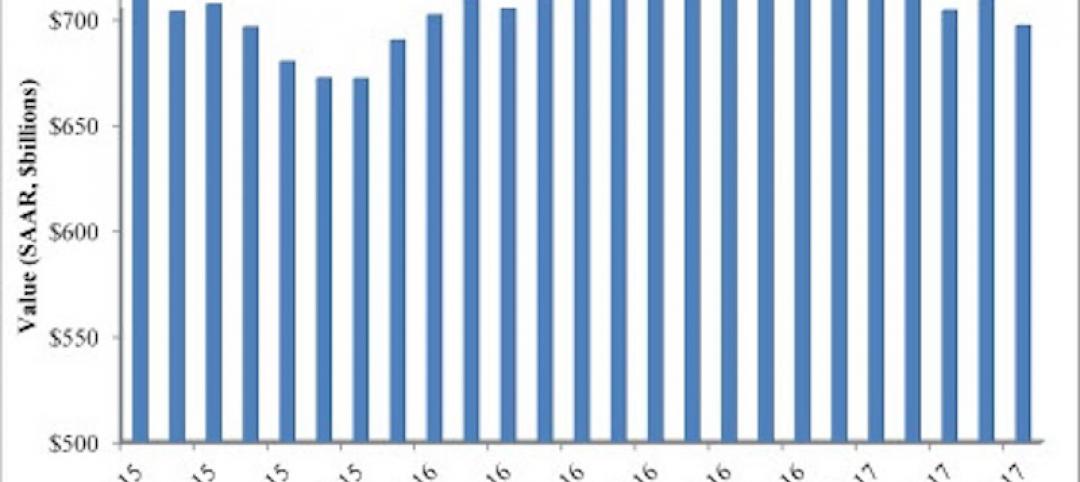

Nonresidential Construction Spending falls in June, driven by public sector

June’s weak construction spending report can be largely attributed to the public sector.

Market Data | Jul 31, 2017

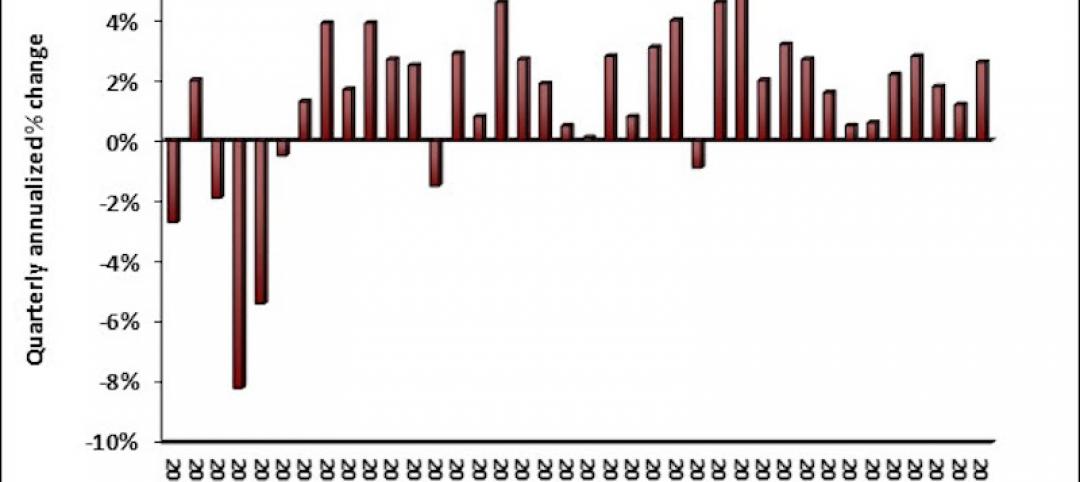

U.S. economic growth accelerates in second quarter; Nonresidential fixed investment maintains momentum

Nonresidential fixed investment, a category of GDP embodying nonresidential construction activity, expanded at a 5.2% seasonally adjusted annual rate.

Multifamily Housing | Jul 27, 2017

Apartment market index: Business conditions soften, but still solid

Despite some softness at the high end of the apartment market, demand for apartments will continue to be substantial for years to come, according to the National Multifamily Housing Council.

Market Data | Jul 25, 2017

What's your employer value proposition?

Hiring and retaining talent is one of the top challenges faced by most professional services firms.

Market Data | Jul 25, 2017

Moderating economic growth triggers construction forecast downgrade for 2017 and 2018

Prospects for the construction industry have weakened with developments over the first half of the year.

Industry Research | Jul 6, 2017

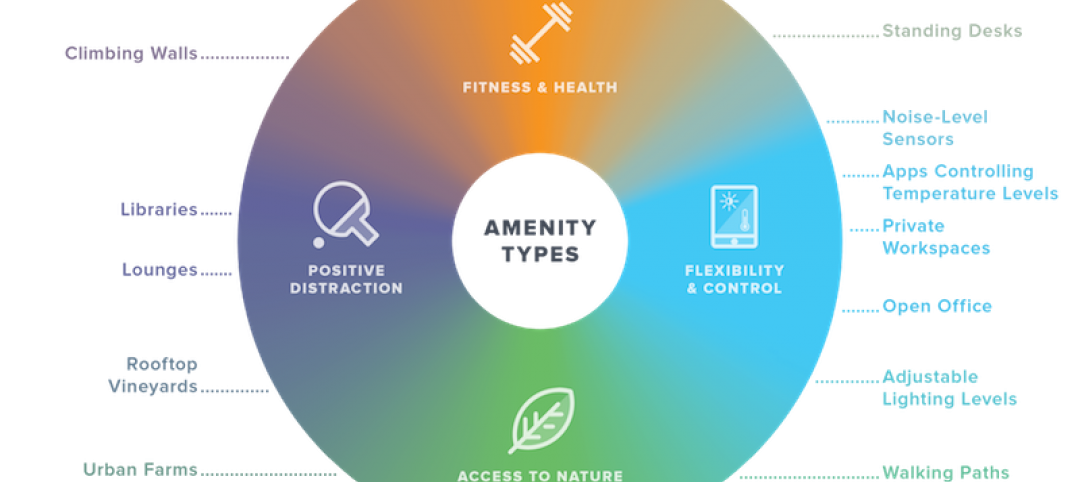

The four types of strategic real estate amenities

From swimming pools to pirate ships, amenities (even crazy ones) aren’t just perks, but assets to enhance performance.

Market Data | Jun 29, 2017

Silicon Valley, Long Island among the priciest places for office fitouts

Coming out on top as the most expensive market to build out an office is Silicon Valley, Calif., with an out-of-pocket cost of $199.22.

Market Data | Jun 26, 2017

Construction disputes were slightly less contentious last year

But poorly written and administered contracts are still problems, says latest Arcadis report.

Industry Research | Jun 26, 2017

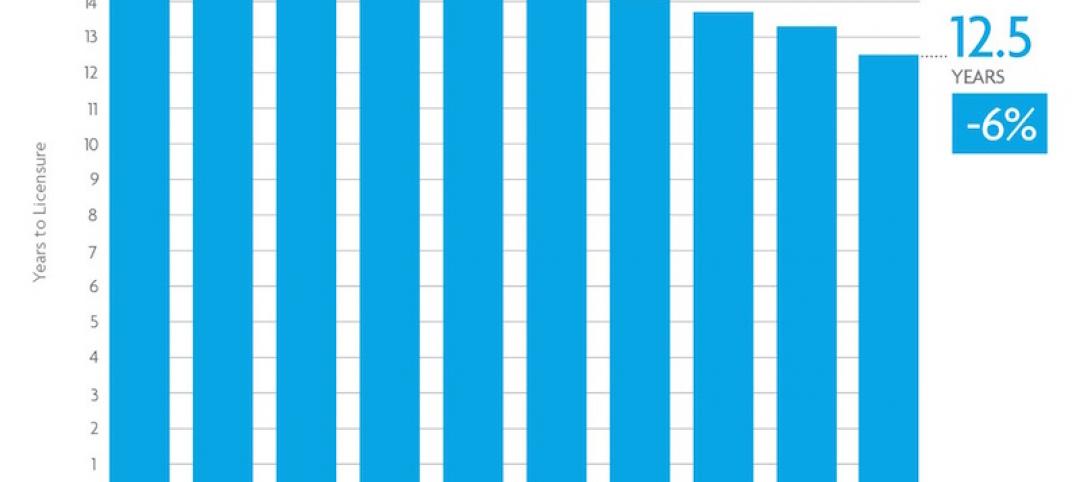

Time to earn an architecture license continues to drop

This trend is driven by candidates completing the experience and examination programs concurrently and more quickly.

Industry Research | Jun 22, 2017

ABC's Construction Backlog Indicator rebounds in 2017

The first quarter showed gains in all categories.