Construction employment declined in more than nine out of 10 metro areas from March to April, a time when industry employment typically increases in most locations, an analysis by the Associated General Contractors of America of new government data shows. Association officials said new federal transportation funding could help restore many lost construction jobs, but cautioned that new legislation released today by House Democrats includes new regulatory measures that could undermine the broader goals of the measure.

“Today’s employment report shows how few areas were left unscathed by April’s unprecedented job losses,” said Ken Simonson, the association’s chief economist. “Sadly, our latest survey shows project cancellations are escalating, making further job losses inevitable unless there is funding for widespread new projects.”

The economist said construction employment declined between March and April in 326, or 91%, out of 358 metro areas and increased in only 20 areas (6%). Industry employment was unchanged in 14 areas. Over the previous 30 years, 75% of metro areas added construction jobs from March to April, on average, while 12% of metros shed jobs.

New York City lost the largest number of construction jobs for the month: 75,900 jobs or 49% of the March total. There were also extremely large construction job losses in the Seattle-Bellevue-Everett, Wash. area, 44,200 jobs or 41%. Construction employment fell by half or more in three areas: Montgomery County-Bucks County-Chester County, Pa. (-54%, -27,200 jobs); Warren-Troy-Farmington Hills, Mich. (-52%, -26,100 jobs); and Brockton-Bridgewater-Easton, Mass. (-50%, -2,300 jobs).

Simonson noted that more respondents in the association’s latest survey reported an upcoming project had been canceled in May or June than in April, implying that further job losses are likely. One-fifth of respondents reported a project scheduled to begin in May had been canceled, as did nearly one-quarter (24%) of respondents regarding a project scheduled to start in June or later, compared to 16% in April.

Association officials said new federal infrastructure investments in roads, bridges, transit and rail systems, like those proposed in a new transportation bill released today by House Democrats, would provide a needed boost to construction employment in many parts of the country and support a broader economic recovery. But they cautioned that new programmatic and regulatory requirements in the measure could undermine some the bill’s potential economic benefits. They urged Congressional leaders to work in a broad, bipartisan manner to rapidly pass a measure that expands highway capacity, improves bridges, builds transit and rail systems and supports long-term economic growth before current legislation expires.

“It is encouraging to see House Democrats proposing a significant increase in investments for transportation infrastructure,” said Stephen E. Sandherr, the association’s chief executive officer. “With over 40 million people unemployed and construction jobs declining in most metro areas, Congress needs to ensure that new, sustainable, investments bring as many people back to work as possible to help improve our aging highway, transit and rail systems.”

View AGC’s coronavirus resources and survey. View the metro employment data, rankings, map, highs and lows, and top 10.

Related Stories

Industry Research | Aug 11, 2017

NCARB releases latest data on architectural education, licensure, and diversity

On average, becoming an architect takes 12.5 years—from the time a student enrolls in school to the moment they receive a license.

Market Data | Aug 4, 2017

U.S. grand total construction starts growth projection revised slightly downward

ConstructConnect’s quarterly report shows courthouses and sports stadiums to end 2017 with a flourish.

Market Data | Aug 2, 2017

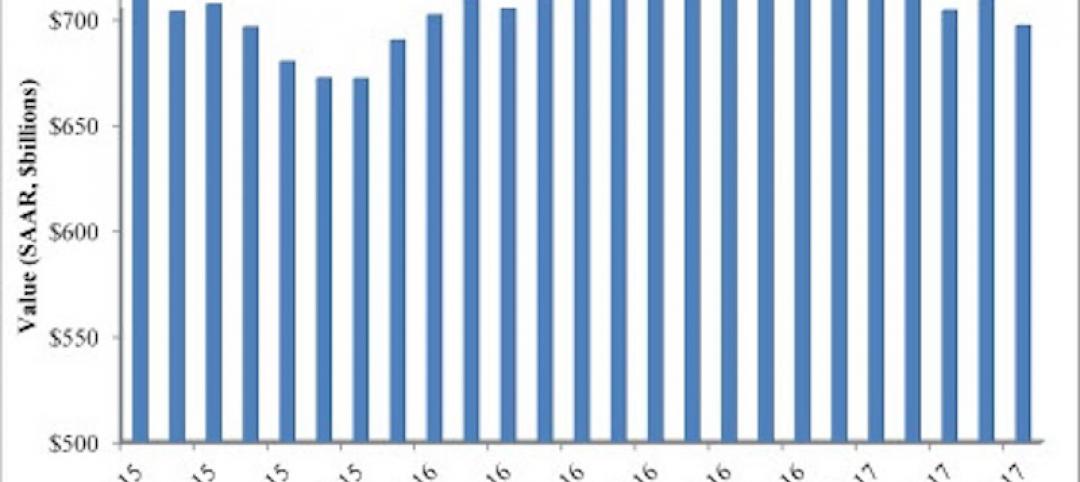

Nonresidential Construction Spending falls in June, driven by public sector

June’s weak construction spending report can be largely attributed to the public sector.

Market Data | Jul 31, 2017

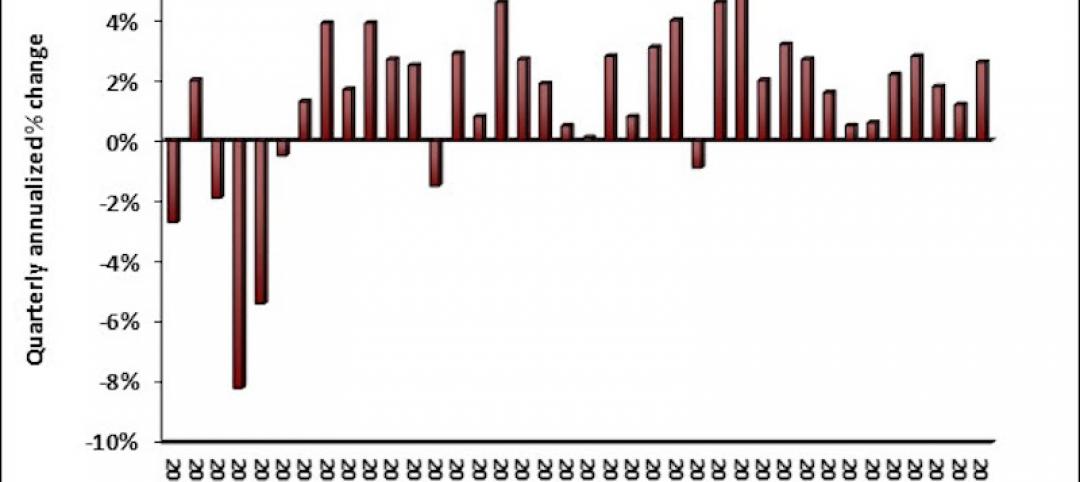

U.S. economic growth accelerates in second quarter; Nonresidential fixed investment maintains momentum

Nonresidential fixed investment, a category of GDP embodying nonresidential construction activity, expanded at a 5.2% seasonally adjusted annual rate.

Multifamily Housing | Jul 27, 2017

Apartment market index: Business conditions soften, but still solid

Despite some softness at the high end of the apartment market, demand for apartments will continue to be substantial for years to come, according to the National Multifamily Housing Council.

Market Data | Jul 25, 2017

What's your employer value proposition?

Hiring and retaining talent is one of the top challenges faced by most professional services firms.

Market Data | Jul 25, 2017

Moderating economic growth triggers construction forecast downgrade for 2017 and 2018

Prospects for the construction industry have weakened with developments over the first half of the year.

Industry Research | Jul 6, 2017

The four types of strategic real estate amenities

From swimming pools to pirate ships, amenities (even crazy ones) aren’t just perks, but assets to enhance performance.

Market Data | Jun 29, 2017

Silicon Valley, Long Island among the priciest places for office fitouts

Coming out on top as the most expensive market to build out an office is Silicon Valley, Calif., with an out-of-pocket cost of $199.22.

Market Data | Jun 26, 2017

Construction disputes were slightly less contentious last year

But poorly written and administered contracts are still problems, says latest Arcadis report.